Founded in 1938, the University of Iowa Community Credit Union is a financial cooperative headquartered in North Liberty, Iowa.

It offers a variety of banking services, including fixed and adjustable-rate mortgages, and federal United States Department of Agriculture (USDA) and Veterans Affairs (VA) home loans. UICCU is a Better Business Bureau Accredited Business with an A+ rating.

Table of Contents

UICCU Mortgage Facts

- A member-owned credit union with 17 branches throughout Iowa

- Membership is open to anyone living or working in Iowa and the Illinois counties of Henry, Knox, Mercer, and Rock Island

- University of Iowa alumni, students, and staff are also eligible, as are the direct relatives of current UICCU members

- Mortgage products include 15- and 30-year fixed-rate mortgages, adjustable-rate mortgages, USDA and VA loans, and jumbo home loans

- No origination fee (1 percent) on its mortgages and offers up to 100 percent financing for some mortgages

- 5,500 mortgages originated in 2016, accounting for more than $1 billion in loans

- The company has been ranked in the top 1 percent of credit unions by Callahan & Associates for returning profits to its members

Overview

UICCU is a credit union with 17 branches in Iowa and a portfolio of financial services available exclusively to its members. Membership is open to anyone living or working in Iowa and four Illinois counties as well as University of Iowa alumni, students, staff, and direct relatives of UICCU members.

Despite being the largest credit union in Iowa serving 175,000 members and managing $5 billion in assets, UICCU is not in our top lenders, nor is it listed by the Consumer Financial Protection Bureau (CFPB) as a top 25 originator.

UICCU’s mortgage options are extensive. In addition to fixed and adjustable-rate mortgages, it extends both VA and USDA loans to qualifying borrowers. First-time homebuyers, residents of USDA-designated rural areas, and veterans in Iowa and western Illinois may benefit from UICCU’s offerings.

The BBB has accredited the UICCU and given it an A+ rating, although the average of a small sample of reviews on the BBB site was negative as of February 2019. The main qualification for getting a mortgage through UICCU is to be a member of the credit union.

Current UICCU Mortgage Rates

UICCU Loan Specifics

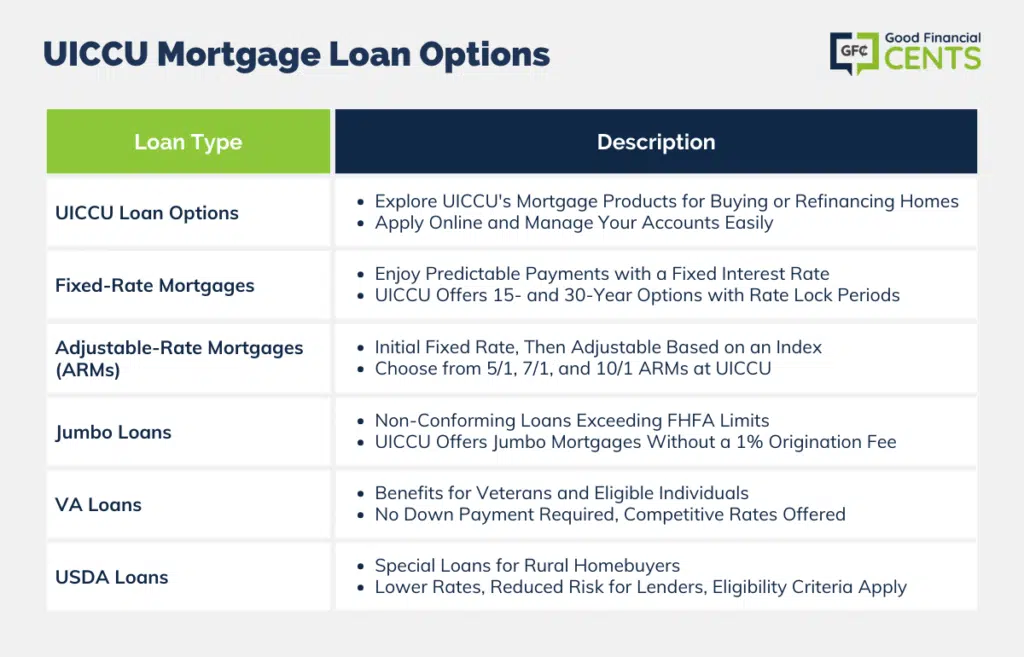

Members of the UICCU have access to a broad spectrum of mortgage products for purchasing and refinancing a home. They may apply for these loans online and manage their documents and accounts there too.

Fixed-Rate Mortgage Loans

A fixed-rate mortgage is the most popular type of mortgage, primarily because of its predictable payments and typically straightforward terms. The interest rate of the loan remains the same over the entire life of the loan, regardless of the loan’s length or any fluctuations in interest rates elsewhere. Homebuyers can lock in a competitive rate upfront and gain the assurance of a stable principal payment, although applicable escrow payments such as property taxes may still change over time.

UICCU offers 15- and 30-year fixed-rate mortgages with rate lock periods of 30 days or more, depending on the specific loan type.

Adjustable-Rate Mortgage Loans

An adjustable-rate mortgage (ARM) has an initial fixed rate for its mortgage rate, after which that rate may fluctuate in response to changes in an index of prevailing credit rates, such as LIBOR. Some ARMs have interest rate caps limiting the amount the rates can increase or decrease, over either a set period or the lifetime of the loan. Borrowers take on more risk with an ARM than with a fixed-rate mortgage but often benefit from the relatively low starting interest rates.

UICCU offers 5/1, 7/1, and 10/1 ARMs, indicating mortgage loans with rates that remain fixed for the first 5, 7, and 10 years, respectively, and then adjust upward or downward. The 7/1 and 10/1 ARMs are available via the secondary market or in-house, while the 5/1 ARM is in-house only.

Jumbo Loans

The Federal Housing Finance Agency sets limits on loans that can be acquired, guaranteed, or secured by Fannie Mae and Freddie Mac. The current limit for most areas is $766,550. A jumbo loan is a non-conforming mortgage loan, meaning it exceeds the applicable FHFA conforming limits.

Buyers applying for jumbo loans usually have to meet stricter requirements, in terms of their credit scores and down payment amounts than if they were applying for a conforming loan. UICCU offers fixed-rate jumbo mortgage loans without a 1 percent origination fee.

VA Loans

The U.S. Department of Veterans Affairs oversees specialized mortgage loans for veterans, active service personnel, some reservists and National Guard members, and eligible surviving spouses. VA-approved lenders, including UICCU issue the loans. Compared with other types of mortgage loans, VA loans have multiple advantages.

For starters, no down payment is required, and because the VA guarantees a portion of each loan against loss, lenders can offer highly competitive rates to qualifying borrowers. UICCU provides 15- and 30-year fixed-rate VA mortgages.

USDA Loans

Via its Single-Family Housing Guaranteed Loan Program, the U.S. Department of Agriculture oversees loans to homebuyers who are purchasing or refinancing homes in rural areas. Applicants to this special mortgage financing program must meet eligibility criteria for income, residency (only owner-occupied housing is eligible), capacity to incur the loan obligation and general receipt of federal benefits. They must also ensure that the home’s physical address falls within USDA definitions of rural areas.

Since the USDA guarantees a portion of the note, there is less risk for lenders and lower competitive rates for buyers compared with conventional loans.

UICCU Mortgage Customer Experience

UICCU has an online application process. A prospective buyer can enter an email address to begin the process of applying for pre-approval, scanning, and uploading their documents, and receiving communications from a selected mortgage officer. Buyers can also use the dedicated UICCU mobile app to perform the same tasks.

Homebuyers can use UICCU’s online mortgage calculators to compare mortgages based on parameters including amount, interest rate, length, and points. Other tools are available for tasks such as calculating prepayment savings.

UICCU members may obtain a quote for any of the credit union’s main products by filling out a form that requires a Social Security number. The main UICCU site contains most of its mortgage information under the “Borrow” banner; the site is also available in Spanish.

UICCU was not one of the financial institutions evaluated in the J.D. Power 2022 U.S. Primary Mortgage Origination Satisfaction Study. It has been ranked in the top 1 percent of the Callahan & Associates Return of the Member Index, which evaluates credit unions on their returns to savers and borrowers and overall member usage of their services. In 2016, UICCU ranked 3rd within Callahan’s top 100.

UICCU Lender Reputation

UICCU was founded in 1938, and it has since grown into a 17-branch member-owned and operated financial cooperative, serving the entire state of Iowa and parts of Illinois. As a credit union, it is insured by the National Credit Union Administration.

UICCU is a Better Business Bureau Accredited Business with an A+ rating. However, as of February 11, 2019, its customer review average on the BBB site was 1 out of 5 stars, based on three reviews. There were 17 total public complaints submitted to BBB at that time.

Through its stated commitment to equal housing opportunity, UICCU adheres to the provisions of the Fair Housing Act of 1968. It originated more than 5,000 mortgages in 2016, totaling $5 billion and saving borrowers an estimated $10 million by not charging them a 1 percent origination fee.

UICCU Mortgage Qualifications

| MORTGAGE TYPE | DOWN PAYMENT REQUIRED? |

| Conventional Fixed-Rate | Yes |

| Adjustable-Rate | Yes, Unless In-House Arm With 100% Financing |

| Jumbo | Yes |

| USDA | No |

| VA | No |

Only members may secure a mortgage loan of any type from UICCU. For ARMs, the UICCU mortgage rates publicly listed on its site assume a FICO credit score of 720 or 740 (depending on whether it’s secondary market or in-house), in tandem with a 75 percent combined loan-to-value ratio and $1,800 in closing costs. Actual rates may be different based on credit history.

The average FICO score for Americans is 701, within the “Good” range of the three specialized FICO score types managed by Equifax, Experian, and Transunion, which are routinely used by mortgage lenders. These scores, which cover a range from 300 to 850, are required for any mortgages sold to Fannie Mae and Freddie Mac, and as such are ubiquitous in lender evaluations of borrowers.

There is no industry standard minimum credit score for securing a mortgage loan, with lenders performing a case-by-case analysis of applicant creditworthiness. However, 580 is an inflection point, as it is the lower bound of the “fair” range in the big three credit reports.

UICCU Phone Number and Additional Details

Homepage URL: https://www.uiccu.org/

Company phone: 319-339-1000 or 800-397-3790; 877-527-3510 for mortgage department

Headquarters address: 2355 Landon Rd, North Liberty, IA 52317

The Bottom Line – UICCU Mortgage Rates Review

Navigating through the mortgage labyrinth can be intricate, yet the University of Iowa Community Credit Union (UICCU) surfaces as a viable option, especially for those embedded in the Iowa and western Illinois communities.

With a variety of offerings, from conventional fixed and adjustable-rate mortgages to specialized USDA and VA loans, UICCU manifests a commitment to facilitating homeownership across diverse financial landscapes.

Despite some criticisms and a need for membership, its no-origination-fee policy, diverse loan products, and online application convenience position UICCU as a noteworthy contender in the mortgage sector.

As one delves into the homebuying journey, an insightful examination of UICCU’s mortgage offerings, juxtaposed against one’s unique financial standing and goals, becomes imperative.

Thus, potential homebuyers are encouraged to weigh the benefits and limitations presented by UICCU with meticulous discernment to secure a mortgage that most adequately fulfills their needs and aspirations.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

University of Iowa Community Credit Union (UICCU) Review

Product Name: University of Iowa Community Credit Union (UICCU)

Product Description: The University of Iowa Community Credit Union (UICCU) provides a comprehensive suite of mortgage products designed to meet varied homebuying needs across Iowa and select Illinois counties. Tailoring offerings from conventional fixed-rate and adjustable-rate mortgages to specialized USDA and VA loans, it endeavors to pave a smooth financial path for both traditional and first-time homebuyers, ensuring accessibility and inclusivity in securing homes.

Summary

Established to serve the unique financial needs of its community, UICCU couples its rich legacy with modern solutions to navigate the varied terrains of mortgage offerings. The institution champions not only in delivering a wide spectrum of mortgage products but also in facilitating a user-friendly online application process, enabling prospective homeowners to approach, analyze, and secure their loans with increased convenience and lesser hassle. Whether it’s the stability offered by their fixed-rate mortgages, the flexibility of their ARMs, or the specificity of VA and USDA loans, UICCU emerges as a one-stop-shop for diverse mortgage needs, underscored by an ethos of member-centric service and support. Furthermore, the distinct advantage of no origination fee on certain loans and the capability of 100% financing, particularly, carve out a niche for UICCU in the competitive mortgage market.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Variety of Mortgage Products: UICCU offers a wide spectrum of mortgage options catering to varied buyer needs and circumstances, including fixed-rate, ARMs, jumbo, USDA, and VA loans.

- No Origination Fee: UICCU extends a significant financial advantage by not charging a 1% origination fee on its mortgages, alleviating an often sizable upfront cost for borrowers.

- Online Conveniences: With an online application process, document management, and a mobile app, UICCU ensures easy access and management of mortgage applications and accounts for its members.

- Inclusive Membership: UICCU opens its doors to a broad member base including anyone residing or working in specific Iowa and Illinois counties, and affiliates of the University of Iowa.

Cons

- Membership Requirement: Mortgage products are exclusive to UICCU members, potentially limiting access for those not fulfilling the membership criteria.

- Mixed Reviews: Despite an A+ rating from the BBB, UICCU has received mixed reviews and some negative feedback on the same platform, highlighting potential areas of customer dissatisfaction.

- Limited Geographic Availability: Mortgage offerings are region-specific, confining the benefits and accessibility to those in particular areas of Iowa and select Illinois counties.

- Lack of Broader Recognition: Absence from top lender lists, such as those from the CFPB and J.D. Power, indicating there might be operational or service aspects where UICCU could enhance its performance and customer experience.