Planning for college is a multifaceted endeavor, particularly when it comes to financing education. Many families grapple with the question of how their retirement planning choices, specifically Roth IRA conversions, can influence their financial aid prospects.

It’s a prudent query, given that financial aid calculations take into account a family’s income and assets. In this detailed exploration, we will dissect how converting traditional IRA funds to a Roth IRA may impact financial aid eligibility, providing a comprehensive guide for families navigating the complexities of college funding and retirement planning.

Table of Contents

Understanding Roth IRA Conversion

Before delving into the effects of financial aid, it’s essential to grasp what a Roth IRA conversion entails. A Roth IRA conversion is the process of transferring assets from a Traditional IRA or another retirement account into a Roth IRA. This maneuver typically triggers a taxable event because Traditional IRAs are funded with pre-tax dollars, while Roth IRAs are funded with after-tax dollars. The amount converted is added to your taxable income for the year in which the conversion takes place.

The FAFSA and CSS Profile: Financial Aid Applications

When applying for college financial aid, most families will encounter the Free Application for Federal Student Aid (FAFSA) and possibly the CSS Profile. These forms calculate a student’s financial need by assessing the family’s income and assets. The FAFSA looks at income and tax information from two years before the academic year for which aid is sought, a period known as the “prior-prior year.” In contrast, the CSS Profile, required by some private colleges, may ask for more current financial information.

How Roth IRA Conversion Affects Financial Aid

Increased Adjusted Gross Income (AGI)

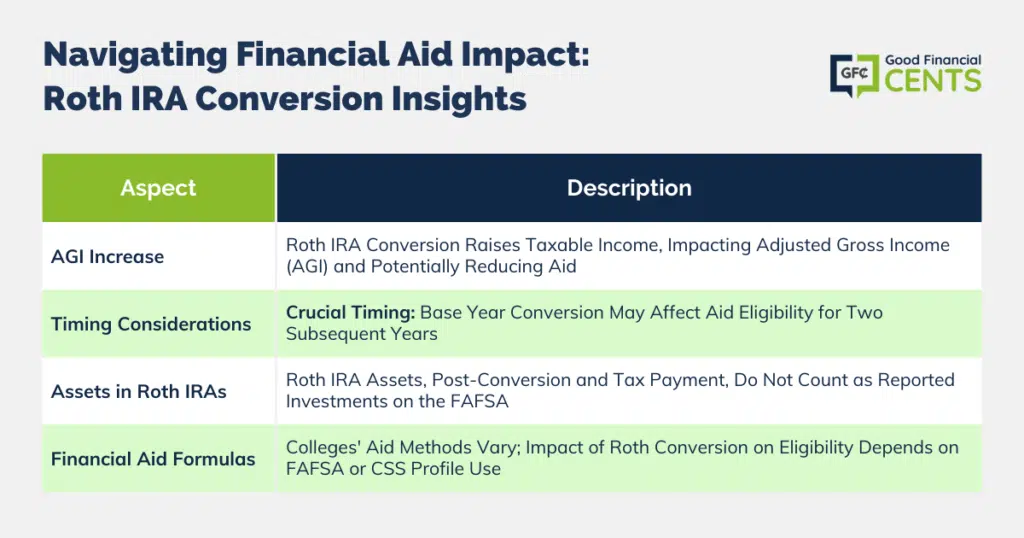

A Roth IRA conversion can significantly increase a family’s Adjusted Gross Income (AGI) because the converted amount counts as taxable income. Since financial aid formulas primarily consider AGI to determine aid eligibility, a spike in income due to conversion could reduce the amount of aid for which the student qualifies. This could particularly impact the Expected Family Contribution (EFC), which is a number that college financial aid offices use to determine how much aid you are eligible to receive.

Timing of the Conversion

The timing of a Roth IRA conversion is critical. If the conversion occurs during the base year, the year before the prior-prior year, it could affect financial aid for two years down the road. It’s vital to plan the timing of your conversion with an eye on the collegiate calendar to mitigate potential impacts on financial aid eligibility.

Assets in Roth IRAs

While the income from a Roth conversion can affect financial aid, assets held in Roth IRAs are not reported as investments on the FAFSA. Consequently, once the money has been converted and the taxes have been paid, the Roth IRA funds themselves will not jeopardize financial aid eligibility in subsequent years.

Financial Aid Formulas

It’s also worth noting that not all colleges use the FAFSA methodology to award their institutional funds. Some use the CSS Profile, which may treat retirement assets and income differently. Therefore, the impact of a Roth conversion might vary depending on the institution and the specific financial aid policies in place.

Strategies to Consider

For families considering a Roth IRA conversion, strategic planning is essential. Here are some strategies that might help minimize the impact on financial aid:

- Plan Early: Consider executing Roth conversions long before your child reaches the college planning stage, ideally before they enter high school.

- Weigh the Benefits: Analyze whether the potential long-term tax benefits of a Roth IRA outweigh the possible short-term reduction in financial aid.

- Professional Guidance: Consult with a financial advisor who understands both retirement planning and college financial aid rules to develop a strategy that takes both into account.

- College Choice: When selecting colleges, consider their financial aid policies and how they might be influenced by your retirement accounts and income.

Long-Term Considerations

A Roth IRA conversion is often executed with long-term tax planning in mind. The tax-free growth and distributions from a Roth IRA can be significant benefits during retirement. These advantages often extend to estate planning, as Roth IRAs can be passed on to heirs. Balancing the immediate impact of financial aid with these long-term benefits is a crucial component of the decision-making process.

Final Thoughts on Roth IRA Conversions and Financial Aid

While a Roth IRA conversion can indeed affect financial aid eligibility due to the increase in taxable income, the action must be weighed against the backdrop of overall financial strategy and long-term goals. The decision to convert should not be made in isolation but as part of a comprehensive financial plan that considers college funding, retirement needs, tax implications, and estate planning objectives.

Careful timing and strategic financial planning can help families navigate the potential pitfalls of increased AGI during the college years while still reaping the benefits of Roth IRA accounts in their broader financial landscape. Ultimately, the key lies in aligning retirement planning activities with education funding strategies, ensuring that each move is made with a full understanding of its implications on the other.