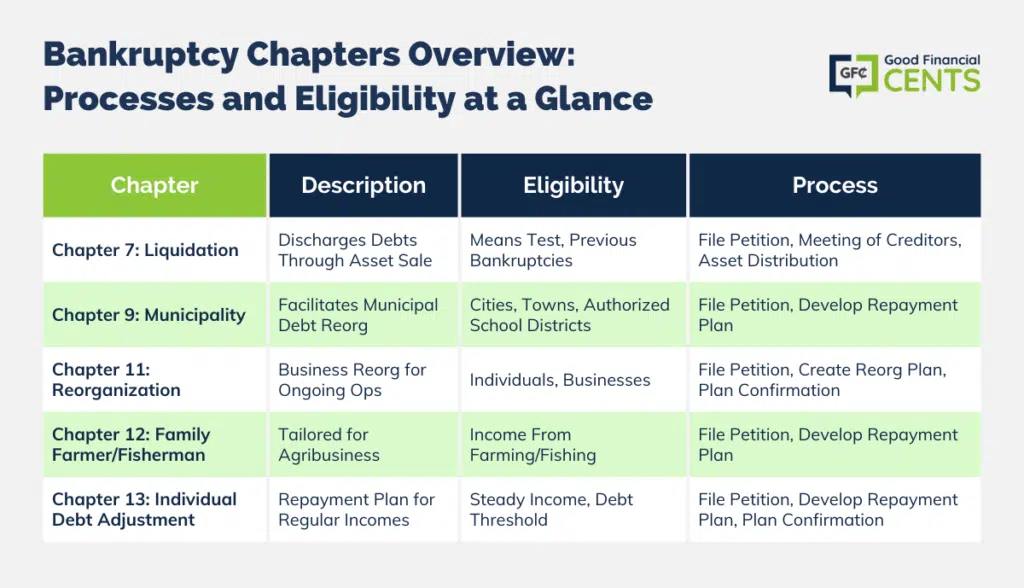

Different bankruptcy chapters cater to different needs and circumstances, ranging from personal bankruptcy involving asset liquidation to business reorganization and municipal bankruptcy.

Table of Contents

Chapter 7: Liquidation

Chapter 7 bankruptcy, also known as “liquidation bankruptcy,” allows the discharge of most debts after non-exempt assets are sold to repay creditors. Primarily, it offers individuals and businesses a clean slate by wiping out unsecured debts such as credit card debt and medical bills.

Eligibility Requirements

1. Means Test: To qualify for Chapter 7, individuals must pass a means test that considers income, expenses, and family size. This test ensures that only those genuinely unable to repay debts can access this form of bankruptcy.

2. Previous Bankruptcies: Your eligibility might also be affected by previous bankruptcy filings, and certain time restrictions apply.

The Process

- Filing the Petition: The process commences with filing a petition in bankruptcy court. Subsequent steps involve the evaluation of assets, liabilities, income, and expenditures.

- Meeting of Creditors: A trustee is appointed to oversee the case, and a meeting of creditors is conducted, allowing them to ask the debtor questions about financial status and property.

- Distribution of Assets: Non-exempt assets are sold, and the proceeds are distributed to creditors according to the bankruptcy code’s priority scheme.

Chapter 9: Municipality Bankruptcy

Exclusively designed for municipalities, Chapter 9, or ‘Municipality Bankruptcy,’ facilitates the reorganization of a municipality’s debts. It empowers municipalities to continue operations while they formulate and negotiate plans for debt adjustment.

Who Can File

Only municipalities such as cities, towns, and school districts are eligible. They must be specifically authorized by state law to file for bankruptcy.

The Process

- Filing the Petition: A petition is filed in federal bankruptcy court, initiating the process.

- Developing a Repayment Plan: The municipality, in collaboration with creditors, formulates a plan to reorganize and adjust its debts.

Chapter 11: Reorganization

Chapter 11, predominantly used by businesses, facilitates the reorganization of a debtor’s business affairs and assets. It allows businesses to continue operating while repaying creditors through a court-approved plan.

Eligibility Requirements

Both individuals and business entities can file for Chapter 11, but it is particularly suited to larger businesses due to its complexity and cost.

The Process

- Filing the Petition: The debtor must file a petition in bankruptcy court, marking the commencement of the case.

- Creating a Reorganization Plan: A detailed reorganization plan, which must be voted on by creditors, is developed to propose how the debtor will operate and repay creditors moving forward.

- Plan Confirmation: The court confirms the reorganization plan, which binds the debtor and creditors.

Chapter 12: Family Farmer or Fisherman Bankruptcy

Chapter 12 bankruptcy is tailor-made for family farmers and fishermen, offering them mechanisms to reorganize and adjust their debts. It’s a specialized form, accommodating the unique income structures and necessities of family farmers and fishermen.

Eligibility Requirements

The Process

- Filing the Petition: A voluntary petition is initiated in bankruptcy court, followed by the submission of schedules and statements detailing finances.

- Developing a Repayment Plan: A repayment plan is proposed, detailing the manner in which debts will be settled over three to five years.

Chapter 13: Individual Debt Adjustment

Chapter 13 bankruptcy, or ‘Individual Debt Adjustment,’ is a beacon for individuals with regular incomes, allowing for the development and execution of a debt repayment plan. It offers a platform to repay debts, partially or fully, over a period, typically ranging from three to five years.

Eligibility Requirements

Debtors must have a steady income and their secured and unsecured debts must fall below certain thresholds.

The Process

- Filing the Petition: The process initiates with the filing of a bankruptcy petition, followed by detailed financial statements.

- Developing a Repayment Plan: A repayment plan is devised, specifying how creditors will be paid over the plan period.

- Plan Confirmation: The court confirms the plan, allowing the debtor to make payments to the trustee who distributes it among creditors.

Comparison Between Chapters

Chapter 7, a liquidation form, primarily caters to individuals and businesses, enabling the discharge of debts post the liquidation of non-exempt assets, providing a fresh financial start.

Chapter 9 is meticulously designed for municipalities, facilitating the reorganization of debts while ensuring continuous operational functionality, thus safeguarding public interests and services.

Chapter 11, renowned for its business reorganization approach, is a lifeline for businesses, particularly larger enterprises, allowing for a restructuring of affairs and assets. It permits businesses to continue operations and maintain asset control while undergoing the reorganization process.

Chapter 12 is a specialized form crafted for family farmers and fishermen, addressing their unique financial landscapes, and providing mechanisms for debt adjustment and reorganization.

Chapter 13, often termed as the wage earner’s bankruptcy, provides a structured repayment platform for individuals with consistent incomes. It offers a way to repay debts over time while protecting assets from liquidation.

Each chapter is a different avenue, meticulously crafted to address specific financial scenarios, ensuring a relevant and practical approach to managing and overcoming financial distress.

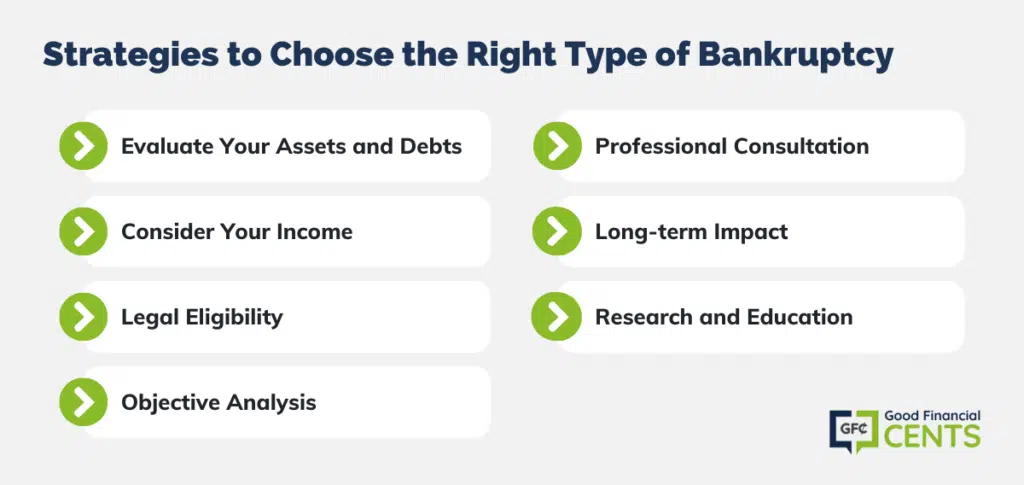

Strategies to Choose the Right Type of Bankruptcy

Choosing the right bankruptcy chapter is a crucial decision that involves thoughtful consideration of various factors tailored to individual circumstances. Here are some strategies to guide this decision:

1. Evaluate Your Assets and Debts: Analyze the nature of your debts and assets. Consider whether your debts are mainly unsecured, like credit card debts, or secured.

2. Consider Your Income: Review your regular income sources. Stable income may make you suitable for Chapters 13 or 12, enabling structured repayment plans.

3. Legal Eligibility: Familiarize yourself with the eligibility criteria for each chapter. For instance, Chapter 7 requires passing a means test, while Chapter 12 is specific for family farmers and fishermen.

4. Objective Analysis: Clearly define your bankruptcy objectives. Whether it’s a fresh start, business reorganization, or structured repayment, align your choice with your primary goal.

5. Professional Consultation: Seek advice from bankruptcy professionals or attorneys. Their expertise will provide personalized insights, guiding you toward the most beneficial choice.

6. Long-term Impact: Consider the long-term implications on your credit and assets. Some chapters may lead to asset liquidation, while others allow asset retention.

7. Research and Education: Invest time in understanding each chapter’s process and consequences. Knowledge empowers informed decisions aligned with personal or business financial recovery goals.

Bottom Line: Exploring Bankruptcy

Bankruptcy chapters serve diverse financial predicaments, offering routes from asset liquidation to debt reorganization. Chapter 7 clears unsecured debts through asset sales, while Chapter 9 aids municipalities, ensuring public service continuity.

Chapter 11 allows businesses to restructure and operate during recovery, whereas Chapters 12 and 13 provide tailored debt adjustment plans for family farmers, fishermen, and wage earners with regular income. Choosing the appropriate chapter hinges on a careful analysis of debts, assets, income, and long-term goals, often necessitating professional counsel for the most advantageous outcome.