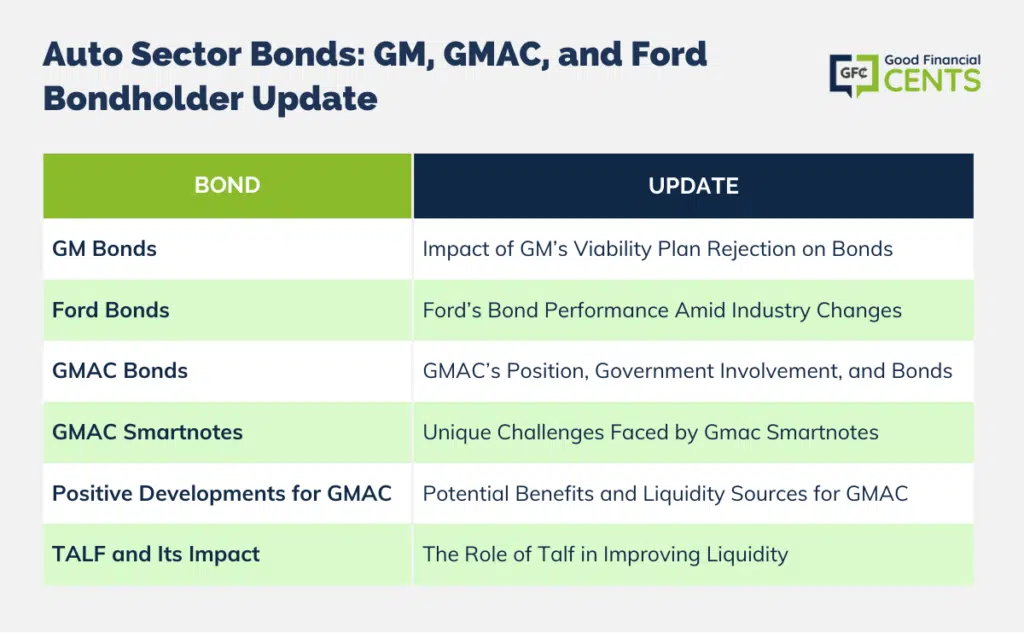

The report below was prepared by my firm and is part of an ongoing effort to provide investors with important information on auto sector bonds. My firm LPL Financial does not cover The report below was prepared by my firm and is part of ongoing effort to provide investors important information on auto sector bonds. My firm LPL Financial does not cover individual bonds but hope the following may help with your investment decision making. bonds but hope the following may help with your investment decision-making.

On March 30, President Obama and the Auto Task Force declared that viability plans submitted by both Chrysler and GM did “not establish a credible path to viability”. GM is being provided 60 days of working capital to develop a more aggressive restructuring and credible plan while Chrysler has 30 days to work an agreement with Fiat or face bankruptcy proceedings. The news raises the risk of GM filing for bankruptcy in mid- to late-May and bankruptcy risk increased today (April 1) following a NY Times story indicating President Obama believes a quick, negotiated bankruptcy is perhaps the best path.

GM Bonds

For bondholders, GM’s viability plan had included a reduction of debt to two-thirds but the rejection means that bondholders will have to endure deeper cuts. GM bonds dropped several points on the news since the rejection introduces new uncertainty as to how to how much bondholders would receive either via bankruptcy or a debt exchange as both Ford and GMAC have already done.

GM senior bondholders had been striving for 50 cents on the dollar while GM was targeting a price in the low 30s (roughly the two-thirds reduction). Prior to the Obama Administration’s announcement GM intermediate and long-term debt traded between 20 and 30 cents on the dollar. So the two-thirds reduction was roughly already priced in but bonds dropped several points given the new uncertainty that bondholders could receive less. GM intermediate and long-term debt is currently trading in the 10 to 17 range.

For bondholders the decision boils down to sell now or wait for more favorable pricing as a result of either bankruptcy or a government led restructuring. Even a government led restructuring may not be as quick and easy as government rhetoric indicates. A March 31, Wall Street Journal points out that prior “pre-packaged” bankruptcies still average seven months in duration, a fair amount of time to go without receiving interest payments.

And this time is likely no different as bondholders will argue their claim versus other parties particularly the UAW. In 2003 GM issued bonds to help make up for a pension shortfall. At the time, the $13 billion deal was the largest bond issue in history. Bondholders essentially helped GM help the UAW and this point will not go without debate.

While its unlikely bondholders get wiped out, they should expect to receive no more than 10 to 30 cents on the dollar absent a prolonged battle in bankruptcy court that turns out favorably. And income-seeking investors should be aware that bondholders will likely receive the bulk of compensation in the form of stock, not bonds, in a newly restructured GM.

Ford Bonds

Ford Motor Corp bonds benefited from the news as the elimination of one or more of the big three was viewed positively for what looks to be one of the survivors. Long-term Ford bonds still remain deeply depressed at 28 to 30 cents on the dollar, reflecting still high levels of risk to Ford, but are up roughly 10 points over the past month according Trace reporting.

Ford Motor Credit Corp (FMCC) bonds were unchanged to only slightly higher. FMCC bonds are viewed as having as higher recovery values in the event of bankruptcy. Ford’s recently completed debt exchange increased its liquidity but should car sales remain at such depressed levels, bankruptcy still remains a longer-term risk. For now, bondholders are focusing on increasing sales as a result of a Chrysler or GM bankruptcy.

GMAC Bonds

GMAC is a separate legal entity from GM and should GM file bankruptcy, or be subject of a government-led restructuring outside of bankruptcy court, it does not entail an automatic bankruptcy filing for GMAC. On the surface, a bankruptcy or restructuring would be a negative for GMAC but it depends on which path GM takes.

Should GM file chapter 11 bankruptcy it would need to line up private investors for Debtor-in-Possession (DIP) financing. DIP financing is interim financing that provides needed cash while a company is in the process of restructuring. Given the still credit constrained environment such financing would likely be difficult if not impossible to obtain. In such an environment consumers are unlikely to purchase GM cars, justifiably concerned over future viability.

A government supervised restructuring, where the Treasury would provide financing while GM restructures, would likely lessen or eliminate that effect as consumers continue to purchase GM autos knowing the entity would still exist in some form. Given GMAC’s reliance on GM auto sales, anything to promote sales would be beneficial.

On that note, the US government announced it would guarantee the warranties of GM vehicles during the restructuring period. This news coupled with President Obama’s statement that, “We will not let our auto industry simply vanish” suggests that some form of GM will exist in the future. Both are positives for continued auto sales during a restructuring.

Furthermore, it appears that GMAC, and its role in assisting consumer financing, remains a key tool for the government in efforts to turn around the economy. In late 2008 and early 2009, GMAC reached important milestones by 1) receiving Federal Reserve approval to become a bank holding company and 2) shortly after, receiving a $6 billion capital injection from the US Treasury. Unlike many banks, GMAC prepared to boost lending by lowering minimum FICO scores for loan qualification to 621 from 700.

It appears that GMAC has become an important vehicle for Treasury to foster consumer lending. Concurrent with the events above GMAC concluded a debt exchange that reduced its debt load (a requirement for bank holding company status), extended bond liabilities, and subordinated other bond claims. The debt exchange enabled GMAC to post a profit for the fourth quarter but removing the extraordinary item GMAC lost $1.3 billion for the quarter.

Bonds have come under pressure again following the GM/Chrysler news but remain above the lows for the quarter. Still, current bond prices, particularly those maturing beyond one-year, reflect a significant probability of default. In the cash market, GMAC’s benchmark 6.75% due 12/14 closed March 30 at a 45 price, according to Trace, suggesting a 40% probability of default if one assumes a 30 cent on the dollar recovery (Moody’s forecast for high yield bonds). Credit Default Swap (CDS) spreads are bit more bearish and require a 31% upfront payment, an increase from

Despite all the bankruptcy news, a couple of potential positive developments could benefit GMAC. To our knowledge, GMAC has yet to borrow from the Fed. As a bank holding company it could gain access to the Fed’s discount window and even pledge auto loans as collateral. GMAC could also have access to the FDIC’s Temporary Liquidity Guarantee Program (TGLP) and issue bonds at very low government guarantee rates. These liquidity sources could amount to $10 to $80 billion in additional liquidity but remain untapped as of yet.

Lastly, the newly launched Term Asset Lending Facility (TALF) included auto loans as one of the lending areas it directly seeks to improve. The TALF should be a source of liquidity for both GMAC and FMCC.

GMAC Smartnotes

GMAC Smartnote pricing has been particularly depressed due to market illiquidity. While Smartnotes contain an estate feature, they were issued in small denominations on a weekly basis. Their small size makes them elatively illiquid, particularly in the current environment where bond dealers are reluctant to hold bond inventory let alone illiquid bonds. As a result, GMAC Smartnotes trade, in some cases much lower in price than similar non Smartnote GMAC bonds.

For example, the GMAC Smartnotes 6.75% due 6/2014, a very similar bond to the benchmark issue (same coupon rate but 6-months shorter in maturity) listed earlier has recently traded between 26 and 29 according to Trace reporting, a dramatic difference. GMAC bonds remain a high-risk play due to its dependence on GM and the potential path of any restructuring. The potential path of any GM restructuring (Ch. 11 vs. government led), whether GMAC receives additional capital injections from the Treasury, and the severity of the economic downturn will play a role in GMAC bond pricing. These many moving parts, including a politically influenced government role, make handicapping future bond performance difficult at best.

Important Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

- Investors should consider the investment objectives, risks, charges and expenses of the investment company carefully before investing. The prospectus contains this and other information about the investment company. You can obtain a prospectus from your financial representative. Read carefully before investing.

- Government bonds and Treasury Bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

- Municipal Bonds are subject to availability and change in price; subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

- Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise and are subject to availability and change in price. High yield/junk bonds are not investment grade securities, involve substantial risks and generally should be part of the diversified portfolio of sophisticated investors. Stock investing involves risk including loss of principal.

The Bottom Line – GM, GMAC, and Ford Bondholder Update

The auto sector, specifically GM and GMAC, faces uncertainty amid potential bankruptcies and restructuring. Bondholders in GM may receive less than expected, impacting their investments. Ford, seen as a survivor, benefits from the elimination of competitors but still faces risks due to economic challenges. GMAC’s fate depends on the path GM takes, and access to government resources may influence its future.

Despite market illiquidity, GMAC Smartnotes face unique pricing challenges. Overall, these developments underscore the high-risk nature of auto sector bonds, influenced by complex factors including government involvement, making future performance difficult to predict. Investors should consult financial advisors for guidance.

Howdy! Would you mind if I share your blog with my zynga group? There’s a lot of people that I think would really enjoy your content. Please let me know. Cheers

here we are june 24, 2019. No one is ever going to buy another GM bond

after the shellacking the bondholders took during the GM bankruptcy.