I’ve asked my friend and freelance writer, Les O’Dell, to share experiences as he and his wife, Christine, participated in Financial Peace UniversityTM, a 13-week course from national money talk-show host, Dave Ramsey. This will focus on what FPU is, and his review of the lessons within.

Here’s a quick navigation guide, since this is a (very) comprehensive review of the Financial Peace University course.

Table of Contents

- What Is Financial Peace University?

- Our Story: It Begins With A Single-Step

- FPU – Week 1 – Super Saving

- FPU – Week 2 – Relating With Money

- FPU – Week 3 – Cash Flow Planning

- FPU – Week 4 – Dumping Debt

- FPU – Week 5 – Credit Sharks in Suits

- FPU – Week 6: Buyer Beware!

- FPU – Week 7 – Insurance

- FPU – Week 8 – That’s Not Good Enough!

- FPU – Week 9 – Intro to Investing

- FPU – Week 10 – All About Tuition

- FPU – Week 11 – Working On Your Strengths

- FPU – Week 12 – Real Estate and Mortgages

- FPU – Week 13 – The Great Misunderstanding

- Course Wrap-up

- Is Financial Peace University Right For You?

What Is Financial Peace University?

Dave Ramsey’s Financial Peace University (FPU) is a comprehensive financial education program designed to help individuals and families create a plan for getting out of debt, managing their money, and building wealth.

FPU is an online course with videos, downloadable worksheets, podcasts, and other resources to help you understand money management from the basics to advanced strategies. The program also provides helpful tools such as budgeting spreadsheets, debt payoff calculators, investing advice, and more.

The core teaching of Financial Peace University is that “you can’t get out of debt until you change the way you think about handling money.”

It encourages participants to take charge of their finances by making sound decisions now that will lead to long-term financial stability.

Our Story: It Begins With A Single-Step

Let me start by saying I’ve been a huge fan of Dave Ramsey’s financial teachings for many years.

I first heard his radio show more than ten years ago when it was called The Money Game. Even then, while I enjoyed listening, I was not financially mature enough to really grasp what he was teaching.

I was able to grasp the “head knowledge,” but never convert it to “heart knowledge.”

So, despite knowing better, we continued to make stupid mistakes with our money.

The Man Has a Plan

Over recent years, I’ve gotten smarter.

I’ve listened to what is now called The Dave Ramsey ShowTM whenever possible, and have read most of his books.

In fact, my wife and I have literally given away dozens of copies of his book, The Total Money Makeover, to friends and family members. We’ve even told our kids, and their boyfriends and girlfriends, we’d pay them each $50 for a book report on The Total Money Makeover.

Despite our seeming devotion, one thing we had never done, however, was enroll in Ramsey’s signature product, a 13-week program called Financial Peace UniversityTM.

With two teenagers and busy lives, we just never felt as though we could commit to a two-to-three-hour class, one night a week—that is, until this year.

Decisions, Decisions: Making the Commitment

Last fall, I learned the course was going to be offered at a local church in the spring.

I immediately called my wife at work to ask her if she was interested in 13 weeks, every Monday night, from February through the beginning of May.

We had to weigh the decision carefully; we already had one night a week tied up with a small group activity from our church, and she was planning on taking a class on another evening.

After quite a bit of discussion, we decided it was a commitment we were willing to make. I went online and signed up for the class.

The Kit

Signing up simply meant putting in a reservation for us to take part in this particular class. We still had to get our official Financial Peace University kit.

The “kit” is a lifetime membership for each couple (meaning you can take the class multiple times if you wish), as well as class materials. They usually cost $199, but often Ramsey’s website and participating churches have special offers.

This was the case for us, I was able to go over to the church and pick up our kit for just $86. Here’s what we received:

- First, there was a copy of the revised version of Dave’s first book, Financial Peace Revisited.

- Second, was an envelope system/wallet to use for spending cash.

- Third was a collection of CDs—all of the audio from the DVDs we would be watching each week in class.

There were also tip calculator cards and sleeves for debit cards with an imprinted warning:

Danger! Use of this card may be harmful to your budget!

We had everything and were ready to go!

On to the first class!

FPU – Week 1 – Super Saving

On a Monday night earlier this year, we walked into our first Financial Peace UniversityTM class at a local church.

There were about 20 people in the room: people of all colors and ages, and, judging by the cars in the parking lot, of a wide range of financial statuses.

Each session was to be led by a coordinator who, himself, was an FPU ‘graduate’, and it consisted of watching a DVD of Dave Ramsey teaching, followed by discussions among our fellow students in the room.

I learned this was to be the format of each week’s class. After a brief introduction, we dove into lesson one—Super Saving.

Save, Save, Save

In the lesson, Ramsey discusses the importance of, as Grandma said, “a rainy day” because, as he said, “it is going to rain.”

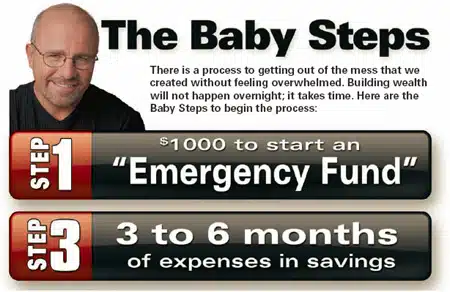

With the lesson on saving, Ramsey introduces the first and third of what he calls The Baby Steps toward financial peace.

1. Step one is to set aside $1,000 as a small emergency fund to provide a cushion for unexpected events as well as giving peace of mind.

2. Step two (paying off debt) comes in a later lesson.

3. Step three is to expand the emergency fund to equal three to six months of household expenses.

Throughout the lesson, Ramsey reminds us emergency funds should not be tied up in long-term investments including CDs, but rather should be easy-to-get-to, such as in a simple savings account or money market account.

Also, he stresses purchases, wants and whims do not qualify as emergencies.

Let Your Money Work For You

The DVD lesson concludes with Ramsey briefly teaching the magic of compound interest and living frugally.

He uses the example of a 16-year-old who spends $3 daily on cigarettes. He says if instead, the teen invested his cigarette money and averaged a 12 percent return, by his 76th birthday, he’d have $11.6 million.

Quick Recommendation

Even your emergency fund can work for you!

Consider using a high yield savings account or money market, like those from CIT Bank, and get paid to leave your money there while it acts as your safety net.

Wait, There’s Homework?

Finally, the class finishes with a quick primer on simple budgeting and a homework assignment: several chapters of reading from Financial Peace Revisited, FPU’s companion text, and completion of a “quickie budget”.

My wife and I left the evening’s session fired up about working hard together on our finances.

I think for couples, this might be one of the best parts of the entire program—getting it together, together.

We knew we had a long way to go to get our financial ship in shape, with a lot of debt to wade through as well as so many old habits to break and replace with new ones.

We were eager to get started, beginning with the reading and the quickie budget while looking forward to the next twelve weeks.

FPU – Week 2 – Relating With Money

Our second session of Financial Peace UniversityTM was humbling.

The course coordinator asked each family to write on a nameless index card the best guess of our total level of indebtedness, as a group.

He would add all of the figures together for a class total and then we could use it as a benchmark for measuring success when a new total is calculated at the end of the course in May.

Writing down this number was a sort of reality check.

I wondered how our number (which I felt was way too large) would compare to everyone else’s figure.

Battle of the Sexes

The second FPU lesson was related to money.

In it, Ramsey discusses the different approaches men and women take toward money and savings, and how finances are often the top issue in marriages.

He tells how money is tied to men’s self-esteem, and to women’s sense of security.

While admitting it was an over-generalization, Ramsey says—according to women—having an emergency fund is the most important part of a financial plan.

Nerd? Free Spirit? Spender? Saver?

Ramsey also introduces several personality types, sharing his experience of how most marriages have one of each.

These are the nerd and the free spirit.

Free spirits can be lackadaisical in their approach to money, sort of in a carefree way.

On the other hand, nerds like to feel in control: they love doing budgets and (gasp!) may even enjoy filing tax forms.

He also says people are usually either spenders or savers.

Again, most marriages have one of each. It’s hard for me to imagine how someone could be a nerd/spender, but I guess it’s possible.

My wife and I had already discussed this concept years before, and we’re easy to classify.

I am the typical nerd/saver.

On the other hand, I like to call her a recovering free-spirit/spender.

I say recovering because we’re both totally on board with following The Baby Steps which Ramsey outlines, and improving both our finances and our relationship.

As FPU teaches, we know we must get it together, together, and make financial decisions together.

Singles and Money

Through the lesson, Ramsey gives pointers on working together as a couple, how single people should approach their financial decisions (get an accountability partner and beware of impulse buying), and how to teach kids about money, too.

Relating to Others

Following the DVD lesson, our class split into smaller groups to discuss our own circumstances.

Since none of the people in our group knew one another, no one was really willing to open up about their own situation or to share their circumstances.

We all introduced ourselves and shared pleasantries, but that was about it.

It looked like we had some work to do if we were all going to relate to one another.

FPU – Week 3 – Cash Flow Planning

Tonight’s lesson was about the hated B-word: budget.

I’m sure for some people, this was maybe their first exposure to planning where money is to go.

My wife and I have budgeted with limited success over the years. Usually, it’s been the case of planning how to spend this week’s paycheck based on what bills and needs were most pressing.

We never had done a whole month’s budget at once before. This should be interesting!

Budgeting Basics

Dave started the night with some basics.

1. Checking accounts that are not in balance are a mess waiting to happen.

2. Overdrafts are signs of sloppy and lazy money habits and ATM withdrawals and debit cards can bust budgets

3. Most people don’t budget because others have used budgets to abuse them; they fear finding out what’s really happening to their money and they feel locked in with a budget.

The night continued with reasons everyone should have a budget or cash flow plan, and then progressed into things (sadly) many people don’t know how to do anymore: balance a checkbook.

Envelopes And The Envelope System

We were introduced to the envelope system—a spiral-bound series of envelopes that came in our FPU kit.

Because our brains actually feel pain when we spend cash (spending with a debit card or check registers less pain and with a credit card almost no pain), Ramsey recommends using cash.

For example, instead of swiping plastic, or writing a check at the grocery store, put the month’s budget for groceries in an envelope marked food, and spend from it.

It forces users to stay on budget—if there’s no money, there’s no buying.

Forms (and More Forms)

We then began to learn about a variety of forms provided to us by the class:

- Consumer equity sheets (a balance sheet to learn our financial health)

- A form to list all sources of income

- A lump sum payment form to help work non-regular payments into a monthly budget

- A very, very detailed monthly cash flow plan

We also learned the recommended percentages of our income which should go toward things like housing, transportation, and clothing.

Then we learned how to allocate our spending based on income, not upon which creditor was screaming the loudest, or how much we wanted to buy ourselves something.

The Big Challenge

At the end of the lesson, we were challenged to go home and make a monthly budget (maybe for the first time ever).

We were told it would be stressful, at best, and probably downright frightening.

We also heard couples should expect to have some intense discussions while working together on their budget.

Okay, let’s be honest. Couples should expect to fight on this one!

Small Groups

As we talked among our small groups, we discussed why we each had failed to live on a budget before.

Answers ranged from admitted laziness to cases of life just getting in the way.

We discussed our initial reactions to the thought of budgeting (“We’ll try it,” “It will never work for us,” and “I’m excited about it”).

We went home and worked on the month’s budget. There were some surprises and a few discussions, but no fights.

We were ready. Bring on the month!

FPU – Week 4 – Dumping Debt

This was the Financial Peace University lesson I had been most eager for and the most excited about: how to get rid of debt.

It’s the reason we signed up for the class.

Our enthusiasm was contagious—our 16 year-old-daughter and her boyfriend agreed to attend the night’s session with us. She’s expressed some interest in a career in finance, so I thought it would be a great experience for her.

Myth-Busting!

The evening’s DVD lesson featured Dave Ramsey popping the myths of conventional wisdom like balloons: 15 in all.

Among the first were the beliefs about how loaning others money, or cosigning loans, is a way of helping them.

Sharing stories of people who’ve had to pay other’s debts, as well as their own, he said to always refuse to “help” in this way.

Instead, Ramsey added if you have the money to give, then give it, but don’t ever expect it back.

From there, Ramsey explained the pitfalls of cash advances, rent-to-own, payday loans, and car lots with on-site financing.

He called these “services” horrible, greedy rip-offs. He also called the lottery, and other forms of gambling, a tax on the poor and those lacking basic math skills.

On Auto-Pilot

Next, he took on the myth about how people will always have car payments.

He shared how typical millionaires become wealthy, partially, because they do not buy new cars.

He explained how a new car will lose up to 70 percent of its value in the first four years, and how leasing is the most expensive way to operate a vehicle.

Despite our money mistakes, this is one area where we’ve been on target for many years.

There are four cars in our family—all paid for!

I can’t imagine what it would be like to have car payments and I don’t plan on ever having them again.

Financing a Home

Ramsey shared how people take out a 30-year mortgage, saying they’ll pay extra on it each month when the truth is that the “extra” rarely happens.

Instead, he recommended never taking more than a 15-year mortgage and shared how payment of just a few hundred dollars more each month (compared to payments on a 30-year note) translates into thousands—and sometimes hundreds of thousands—in savings.

Scissors Time

Then came the part of the lesson I so wanted my daughter to hear: the dangers of credit cards.

She’s heard my wife and I preach this lesson for so long, that I couldn’t wait for her to hear it from someone else.

Ramsey outlined the dangers of credit cards from the company’s marketing tactics to the fact spending with plastic is psychologically less painful than using cash.

With the largest pair of scissors I’d ever seen, Ramsey began sharing the alarming truths of credit cards and cutting through the offending Visa, Mastercard, and Discover cards, as well as a variety of retailer-issued plastic.

Finally, he shared the exciting truth of what life without debt can really be and, using the example of a gazelle intent on escaping predators, motivated his audience to become debt-free using Baby Step 2 – the debt snowball.

The Debt Snowball is simply paying as much extra as possible on your smallest debt, to eliminate it, then rolling over the amount of those payments to eliminate the next smallest, etc.

On Fire

I couldn’t wait to ask our young guests what they thought of the lesson.

I could tell during the session it was making an impact.

Our daughter’s boyfriend said he couldn’t wait to share what he learned with his parents.

Our daughter came out on fire to never be in debt, and to help others reach financial independence and freedom.

As soon as we got home, she began investigating college programs to become a financial planner.

My wife and I came out of the class with a new resolve to dump debt and make good choices. Let the gazelle intensity begin!

FPU – Week 5 – Credit Sharks in Suits

Carrying over the team of debunking myths he used in the fourth lesson, Ramsey teaches in the fifth lesson of Financial Peace University there is one additional myth: the importance of the almighty credit score.

He explained how a credit score is calculated (calling it an ‘I love debt‘ score) and explaining how people actually can live without worrying about—or even having—a credit score.

Credit Bureaus

An extensive discussion of credit bureaus and credit reporting agencies followed.

Ramsey shared how these reports work, and how a vast majority of them contain errors—often damaging mistakes. He recommends checking your report at least annually and mentions how to correct errors on credit reports.

Identity Theft

As one of the fastest-growing crimes in the nation, identity theft was the main focus of the evening’s teaching.

We learned what to do, how to proceed if someone stole our identity, and how to work to fix problems identity theft causes.

Identity theft insurance was also discussed, and recommended, by Ramsey.

Collectors

Turning to the more seedy side of the evening’s discussion, Ramsey presented horror stories of debt collectors and some of the tactics they use, some of which are illegal, and many of which are completely unethical.

He shared protections provided in the Federal Fair Debt Collection Practices Act and provided suggestions on how to deal with calls and/or threats from collectors.

A variety of forms and materials were provided in the workbook for this class session, including a pro-rata budget plan to help users determine how much to pay on old debts, as well as sample letters for correspondence with creditors or collectors.

Break Out Session

Following the DVD portion of the session, we broke into smaller groups for a time of discussion and sharing.

Several people in our group told of bad experiences with creditors.

In fact, no one had anything positive to say about their experiences with collection agencies and collectors.

Our small group leader then asked everyone how they were doing with their budgets, and The Baby Steps so far.

Then, unveiling a pair of super-size scissors, he asked if anyone wanted to do a “plasectomy”, that is, cut up their credit cards.

My wife and I haven’t had any credit cards for several years, so we joined in encouraging others to kill their cards.

Despite our urging, no one reached for their wallets.

Perhaps, if only to get things started, he removed his own electronics retailer’s card and began to cut it into small strips.

The Resistance

He then turned to his wife and asked for her favorite credit card, one from a national clothing retailer.

She flat refused!

He pleaded.

She told him the card “gave her a sense of security.”

He pleaded again and we piped in with encouragement.

She still wouldn’t subject her card to the scissors.

We were all blown away; I couldn’t believe it.

Here were individuals who were supposed to be leading the small group, and they weren’t getting rid of all of their cards, nor were they on the same page as a couple.

It wasn’t a very good example to the rest of the group, in my opinion.

We can only hope she’ll cut it up next week.

FPU – Week 6: Buyer Beware!

Caveat emptor.

It’s a Latin expression meaning let the buyer beware.

I had always heard it and thought it meant to be careful to not get ripped off, but in tonight’s Financial Peace University lesson, Dave Ramsey taught how the phrase should be a caution to consumers about spending and giving into marketing pressures, as well as fads.

Ramsey shared how companies use every conceivable angle to convince us to purchase their products and services.

He described the techniques and persuasions involved in personal selling, as well as the use of financing (including 90 days same-as-cash offers) as a marketing tool.

We also explored the use of advertising and marketing messages, sponsorships, and product positioning to entice consumers to spend money.

Five Steps For Purchasing Power

Ramsey shared how our bodies go through some physiological changes when we make what he called a “significant” purchase.

For most people, he explained, a significant purchase is one of $300 or more.

He suggested anytime we’re facing a potential big purchase do work through five steps in considering the purchase.

It’s important, he says because we have the ability to spend more than we make.

The keys Ramsey gives to have power over purchases are:

1. Wait overnight before making a major purchase.

2. Carefully consider your buying motives. He reminds people buying stuff doesn’t equate to happiness in the long run (quite often it is the opposite).

3. Never buy anything you don’t understand. Ramsey said this includes intangible products and services such as investments and insurance.

4. Keep in mind opportunity cost. Opportunity cost is common knowledge to economic students, but a foreign concept to many of the rest of us. Basically, what he is saying is people should consider what else the money they are preparing to spend could be doing or going towards.

5. Finally, for people who are married, make sure you get your spouse’s input before making any major buying decisions. Basically, he suggested using your spouse (or someone else if you’re single) as a spending accountability partner.

Reminders

Of course, Ramsey urged FPU students to make sure major purchases fit into their budget and cautioned (although that is not a strong enough word) to never borrow in order to buy something and to avoid put purchases of any size on a credit card or payment plan.

FPU – Week 7 – Insurance

The seventh week of Financial Peace University dealt exclusively with insurance.

It was a lesson (believe it or not) I was actually looking forward to.

My wife and I both used to work in the medical malpractice insurance field, and we both were licensed insurance agents.

For this reason, I was overwhelmed by the thought of an hour and a half on insurance.

What Is Insurance?

In the teaching for the evening, Dave Ramsey discussed the purpose of insurance – spending some money to keep lots more of it – and he gave a rather simple definition of insurance.

He described the concept simply as a tool to transfer risk.

Much like he taught about mutual funds, the idea is a large group of people all pool their resources together to avoid financial catastrophe in the event of, well, a catastrophe.

In the lesson, Ramsey discusses seven basic kinds of coverage:

While the specifics and details of what he shared are too complex and complicated to share in a short post, suffice it to say Ramsey offers common sense tips and ideas that work hand-in-hand with The Baby Steps to make sure individuals, and families, are protected.

Insurance at Home

Anyone who has ever listened to The Dave Ramsey ShowTM knows how much he stresses having a high level of insurance for your home (if you own it) and for the contents (regardless of whether you own or not).

Given that he teaches people to be working through The Baby Steps, he suggested people with a fully-funded emergency fund should consider a higher-than-normal deductible to lower premiums.

He also encouraged homeowners to purchase a policy with Guaranteed Replacement Cost. This way, coverage keeps up with any increases in the value of your home automatically.

Auto Coverage

Dave recommended avoiding the state minimum levels of liability coverage, in favor of a much higher level of liability.

Like in homeowner’s coverage, he reminded us with an emergency fund, we can probably handle a higher deductible and may want to even consider completely dropping collision insurance (pays for fixes to your own car).

Health Insurance

Here again, a key to saving on insurance premiums is to increase the deductible and/or coinsurance amount.

He also recommends a Health Savings Account, a tax-sheltered savings account for medical expenses.

HSAs have very high deductibles, but often pay at 100 percent above the deductible.

Guarding Against Disability

This insurance, which Ramsey says is among the most affordable types of coverage, replaces your income in case you cannot work because of a disability.

He recommended the specific types and levels of disability coverage.

Long-Term Care Coverage

He shared that the number one financial challenge facing people today is how to care for their aging parents, and reported after age 60 some 70 percent of Americans will require a nursing home stay of at least six months.

For this reason, he recommended long-term care insurance be purchased at age 60.

ID Protection

There is a real difference, he said, between identity monitoring and insurance.

He recommends insurance protection against someone stealing your identity.

With the protection, the insurance carrier will work to clean up the mess rather than you – and he said it often takes as much as 600 hours to resolve problems from identity theft.

Life Insurance Explained

A majority of the teaching was about the difference in life insurance products.

Two main points were emphasized:

1. One, the goal of good financial planning is to become self-insured, meaning having enough savings that you don’t even need life insurance.

2. Two, if you do need life insurance, the only type to purchase in his opinion is term life insurance equal to 8-10x your income.

A Powerful Wrap-up

The evening’s teaching closed with the most powerful presentation of the entire 13 weeks.

Ramsey told the story of a 28-year-old he met who was suffering from brain cancer.

Prior to the diagnosis, Steve Manis had completed most of The Baby Steps and had purchased the suggested level of life insurance.

Manis told Ramsey, that even though the doctors gave him just a few months to live, he knew his wife Sandy would be okay.

Manis passed away three days before his son was born.

While life has been tough for Sandy and the baby, they are financially secure because of what Steve has put into place.

Each of us in class that night wiped tears from our cheeks as we left, and most of us promptly made changes to our insurance coverage to better protect those we love the most.

FPU – Week 8 – That’s Not Good Enough!

Compared to the weighty topics covered in recent sessions of Financial Peace University, the teaching for lesson eight was more lighthearted and could be beneficial to everyone.

Instead of teaching how to make more money or reduce debt, in this lesson, Dave Ramsey talked about shopping – how to find the best deals on items.

While it was one of the shortest lessons in FPU, the material was packed with great information.

Ramsey started by sharing basic guidelines – ground rules he called them – for finding big bargains.

Of course, everything was prefaced on all of the previous lessons, so the bargain hunting needs to be done with cash (never credit or payments!) and only for items that are actually needed.

The ground rules all revolve around issues of integrity: getting a great deal is never worth being untruthful or causing harm to anyone else.

The Culture

Ramsey went on to explain there is nothing wrong with wanting to get a bargain.

In fact, he explained how Americans are some of the only people in the world who do not go into every buy-sell setting expecting to negotiate.

He shared how we often are too embarrassed or ashamed to ask for a lower price, while those in other countries are offended if you don’t try to haggle.

He said to be counter-cultural and don’t be afraid to try to get a great deal.

Negotiations

For the next segment of the DVD lesson, Ramsey shared what he called the Lucky Seven Basic Rules of Negotiating.

Through personal stories and examples, he discussed the importance of honesty, “flashing cash” and simply being quiet in buying situations. H

e talked about how important it is just to ask for a better deal.

The techniques we learned, as well as the encouragement, were to get us to seek out better bargains.

The next day my wife was making a purchase at a local department store.

She knows the store often sends coupons to credit card holders (which excluded us… yeah!).

Regardless, she inquired about a discount when she was checking out. The clerk scanned a 10 percent-off coupon for her simply because she asked!

Other Keys to Success

Ramsey shared other keys to bargain hunting as well, including having the patience to wait and being able to walk away from a potential purchase.

He also talked about developing a willingness to pass on the latest and greatest, instead, opting for last year’s model, a display model, or a scratch-and-dent bargain.

Finally, he shared ways and places to find great deals, ranging from the simple, tried-and-true, such as coupons and yard sales, to other approaches I had never considered before (conventions and trade shows).

It was a great lesson; one that all of us could use to our benefit immediately!

FPU – Week 9 – Intro to Investing

Week 9’s Financial Peace University lesson began with the story of a man who never made more than $65,000 a year through his career, yet he was able to retire in his mid-50s with more than $1 million.

He shared a simple philosophy: live below your means (Dave Ramsey calls it “acting your wage”) and save money within investments.

Saving Simplified

Ramsey began his portion of the teaching with some simple rules of investing, all prefaced on his belief that there is no point in doing everything else he teaches (including getting out of debt) unless the later goal is to use the income to work toward building wealth.

He talked about reaching the pinnacle point when your nest egg makes more money for you than what you earn from work.

He shared the concepts of simplicity in making investments (if you don’t understand a financial product well enough to be able to explain it to a room full of seventh graders, you should not be buying it), diversification (as grandma says, don’t put all of your eggs in one basket) and the correlations between risk and return and liquidity and return.

Types of investments

A discussion of types of investments followed.

Ramsey outlined the basics of Certificates of Deposit, single stock purchases, bonds, real estate, and other tax-deferred investments.

Spending a majority of the evening on managed stock and bond portfolios, he outlined his strategy and guidelines for investing, including definitions and explanations, as well as how to judge things as potential investments and how to diversify the purchase of these investments.

While most of the discussion was on basic investing strategies, he did take the time to explain various tax-deferred investments and how they work.

Using the analogy of a coat to keep an investment warm, he outlined the tax advantages.

However, he did caution, at several points in the evening’s lesson, to never invest purely for potential tax savings.

He also covered what he called “Horrible Investments” and cautioned students to avoid them.

He explained how some are marketed heavily, and others are so complicated even professionals don’t usually profit from them.

Some are downright just dangerous.

In-Class Discussion

After the DVD lesson was complete, we talked as a class about our experiences in investing and working with financial planners.

Some people shared their own stories about working with a company-appointed, or company-approved, planner who was only “pushing” a product or was encouraging investing in something without explaining it.

Others shared their experiences of working with a financial planning professional who understands what Ramsey teaches and explains investments allowing them to make their own decisions.

Everyone agreed this was the type of planner to seek out.

FPU – Week 10 – All About Tuition

From Fruition to Tuition was somewhat painful for me. Designed to go with some of the later Baby Steps (after debt is eliminated), this lesson deals with funding your own retirement and college for your children.

Baby Step 4 is investing 15 percent of your household income into Roth IRAs and other pre-tax retirement plans.

If needed, Baby Step 5 is to be done at the same time. It is safe for your children’s college to use tax-favored plans.

Despite the fact we have a student in college and another in high school, we’re still working on Baby Step 3 – The Debt Snowball – and probably won’t need to work on Step 5 at all; by the time we get there, we won’t need it!

Regardless, the lessons provided in this part of FPU are very good ones.

Saving for Retirement

The first part of the lesson dealt with saving for retirement.

The teaching was much too involved and complex to package in just a few paragraphs.

I’d recommend you enroll in FPU, read Ramsey’s book Financial Peace, or talk with your financial planner for details.

Some highlights of the material include a discussion of qualified retirement plans including:

- Individual Retirement Accounts (including Roth IRAs)

Ramsey stressed the importance of saving for retirement with tax-favored accounts, meaning the plans may grow tax-free if they meet certain requirements. Taxes may apply upon withdrawal.

He went into great detail on the benefits and characteristics of Roth IRAs and other retirement plans.

He even gave suggestions on how to fund Baby Step 4 using employer matches and several retirement savings vehicles to our advantage.

Graduating to College Savings

Following the discussion of saving for retirement, Ramsey moved into the importance of saving for children’s college educations.

Sharing facts about the current cost of university education and the average student debt load of college graduates, he stressed how important saving early for college really is.

What came next was a presentation on specific ways to save for college including the use of an Education Savings Account, also known as an Education IRA.

The ESA provides some tax-free savings.

Contributions are not tax deductible.

Earnings are tax-deferred and withdrawals are tax-free for qualified educational expenses.

Additionally, Ramsey outlined 529 savings plans, as well as UTMA and UGMA (Uniform Transfer/Gift to Minors Act).

The Impact on Us

I said earlier how this lesson on saving for college probably would not be pertinent to us, but I’ve been rethinking it.

My youngest is a high school sophomore. If we really work Dave’s plan and roll through the other Baby Steps, we just may be in a position to save some for her education – or at least pay for school with good ol’ cash!

FPU – Week 11 – Working On Your Strengths

This lesson from Financial Peace University was somewhat different than all of the rest.

So far in the course, we’ve talked about reducing debt, making better buying decisions, and saving money – all things that deal with the “outgo.” This time, we learned about the income side of the equation.

As Dave Ramsey tells many of the callers on his radio show, “When you’ve got a big hole, it helps to have a really large shovel,” meaning while income alone does not solve all financial problems, it certainly can help.

Finding the Right Job

During the video segment of the lesson, Ramsey explained how important is it to not only find a job, but how vital it is to always be prepared for the next job.

He pointed out that the rate of change in the world today is blinding and it takes effort to keep up.

As a part of the ongoing evolution, he said, unlike in previous generations, jobs (or even careers) very rarely last for a lifetime.

In fact, the average job tenure today is just 2.1 years.

Match Your Personality

Ramsey discussed the dangers of choosing a career path just for the potential of making large sums of money.

He shared the stories of high-income earners who were so miserable they (at worst) attempted suicide or (more frequently) finally became happy again after a drastic career change.

He said the key is finding work that fits your own personality, regardless of income.

Understanding personal strengths, passions, weaknesses, and differences can lead to work that is rewarding, both in terms of emotional well-being and finances.

He added it’s impossible to outgrow your personality and there is a myth people should strive to be well-rounded.

Instead, he urged, do not become average at everything; become excellent at a few things.

This way, you’ll be indispensable.

Discovering Your Personality

Ramsey asked every student to make a note in their Financial Peace University workbook, to ensure we had this sentence down:

How can you know where you ought to be, and what you ought to be doing, if you don’t know who you are?

With this, he entered into a time of explaining four personality types:

1. Dominant

2. Influencing

3. Stable

- Compliant

He explained how each type of person fits into certain behaviors and how understanding ourselves and others can influence our relationships and influence the way we handle our finances.

Finding the Jobs

He concluded the evening’s lesson with a discussion of finding the right jobs, including how (and where) to look, how to communicate with potential employers, and what to do in interview situations.

Finally, he shared how jobs (including second and part-time ones) can impact all of the Baby Steps.

He reminded students how raising income in the long term is a career track issue; raising it short term means a part-time job.

Regardless, he said to have a detailed plan, be willing to sacrifice and don’t give up, then financial peace can be achieved.

FPU – Week 12 – Real Estate and Mortgages

This Financial Peace University session dealt exclusively with real estate – buying and selling homes, paying for property, and what sort of loans to look for when mortgage shopping.

While the lesson itself was relatively short, the material covered draws on Dave Ramsey’s years of experience in the real estate field.

As he tells his students and listeners, he made (and lost) millions of dollars in real estate in his early 20s.

Then he learned the proper way to approach property and loans.

The Right Home Loan

Of course, the lesson was prefaced with an understanding of Baby Step 6: Pay off your home early.

Ramsey told students simply,

Remember to hate debt.

He said the absolute best mortgage is the 100 percent down plan, but if borrowing is necessary, he teaches to get a 15-year fixed-rate loan with payments that do not exceed more than 25 percent of your take-home pay.

He also reminded students to make sure they have a fully funded emergency fund (Baby Step 3).

Things to Avoid

Ramsey says that avoiding Adjustable Rate Mortgages (ARMs), interest-only loans, reverse mortgages, and falling into the myth of keeping a mortgage for tax advantages is a good idea.

He outlined several financing options (always reminding students to borrow for 15 years or fewer) including conventional financing, FHA mortgages, Veteran’s Administration loans, and owner financing, which he called a great option because of the ability to structure the loan creatively.

Buying a Home

Ramsey outlines how homes are great investments because they are the equivalent of a forced savings plan; they are also a good hedge against inflation and the invested money grows virtually tax-free.

He recommended purchasing a home in the lower portion of the price range in the neighborhood and, when possible, buying a home with a view or one that is near water.

The idea is that bargains can often be found by overlooking bad landscaping, outdated décor, and ugly colors – all of those things can be fixed.

But you can’t move the house.

He recommended a survey of the property as well as a certified home inspection and an appraisal if it makes you more comfortable with your prospective purchase. He cautioned against buying trailers or mobile homes (they go down in value, he says) and timeshares.

Selling a Home

Ramsey also gave several tips for individuals selling their homes, including thinking like a retailer and making sure the home is in near-perfect condition.

He said there is a tremendous return on fix-up dollars and the most important preparation is to make sure the home has curb appeal or looks good from the street.

He taught how sellers should work with a realtor, particularly one with a track record of success, and avoid real estate agents who are family or friends.

He said to make sure the home gets exposure, both online and through the Multiple Listings Service (MLS).

FPU – Week 13 – The Great Misunderstanding

Next to the lesson on dumping debt, week 13’s teaching was my favorite.

Despite an absolutely horrible night, weather-wise (severe thunderstorms), my wife and I were looking forward to the evening.

We were excited about finishing up Financial Peace University and wanted to hear what Dave Ramsey had to say about giving.

We were not disappointed.

The lesson was, in many ways, the goal for us.

Based upon Baby Step Seven: Build Wealth and Give, the title of the lesson was “The Great Misunderstanding.”

Ramsey said in the teaching for the evening why the reason for the title is a great paradox when it comes to giving.

He said, contrary to popular belief, the way to have more is not by holding on tightly, but rather having an open hand and giving.

A Change in Attitude

In giving, Ramsey taught, people tend to become less selfish.

The result, he said, was less selfish people tend to prosper more in relationships and in wealth.

He said understanding this lesson was very important: while a student can prosper by following all of the other lessons, it is only by giving a person can truly have financial peace.

Lessons From the Bible

The lesson spoke most clearly to those of us who are Christians.

Ramsey taught the Biblical principles of tithing and stewardship.

In our giving, we are more Christ-like and because we are designed in God’s image, we are happiest and most fulfilled when we are serving and giving.

He taught how giving is a reminder of who actually owns everything, it is a form of praise and worship and he likened giving tithes and offerings to spiritual warfare.

He concluded the lesson and the course by saying financial peace is more than just God’s system for understanding money, becoming debt free, and building wealth.

Financial Peace, he said is when The Great Misunderstanding is truly understood.

At this point in the evening’s lesson, my wife nudged me with her elbow and pointed outside.

The storm clouds had lifted, the sun was shining and there was a beautiful full rainbow in the eastern sky.

I got the point.

I understood.

Course Wrap-up

We had completely finished Financial Peace University.

Through the 13 weeks, we had learned a lot and reconsidered many of the decisions we had made with money.

We came away from the class inspired and ready to tackle our finances and to begin making better decisions.

Financial Peace isn’t everything I had hoped for; it was much more. The course was entertaining, educational, and motivational.

It was a great experience and an investment I’m very glad we made.

Is Financial Peace University Right For You?

Financial Peace University (FPU) is an online course that can help individuals and families create a plan for getting out of debt, managing their money, and building wealth. The program provides helpful tools such as budgeting spreadsheets, debt payoff calculators, investing advice, and more.

Whether FPU is the right choice for you depends on your individual financial situation and goals. If you’re looking to improve your money management skills or get out of debt quickly, then it may be a valuable resource.

However, if you already have a solid grasp of personal finance or simply want one-on-one guidance with an experienced financial advisor, then FPU may not be the best option for you.

Dave Ramsey's Financial Peace University Review

Product Name: Dave Ramsey's Financial Peace University

Product Description: Dave Ramsey's Financial Peace University is a comprehensive personal finance course designed to empower individuals to take control of their money. Through a series of lessons, FPU delves into money management, debt elimination, and wealth building from a faith-based perspective. The course emphasizes Ramsey's seven-step "Baby Steps" plan to achieve financial freedom.

Summary of Dave Ramsey's Financial Peace University

FPU is a 9-week course that covers topics such as budgeting, saving, investing, and reducing debt. The program includes a workbook, access to online resources, and a membership in Ramsey’s online community. Many people have found the program to be helpful in gaining control of their finances and achieving financial peace. However, it is important to note that results may vary and it’s always a good idea to do your own research and consult with a financial advisor before making any financial decisions.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Comprehensive guidance on budgeting, paying off debt, investing, and more.

- Helpful tools such as budgeting spreadsheets, debt payoff calculators, and investment advice.

- Practical advice: The program is known for its practical, actionable advice that can be easily implemented in real life.

- Support and accountability: The program includes access to an online community of individuals who are also working through the course, which can provide support and accountability.

- Popularity: Dave Ramsey is a well-known personal finance expert and the program has helped many people achieve financial peace, which can be a good indication of the effectiveness of the program.

Cons

- One-size-fits-all approach: The program is based on Dave Ramsey’s personal philosophy, which may not align with everyone’s values or needs.

- Limited to the USA: The program is primarily aimed at the US market, which may not be as relevant or helpful to individuals living in other countries.

- No professional advice: The program is a self-help program, it doesn’t provide professional advice, so it’s always a good idea to consult with a financial advisor before making any financial decisions.

Les O’Dell is a freelance writer living in Carbondale, Ill. His work can be seen in a number of newspapers, magazines, publications, and websites. He is co-author of the popular “He Said, She Said” newspaper column. He can be found on the web at www.lesodell.net.

God bless you for making my brothers and sisters in Christ more stable. Lights.

Hello- I would like to see if I could get a replacement disc for lesson 3? Any help with this would be greatly appreciated.

Thank you,

Michael Moran

Cross connection church

6812 lafayette rd.

P.o. box 686

Chickamauga, ga

30707

Hi Michael – You’ll need to contact Dave Ramsey’s organization to make that happen.