Gate City Bank has nearly 44 locations in 23 communities across North Dakota and central Minnesota.

While the Great Plains and the snowy north might give the impression of a sleepy territory, the bank serves thriving communities around Fargo and elsewhere, making its regional identity a big part of its appeal to customers.

Besides engaging in volunteer efforts, the bank has a wide number of products and services that are designed for personal and banking customers. Home loans are a big part of those offerings, and Grand City Bank mortgage rates can be easily viewed on its website.

The bank has a dynamic online presence, extending to customer web-based functionality like online banking and bill pay, as well as a host of resources to help homebuyers, including checklists, guides, and calculators.

The company has an A+ rating from the Better Business Bureau but is not accredited.

Table of Contents

Gate City Bank Facts

- Serves consumers in North Dakota and west-central Minnesota since 1923, with a focus on Fargo has 43 locations in 22 communities, and engages in local volunteering and fundraising.

- Offers customers fee-free ATM access, personal and business banking, plus online services.

- Provides various mortgage, refinancing, construction loan, and home equity loan options.

- Offer a free consultation with a mortgage loan officer and an extensive library of guides and checklists.

- Promises various benefits like rate locks, first-time homebuyer programs, and low down payments on some loans.

Overall

Grand City Bank bases its moniker in part on the nickname for Fargo, “Gateway to the West,” and that reflects the high value it puts on its regional identity as a bank for communities of North Dakota and west-central Minnesota.

With 43 locations in 22 communities, Gate City Bank has focused its efforts on providing products and services to local consumers, businesses, and organizations since 1923.

The company describes itself as “a hometown bank that provides excellent service that is convenient, friendly, and personalized.” Gate City Bank covers the entire state of North Dakota, including the border markets of Fargo and Grand Forks, the capital of Bismark, and other communities.

They also have Minnesota branches found along the I-94 corridor in the west of the state.

In addition to personal, business, and insurance products, home loans are a big part of Grand City Bank’s portfolio. It advertises its ranking as the No. 1 home lender in North Dakota.

The bank has a variety of different conforming mortgage, refinance, and home equity loan options.

It also places a big emphasis on servicing borrower needs: The bank’s website has a useful library that includes content on homebuying basics and mortgage rates. Customers can get a free initial consultation and access to several online mortgage tools.

Current Gate City Bank Mortgage Rates

Gate City Bank Loan Specifics

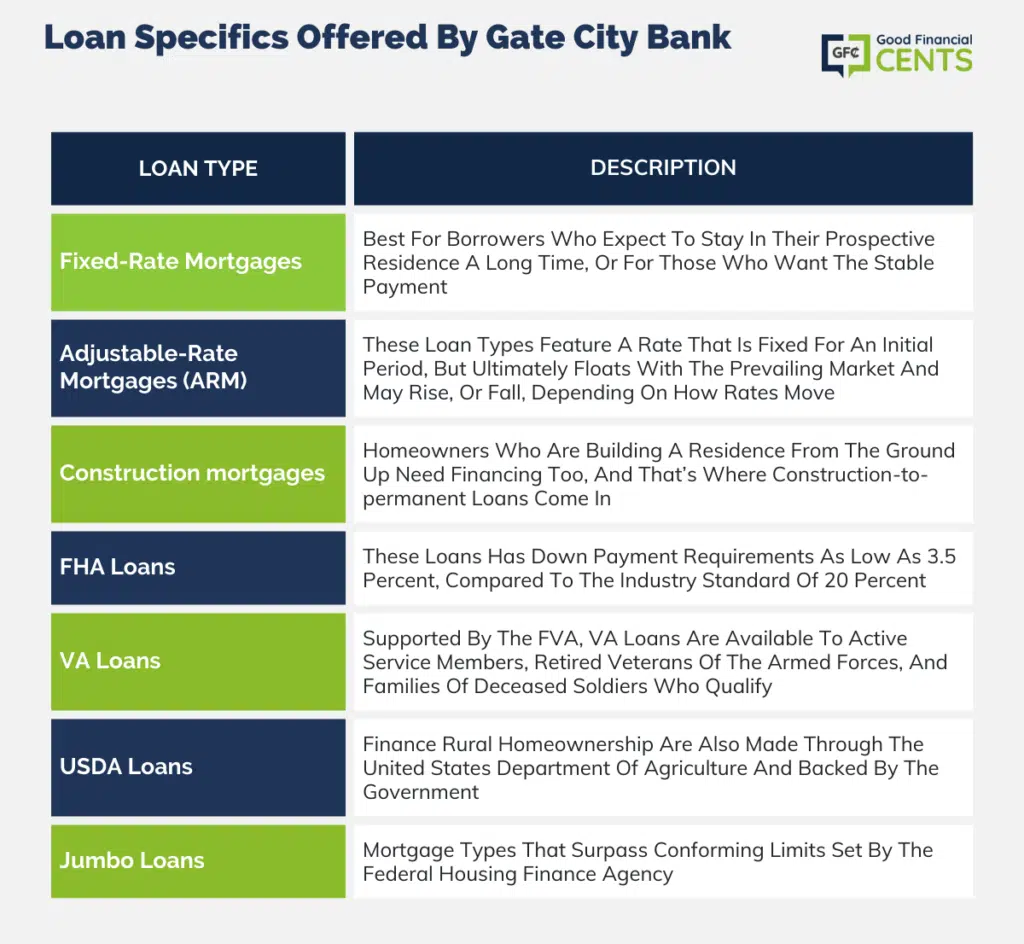

There are a variety of loans borrowers can choose from. However, different terms and mortgage rates will help you decide which is best for your needs. Some of the loan options Gate City Bank offers include:

Fixed-rate mortgages

This type of mortgage has a fixed interest rate attached to it over the course of the loan. The rate never changes, hence the “fixed” aspect and homeowners can depend on a consistent monthly payment that is easily budgeted for.

Fixed-rate loans are best for borrowers who expect to stay in their prospective residence a long time, or for those who want the stable payment.

These are the most common mortgages and are offered by most mortgage lenders. Gate City Bank has fixed-rate options of 30 years, 15 years, and 10 years.

Adjustable-rate mortgages

On the opposite end of the spectrum are adjustable-rate mortgages (ARMs). These loan types feature a rate that is fixed for an initial period, but ultimately floats with the prevailing market and may rise, or fall, depending on how rates move.

ARMs are attractive because they can offer lower interest rates than fixed-rate mortgages.

Timed right, an ARM that rebalances when rates are low will net homeowners savings on their mortgage. Conversely, if rates rise, so does the monthly payment. Adjustments can be monthly, annually, and biannually, and yearly terms differ between lenders.

Construction mortgages

Homeowners who are building a residence from the ground up need financing too, and that’s where construction-to-permanent loans come in.

These options allow borrowers to finance construction and then convert to a mortgage.

Gate City Bank offers such new construction loans with a one-time closing and a 15-month rate lock to ensure homeowners aren’t negatively affected between groundbreaking and getting the keys.

It also has flex and lot loans to help families that need to stay in a home during construction and finance real estate lot purchases, respectively.

FHA Loans

The Federal Housing Authority backs these loans and has down payment requirements as low as 3.5 percent, compared to the industry standard of 20 percent.

As such, FHA mortgages help incentivize and facilitate first-time homeownership, as well as provide consumers with poor credit a mortgage option.

VA Loans

Supported by the federal Veterans Administration, VA loans are available to active service members, retired veterans of the armed forces, and families of deceased soldiers who qualify.

Terms of these loans are generally more generous, featuring low down payments and attractive mortgage rates, and are made through approved financial institutions.

USDA Loans

Loans that finance rural homeownership are also made through the United States Department of Agriculture and backed by the government. Prospective borrowers can benefit from less strict eligibility standards, as well as a low down payment.

Jumbo Loans

If in the market for a mortgage above $766,550 for 2024, consumers might need to look elsewhere. Jumbo loans are mortgage types that surpass conforming limits set by the Federal Housing Finance Agency.

The bank only offers conventional mortgages, but within that segment is a large variety for borrowers in North Dakota and Minnesota communities.

Gate City Bank Mortgage Customer Experience

Serving the financial needs of the community is a major part of Gate City Banks’ mission, so it makes sense that the customer experience would be a focus. One example of this is the free initial consultation with a mortgage loan officer extended to every prospective borrower.

The bank also makes an effort to ensure customers know as much about mortgages and mortgage rates as possible, with information assets that include:

- Mortgage application checklist

- Mortgage Glossary

- Calculators

- Guides on homebuying

Other advantages to the Grand City Bank customer experience include mortgage options with no origination fee, first-time homebuyer programs (available in North Dakota), and niche loan products for lake and winter homes. Borrowers can fill out their mortgage application online.

Gate City Bank Lender Reputation

Grand City Bank maintains an A+ rating from the BBB. A file has been open on the business since 2001, and the bank is not accredited. While it has received a few consumer complaints, the bank has responded to each.

Gate City Bank Mortgage Qualifications

Qualification standards aren’t disclosed on the bank’s site; however, borrowers should expect common personal finance factors to be considered.

Debt-to-income ratio is an oft-consulted measure of a borrower’s ability to afford the loan, while credit history and score are sure to be part of the equation.

Your credit score is an expression of your creditworthiness to lenders, reflecting payment history, credit length, types of account, and credit usage.

The higher the score, the more favorably lenders will look upon a mortgage application.

Here is a basic chart demonstrating how credit score affects home-buying:

| Credit score | Category | Likelihood of Approval |

|---|---|---|

| 760 or higher | Excellent | Very likely |

| 700-759 | Good | Likely |

| 621-699 | Fair | Somewhat likely |

| 0-620 | Poor | Somewhat unlikely |

| None | N/A | Unlikely |

Gate City Bank Phone Number and Additional Details

- Homepage URL: https://gatecity.bank/

- Company Phone: 701-293-2400

- Headquarters address: 500 2nd Ave North, Fargo, ND 58102

Conclusion

Gate City Bank, rooted in the communities of North Dakota and west-central Minnesota since 1923, prides itself on its strong regional identity.

With 43 locations spread across 22 communities, the bank has remained a steadfast presence in regions such as Fargo, Grand Forks, Bismark, and areas along the I-94 corridor in Minnesota.

Their services are comprehensive, ranging from personal and business banking to a plethora of home loan options, including fixed-rate mortgages, adjustable-rate mortgages, FHA, VA, USDA loans, and more.

While their online presence is strong with web-based functionalities like online banking and bill pay, they also provide valuable resources for homebuyers, such as calculators, checklists, and guides.

Prospective borrowers benefit from a free consultation with a mortgage loan officer. Though the bank is not accredited, it has maintained an A+ rating from the Better Business Bureau.

With its emphasis on excellent, friendly, and personalized service, Gate City Bank continues to prioritize the needs of its local communities and customers.

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability.

Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation.

Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Gate City Bank Product Description: Gate City Bank, operating since 1923, is a regional financial institution serving North Dakota and west-central Minnesota. With 43 locations, they offer a wide range of banking services, including an extensive portfolio of home loan products and a robust online banking platform. Summary of Gate City Bank Founded in 1923, Gate City Bank has firmly established itself as a trusted financial institution in North Dakota and west-central Minnesota. With 43 strategically placed branches, they cater to the diverse needs of local consumers, businesses, and organizations. Beyond traditional banking services, Gate City Bank emphasizes its mortgage offerings, positioning itself as the No. 1 home lender in North Dakota. They complement these services with a dynamic online presence, including tools and resources for homebuyers and a comprehensive online banking system. Pros Cons

Gate City Bank Review

Overall