Life insurance is about making final provisions for your loved ones in the event of your death. But there’s more involved in those provisions than just life insurance. And that’s where Fabric by Gerber Life can help.

Not only does Fabric offer life insurance policies – and some of the largest available anywhere – but they also help you through the process of making your final arrangements, and they do it free of charge.

That includes drawing up a will to name a beneficiary, appointing a guardian for your children, and spelling out your final arrangements.

In this Fabric by Gerber Life review, I’ll cover some recent changes to the company and let you know how it stacks up to the competition.

Table of Contents

- Announcement: Fabric is now Fabric by Gerber Life

- Key Takeaways

- About the Company

- Unique Features

- To Whom Is Fabric Life Best For

- Types of Insurance Offered by Fabric by Gerber Life

- Is Fabric by Gerber Life Legit?

- Is Fabric a Good Company?

- Fabric by Gerber Life Alternatives

- How to Use Fabric to Shop for Life Insurance

- How to Save Money on Life Insurance

- Final Thoughts on Fabric by Gerber Life Insurance

Announcement: Fabric is now Fabric by Gerber Life

On October 11, 2022, Fabric announced on its website that they are now Fabric by Gerber Life, owned by parent company Western-Southern Life Assurance Company.

Aside from a new name and branding, customers’ biggest change is that Western-Southern Life will now issue Fabric’s insurance policies instead of Vantis Life Insurance Company.

In a news release on their website, Fabric by Gerber Life assured customers that they will receive “the same digital convenience that you expect from Fabric.”

With the news, Fabric by Gerber Life also informed customers that they can apply for a new or additional policy through an updated application experience. If you are already a policyholder, there is no change to your existing coverage.

Note:

Because of this recent news, other changes made by Fabric as a result of their move to Western-Southern Life may not be reflected in this review. We will do our best to keep our information current but double-check with Fabric by Gerber Life if you have questions.

Key Takeaways

- Fabric by Gerber Life is a direct provider of life insurance, not an online insurance marketplace.

- The company offers accidental death policies, free will preparation, and the ability to set up 529 college savings plans for your children.

- The application process takes about 10 minutes, can result in immediate approval, and generally does not require a medical examination.

- Fabric’s maximum death benefit of $5 million is at the high end of the online life insurance provider range.

About the Company

- Fabric by Gerber Life is a subsidiary of Western-Southern Life Assurance Company.

- The company offers accidental death insurance in addition to term life insurance.

- Though coverage is available for applicants between the ages of 21 and 60, Fabric strongly focuses on providing family life insurance.

- Customer service is available by phone, email, and live chat, Monday through Friday, from 9:00 AM to 6:00 PM, Eastern time.

- The company issues policies in 48 states (excluding New York and Montana).

Unique Features

- Fabric is a “fintech” insurance provider with an all-online application process that relies heavily on advanced algorithms.

- You can get a quote in a few minutes or complete an application in about 10 minutes.

- Because Fabric relies heavily on information provided by available databases (the Medical Information Bureau, your state department of motor vehicles, pharmacy benefit managers, consumer reporting agencies, and other publicly available sources), the need for a medical exam is often eliminated.

- Fabric by Gerber Life has licensed team members available to answer your questions and help you through the application process.

- Once issued, policy offers are valid for 60 days, giving you plenty of time to review the policy before accepting it.

- Even if you purchase the policy, you’ll have 30 days to decide if you want to keep the coverage or not. If you decide you don’t want it, you’ll be entitled to a full refund of the premium paid.

- In addition to term life and accidental death insurance, Fabric offers free will preparation online. That includes appointing a guardian for the dependent children, naming beneficiaries, and making final arrangements.

- You can open a 529 college savings plan for your child(ren) directly from the Fabric Life Insurance website or mobile app.

- Fabric offers a mobile app to track your policy for Android and iOS users.

To Whom Is Fabric Life Best For

Fabric by Gerber Life is an excellent choice for the following applicants:

- Require a life insurance policy in a hurry.

- Prefer life insurance without the need for a medical exam.

- Want accidental death insurance.

- Need coverage for both themselves and their spouse.

- Could benefit from a comprehensive financial plan .

Types of Insurance Offered by Fabric by Gerber Life

Fabric offers two types of life insurance: term and accidental death coverage. Here’s a closer look at each one.

Term Life Insurance

Term life insurance policies provide a death benefit only, with no cash value accumulation or investment provision. That means premiums are only a fraction of what they are for whole-life insurance policies. Lower premiums mean you can purchase more coverage at a lower cost.

Fabric by Gerber Life term policies are available for applicants and their spouses between the ages of 21 and 60. Policy face values range between $100,000 to as much as $5 million.

Because of the reliance on algorithms and available databases, a policy can be available in as little as a few minutes. However, if additional information or a medical exam is required, the process will take several days longer.

If a medical exam is required, an appointment will be scheduled with a qualified examiner to come to your home or office at no cost to you and on your schedule.

Because an accidental death policy excludes death due to illness, it’s generally less expensive than a term life insurance policy

Accidental Death Insurance

Accidental death insurance provides a benefit only if the cause of death is the result of an accident – not an illness. Therefore, an application for accidental death insurance does not require you to answer health questions or submit a medical exam.

Because an accidental death policy excludes death due to illness, it’s generally less expensive than a term life insurance policy – as long as you don’t work in an occupation or regularly participate in hazardous activities.

Fabric by Gerber Life offers accidental death policies in all states except Colorado, Massachusetts, Montana, New York, North Dakota, Pennsylvania, Virginia, and Wisconsin.

The policy offered is a guaranteed issue plan, available to applicants between the ages of 25 to 50, which is the age range most likely to experience accidental death. The application process takes only about five minutes, and coverage begins as soon as your first premium payment is made.

The policy is automatically renewable as long as you make your premium payments. But it will expire on the policy’s anniversary date nearest your 60th birthday.

Fabric by Gerber Life: Comprehensive Overview of Term and Accidental Death Insurance Policies

| Insurance Type | Term Life Insurance | Accidental Death Insurance |

|---|---|---|

| Description | Provides a Death Benefit Only, No Cash Value | Benefits for Accidental Death, Excluding Illnesses |

| Premiums | Lower than Whole-Life Insurance | Generally Less Expensive Than Term Life Insurance |

| Eligibility | Ages 21-60 for Applicants and Spouses | Ages 25-50 for Guaranteed Issue Plan |

| Face Values | $100,000 to $5 Million | Not Specified |

| Application Process | Quick Availability, May Require Additional Information | 5-Minute Process, No Health Questions or Exam Needed |

| Medical Exam | May Be Required, Scheduled at No Cost if Needed | Not Required |

| Coverage Start | Varies, Can Be Within Minutes to Several Days | Starts With the First Premium Payment |

| Renewability | Not Specified | Automatically Renewable Until Nearest 60th Birthday |

| Exclusions | None Specified | Excludes Certain States (CO, MA, MT, NY, ND, PA, VA, WI) |

Is Fabric by Gerber Life Legit?

Yes, Fabric by Gerber Life is a legitimate business. Its policies are issued by Western-Southern Life Insurance Company, a long-standing business that dates back to 1888. Western & Southern is the parent company of Gerber Life Agency.

According to its website, Western-Southern has been granted a “Superior” A+ rating for financial strength from A.M. Best, the largest global credit rating agency specializing in the insurance industry.

Is Fabric a Good Company?

Whether Fabric by Gerber Life is a good company or not is subjective, but we can point to the online ratings from its customers.

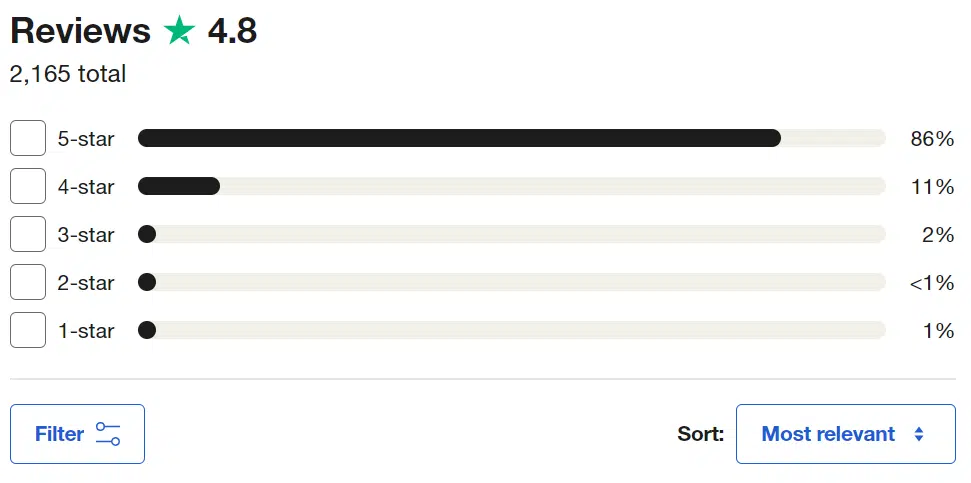

Under its previous name, Fabric, the company enjoys the following ratings:

- 4.8 out of five stars on The App Store on 484 user reviews.

- 4 out of five stars on Google Play on more than 1,000 user reviews.

Under its new name, Fabric by Gerber Life has the following Trustpilot ratings:

- 4.8 out of five stars on Trustpilot on over 2,000 customer reviews.

Looking closely at the Trustpilot reviews, 97% of reviews were four or five stars. I perused the negative reviews and couldn’t identify any recurring issues.

There were a few complaints about wait times, and some reviewers were upset about their policies being declined for various reasons.

Fabric by Gerber Life Alternatives

Fabric is one of the rising numbers of fintech life insurance providers that have become available in the past decade. You may want to investigate similar providers before you purchase term life insurance.

Two of the most popular are Bestow and Haven Life. The table below shows a side-by-side comparison of the major features of all three companies:

| Company / Feature | Fabric by Gerber Life | Bestow | Haven Life | Ladder |

|---|---|---|---|---|

| Available Policies | Term Life Insurance, 10 – 30 Years; Accidental Death Insurance | Term Life Insurance, 10 – 30 Years | Term Life Insurance, 10 – 30 Years | Term Life Insurance, 10 – 30 Years |

| Coverage Amounts | $100,000 to $5 million | $50,000 to $1.5 million | $100,000 to $3 million | $100,000 to $8 million |

| Medical Exam Required | Not Always | Yes | Not Always | No medical exam for up to $3 million coverage |

| Age Range to Apply | 21 – 60 | 18 – 60 | Up to Age 64 | 20-60 |

| Money Back Guarantee | Yes | Yes | No | Yes, within 30 days |

Unlike Bestow, Haven Life, and Ladder, Fabric offers accidental death insurance coverage. It also offers a higher potential death benefit of up to $5 million.

All three offer no-medical exam policies, at least in most cases. In fact, Ladder states that they don’t require a medical exam for policies up to $3 million, although their coverage extends as high as $8 million.

An advantage to Haven Life is that they will accept applicants up to age 64, making it the better choice if you are over 60.

How to Use Fabric to Shop for Life Insurance

Getting policy quotes for applying for insurance on Fabric is straightforward, thanks to the all-online process. You can get a quote or complete the application within minutes. And if no medical exam is required, your policy will be issued shortly after.

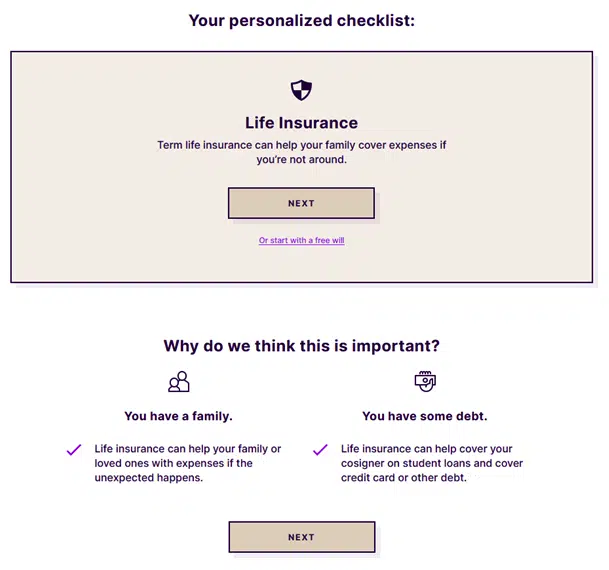

When making an application, click the APPLY NOW button (which appears in various places on the website), then answer the following questions:

Screen 1:

- Do you have a spouse or partner?

- Do you have kids under 18?

- Do you have a will?

- Do you have life insurance through work?

- Do you have personal life insurance outside work?

- Assets, such as bank accounts, investments, or a home?

- Do you have a mortgage?

- Do you have a student loan, credit card, or other debt?

Once you complete Screen 1, the following will appear:

When you click NEXT, another screen will appear asking about your age, gender, state of residence, tobacco usage, and health.

You’ll be asked to indicate that your health is excellent, good, or OK. Once you’ve completed that screen, you’ll get your quote after clicking SEE YOUR ESTIMATE.

Getting a Rate Quote

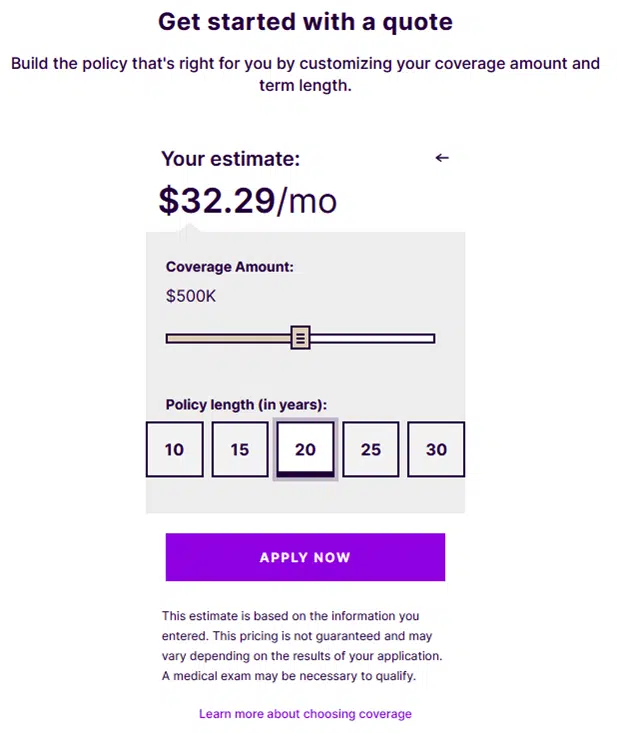

A 40-year-old non-smoking male in excellent health and living in California produces the following results for a $500,000 term life insurance policy:

- 10 years – $16.77 per month

- 15 years – $22.86 per month

- 20 years – $32.29 per month

- 25 years – $46.32 per month

- 30 years – $54.94 per month

The application provides you with a quote tool that looks like this:

You can choose the dollar amount of the policy you want and the term. Once you’ve decided, you can proceed with the application by tapping APPLY NOW.

The application will ask for more specific information, including your age, height, and weight; your medical history and that of your family; employment information, including annual income and net worth; and lifestyle habits, including hobbies, tobacco use, and alcohol consumption.

Upon completion, you’ll either receive 1) an immediate offer, 2) a rejection, or 3) a request for more information, additional time for a more thorough review, or a request that you submit to a medical exam.

Whether you receive a quote or approval, you’re under no obligation to accept the policy. But be aware that your policy will not be in force until you make the first premium payment.

How to Save Money on Life Insurance

Though it may seem as if life insurance is a static product with fixed pricing, there’s plenty you can do to save money.

By following these seven strategies, you can save a small fortune on life insurance:

- Buy a policy right now. Life insurance premiums are based on your age at the time of application. The younger you are, the lower the premium. Since you’ll never be younger than you are right now, now is the perfect time to apply.

- Apply when you’re in good health. This is another compelling reason to make an application today. You’ll get the lowest premium possible if you’re in good or excellent health. But if you wait a few years, you may develop a health condition that will cause the policy to cost more.

- Buy term life insurance rather than whole life. Whole life insurance can cost between five and 15 times the premium for an equivalent amount of term life insurance. You can buy more coverage with a term policy and pay less for the premium.

- Choose a shorter term. Interestingly enough, the shorter the term, the lower the premium. You’ll pay less by choosing a 20-year term instead of a 30-year one.

- Maintain good health habits. That means eating a balanced diet, exercising regularly, maintaining a favorable weight-to-height ratio, and visiting your doctor regularly. It also means avoiding health-impairing activities, like smoking and excess alcohol consumption.

- Maintain clean credit and good driving history. Life insurance companies regularly check your credit report and your driving history. That’s because there is a correlation between bad credit, reckless driving, and early death.

- Shop around! This may be the single best strategy for a low premium. Premium rates can vary significantly from one company to another. Get quotes from several companies before settling on a policy.

Final Thoughts on Fabric by Gerber Life Insurance

If you want to purchase life insurance online, you should consider Fabric by Gerber Life alongside similar providers, like Bestow and Haven Life. The company offers a quick online application process with fast approvals. Most applicants are approved without the need for a medical exam.

Fabric is especially well-suited to applicants with kids. Not only do they provide a very high death benefit, at $5 million, but they also offer will preparation and the ability to set up 529 college savings plans right from the website for the mobile app.

The fact that they offer live, licensed agents to help walk you through the process is an added bonus. Unfortunately, you won’t qualify for life insurance if you’re over age 60, but in that case, Haven may be a good alternative.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Fabric Life Insurance Product Description: Fabric Life Insurance is an online life insurance provider that offers flexible and affordable plans to help families provide financial protection in the event of death or other unexpected events. Fabric provides term life insurance, whole life insurance, and universal life insurance plans with no physical exam required. The company also offers additional products such as accidental death & dismemberment coverage and living benefit riders. Summary of Fabric Life Insurance Fabric Life Insurance offers comprehensive life insurance policies that provide financial protection and peace of mind for families and individuals. Coverage includes death benefit protection, living benefit riders, and policy customization options to help meet specific needs. Coverage can range from basic term life coverage to more complex universal life coverage. Pros Cons

Fabric Life Insurance Review

Overall