Importance of Financial Harmony in Relationships

Financial harmony is a cornerstone in the foundation of a strong and enduring relationship. When partners are in sync about money, they tend to experience less stress and more satisfaction with each other. Disagreements about finances, on the other hand, are one of the leading causes of discord and separation.

Achieving financial harmony requires understanding, communication, and cooperation. It isn’t just about having enough money but about managing it in ways that support both partners’ needs and goals.

Building a solid relationship with money and each other involves more than budgeting and saving. It’s about cultivating a shared approach to financial matters, reflecting shared values and aspirations.

When couples harmonize their financial paths, they build trust and security, which are vital ingredients for a happy and lasting partnership. This comprehensive journey of financial togetherness is not a one-time event but an ongoing process of collaboration and adaptation.

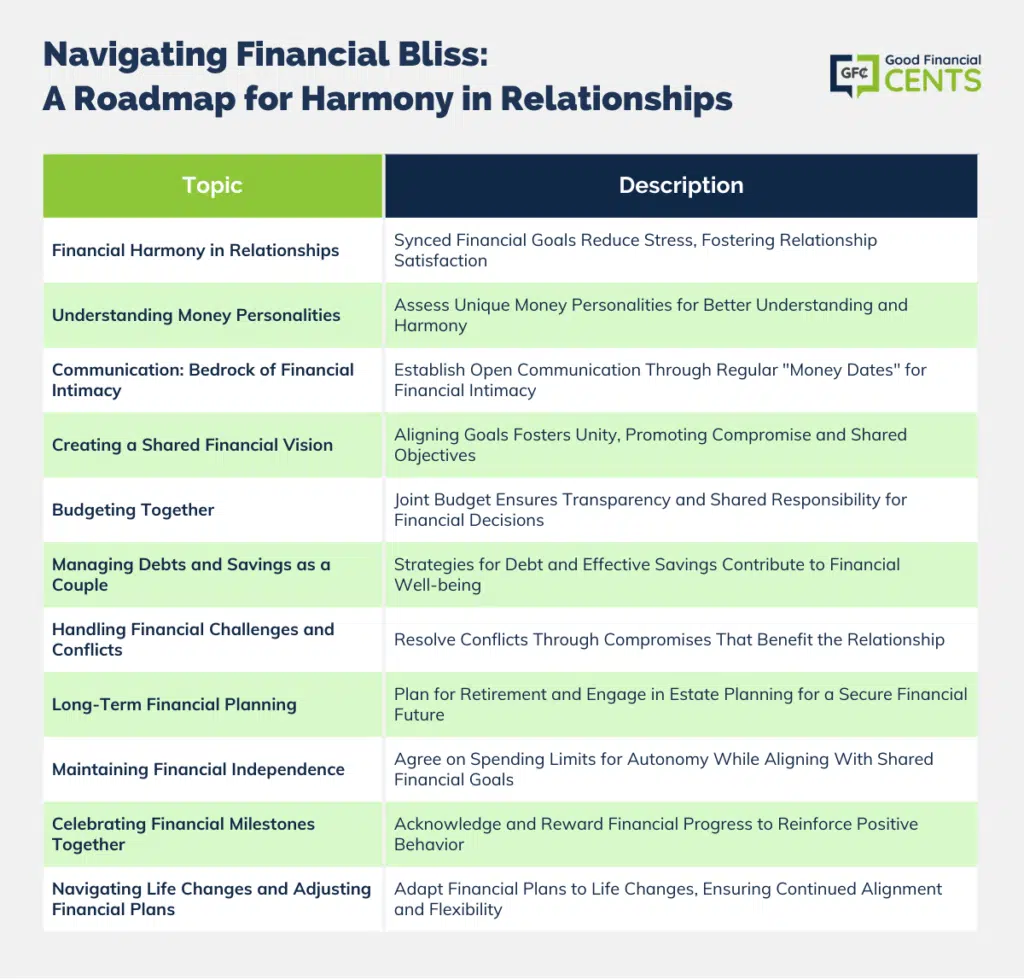

Table of Contents

- Importance of Financial Harmony in Relationships

- Understanding Individual Money Personalities

- Communication: The Bedrock of Financial Intimacy

- Creating a Shared Financial Vision

- Budgeting Together

- Managing Debts and Savings as a Couple

- Handling Financial Challenges and Conflicts

- Long-Term Financial Planning

- Maintaining Financial Independence

- Celebrating Financial Milestones Together

- Bottom Line: Strengthening Financial Bonds

Understanding Individual Money Personalities

Assessing Your Money Personality

Your money personality is a unique blend of your beliefs, values, and attitudes towards finances. It influences how you save, spend, and manage money. Are you a spender, saver, risk-taker, or security-seeker? To assess your money personality, reflect on your financial habits and emotions. Understanding your relationship with money is the first step in creating harmony within your relationship.

Recognizing Your Partner’s Money Personality

Just as you have a distinct money personality, so does your partner. Recognizing and understanding these differences is crucial. It’s not uncommon for a spender to be in a relationship with a saver. The goal is not to change each other but to understand where each is coming from. This understanding is key to managing finances together in a way that respects both personalities.

Communication: The Bedrock of Financial Intimacy

Establishing Open and Honest Communication

Open and honest communication is the bedrock of financial intimacy. It involves having regular, judgment-free discussions about money matters. Transparency about earnings, debts, and financial aspirations is essential. Set aside time for “money dates” where you can talk about your finances without distractions or interruptions.

Techniques for Effective Financial Discussions

Effective financial discussions require more than just talking; they require listening, understanding, and responding. Use “I feel” statements to express your feelings without blame. Practice active listening by acknowledging your partner’s perspective. To avoid conflicts, never discuss finances when emotions are high. Instead, choose a time when both of you are calm and can tackle the subject rationally.

Creating a Shared Financial Vision

The Significance of Aligning Financial Goals

Aligning your financial goals creates a shared vision that fosters unity. It’s about finding common ground and working towards shared objectives. This might mean compromising on certain things to achieve what’s most important for both of you. When both partners are working towards the same goals, they are more likely to achieve them.

Steps to Crafting a Joint Financial Plan

Crafting a joint financial plan begins with outlining your individual and shared goals. Then, prioritize these goals and determine the steps necessary to achieve them. Develop a timeline for your short-term, medium-term, and long-term objectives. Regularly review and adjust your plan as needed to reflect any changes in your circumstances or goals.

Budgeting Together

Importance of a Joint Budget

A joint budget is crucial for managing your finances together. It helps ensure that all expenses, regardless of who earns more, are covered. It also aids in tracking where money is going and in identifying potential savings. Creating a budget together means both partners have a say in the financial decision-making process, which can strengthen the relationship.

Strategies for Successful Budgeting as a Couple

When budgeting as a couple, start with full disclosure of income and debts. Allocate funds to essential expenses first, then savings, followed by discretionary spending. Consider using budgeting apps to streamline the process. Regular budget reviews are also essential to adapt to changes in income or expenses and to make sure you are both still on track with your financial goals.

Managing Debts and Savings as a Couple

Strategies for Debt Consolidation and Elimination

Combining your debts and creating a plan for paying them off can relieve financial stress. Strategies may include consolidating multiple debts into one with a lower interest rate or focusing on paying off the highest-interest debt first. Whichever strategy you choose, commit to it together and celebrate small victories along the way.

Savings Plans and Emergency Funds

An effective savings plan aligns with your financial goals and includes creating an emergency fund. Decide how much to save each month and consider automating your savings to ensure consistency. Your emergency fund should cover three to six months of expenses and be readily accessible.

Handling Financial Challenges and Conflicts

Recognizing Common Financial Conflicts

Common financial conflicts include disagreements on spending, saving, investment decisions, and financial priorities. Recognizing these conflicts early is vital in addressing them before they escalate. Understand that financial conflicts are often less about money and more about what money represents—security, freedom, or control.

Resolving Disagreements and Finding Compromise

Resolving financial disagreements often involves finding a middle ground where both partners can be satisfied. Develop a strategy for compromise that might involve alternating who gets the final say or finding a third option that suits both of you. It’s important to approach conflicts with a team mindset, aiming for solutions that benefit the relationship rather than the individual.

Long-Term Financial Planning

Retirement Planning as a Couple

Planning for retirement together ensures that you both have a clear vision of your golden years. Discuss how much you need to save, what types of retirement accounts to use, and what kind of lifestyle you hope to have. Regular reviews and adjustments to your retirement plans are crucial as your financial situation and retirement goals evolve.

Estate Planning and Will Preparation

Estate planning and preparing a will are essential aspects of long-term financial planning. They ensure that your assets are distributed according to your wishes and that your partner is protected in the event of your death. Both partners should have an up-to-date will, and it’s wise to review these documents regularly, especially after major life events.

Maintaining Financial Independence

The Importance of Personal Financial Space

Maintaining some level of financial independence can be beneficial for personal growth and relationship health. It allows each partner to make financial decisions without constantly needing the other’s approval and helps to foster a sense of individual responsibility.

Agreeing on Personal Spending Limits

Agreeing on personal spending limits allows for autonomy while maintaining the shared financial vision. Set a monthly allowance for each person to spend as they wish, no questions asked. This helps prevent resentment and allows for personal expression, while still keeping shared financial goals on track.

Celebrating Financial Milestones Together

Acknowledging and Rewarding Financial Progress

Celebrating financial milestones reinforces positive behavior and motivates continued progress. Acknowledge when debts are paid off, savings goals are met, or when you’ve stuck to your budget. These celebrations can be small acknowledgments or planned events, but they should always reinforce the teamwork that helped you reach these goals.

Navigating Life Changes and Adjusting Financial Plans Accordingly

Life is full of changes—career shifts, family expansions, and unexpected events. With each change, take time to adjust your financial plans. This ensures that your financial strategy remains relevant and that both partners are still aligned with the new direction. Maintaining flexibility within your financial planning can help mitigate stress when life’s inevitable changes occur.

Bottom Line: Strengthening Financial Bonds

The key to sustaining harmony lies in understanding each other’s financial identities, fostering transparent communication, and aligning individual desires with collective ambitions. Establishing a cooperative budget, addressing debt and savings, and celebrating fiscal milestones are fundamental steps toward a secure common future.

As life unfolds, adapting plans to new circumstances keeps the partnership dynamic and resilient. Ultimately, a successful financial union thrives on the bedrock of continuous collaboration, ensuring that both partners move forward together, not just in wealth, but in unwavering support and understanding.

Great post and so true…I can say from our experience that working together was/is the key to our success. A plan never works if only half the team knows and understand the details. Also agree that you need to stay flexible because no matter how well you plan, life’s twists and turns will alter that plan at one point or another. cheers! 🙂

Hey Diane,

Congrats on a great first article. The money talk is so important, both when couples start out, and as they get older. My Dad had a pretty serious health scare this week and I was surprised how little my Mom knew about their finances.

Thanks for your insight, Diane! Great post.

Great points! It is so important to be on the same page. My spouse and I were on the same page, but now that I am learning more from reading finance blogs, my page is a little different. We are working together to create goals, and I am trying to help him see the changes we need to make. It is going smooth so far, slow and steady:)

Hi Diane, Great Post! I am agree with your point that’s really important to talk about financial status with partner. I have checked your questions list that’s nice and true question. Diane, No, I have not the “money talk” with my spouse but definitely, I will make a plan this weekend and try to execute them without any internal relationship damages. Diane, one question about before start talk, actually my life natures is short tempered, what did you think it’s leave bad effect on this talk?