She was my pride and joy.

A champagne colored 4 door ’98 Chevy Lumina Sedan that was suitable for a grandmother to drive.

In fact, one did – mine. My “Nanny” to be exact.

Before the Lumina I drove a 4-door ’96 red Pontiac Grand-Am. (Guess I had some weird obsession with 4 doors, huh?)

I bought the car when I first moved back to Illinois to attend junior college. It was the first car that I was actually responsible for the payment.

Either way, I was ecstatic. I was driving a car and it was mine.

I was lucky enough to have an awesome grandmother who offered to pay it off as a graduation gift.

Table of Contents

Although I constantly envisioned myself driving something A LOT cooler, it was still nice having extra cash to enjoy life. I was supporting myself all through college (with the help of the National Guard) and shelling out $250 a month for a car payment just didn’t feel right.

A Valuable Life Lesson

That wasn’t always the case.

I had this vision that once I graduated and got a real job I’d be driving something sporty like BMW. If it wasn’t a BMW, it was going to be something foreign for sure.

Anything better than my Grand Am.

Then one day the professor of my Finance 361 class changed my outlook on car payments for the rest of my life. During one of his lectures, he asked our class the following question:

How many of you plan on buying a new car every 3-5 years?

He asked the class to raise our hands if this were true.

I recall being one of the first students to immediately raise my hand. “Heck yeah!“, I proudly thought. I’m buying a new BMW every 3-5 years.

I wasn’t the only one to raise my hand. Over half of the class raised their hands with me. The professor’s next statement has stuck with me ever since:

“Enjoy making your car payments for the rest of your life while I take my family to Europe on vacation whenever I want.”

At that time I wasn’t really familiar with the concept of the time value of money and compounding interest. No one took the time to really explain it to me.

Thankfully, he did.

We ran numbers after numbers and it was staggering how much I was really giving up by shelling out for a stupid car payment each and every month. I now felt foolish for raising my hand.

So What About This Lumina and $2 Million Dollars?

A few years into my career as a financial advisor my grandmother passed away. Among the things I inherited was the 1998 Chevy Lumina or “The Lu”- as my wife called it.

At the time, my Grand Am had accumulated some decent mileage and was reaching that time where stuff was starting to happen: engine lights were coming on, new rattles I had never heard before, and a funky scent from having left my windows down during a downpour (think wet rotten cat smell–ewww!).

The Lumina was 2 years older than my Grand Am, but, it had 70,000 fewer miles on it. Although the car was 6 years old it was basically brand spanking new.

Tempting Decisions

I could have sold both cars and used the proceeds for a down payment on the car of my dreams.

Remember the one I raised my hand for in class?

Was it tempting? Absolutely.

I thought long and hard about it and for a split second almost gave into my previous foreign car cravings. Thankfully, I gave myself a well-deserved “biff-slap” to the forehead and smacked myself back to reality.

Taking that class revealed to me the flaws in my logic of buying brand-new cars and prevented me from wasting money on a BMW that I really couldn’t afford.

By not taking on a car payment, I was able to sock away some serious cash both in my Roth IRA and my 401(k). So much in fact I’ve maxed out my Roth IRA every year I started working (after my 1st year) and I was able to put some in my 401(k), too.

I figure that conservatively, I was able to invest at least $400 per month (sometimes more) I would not have been able to if I had had a car payment.

What Does $400 a Month Really Mean?

Quite simply: A LOT.

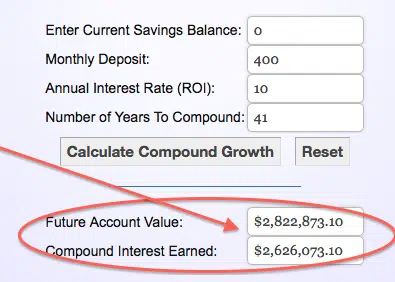

This is where it gets fun and you can see some really eye-popping numbers. Using the Monthly Compound Interest Calculator you see below I entered in investing $40 per month and averaging 10% a year (optimistic I know but I’m the forever optimist when it comes to the stock market) until my retirement age of 65.

The calculator reveals I will have $2,883,185. (seen below) For those who think 10% is outrageous, an 8% return would yield $1,527,399.10. Still not too shabby, eh?

Now, let’s say instead of driving my Chevy Lumina I opted to go and splurge on a new car. This would delay my investing until age 27 thus far decreasing the total to $2,081,337.26; a difference of over $800,00o.

In case you missed it: that’s over $800,000 more in your pocket for just 3 years of early savings!

Three years of sucking it up and not driving my dream car, albeit a reliable car, had that much of an impact on the future.

Amazing.

No Car Payment

The concept of not having a car payment is far-fetched for many. A good friend of mine once tried to convince me it makes sense to always have a car payment because he’ll always have a warranty.

Yeah, because cars ALWAYS break down? Ummm….not quite.

So am I totally against having a car payment? Actually, no.

What am I against? Convincing me you have to buy a brand new car. I wouldn’t even go there. If you don’t believe it, go here.

While it’s definitely possible for people to not have a car payment, one easy rule of thumb to follow is this:

You should be investing more per month than you are making car payments.

It literally makes me sick when I talk to a young couple who are wasting $700 per month on car payments (remember, this doesn’t include insurance, gas, maintenance, etc.) and are only saving around $100 per month.

Hello!? The last time I checked your car didn’t grow in value. It’s not like you can enter your car payment into a future value calculator like the one above and get excited to see how much your money has grown.

In this sad scenario, all the money you dump into your car is worth less.

In the spirit of this blog, that does not make “good financial cents“.

A Valid Argument?

The title of this post boasted how my Chevy Lumina made me over $2,000,000 but my numbers show it only netted me $800,000, so what gives?

Here’s the thing I know: having the discipline to start saving at an early age laid the groundwork to be able to save as much as I do now.

Had I bought a new car and not started saving, my gut says I wouldn’t have started investing at 27. Or if I did, it wouldn’t be nearly as much.

What has actually occurred is I was able to save 2-3 times that amount throughout my 20s all thanks to driving “The Lu”.

What have you sacrificed so that you might prosper later on? How long did it take for you to see an impact from your sacrifice?

Your story has one problem , you forget you are pouring your money into sometime that could collapse and leave you with nothign that is not a good gamble ,place your money in a trust fund or cdl, not the stock market which is already showing signs of loss for millions and at a great rate

@ Kathy Anything “could collapse”. That’s an inherent risk in anything you invest into.

So many good arguments towards saving for the future! We just bought a 2003 Odyssey with semi low miles and paid CASH! You’re making me think more about investing what we could be paying past my Hubby’s 401K

Wonderful article. Auto debt is just an excepted fact of life for too many people.

We need to get to more college students to help get them on the right foot. Maybe it needs to be in high school.

Thank you for sharing your story and thanks to your “Nanny.”

Great story – I am currently still driving the car my parents gave me as a teenager. It’s got 250,000 miles on it and is 14 years old. Rock on!

Where the calculator you used to add up compound interest?

I am still driving my “mommy van” that is a 2003 with over140,000 miles!! No car payments and although I would like a more stylish vehicle, not having a car payment is more important. I am still trying to payoff some credit card debt, but can’t wait until I am debt-free!!!

I love this article and whole heartedly agree that car payments should be avoided. I did, however, have a hard time understanding some of the article due to what I’m guessing is a lack of proofreading. I don’t want to be THAT person and I have no intention of being a grammar nazi, but I’d enjoy your blog much more if it were easier to read. Still, I don’t give up that easily 🙂

I’m working on a 15 year old car now to save the $$$ towards retirement. Great story!

Love this article. We always buy used, pay them off early, and drive them til they cannot drive no more. I love your youtube video and think I will share with the business teacher to use where I teach high school.

And this is exactly why I love my paid off 2006 Mazda I bought seven years ago.

Great story Jeff! We don’t like having car payments. We bought my car in cash, and paid off my husband’s car as soon as we could. Don’t like having those payments over our heads.

Great story Jeff. Sooo many great reasons to NOT have a car payment. Just the peace of mind alone is worth it, but an extra $250 a month invested in your future can’t be beat. Just think of the fancy four door Cadilac you will be able to afford when you are 72 living in Florida!

Hi Mike,

Why would you rather have a cadillac at 72 than a nice car when you’re younger? OR is that the point you’re making?

I usually own my cars well beyond the normal time. My last car was 17 years old and my wife’s car is 17 years old with just 100K miles on it. I like no payments and will have the new car paid off in just 3 more years.

Jeff, Great piece. I love the simple formula question: Are you spending more on your car payment than you are saving/ The answer for most folks is the wrong one!

Thanks Jim!