The Canadian Bank of Commerce was founded in 1867, while the Imperial Bank of Canada began in 1875. A century and a half later, the company is still in business. The two banks merged in 1961, and thus the Canadian Imperial Bank of Commerce (CIBC) was born.

One of the Big 5 banks in Canada, CIBC has a high profile and presence across North America, including the U.S. and the Caribbean, serving more than 10 million customers.

CIBC Bank USA formally started operations in 2017, marking the lender’s most recent attempt to become a significant player in the American market.

While the bank has customers across all 50 states, it has a particular focus on the Midwest.

For instance, private wealth management offices are located from coast to coast in Massachusetts, Texas, California, and so on; yet CIBC’s ATMs and banking centers are only available in Illinois, Michigan, Missouri, and Wisconsin. The bank’s U.S. headquarters are located in Chicago.

CIBC has a full breadth of services and products including bank accounts, credit cards, student loans, mutual funds, investment portfolios, travel insurance, business lines of credit, banking for indigenous persons, business succession planning, large corporate accounts, and international services.

Of most interest to would-be homeowners are the numerous mortgage products and resources the bank offers. While there is some difference in home lending options across borders, CIBC generally offers customers fixed-, adjustable-rate, and specialty mortgages.

Borrowers on either side of the 49th parallel can take advantage of the online guides, calculators, videos, and other resources available on the bank’s website.

Table of Contents

CIBC Mortgage Facts

- One of the Big 5 banks in Canada, it is the product of a 1960s merger between two banks established in the 19th century.

- Expanded into American banking operations with a 2017 acquisition relaunch as CIBC Bank USA.

- Serves customers across the nation, but has a more substantial presence in the Midwest.

- Offers a wide range of personal and small-business banking services.

- Provides wealth management and commercial banking for industry customers.

- Extends a variety of fixed-, adjustable-rate, and specialty mortgage products.

- Has online resources for borrowers to consult, including a mortgage glossary and guidance on regulations.

Overview

CIBC has operations across Canada and the United States, as well as in the Caribbean, providing 13 million customers with banking, savings, investment, and lending services.

The bank has a long history, being the result of the merger between two Canadian banks started in the 19th century.

Having been in business for more than 150 years, CIBC has developed four strategic units:

- Canadian personal and business banking

- Canadian commercial banking and private wealth management

- U.S. commercial banking and private wealth

- Capital markets

Alongside providing quality products and services, CIBC focuses on community investment, having contributed more than $60 million in 2018 to different organizations in the U.S. and Canada.

CIBC has an F grade with the Better Business Bureau. While the bank does respond to and resolve complaints, 22 in all have been settled in the last three years.

The lender is not yet accredited by the BBB, though its file has been open since 2008. CIBC also has very low user reviews on Trustpilot.

Current CIBC Mortgage Rates

CIBC Loan Specifics

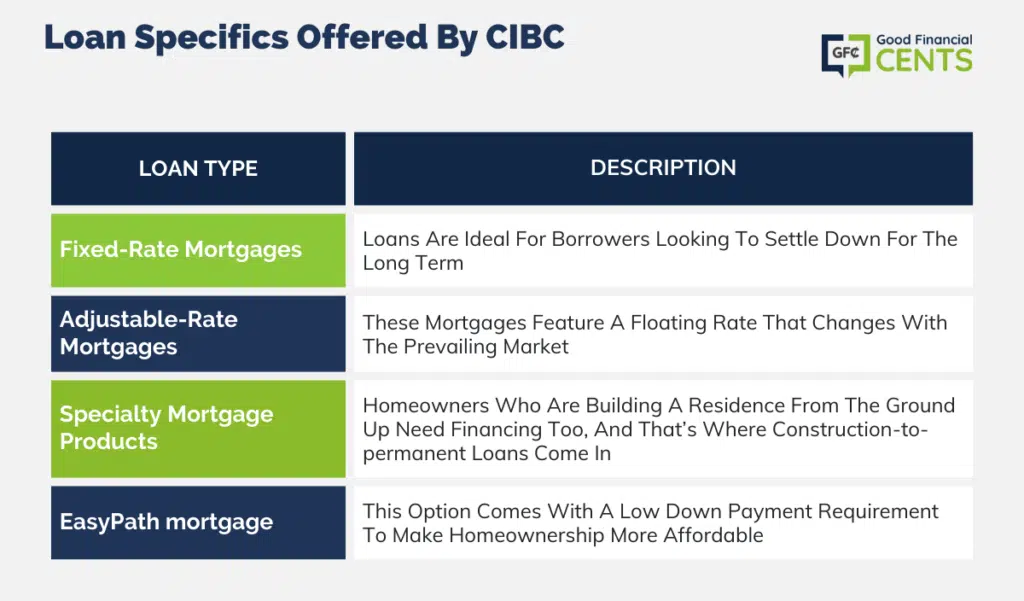

Borrowers looking for a home loan can find a number of options and mortgage rates at CIBC. In general, customers in any of the 50 states can get financing for a:

Fixed-rate mortgages

These home loans are ideal for borrowers looking to settle down for the long term. They feature fixed rates and flat payments throughout the life of the loan and are available on 30-year or 15-year terms.

As payments are predictable and terms are longer than those of adjustable-rate mortgages, these loans might be ideal for homeowners who don’t plan to move around or have tight budgets.

Adjustable-rate mortgages

As opposed to having a fixed rate, these mortgages feature a floating rate that changes with the prevailing market.

The interest rate stays fixed for an introductory period, but then rises or falls on a periodic basis that is predetermined it could be once a year or once every six months, for example.

The benefit of adjustable-rate mortgages is that interest rates for these products tend to be lower, yet rates can increase with market fluctuations after the initial fixed-rate period and hike up monthly payments in the process.

Specialty mortgage products

Home loans that suit niche borrowing needs are also available from CIBC. For instance, customers can pursue a construction renovation loan to finance a home makeover or a home equity line of credit for other financial needs.

The bank also offers reverse mortgages, which are geared toward senior banking customers who can leverage their homes to pay health care needs and other expenses in retirement.

EasyPath mortgage

This option comes with a low down payment requirement to make homeownership more affordable. There’s no private mortgage insurance and flexible underwriting standards apply.

Certain borrowers may look for government-backed loans, like those available from the Federal Housing Administration, the Department of Veterans Affairs, or the U.S. Department of Agriculture.

These loans usually come with more favorable terms for qualifying borrowers and are an option for those with insufficient credit or low cash flow.

CIBC Bank USA does not publicize government-backed opportunities or jumbo mortgages for non-conforming home loans. It does, however, offer cash-out refinancing.

CIBC Mortgage Customer Experience

Borrowers have an easy route to a mortgage when working with CIBC, as they can view mortgage products, apply for a loan, and access other information resources online.

CIBC Bank USA does not have as robust a resource library as CIBC’s Canadian homepage, but that doesn’t stop stateside homeowners from referencing educational materials featured on the latter.

U.S. borrowers will want to focus on how-to guides and advice content on subjects like first-time homebuyers, second homes, or what mortgage and what mortgage rate is best.

Customers can, however, view the mortgage team at CIBC Bank USA and find contact information for those experts.

CIBC Lender Reputation

There is some concern when it comes to CIBC’s lender reputation in Canada, as the bank has an F rating from the Better Business Bureau. CIBC Bank USA, on the other hand, does have an A+ but has only been in business since 2017.

The lender has closed 22 complaints against it in the last three years (as of early 2019) and is not accredited by the BBB. It has similarly low ratings from Trustpilot users.

Previous controversies have also affected this lender’s reputation. CIBC was involved in the Enron scandal, allegedly helping the company hide losses.

As a result, it reached a settlement of over $2 billion to end a related class-action lawsuit. It has also run into trouble regarding customer privacy.

The bank was previously investigated for a breach of sensitive information in 2007 and recently came under fire again in 2018.

CIBC Mortgage Qualification

CIBC Bank USA does not disclose its rates or qualification standards. However, American borrowers can be sure that normal measures of financial stability and creditworthiness are in play.

That means the bank will assess credit scores, debt-to-income ratios, and other requirements to gauge the risk in lending to a given borrower. For easy reference, here’s a basic table of how credit score figures into the decision.

| Credit Score | Category | Likelihood of Approval |

|---|---|---|

| 760 or higher | Excellent | Very likely |

| 700-759 | Good | Likely |

| 621-699 | Fair | Somewhat likely |

| 0-620 | Poor | Somewhat unlikely |

| None | N/A | Unlikely |

CIBC Phone Number and Additional Details

- Homepage URL: https://www.cibc.com/US

- Company Phone: 877-448-6500

- Headquarters address: 120 South LaSalle St., Chicago, IL 60603

Final Thoughts

The Canadian Imperial Bank of Commerce (CIBC) stands as an enduring testament to Canada’s banking history, tracing its roots back to two banks from the 19th century.

Having expanded its footprint beyond Canada into the U.S. and the Caribbean, CIBC not only offers a comprehensive suite of banking services but also exhibits a commitment to community investment.

Despite this rich heritage and expansive service offering, it’s imperative for potential customers to do their due diligence.

The bank’s past controversies and current reputation, especially in online review platforms and with the Better Business Bureau, highlight the importance of consumer research.

Potential borrowers, in particular, should weigh the bank’s product offerings against their personal needs and the experiences of other customers to make the most informed decision about their financial future.

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability. Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Canadian Imperial Bank of Commerce Product Description: Canadian Imperial Bank of Commerce (CIBC) is one of the "Big Five" banks in Canada, providing a comprehensive suite of banking services that spans across personal, business, and investment needs. Established from the merger of two historic banks, CIBC has a significant presence not only in Canada but also in the U.S. and the Caribbean. Summary of Canadian Imperial Bank of Commerce (CIBC) Founded from the union of the Canadian Bank of Commerce and the Imperial Bank of Canada, CIBC has been serving its clientele for over 150 years. With operations extending from Canada to the United States and the Caribbean, it caters to roughly 13 million customers, offering a myriad of services ranging from basic savings and checking accounts to sophisticated investment portfolios and lending services. Apart from its primary banking services, CIBC is also recognized for its community investment initiatives, underpinning its commitment to both financial excellence and societal contribution. Pros Cons

Canadian Imperial Bank of Commerce Review

Overall