One of the biggest challenges for small business owners and the self-employed is finding affordable health insurance. Being able to take care of your health is important, and health insurance is a big part of that ability since it can help shield you from high healthcare costs.

Table of Contents

On top of that, offering health coverage to your employees can be vital in your efforts to recruit top people. By offering health insurance as a benefit, you can improve the quality of your business by attracting competent and productive workers.

For small businesses, health insurance can be one of the biggest hurdles or one of the best assets. Unfortunately, navigating the healthcare marketplace can be an overwhelming process. If you’re a small business owner, you don’t have time to spend hours and hours researching plans and companies.

Group Health Insurance

One of your best options is to look into group health insurance. Group plans use the power of numbers to help keep costs contained. If you purchase health coverage for your employees, you can get group rates, which can be lower than individual rates.

It is also possible for the self-employed to take advantage of group rates. Many online aggregators allow families, individuals, and the self-employed to find insurance plans as part of a group. When you are added to the group, you have access to these lower rates.

The same concept is true of group health plans for small businesses. If you want to provide this benefit to your employees, you can usually find group rates that will make it a little more affordable for you to provide benefits to your employees.

Looking Online for Health Insurance

You can look online for group health insurance. Group rates can be less expensive.

When I was looking for health insurance, as someone self-employed, for my family, I used eHealthInsurance. The site also has options for business group insurance. There are plenty of other aggregate websites that can help you find group plans for your business or help you find health insurance as someone who is self-employed.

Many insurance companies offer quotes, and you can choose to offer different options that can help your cost. Offering a high deductible plan that is compatible with a Health Savings Account can be one way to reduce your costs.

Tax Benefits for Providing Health Coverage to Employees

Small businesses can benefit from offering health plans to their employees. If you are a small business paying for at least half of your employee’s health insurance, you may be eligible for a tax break if you are a business with 10 employees or less who earn average wages of $25,000 annually and phasing out as companies approach 25 employees and an average salary of $50,000 a year.

Until 2013, you can receive a tax credit of up to 35% of what your business spends on health insurance. In 2014, the maximum credit for small businesses will increase to 50% of what you pay for insurance premiums. Of course, there are tax deductions available for what you pay in insurance premiums as someone who is self-employed.

You might also want to look into the options for state tax benefits. Check your state tax code for information about what tax breaks are available, as well as the requirements for qualifying. You should also consider speaking with a trusted tax professional, who can help you find out what advantages you have when offering health coverage to your employees.

Options for Small Business Health Insurance

As an employer, there are hundreds and hundreds of decisions you have to make. Trying to navigate all of those can be overwhelming, but health insurance doesn’t have to be one of those. There are a couple of different options you can choose from.

Individual Health Insurance

One of the simplest options is to let each employer choose their own health insurance plan. They can pick any plan to fit their needs.

As the employer, you can help pay a part of the premium of some of the other fees. In this situation, you can help pay the premiums or expenses through a health reimbursement arrangement.

Private Health Exchange

Private health exchanges have become one of the most popular options for a lot of small businesses. They offer a lot of flexibility for both employers and employees.

After the employer has created their list of products and options, the employees can then get access to the exchange and decide which ones they want to participate in.

SHOP Marketplace

One of the byproducts of the Affordable Care Act was the ability for small businesses to buy group plans through the Small Business Health Option (SHOP). Each state is required to have SHOP as a part of its health insurance marketplace. Depending on the state, your business must have fewer than 100 or fewer than 50 to purchase a plan through SHOP.

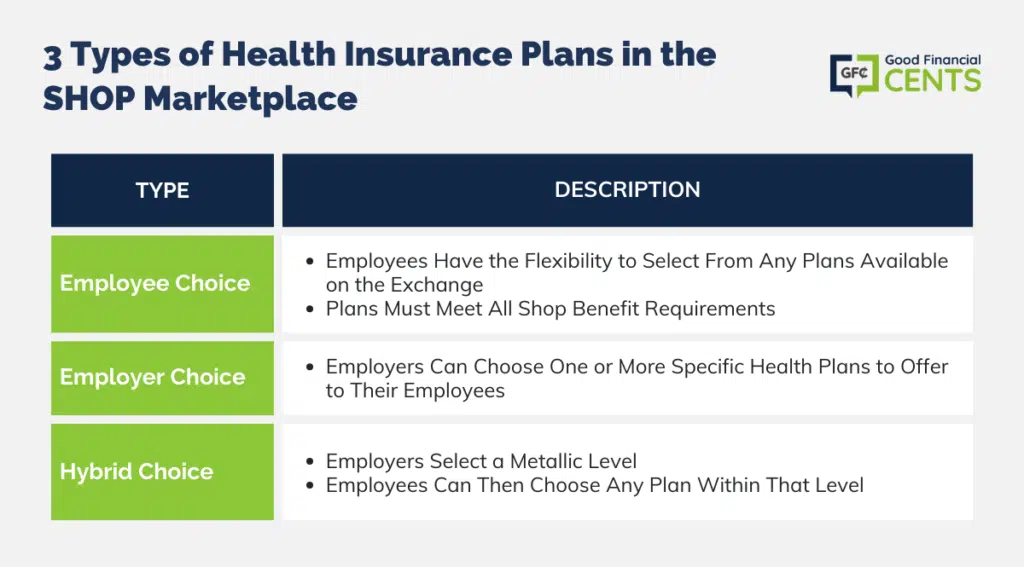

Inside the SHOP marketplace, there are three different types of health insurance plans you can provide for your employees:

- Employee Choice – the employee can pick any of the plans offered on the exchange as long as it meets all of the SHOP benefit requirements.

- Employer Choice – the employer can select one or more specific plays for their employees.

- Hybrid Choice – the employer can pick a metallic level, and then the employee can pick any of the plans inside of the level.

Every small business is different, and your employees may have different needs. There is no “one best option” which works for every business.

The Bottom Line – Health Insurance Plans for Small Business

Navigating health insurance for small businesses can be daunting, but it’s a crucial aspect in ensuring the well-being of both the employer and employees.

Group health insurance, often offering more affordable rates, is a prime choice for many. Online platforms like eHealthInsurance can assist in finding suitable plans.

Tax incentives further encourage businesses to provide health coverage, with credits potentially covering a substantial portion of premium costs.

Options for health insurance range from individual health insurance to private health exchanges to the SHOP marketplace, each with its distinct features. Recognizing the diverse needs of businesses, it’s imperative to evaluate and select the most fitting health insurance solution.