Since it doesn’t have an immediate benefit – like auto or health insurance – life insurance may be the most underestimated insurance product there is. But if you die, life insurance will likely be the single most important policy type you’ve ever purchased.

And That’s Why You Have to Get It Right: Not only do you need a policy, but you need the right amount of coverage. Buying a flat amount of coverage and hoping for the best isn’t a strategy. There are specific numbers that go into determining how much life insurance you really need. There are even numbers that can reduce the amount you need.

Calculate what that number is, compare it with any life insurance you currently have and get busy buying a policy to cover the amount you don’t have. I’ll not only show you how much that is, but also where you can get the lowest cost life insurance possible.

The best life insurance companies offer simple terms and have affordable coverage tiers that help you find exactly the coverage you need.

How to Calculate How Much Life Insurance You Really Need

Now that you have an idea of how much life insurance you need, the next step is to get quotes from top life insurance companies for their best life insurance products. And the best way to get the most coverage for the lowest premium is by getting quotes from several companies. Use the quote tool below from our life insurance partner to get those offers:

Table of Contents

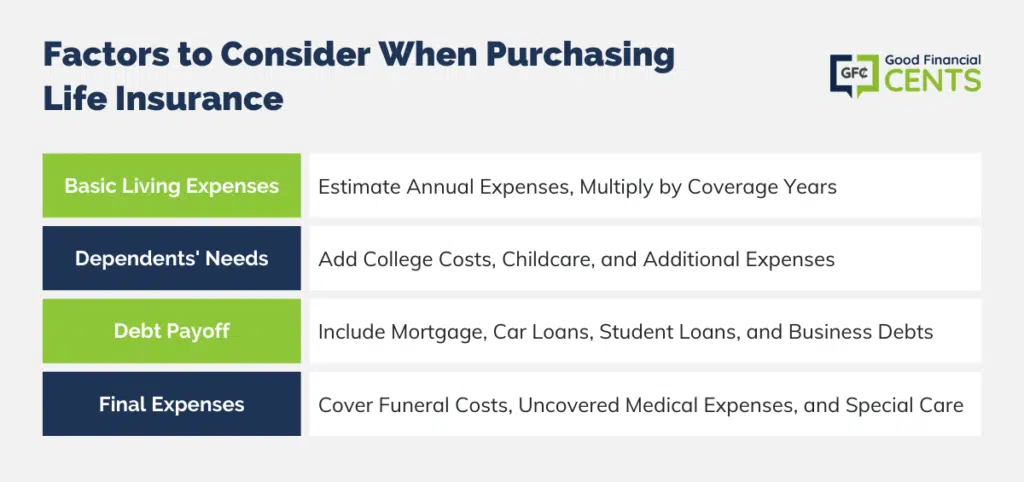

What to Consider When Purchasing Life Insurance

To answer the question of how much life insurance do I need, you’ll first need to break down the factors that will give you the magic number. You can use a rule of thumb, like the popularly quoted buy 10 times your annual income, but that’s little more than a rough estimate. If you use that as your guide, you may even end up paying for more coverage than you need, or worse – not having enough insurance.

Let’s take a look at the various components that will give you the right number for your policy.

Your Basic Living Expenses

If you’re not using budget software to track this number, a good strategy is to review and summarize your expenses for the past 12 months.

When you come up with that number, the next step is to multiply it by the number of years you want your life insurance policy to cover.

For example, let’s say your youngest child is five years old and you want to be able to provide for your family for at least 20 years. If the cost of your basic living expenses is $40,000 per year, you’ll need $800,000 over 20 years.

Now if your spouse is also employed, and likely to remain so after your death, you can subtract his or her contribution to your annual expenses.

If your spouse contributes $20,000 per year to your basic living expenses, you can cut the life insurance requirement in half, allowing $400,000 to cover basic living expenses.

But in considering whether or not your spouse will continue to work after your death, you’ll need to evaluate if that’s even possible. For example, if you have young, dependent children, your spouse may need to quit work and take care of them.

Alternatively, if you have a non-working spouse, there’ll be no contribution from his or her income toward basic living expenses.

In either case, your need to cover basic living expenses will go back up to $800,000.

Providing for Your Dependents

It may be tempting to assume your dependents will be provided for out of the insurance amount you determine for basic living expenses. But because children go through different life stages, there may be additional expenses.

The most obvious is providing for college education. With the average cost of in-state college tuition currently running at $10,940 per year, you may want to gross that up to $20,000 to allow for books, fees, room and board, and other costs. You can estimate a four-year cost of $80,000 per child. If you have two children, you’ll need to provide $160,000 out of life insurance.

Now it may be possible that one or more of your children may qualify for a scholarship or grant, but that should never be assumed. If anything, college costs will be higher by the time your children are enrolled, and any additional funds you budget for will be quickly used up.

Life insurance is an opportunity to make sure that even if you aren’t around to provide for your children’s education, they won’t need to take on crippling student loan debts to make it happen.

If childcare in your area costs $18,000 per year per child, and you currently have a nine-year-old and a 10-year-old, you’ll need to cover that cost for a total of five years, assuming childcare is no longer necessary by age 12. That will include three years for your nine-year-old and two years for your 10-year-old. It will require increasing your life insurance policy by $90,000 ($18,000 X five years).

Paying Off Debt

This is the easiest number to calculate since you can just pull the balances from your credit report.

The most obvious debt you’ll want to be paid off is your mortgage. Since it’s probably the biggest single debt you have, getting it paid off upon your death will go a long way toward making your family’s financial life easier after you’re gone.

You may also consider paying off any car loans you or your spouse have. But you’ll only be paying off those loans that exist at the time of your death. It’s likely your spouse will need a new car loan in a few years. Use your best judgment on this one.

But an even more important loan to pay off is any student loan debt. Though federal student loans will be canceled upon your death, that’s not always true with private student loans. Unless you know for certain that your loan(s) will be canceled, it’s best to make an additional allowance to pay them off.

Credit cards are a difficult loan type to include in a life insurance policy. The reason is because of the revolving nature of credit card debt. If your death is preceded by an extended period of incapacitation your family may turn to credit cards to deal with uncovered medical expenses, income shortfalls, and even stress-related issues. An estimate may be the best you can do here.

Still another important category is business debts, if you have any. Most business debts require a personal guarantee on your part and would be an obligation of your estate upon your death. If you have this kind of debt, you’ll want to provide for it to be paid off in your policy.

Covering Final Expenses

These are the most basic reasons to have life insurance, but in today’s high-cost world, it’s probably one of the smallest components of your policy.

When we think of final expenses, funeral costs quickly come to mind. An average funeral can cost anywhere from $5,000 to $10,000, depending on individual preferences.

But funeral costs are hardly the only costs associated with total final expenses.

We’ve already mentioned uncovered medical costs. If you’re not going to include a provision for these elsewhere in your policy considerations, you’ll need to make a general estimate here. At a minimum, you should assume the full amount of the out-of-pocket costs on your health insurance plan.

But that’s just the starting point. There may be thousands of dollars in uncovered costs, due to special care that may be required if your death is preceded by an extended illness.

A ballpark estimate may be the best you can do.

Related: The Best Life Insurance Companies

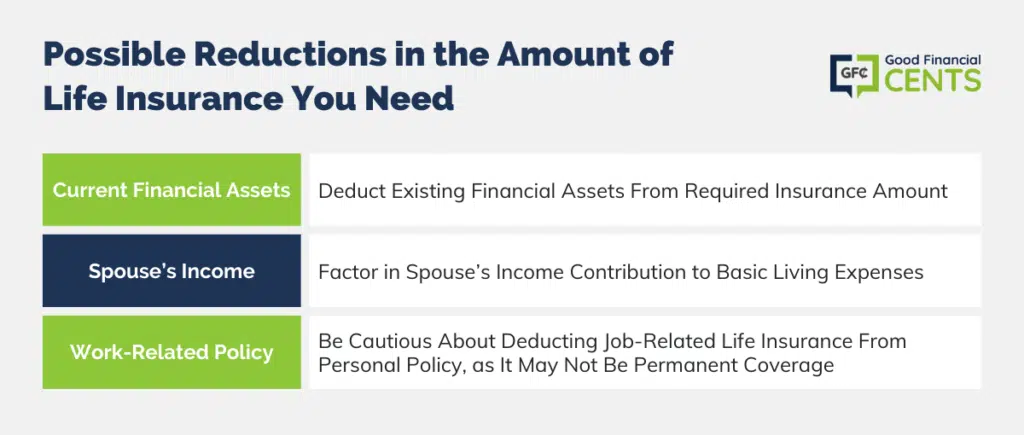

Possible Reductions in the Amount of Life Insurance You Need

What’s that? Reductions in the amount of life insurance I need? It’s not as out-in-orbit as you may think – even though any life insurance agent worth his or her salt will do their best to ignore this entirely. But if you’re purchasing your own life insurance, you can and should take these into consideration. It’s one of the ways you can avoid buying more life insurance than you actually need.

What are some examples of possible reductions?

Current Financial Assets

Let’s say you calculate you’ll need a life insurance policy for $1 million. But you currently have $300,000 in financial assets. Since those assets will be available to help provide for your family, you can deduct them from the amount of life insurance you’ll need.

Your Spouse’s Income

We’ve already covered this in calculating your basic living expenses. But if you haven’t, you should still factor it into the equation, at least if your spouse is likely to continue working.

If you need a $1 million life insurance policy, but your spouse will contribute $25,000 per year (for 20 years) toward your basic living expenses, you’ll be able to cut your life insurance need in half.

But be careful here! Your spouse may need to either reduce his or her work schedule or even quit entirely. Either outcome is a possibility for reasons you might not be able to imagine right now.

What About a Work-Related Life Insurance Policy?

While it may be tempting to deduct the anticipated proceeds from a job-related life insurance policy from your personal policy, I urge extreme caution here.

The basic problem is that employment-related life insurance is not permanent life insurance. Between now and the time of your death, you could change jobs to one that offers a much smaller policy. You might even move into a new occupation that doesn’t provide life insurance at all.

There’s also the possibility your coverage may be terminated because of factors leading up to your death. For example, if you contract a terminal illness you may be forced to leave your job months or even years before your death. If so, you may lose your employer policy with your departure.

My advice is to consider a work policy as a bonus. If it’s there at the time of your death, great – your loved ones will have additional financial resources. But if it isn’t, you’ll be fully prepared with a right-sized private policy.

Example: Your Life Insurance Requirements

Let’s bring all these variables together and work on an example that incorporates each factor.

Life insurance needs:

- Basic living expenses – $40,000 per year for 20 years – $800,000

- College education – $80,000 X 2 children – $160,000

- Childcare – for two children for 5 years at $18,000 per year – $90,000

- Payoff debt – mortgage ($250,000), student loans ($40,000), credit cards ($10,000) – $300,000

- Final expenses – using a ballpark estimate – $30,000

- Total gross insurance need – $1,380,000

Reductions in anticipated life insurance needs:

- Current financial assets – $300,000

- Spouse’s contribution toward living expenses – $20,000 per year for 20 years – $400,000

- Total life insurance reductions – $700,000

Based on the above totals, by subtracting $700,000 in life insurance reductions from the gross insurance need of $1,380,000, leaves you with $650,000. At that amount, your family should be adequately provided for upon your death, and the amount you should consider for your life insurance policy.

Once again, if you have life insurance at work, think of it as a bonus only.

The Bottom Line

Once you know how much life insurance you need, it’s time to purchase a policy. Now is the best time to do that. Life insurance becomes more expensive as you get older, and if you develop a serious health condition, it may even be impossible to get. That’s why I have to emphasize that you act now.

Crunch the numbers to find out how much life insurance you need, then get quotes using the quote tool above. The sooner you do, the less expensive your policy will be.

Dear Mr. Kevin Mercadante,

After reading your writeup on “How Much Life Insurance Do I Need?” in the article titled “Life Insurance for 80 year olds / Finding the Best Policy” I am encouraged to write to you. I am looking for a policy for nearly $2,000.000, and I am 80 years old. I am in good health and would be willing to take a medical exam.