Navigating the complex landscape of retirement planning is a daunting task, and the role of company stock within your portfolio is a particularly intricate piece of the puzzle. It’s not just another investment; it’s a share in the company you work for, carrying both sentimental value and financial weight.

The right amount can be a pillar of strength in your financial future, but too much can be a fault line waiting to create a fissure in your nest egg. Therefore, understanding and managing company stock is not just prudent; it’s a fundamental aspect of ensuring a resilient retirement plan.

Table of Contents

Understanding Company Stock Options

Employee Stock Purchase Plans (ESPP)

An ESPP is your ticket to buying into the company’s success at a discounted rate, often through a simple payroll deduction. It’s like being part of an exclusive club where your membership comes with a financial perk.

But such opportunities beg the question of how much to invest, even when the discount makes the offer seem irresistible.

It’s essential to consider the potential implications of such a decision, including the impact on your overall investment diversity and the potential for financial overexposure to your employer’s fortunes.

Restricted Stock Units (RSUs)

RSUs represent a commitment from your employer, rewarding you with a vested interest in the company’s future. They’re like seeds planted today, which could bloom into a significant part of your investment garden tomorrow.

However, they also come with their complexities and conditions, such as vesting schedules and tax considerations. Understanding these nuances is vital, ensuring that what seems like a benefit today doesn’t become a burden tomorrow.

Stock Options

Stock options are akin to holding a golden ticket, offering the potential for a significant payoff if the company’s stock price soars. It’s an enticing aspect of compensation packages for many employees, offering a sense of participation in the company’s growth.

However, this form of stock ownership is fraught with ifs and buts, as options can expire worthless if the stock doesn’t perform as hoped. The key lies in understanding the specific conditions and time frames associated with these options and how they fit into your personal financial planning.

Tax Implications of Each Option

Navigating the tax implications of company stock options is like playing a strategic board game, where each move comes with its own set of rules and consequences. Each type of stock option carries unique tax considerations that can impact your income now and in the future.

Being informed about these tax rules can make the difference between a savvy investment and an unforeseen tax liability, so it’s imperative to consult with a tax professional who can guide you through the intricacies of your investment choices.

Benefits of Owning Company Stock

Potential for Substantial Growth

Investing in company stock holds the tantalizing potential for growth, particularly if the company’s fortunes rise dramatically. It’s like riding a wave that could potentially carry you all the way to a prosperous shore.

Nevertheless, it’s crucial to remember that stock performance is never guaranteed, and this potential for growth must be weighed against the inherent risks.

Dividend Income

Dividends from company stock can provide a stream of income that feels like a pat on the back for your investment decisions. These payments can be a boon in building wealth over time, providing a tangible return on your investment.

They not only contribute to your current income but can be reinvested to compound your growth, acting as a financial catalyst in your retirement portfolio. But as with any investment, dividends are subject to change, and relying on them too heavily could lead to financial imbalance.

Employee Discounts

Employee discounts on company stock purchase plans add an extra layer of incentive, lowering the barrier to entry for stock ownership. It’s like getting an exclusive deal that makes the prospect of investing in your employer that much more attractive.

These discounts can kickstart your investment journey, allowing you to potentially buy more with less. However, while it’s advantageous to purchase at a discount, it’s equally essential to ensure that these purchases align with a diversified and balanced investment strategy.

Loyalty and Alignment With the Company’s Success

Owning stock in your employer fosters a sense of belonging and vested interest in the company’s success, merging financial goals with workplace loyalty. This alignment can be a source of motivation and engagement at work, as the company’s wins become personally rewarding.

Yet, this emotional connection must be tempered with financial realism. Loyalty to your employer should not overshadow the need for a well-rounded investment approach that protects your financial future against the volatility of a single company’s performance.

Risks of Overconcentration in Company Stock

Impact of Company-Specific Risks

The impact of company-specific risks on your portfolio is akin to a sudden storm threatening a single vessel at sea – if that’s your only ship, your entire venture is at risk.

When too much of your retirement savings is tied to the fate of one company, any downturn in its fortunes can have outsized consequences on your financial well-being.

This concentration risk can be mitigated through diversification, spreading your investment across different sectors and asset classes, and providing a lifeline in turbulent times.

Historical Examples of Overconcentration Fallout

Looking back at history, we find sobering examples of employees who faced financial ruin after putting all their eggs in their company’s basket.

The fallout from overconcentration has led to lost livelihoods and shattered retirements, underscoring the fact that market leadership today does not guarantee stability tomorrow. These historical lessons are stark reminders of the need for balance and caution in investment decisions.

Adding to the chorus of cautionary tales, every investor should take heed of the past’s hard-learned lessons and guard against similar pitfalls.

Diversification as a Risk Management Tool

Diversification stands as your portfolio’s first line of defense, diluting the impact of individual stock volatility. It’s the equivalent of building a financial fortress with various lines of defense against the assault of market unpredictability.

By spreading your investments, you’re not just protecting your financial future; you’re creating a buffer that can absorb the shocks of economic downturns and sector-specific disruptions. Like a well-trained army, a diversified portfolio is prepared to face uncertainties from multiple fronts.

How Much Is Too Much?

Guidelines From Financial Experts

Financial experts often suggest the 10-15% figure as a guardrail, advising against excessive company stock holdings to prevent the derailment of retirement plans. These guidelines are distilled from years of market observation and are designed to temper enthusiasm with prudence.

However, they also recognize the individuality of each investor’s situation. Integrating such guidance with personal financial goals and market understanding forms the bedrock of a sound investment strategy.

Assessing Your Risk Tolerance

Determining your personal risk tolerance is an exercise in self-awareness, requiring an honest assessment of your financial boundaries and sleep-at-night comfort level. It’s about knowing how much market fluctuation you can endure without panic selling or experiencing undue stress.

This introspection helps shape a portfolio that reflects your personal comfort with risk, ensuring that your investments are a source of security rather than anxiety. This understanding evolves over time, necessitating ongoing reflection as life circumstances change.

The Role of Company Stock in Your Overall Investment Strategy

The strategic role of company stock in your investment portfolio must be carefully orchestrated. It should neither dominate the stage nor be a mere understudy but play its part to perfection.

Your investment strategy should be like a well-balanced diet, varied enough to provide nutritional value while satisfying specific dietary needs. Company stock may provide the protein, but your financial health will depend on a mix of assets that work in concert to meet your long-term goals.

Crafting a portfolio with an eye for diversity ensures that you are not overly reliant on the success of your employer for your financial security. This strategic allocation helps in weathering market storms and capitalizing on different economic cycles.

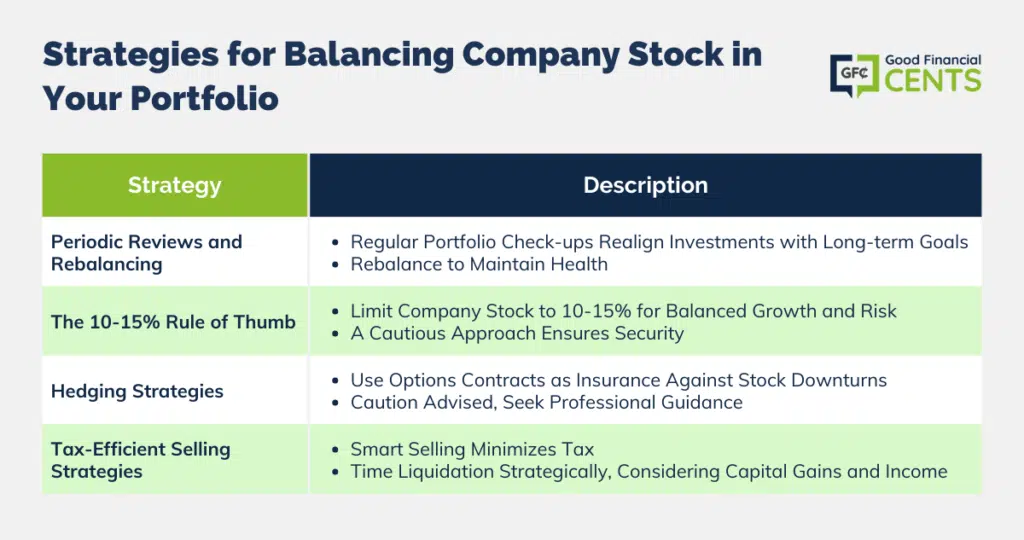

Strategies for Balancing Company Stock in Your Portfolio

Periodic Reviews and Rebalancing

Regular reviews of your investment portfolio are like routine health check-ups, vital for maintaining financial fitness. They provide an opportunity to reassess your positions in company stock and make adjustments as necessary to stay aligned with your long-term goals.

Rebalancing acts as a corrective measure, a way to trim back or bulk up on certain investments, much like a gardener prunes a tree to maintain its desired shape and health. Such diligent oversight helps keep your retirement strategy on track, ensuring that no single investment overgrows its intended space.

The 10-15% Rule of Thumb

The 10-15% rule serves as a practical guideline, a rule of thumb to prevent your portfolio from becoming too top-heavy with company stock. It’s like an anchor that keeps your investments from drifting too far into risky waters.

Adhering to this rule can help maintain a balance, ensuring that your exposure to company stock is significant enough to benefit from its growth but not so large that it jeopardizes your financial security. This approach is about striking a balance that is both cautious and opportunistic.

Hedging Strategies

Hedging strategies are akin to financial insurance policies designed to protect your investments from downturns in company stock. Techniques such as options contracts can provide a safety net, allowing you to manage risk and potentially cushion against losses.

However, these strategies can be complex and may carry their own risks and costs. Therefore, they should be employed with care and preferably under the guidance of a financial professional who can tailor hedging strategies to your specific needs and investment profile.

Tax-Efficient Selling Strategies

Implementing tax-efficient selling strategies is about being a smart seller and timing the liquidation of company stock in a way that minimizes tax liabilities. It involves understanding the nuances of capital gains taxes and knowing when to hold or sell your shares.

Such strategies might include selling shares that have been held long-term to benefit from lower tax rates or strategically selling off shares in years when your income is lower.

Engaging in these tax-savvy practices can help you retain more of your hard-earned money and contribute to a more stable financial future.

The Bottom Line – How Much Company Stock Should You Own in Your Retirement Account?

Deciding the right amount of company stock in your retirement portfolio is deeply personal, hinging on your financial status, career span, and future company prospects. It’s a bespoke process, aligning investment choices with life’s changing rhythms.

Regularly revisiting and refining your retirement strategy is crucial, ensuring it adapts to market dynamics and personal milestones.

Prudent company stock ownership balances a commitment to your job with securing your retirement, requiring disciplined investment and flexibility. Striking this balance is key to building a resilient retirement plan attuned to your financial aspirations.