Whereas Dave Ramsey’s Baby Steps have often been dissected one at a time, my goal in this post is to give an overview of the steps as a unit and explain why the order is essential.

Hopefully, these steps can help you create a focused life plan for your finances, regardless of your age or financial well-being.

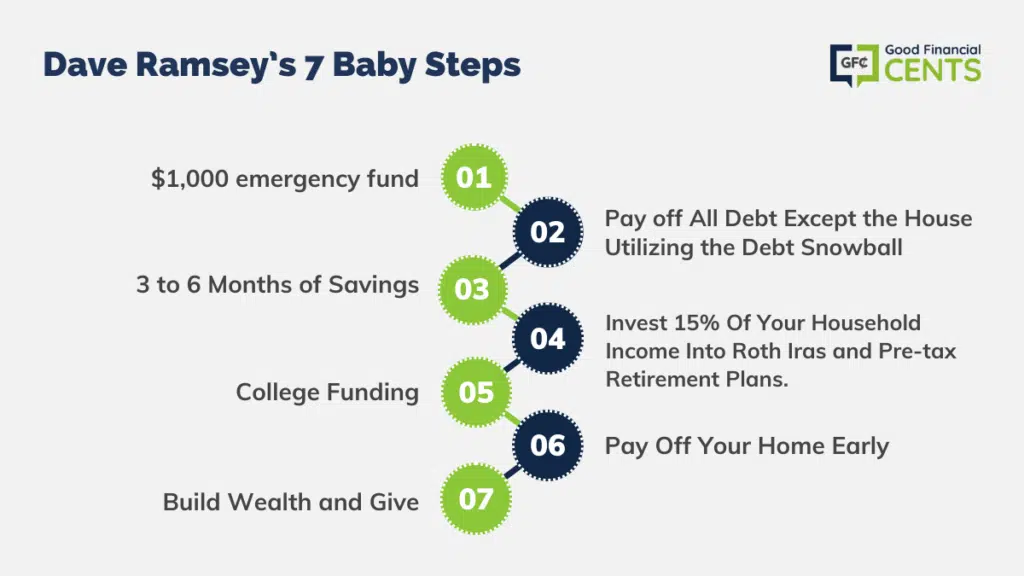

First, the Baby Steps:

- Step 1: $1,000 in an emergency fund.

- Step 2: Pay off all debt except the house utilizing the debt snowball.

- Step 3: Three to six months of savings in a fully funded emergency fund.

- Step 4: Invest 15% of your household income into Roth IRAs and pre-tax retirement plans.

- Step 5: College Funding

- Step 6: Pay off your home early.

- Step 7: Build wealth and give.

The Power of Focus

Dave’s premise with the Baby Steps is that people can accomplish great things IF they can just be focused. When you read over these seven steps, you think, “Yes. I need to be saving. But I also need to be investing for retirement. I should get my house paid off early. But I also need to be getting out of debt and saving for my kid’s college.”

You would readily agree that all of these goals are important for successful financial planning. The problem is that your stress level kicks into overdrive with the prospect of doing them all. You clench your jaw and do what you are capable of doing while feeling anxious about the goals you place on the back burner.

You can also check out my YouTube video, where I break down each of Dave’s Baby Steps here:

Why?

Because accomplishing each step puts you in a great position to accomplish the next one.

You begin to feel an empowerment and a sense of control as you get one step behind you and start the next one. You are making progress instead of treading water.

Why Are the Baby Steps in the Order They Are In?

Steps 1 and 2: $1,000 Emergency Fund and Debt Snowball

Notice that Steps 3 through 7 are all about using your money to do something positive for you and your family. Of course, this money comes from your income, but the problem with most of America is that we are using our income on debt payments.

Because we are paying others instead of ourselves, we need to get rid of our debt (Step 2) in order to free up our income for Steps 3-7.

Ask yourself,

“What if I could use all the money I am currently paying to creditors to start “paying myself”?

For many people, this is $1,000 to $3,000 a month.

Baby Step 2 debt snowball is designed to do just that. Step 1 is necessary before Step 2 because you don’t want to start paying off debt without having a small cushion to absorb the unplanned expenses that will occur during Step 2.

Step 3: 3 to 6 Months of Savings

After completing the first two steps, you are out of debt (except for your house) and now have that cash flow you dreamed about: all of the money you used to pay others is at your disposal. The temptation is to start investing for retirement, saving for your kid’s college, or paying off your house early.

NOT SO FAST!

Stop, take a deep breath, and use that cash flow to build up your emergency fund so you will indeed be ready for emergencies. This fund needs to be liquid (in a top savings account or money market account).

If you skipped the step and started any of the ensuing steps, how would you handle emergencies? Pull money from your retirement account? Rob the kid’s college savings? Borrow money against your house? All bad ideas.

Step 3 is, therefore, always ahead of the following steps

Steps 4, 5, and 6: Saving for Retirement, College Funding, Pay off Home

You may be asking,

“Why is retirement ahead of college funding? Wouldn’t a good parent put his children ahead of himself?”

Good question. But what if you end up without sufficient retirement income because you made college funding a higher priority? Who will you be depending on in your later years? Your kids!

The thing about retirement planning is that you only get one shot at it. The years go by and you will someday be at retirement age. You don’t have a choice. On the other hand, college funding is full of choices: kids can get scholarships, they can work, they can attend community colleges, they can find work/co-op programs, etc, etc.

Step 4 is therefore ahead of step 5. But notice that Step 4 is 15% of your income. If you have cash flow greater than 15%, you can apply that to college funding immediately, and if you have more than enough cash flow to accomplish both steps 4 and 5, you can use all of the extra to pay off your house early (step 6).

Note that Step 6 comes behind retirement and college funding because reversing the order could possibly give you a paid-for house at the expense of a dignified retirement or helping your kids through college. Most of us wouldn’t want that.

Not sure where to start investing for retirement? Here are some tips:

- Best Places to Open a Roth IRA – Figuring out where to start investing your 15% of income can be confusing. A great place to start is a Roth IRA, but deciding on a broker is confusing. This list will help you pick the best broker for your Roth IRA.

- Best Online Stock Broker Sign-Up Bonuses – You can get hundreds of dollars or thousands of airline miles just for opening up a brokerage account.

- Beginner Investing Strategies – If you’ve never invested before, it can be overwhelming. This list breaks down getting started into manageable pieces.

Step 7: Build Wealth and Give

Life is now very good! You have no debt, a great emergency fund, and a paid-for house. All of the cash flow that used to go toward debt reduction and house payments is now at your disposal.

This, by the way, is the step Mandy and I are on. Being semi-retired, we don’t have a huge income, but it is sufficient because we also don’t have any debt. We continue to invest every month and we are able to give more than we have ever given before.

Once we got our house paid off, we started to budget “bless” money, which we put into an envelope every month just to have it available so we could bless others as we see their needs. We are also able to help our grown daughter and daughter-in-law cash flow their college.

As I said, life is good. Mandy and I are experiencing great financial peace, and we are very grateful for Dave Ramsey’s Baby Steps.

I wish the same for you.

Final Thoughts

Dave Ramsey’s Baby Steps offers a clear and effective path toward financial success. By following these steps diligently and with discipline, you can transform your financial life and secure a brighter future for yourself and your family.

The key is to stay focused, stay disciplined, and never lose sight of your financial goals. Continue to educate yourself about personal finance, seek advice when needed, and always strive to make informed decisions. With dedication and perseverance, you can conquer your financial challenges and build the prosperous life you deserve.

Remember, financial freedom is not just about accumulating wealth; it’s about having the peace of mind and the resources to live life on your terms.

This article is a general overview of what Dave Ramsey has to offer and is not intended to replace his course, nor is this sponsored or endorsed by Dave Ramsey or the Lampo Group.

I know I’m late to the party, but I had a quick question:

For Baby Step 4: Is the 15% into a Roth IRA a one time occurrence? Or, is it a yearly occurrence? In other words, am I supposed to invest the money only once into a Roth IRA, then after that invest in other things? Thanks 🙂

Continually invest yearly or however you can and it’s best to get a financial advisor that follows Dave Ramseys plan, go to ramseysolutions.com and fill out the info and it will give you a couple of advisors in your area, it’s under ELP investors.

Do you have a post that goes over the different companies you can go through to open a Roth IRA, any advice on that?

Thanks!

@ Heather We sure do. Check out the best places to open a Roth IRA. Let me know if you have any questions.

I love Dave’s philosophies so much, hes probably one of my favorite financial gurus. I really like how he simplifies the steps needed for success. Great article!

Great article Jeff!

We’ve been following Dave since ’08. Baby steps 4,5,6 are in progress right now!

HUGE fan of “the power of focus” and the Dave Ramsey Baby Steps! Wonderful advice. I am currently on Baby Step 2, paying off my student loans (halfway there, down to $70,000 from $140,000 just 4 years ago). Right now my debt snowball is temporarily stopped, to save up for our wedding….but that fund will be complete no later than the beginning of July. Then I’ll re-start the debt snowball and by the time my fiance comes back from Afghanistan and we get married in the spring, I’ll be at about $50k in debt! 🙂