What Is DB(k) Pension Plan?

The DB(k) pension plan, an innovative approach to retirement planning, combines elements of both traditional defined benefit (DB) pension plans and the widely popular 401(k) plans. Essentially, it offers a hybrid model aiming to provide employees with the best of both worlds – guaranteed monthly payments from the defined benefit plan and the opportunity for additional savings and potential investment gains from the 401(k) component.

Table of Contents

Brief History and Origin of the DB(k) Plan

The birth of the DB(k) plan can be traced back to the Pension Protection Act of 2006. This legislation was crafted in response to the growing concern about the financial security of retirees. By allowing companies to merge the features of traditional pensions with those of 401(k) plans, the goal was to enhance retirement security for workers while providing employers with a more manageable way to offer comprehensive retirement benefits.

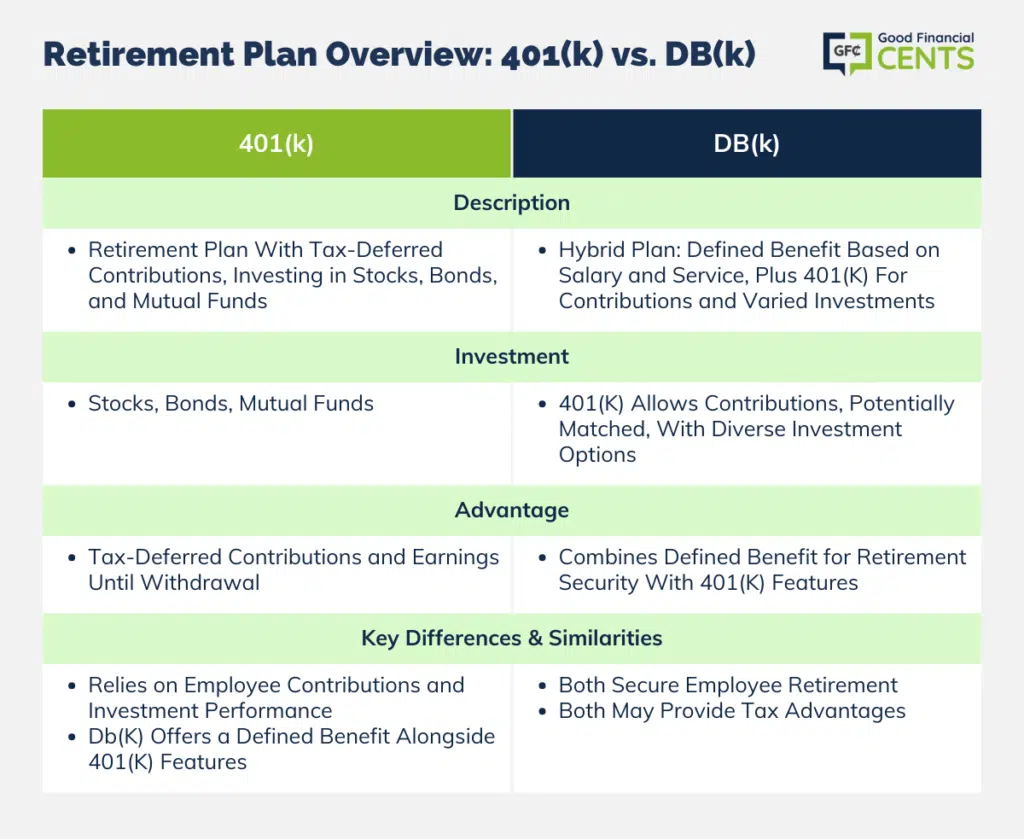

Comparative Analysis of DB(k) and 401(k)

Basic Features of 401(k)

A 401(k) plan allows employees to save a portion of their earnings for retirement, often with a matching contribution from their employer. The funds are typically invested in a range of assets like stocks, bonds, and mutual funds. The most significant advantage of a 401(k) is the tax deferral on both contributions and investment earnings until the funds are withdrawn.

Basic Features of DB(k)

The DB(k) plan, as a hybrid, consists of two main components. The first is a defined benefit feature, promising participants a specific pension amount upon retirement, typically based on their salary and years of service. The second component resembles a traditional 401(k), permitting employees to contribute a portion of their salary, sometimes matched by their employer, which can then be invested.

Key Differences and Similarities

While both plans are geared toward securing an employee’s retirement, they have fundamental differences. The 401(k) relies primarily on employee contributions and the performance of chosen investments, whereas the DB(k) adds the assurance of a defined benefit. However, both share the common goal of aiding employees in saving for retirement and can offer tax advantages.

DB(k) Pension Plan Rules

Eligibility Criteria

- Employers: For an employer to offer a DB(k) plan, they need to have been in operation for at least three years and must commit to providing the plan for at least three more. This ensures stability and a long-term perspective, crucial for such a significant benefit.

- Employees: Generally, employees over 21 years old and with at least a year of service are eligible. However, specific eligibility can vary based on the employer’s plan provisions.

Contribution Limits

- Mandatory Employer Contributions: Employers are required to make a contribution to the defined benefit component, typically a set percentage of an employee’s salary. This ensures the promised pension payments in retirement.

- Employee Deferral Options: On the 401(k) side, employees can defer a part of their salary, within IRS limits. This provides flexibility in retirement savings, allowing employees to adjust based on their financial needs and goals.

- Vesting Schedules: Dictate when an employee has full ownership of their employer’s contributions. In a DB(k), vesting schedules can be immediate or spread over several years, but full vesting must occur by the end of a three-year period.

Benefits Calculations and Distributions

Benefits are typically calculated based on an employee’s final average salary and years of service. Distributions can be taken as lump sums or annuities, depending on the plan’s provisions and the participant’s preference.

Rollovers, Withdrawals, and Loans

Similar to 401(k)s, DB(k)s often allow for rollovers to other retirement accounts, withdrawals under specific circumstances, and loans under certain conditions. It’s essential to be aware of potential penalties and tax implications.

Employee Benefits From DB(k) Plans

An income stream, an employer match, and a really neat tool to save for retirement. In brief, the DB(k) has four compelling attributes:

- Monthly Paycheck for Life. The income stream won’t replace an employee’s end salary, but it certainly will help. Employees who have worked for the company for a longer period of time are rewarded: the pension income equals either

a) 1% of final average pay times the number of years of service, or

b) 20% of that worker’s average salary during his or her five consecutive highest-earning years.

- Automatic Enrollment for 401k. That employees save for the future by default. (They can choose to opt-out.)

- The company automatically directs 4% of a worker’s salary into his or her 401(k) account. The company also has to match 50% of that amount, which is vested upon the match. (Employees do have the choice to alter the contribution level up or down from 4%.)

- It only takes three years for an employee to become fully vested in a DB(k) pension plan. So even if they leave the company, the money is theirs.

Benefits of the DB(k) Pension Plan

- Guarantees and Security Features: The defining benefit component of the DB(k) offers a guaranteed payout in retirement, giving employees a safety net, regardless of market fluctuations.

- Potential for Combined Benefits: DB(k)’s hybrid nature means participants can enjoy the guaranteed pension while also capitalizing on potential investment gains from the 401(k) component. This combined benefit can result in a more substantial retirement fund.

- Attraction and Retention Tool for Employers: Offering a DB(k) can be a competitive advantage for employers, attracting top talent and retaining valuable employees by providing enhanced retirement security.

- Tax Advantages for Employers and Employees: Both employers and employees can enjoy tax advantages. Employers can deduct contributions, while employees benefit from tax-deferred growth.

Bottom Line: DB(k) Pension Plan Rules

The DB(k) pension plan emerges as a groundbreaking approach to retirement, blending the assurance of defined benefits with the flexibility of a 401(k). Born from the Pension Protection Act of 2006, its dual-component structure promises stability, while offering investment growth potential.

It acts as a beacon for employers, drawing in and retaining top-tier talent, and bestows tax benefits upon both employers and employees. In the evolving landscape of retirement planning, the DB(k) stands out, potentially heralding a shift in how we envision future financial security for retirees.