How much do you need to retire? The usual suggestion provided by financial planners and retirement calculators is 75% to 85% (roughly 80%) of your pre-retirement income. But is that really enough money to retire with security? Does the 80% rule-of-thumb work under all circumstances, or is it merely a rough approximation to simplify the retirement planning process? Let’s examine these issues more closely…

Table of Contents

- Is 80% of Pre-Retirement Spending a Realistic Budget?

- Longer and More Active Retirements

- Health Care in Retirement

- Other Ways Expenses Could Rise

- Lower Taxes May Be Wrong

- Spending Statistics Misrepresent Real Spending

- A More Accurate Approach for Determining How Much Money You Need to Retire

- The Bottom Line – Warning! The 80% Rule May Not be Enough to Retire

Is 80% of Pre-Retirement Spending a Realistic Budget?

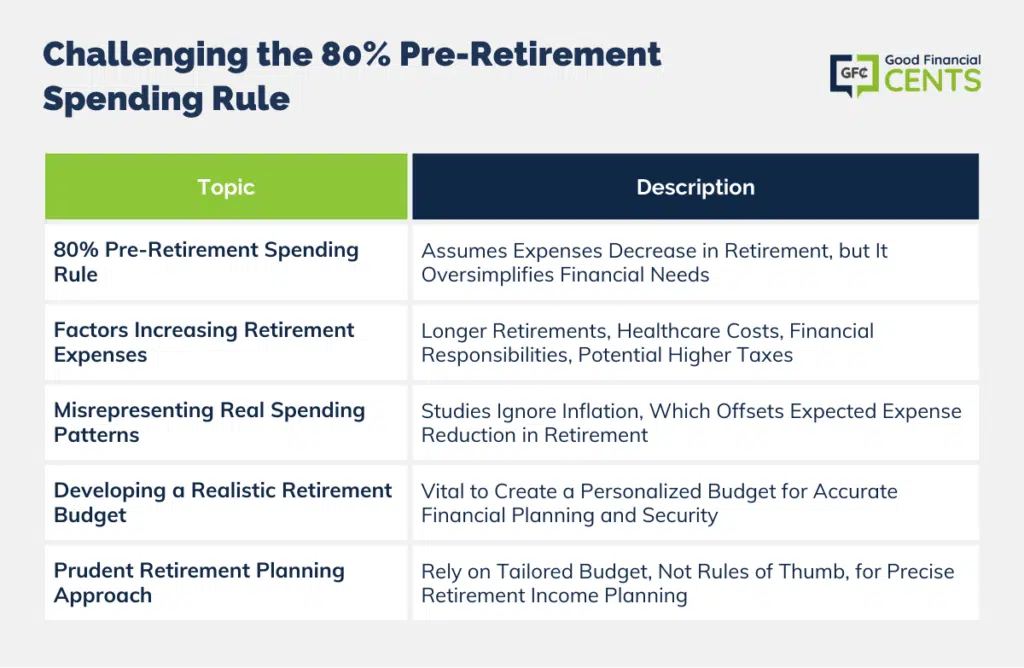

The basis for the 80% spending rule is that your living expenses are expected to decline once you retire. Thus, your spending should decrease without forcing you to lower your lifestyle.

For example, you’ll no longer need to purchase expensive professional clothing, and your transportation costs will drop without a daily commute to work. Additionally, your children will probably be grown and out of the house, and you will no longer have to fund your retirement savings. You may even have your home paid in full, thus eliminating your mortgage payment, and you may be in a lower tax bracket.

Unfortunately, the issue is not as clear as it might appear on the surface. The analysis above assumes certain types of spending will decrease while all other spending remains the same. That is not realistic.

For example, many new retirees like to hit the open road and see the world, thus increasing their travel budgets. Similarly, it is the rare retiree who does not face rising healthcare costs.

In short, the 80% rule of thumb is a generalization designed to simplify the retirement planning process at the expense of accuracy. It makes many assumptions about your future that may not be true for you. It is no substitute for making a real budget based on your actual plans for retirement, and it could actually jeopardize your financial security.

To make this point clear, we will examine five reasons why your expenses may actually increase during retirement instead of decrease…

Longer and More Active Retirements

People are living longer and more active retirement lifestyles than ever before. Increasing longevity has made 60 the new 40. If you plan an early retirement so you can sail around the world or take frequent wine-tasting trips to France and Italy, the cost of those leisure activities and travel can easily offset any decrease in work-related expenses. Alternatively, if you are planning an early retirement, it will mean you need more money to support a longer life of leisure.

A longer retirement means you can’t spend as much investment principal each month, and a more active retirement means you need more savings and income to support a more expensive lifestyle.

Health Care in Retirement

Healthcare costs have risen steadily, and there is every reason to believe that trend will continue. Additionally, your chances of serious illness or need for expensive medications increases with age. A single medical event can be devastating to your retirement savings if you are not prepared, and if you don’t have long-term care insurance, then assisted living or nursing home expenses can deplete your retirement savings.

Other Ways Expenses Could Rise

Maybe you haven’t paid off your house, or possibly you took out a home equity loan to remodel. The 80% rule-of-thumb assumes you no longer support dependents, but you may still be paying a child’s college expenses. Alternatively, you might be caring for an aging parent who is living in your home.

These expenses certainly won’t go away just because you retire.

Lower Taxes May Be Wrong

The assumption that your taxes will drop during retirement could be totally incorrect. After all, if your retirement income level is similar to pre-retirement income, then where will the tax relief come from? In addition, growing budget deficits at all levels of government combined with entitlement program problems indicate a greater likelihood of rising tax rates rather than falling tax rates.

In short, the idea that your tax rate will decrease during retirement may turn out to be just the opposite.

Spending Statistics Misrepresent Real Spending

Many research studies have been conducted on the spending patterns of the elderly. One of the more famous studies comes from Ty Bernicke in the Journal of Financial Planning, where he cites numbers from the U.S. Department of Labor’s Consumer Expenditure Survey indicating that retirees spend less as they age. A typical 75-year-old spends about half as much as the average 45-to-54-year-old. Overall, spending declines about 25% each decade from age 55 to 75.

This appears to be conclusive evidence that spending does, in fact, decline with age during retirement; however, there are a couple of major flaws in the research. The first problem results from these figures failing to include long-term care costs. You can solve that problem with insurance, but there is no solution to the next problem…

Bernicke’s analysis was based on a snapshot in time. Thus, it only compares nominal dollar spending and does not adjust for inflation. In other words, it compares the spending habits of a 75-year-old today to the spending habits of a 45-year-old on the same day.

It does not track a 45-year-old over a period of 30 years to determine if their spending decreases with time, as the study would imply. Instead, it compares the two different groups at a single point in time.

The problem with this approach is it fails to adjust spending for inflation. A mere 3% inflation will double spending in just 25 years, which will more than offset the expected reduction claimed by Bernicke’s research. In fact, it could potentially cause an increase in spending – contrary to what his research would imply.

A More Accurate Approach for Determining How Much Money You Need to Retire

In summary, you would be wise to forget the oversimplified rules of thumb when trying to figure out how much money to retire. Your financial security is at stake, and you deserve better. Instead, it is far more prudent to develop a realistic budget for your retirement spending based on your actual retirement plans. You don’t have to make it perfect because nobody can predict the future, but you do want to make it as accurate as you can.

A personal budget for retirement is necessary because your life situation is unique. Only you know the financial situation facing your maturing children and aging parents that might affect your budget. Only you know about your globetrotting plans to travel the world for a decade or two before slowing down.

That means you will need to add that expense to your budget for a decade or two before removing it. If you have long-term care insurance, then add the premiums as an expense into your budget, and if you don’t, then build a cushion into your savings for self-insurance. In short, develop a plan for retirement and then develop a budget to reflect your plan.

When you complete the budgeting process, you may be happily surprised to learn you only need 60% of pre-retirement income, making you better off than expected – or your dreams could require 140% of pre-retirement income, causing a challenge. This is key to your financial security because the difference between these two numbers can either break the back of your retirement savings or make a meager nest egg look plentiful. Because the range of outcomes is so wide and the stakes are so high, the only realistic solution is to replace the rule of thumb with a carefully developed retirement budget based on your unique needs to figure out how much you really need for retirement.

It is the only prudent thing to do.

The Bottom Line – Warning! The 80% Rule May Not be Enough to Retire

In determining retirement needs, the widely accepted 80% rule-of-thumb may be a misleading oversimplification.

While it’s grounded in the assumption that certain expenses decline post-retirement, factors like increased leisure activities, rising healthcare costs, potential lingering debts, and potential tax increases can inflate retirement costs.

Studies suggesting retirees spend less often overlook key aspects like inflation. Hence, to ensure a secure retirement, it’s imperative to forgo generic financial guidelines and craft a detailed retirement budget tailored to individual plans and circumstances.

Only through this personalized approach can one truly grasp the financial landscape awaiting them in retirement.

About The Author

Todd R. Tresidder is a financial coach who blogs about retirement planning, wealth building, and investment strategy. He wrote the book How Much Money Do I Need To Retire, teaching you how to overcome the hidden problems behind retirement calculators that threaten your financial security.

really good thought provoking article. You covered many aspects. I do think that people shouldn’t rely on just one calculator out there. They should try out at leats 5 different calculator and consider the highest amount as target for retirement.