There’s something weird happening with the real estate markets today. Normally in a recession, demand for rentals goes up while demand for houses goes down. But if there’s anything 2020 has taught us, it’s that everything is turned on its head right now.

Instead, we’re seeing an interesting trend: Despite the ongoing pandemic, home-buying is experiencing higher demand now than they have been since 1999, according to the National Association of RealtorsⓇ (NAR).

Table of Contents

If you’ve been hoping to buy a home soon, you’re probably already aware of this weird trend, and excited. But is it the same story everywhere? And is a pandemic really the right time to buy?

How the Pandemic Is Changing Homeownership

This pandemic is different from any other in history in that many people — especially some of the highest-paid workers — aren’t being hit as hard as people who rely on their manual labor for income. This, coupled with an ultra-low mortgage rate environment and a new lifestyle that’s not fit for a cramped apartment, is creating the perfect storm of high-dollar homebuyers.

“I didn’t want to pay someone else’s mortgage to have three roommates,” says Amy Klegarth, a genomics specialist who recently purchased a home in White Center, a suburb of Seattle where she was formerly renting. “I moved because I could afford to get a house with a large yard here for my goats, Taco and Piper.”

Whether you have goat kids or human kids (or even no kids), you’re not the only one looking for a new home in a roomier locale. According to the NAR report, home sales in suburban areas went up 7% compared to just before the pandemic started. In some markets, it’s not hard to understand why people are moving out.

Where Are People Going?

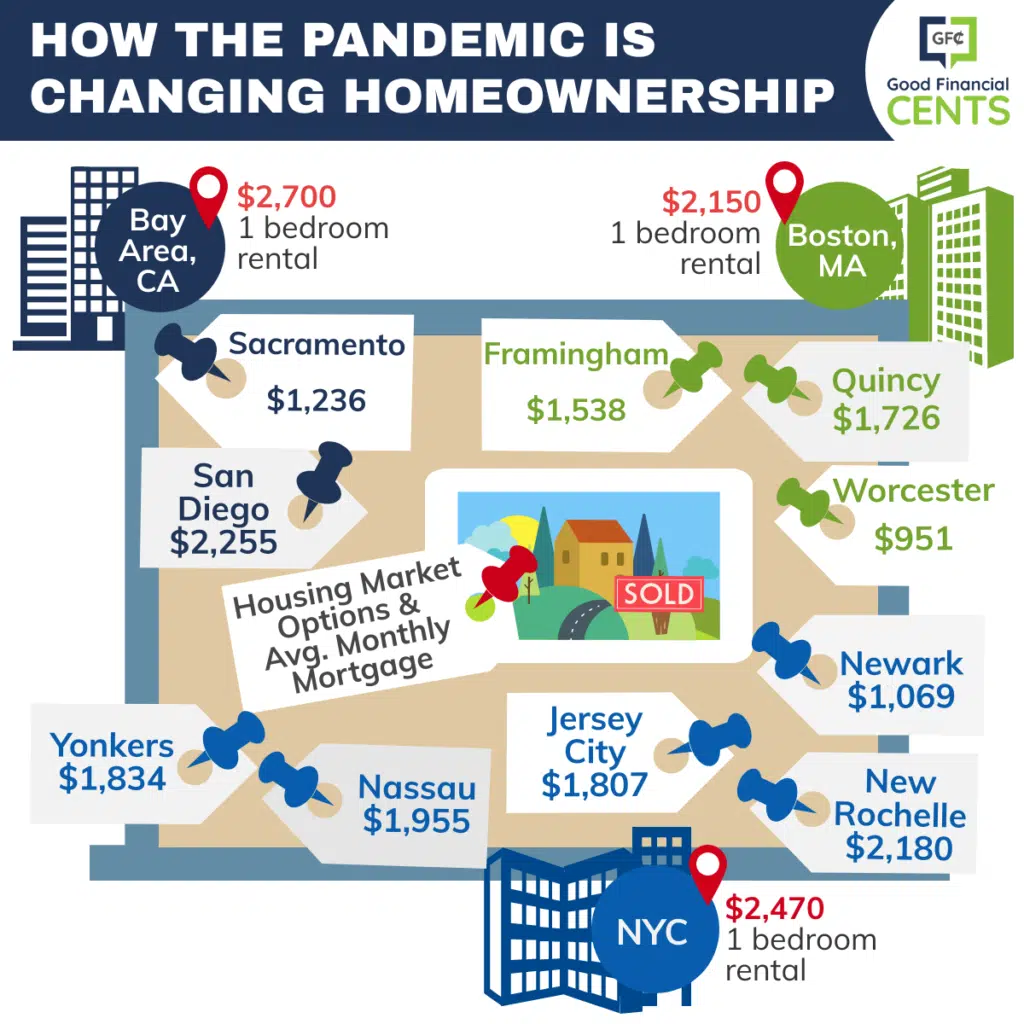

Apartments are small everywhere, but they’re not all the same price. For example, homes in cities tend to be 300 square feet smaller than their suburban counterparts. Some of the hottest home-buying markets right now are in areas where nearby rents are already too high, often clustered around tech and finance hubs that attract high-paid workers. After all, if you can’t go into the office and all of the normal city attractions are shut down, what’s the point of paying those high rental costs?

According to the 2023 PropStream Report, the top five most expensive rental markets in the U.S. are San Francisco, New York City, Boston, Jersey City, and Miami.

If you’re seriously considering buying a house, mortgage experts at Quicken Loans can help you get started with solid advice and priceless information.

If You Rent in San Francisco, San Jose, and Oakland, CA

Alternative home-buying market: San Diego, Sacramento

- Average rent: San Francisco, $3,000, San Jose, $2,498; Oakland; $2,046

- Average home value (as of writing): San Diego ($830,000) and Sacramento ($550,000)

- Estimated mortgage payment with 20% down: San Diego ($4,546) and Sacramento ($2,509)

Big California cities are the quintessential meccas for tech workers, and that’s often exactly who’s booking it out of these high-priced areas right now. Gay Cororaton, Director of Housing and Commercial Research for the National Association of Realtors (NAR), offers two suggestions for San Francisco and other similar cities in California.

San Diego

First, is the San Diego metro area, which has a lot to offer people who are used to big-city living but don’t want the big-city prices. An added bonus: your odds of staying employed as a tech worker might be even higher in this city.

“Professional tech services jobs make up 18% of the total payroll employment, which is actually a higher fraction than San Jose (15.5%) and San Francisco (9.3%),” says Cororaton.

Sacramento

If you’re willing to go inland, you can find even cheaper prices yet in Sacramento. “Tech jobs have been growing, and account for 7% of the workforce,” says Cororaton. “Still not as techie as San Jose, San Francisco, or San Diego, but tech jobs are moving there where housing is more affordable. It’s also just 2 hours away from Lake Tahoe.”

If You Rent in New York, NY

- Average rent: $2,236

- Average home value (as of writing): New Rochelle ($770,500), Yonkers ($545,000), Nassau ($717,000), Newark ($435,000), or Jersey City ($685,000)

- Estimated mortgage payment with 20% down: New Rochelle ($3,881), Yonkers ($2,765), Nassau ($3,617), Newark ($2,220), or Jersey City ($3,458)

Living in New York City, it might seem like you don’t have any good options. But the good news is you do — lots of them, in fact. They still might be more expensive than the average home price across the U.S., but these alternative markets are still a lot more affordable than within, say, Manhattan.

New Rochelle and Yonkers

Both New Rochelle and Yonkers are about an hour’s drive from the heart of New York City, says Corcoran. If you ride by train, it’s a half hour. Both New Rochelle and Yonkers have been stepping up their appeal in recent years to attract millennials who can’t afford city living anymore (or don’t want to be “house poor”), so you’ll be in good company.

Nassau

“NAR ranked Nassau as one of the top places to work from home in the state of New York because it has already a large population of workers in professional and business services and has good broadband access,” says Cororaton. If you have ideas about moving to Nassau you’ll need to move quickly. Home sales are up by 60% this year compared to pre-pandemic times.

Newark or Jersey City

If you don’t mind moving to a different state (even if it is a neighbor), you can find even lower real estate prices in New Jersey. This might be a good option if you only need to ride back into the city on occasion because while the PATH train is well-developed, it’s a bit longer of a ride, especially if you live further out in New Jersey.

If You Rent in Boston, MA

Alternative home-buying market: Quincy, Framingham, Worcester

- Average rent: $2,011

- Average home value (as of writing): Quincy ($577,500), Framingham ($650,000), or Worcester ($400,000)

- Estimated mortgage payment with 20% down: Quincy ($2,926), Framingham ($3,285), or Worcester ($2,046)

Boston is another elite coastal market, but unlike New York, there’s still plenty of space if you head south or even inland. In particular, Quincy and Framingham still offer plenty of deals for new buyers.

Quincy

If you like your suburbs a bit more on the urban side, consider Quincy. Although it’s technically outside of the city, it’s also not so isolated that you’ll feel like you’re missing out on the best parts of Boston living. You’ll be in good company too, as there are plenty of other folks living here who want to avoid the high real estate prices within Boston itself.

Framingham

Framingham is undergoing an active revitalization right now in an effort to attract more people to its community. As such, you’ll be welcome in this town that’s only a 30-minute drive from Boston.

Worcester

“Now, if you can work from home, consider Worcester,” says Cororaton. “It’s an hour away from Boston which is not too bad if you only have to go to the Boston office, say, twice a week.” Worcester (pronounced “wuh-ster”) is also a great place for a midday break if you work from home, with over 60 city parks to choose from for a stroll.

Alternative Home-Buying Markets for Renters in Expensive Cities

| RENTING MARKET(S) | AVERAGE RENT FOR 1-BEDROOM APARTMENT | HOUSING MARKET OPTIONS & AVG. MONTHLY MORTGAGE* |

|---|---|---|

| San Francisco, CA San Jose, CA Oakland, CA | $3,000 | San Diego ($2,498) Sacramento ($2,046) |

| New York, NY | $2,236 | New Rochelle ($3,881) Yonkers ($2,765) Nassau ($3,617) Newark ($2,220) Jersey City ($3,458) |

| Boston, MA | $2, 011 | Quincy ($2,926) Framingham ($3,285) Worcester ($2,046) |

Should You Buy a House During a Pandemic?

There’s no right or wrong answer here, but it’s a good idea to consider your long-term housing needs versus just what’ll get you through the next few months.

For example, just about everyone would enjoy some more room in their homes to stretch right now. But if you’re the type of person who prefers a night on the town, you might be miserable in a rural area by the time things get back to normal. But if you’ve always dreamed of a big vegetable garden or yard for the family dog, now could be the right time to launch those plans.

Another factor to consider is job security. And remember that even if you’re permanently working from home today — and not everyone has this ability — living further from the city could limit your future opportunities if a job requires you to be on-site in the city.

Finally, consider this: most homes in outlying areas weren’t built with the pandemic in mind. For example, “… open floor plans were popular, pre-pandemic,” says Cororaton. “If the home for sale has an open floor plan, you’d have to imagine how to reconfigure the space and do some remodeling to create that work or school area.”

Here are some other things to look for:

- Outdoor space

- Area for homeschooling

- Broadband internet access

- Proximity to transport routes

- Office for working from home

Is It More Affordable to Buy or Rent?

There aren’t any hard-and-fast rules when it comes to whether it’s cheaper to rent or buy. Each of these choices has associated costs. To rent, you’ll need to pay for your base rent, pet fees and rent, parking permits, deposits, renters insurance, and more. To buy, you’ll have an even bigger list, including property taxes, maintenance and upgrades, HOA fees, homeowners insurance, closing costs, higher utility bills, and so on.

Each of these factors has the potential to tip the balance in favor of buying or renting. That’s why it makes sense to use a buy vs rent calculator that can track all of these moving targets and estimate which one is better based on your financial situation and the choices available to you.

In general, though, most experts advise keeping your housing costs to below 30 percent of your take-home pay when setting up your budget. The lower, the better — then, you’ll have even more money left over to save for retirement, your kid’s college education, and even to pay your mortgage off early.