Have you ever been declined when applying for life insurance coverage?

Have you thought that you were super fit and that you would get approved instantly only to have a curve ball thrown at you to realize either something came back on your medical exam or you found out that you’re uninsurable?

You were probably shocked and had no idea where to turn next. Are you looking for a different company? Go with a no-exam policy? Or just skip life insurance altogether? (hint: that’s not the answer)

If this is the case I want to give you a few tips on how you can get approved for life insurance even if you’ve been declined.

Table of Contents

First, let me share with you a quick story that helps illustrate this point.

I had a gentleman that applied trying to get the cheapest life insurance possible. As you know, I am a big fan of getting cheap life insurance, but if you have a previous condition – if you’ve had a felony, misdemeanor, or DWI – opting for that first quote, even if it’s the cheapest, is not always your best option.

Why Did They Get Declined?

In this case, this is what this gentleman did. He went for the cheapest rate and sure enough, because he had a DWI on his record he got declined. At that point, he should have gone with an independent agent, but he went ahead and went with the second cheapest quote. He isn’t the only one. Every year there are thousands and thousands of stories just like his.

Sure enough, he got declined…. again!

This was all within a 90-day period. This is not recommended, so he was very frustrated and didn’t really know how to proceed next. Typically, if you’ve been declined in a 90-day period for the exact same thing, it’s going to be very hard for you to get insured. Because we went with an independent agent (myself) we were able to get him in touch with the right carrier.

Because he had some other high-risk health conditions, we had to really do our homework. But we finally found the carrier that was going to approve him and get him the life insurance coverage that he needed.

If you’ve ever been declined for life insurance, you know how frustrating it can be. You will feel lost and confused with no idea what to do next. You want a plan that covers you and your family, but now you think that it’s impossible.

Don’t worry, a lot of being are declined coverage, but still go on to find coverage with some other option. If you fall into this category, there are several different things you can do to make sure that you get the coverage you want and deserve.

Few Tips If You Get Denied for Your Life Insurance

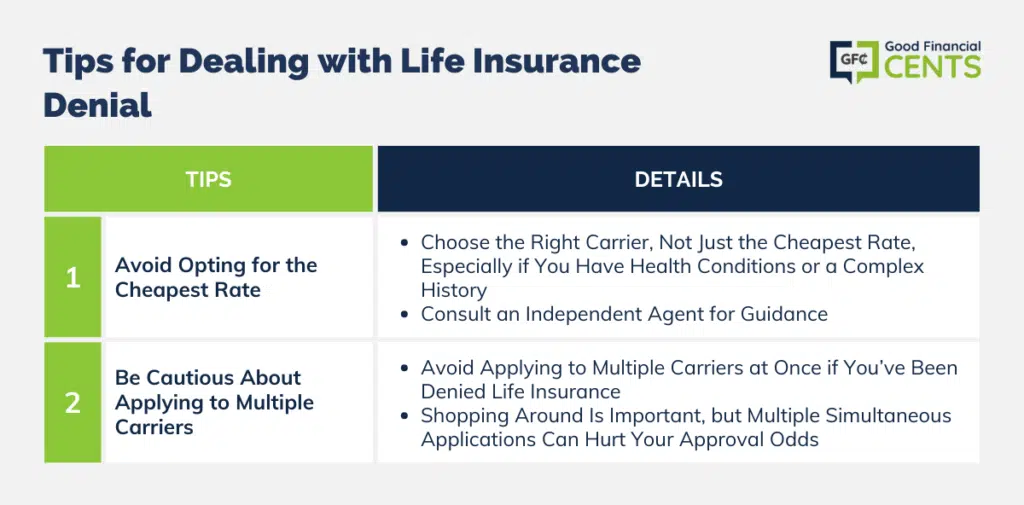

- The first tip is don’t go with the cheapest rate just because you’re trying to save a quick buck. If you have health conditions, if you have other items going on in your history, then going with the cheapest rate is not the best option. Make sure that you go with an independent agent that understands your complete situation to make sure they put you with the right carrier. It might not be the cheapest rate, but at least you know you’ll get insured.

- The second tip is if you’ve been declined for life insurance, don’t apply to more than one carrier at a time. This gentleman was applying to three carriers over and above the two that initially declined him. If you’re trying to shop around and go through all these different top life insurance companies, they are not going to believe that you’re real and they are not going to insure you. Yes, it’s important that you receive quotes from several different companies, but not apply to a lot of them all at once. Shop around for quotes, but don’t apply.

Make sure you go with an independent agent, find the carrier that is best suited for you, and stick with them. That way they can work with you and work with the underwriter to get you the insurance you need.

Finding Life Insurance After Being Declined

Life insurance is an investment you should make for the future of your family. More than likely, your wife and children will be left with a mountain of debt and unpaid expenses that they would be left to pay. Instead of leaving your family with mortgage payments, car loans, and credit card bills, life insurance will give your family the money they need to pay off those debts and get through that difficult time.

Each company is different with different views on applicants. Some of them view applicants with heart conditions more favorably while other companies look at applicants with diabetes or DWIs more favorably. The company that you apply with will make all of the difference between being accepted and being denied.

Sure, you could spend hours and hours researching different companies or calling them on the phone or you can have our agent do that instead. Our agents are extremely knowledgeable about the life insurance space and which companies can get you the best rates for quality coverage.

Not only will we find a company that will accept you, but we will find policies from the highest-rated companies with excellent rates. In most cases, a life insurance policy is much more affordable than most people think. Having quality insurance shouldn’t break the bank.

How Much Life Insurance Do You Need?

Being accepted for life insurance is just the beginning of the life insurance policy process. You also have to decide how large of a policy that you need. As we mentioned earlier, one of the purposes of life insurance is to pay off any debts that you would leave behind.

Because of that, you need to make sure that your policy will cover any final expenses that you leave. Total all of your debts, mortgages, car payments, etc the final number is the best way to ensure that you have a large enough life policy.

The other factor to consider is your annual salary, and how many of your family members rely on your income. If you were to pass away, would your family suffer a huge financial loss? Would they be able to get by without your salary? If you have several family members who NEED your annual income, then one of your life insurance goals is to replace that income if your life ends.

There is no perfect number that you should aim for when purchasing a life insurance policy, however, experts normally suggest 10x your current salary. This will give your loved ones plenty of time to get through the emotional stress without having the added burden of bills piling up.

Bottom Line – Life Insurance Decline: Next Steps

Getting declined for life insurance can be frustrating, but it doesn’t mean you’re out of options. Rushing to the cheapest policy isn’t the best approach, especially if you have health issues. Instead, consult with an independent agent who can find the right carrier for your unique situation.

Avoid applying to multiple carriers simultaneously, as it can raise red flags. Quality life insurance is essential to protect your family’s financial future, so take the time to find the right policy, tailor it to your needs, and ensure it covers outstanding debts. Seek expert guidance to secure the coverage you deserve.

i am 70 years old have copd….. ptsd and am retired military from 1989 .I do not have life insurance for my wife can you help me?

Cavalcade of Risk #159: The Early Edition

CavRisk veteran My Wealth Builder hosts this week’s roundup of risk-related posts, and your post is in it:

http://my-wealth-builder.blogspot.com/2012/06/cavalcade-of-risk-159-early-edition.html

Please tell your readers.

And a friendly reminder to newbies and regulars alike that, while it’s not mandatory to give a link back, it’s the way that carnivals work best. If your submitted post has been included in the Cav, please remember to post about it on your blog because it helps us all.

Thanks!

Hank Stern