With most people transitioning through several employers during their career, it is fairly common for them to leave a trail of employer-sponsored retirement accounts behind.

While it’s possible to let each of these accounts continue growing on their own, this is rarely the best option for your finances. In fact, you would almost always be much better off taking your old retirement accounts, including 403(b) plans, with you.

Fortunately, it’s not that difficult or time-consuming to roll your 403(b) into a new account you can monitor yourself. Once you have left an employer, you have several options for rolling over your 403(b) funds into another type of retirement account such as a traditional IRA or a Roth IRA.

Table of Contents

What Is a 403(b)?

When you are talking to someone who has a 403(b), it’s fairly common for them to not understand what type of retirement account they actually hold. In fact, when asked, they will usually refer to it their “tax-sheltered annuity”.

This is primarily because, when 403(b)’s were initially adopted, insurance companies were the first ones to get their foot in the door. Because of this fact, most people who had a 403(b) had an annuity that was tax-sheltered.

However, that isn’t always the case these days. While tax-sheltered annuities were popular at first, you will find that many other investment companies take part in modern 403(b) plans.

In fact, 403(b) plans and the investments they hold are extremely diverse. As such, the definition for this type of account is fairly diverse and broad as well. According to the Internal Revenue Service, 403(b) plans can be described as follows:

A 403(b) plan, also known as a tax-sheltered annuity (TSA) plan, is a retirement plan for certain employees of public schools, employees of certain tax-exempt organizations, and certain ministers.

Individual accounts in a 403(b) plan can be any of the following types.

- An Annuity Contract: This is a contract provided through an insurance company.

- A Custodial Account: This is an account invested in mutual funds.

- A Retirement Income Account Set Up for Church Employees: Generally, retirement income accounts can invest in either annuities or mutual funds.

As you can see, 403(b) plans can take on a different shape or set-up depending on where they are offered and what type of selections the plan administrator has chosen.

The most important factor to remember, however, is that 403(b) plans are treated much like employer-sponsored 401(k) plans in the real world. First off, both types of plans are funded with pre-tax dollars, allowing the investments to grow on a tax-deferred basis until retirement.

Second, a 403(b) plan offers the same maximum contribution annual as 401(k) plans, which is $23,000 for 2025 if you are ages 50 and below. If you are over age 50, you can make an additional $7,500 in contributions in 2025 with what is known as a “catch up contribution.”

Advantages of Using a 403(b)

If you are offered a 403(b) plan by your employer, it is almost always a smart idea to begin making contributions. In fact, 403(b) plans offer several distinct advantages, some of which are similar to those offered through employer-based 401(k) plans. Here are some of the biggest benefits you’ll get from using a 403(b):

Contributions Are Made on a Pre-tax Basis, Which Can Lower Your Taxable Income: Just like contributions you may have made to an employer-sponsored 401(k) plan, the money you deposit into a 403(b) is pre-tax. As such, the contributions you make annually can lower your taxable income and help you save on your tax annual tax bill.

Your Savings Grow Tax-Free: After you make pre-tax contributions to a 403(b) plan, your money will continue to grow tax-free until you reach retirement and beyond. You’ll only be required to pay income taxes on distributions when you take them.

Take Contributions Later in Life When You Might Be in a Lower Tax Bracket: Since you won’t pay taxes on 403(b) funds until you are in retirement in most cases, you have the potential to pay lower taxes in the future as well. Since most people in retirement fall into a lower tax bracket, it is reasonable to assume they might pay lower taxes in the future.

You May Get an Employer Match: Just like employer-sponsored 401(k) plans, many not-for-profit employers who administer 403(b) plans offer a company match. This is the closest thing to “free money” you’ll ever find, so it’s always wise to contribute enough money to your work-sponsored 403(b) plan so that you’ll get the full benefit.

Contribution Limits Remain Relatively High in 2025: Just like employer-sponsored 401(k) plans, maximum contribution levels remain high for 403(b) accounts. For 2025, you can contribute up to $23,000 to a qualifying 403(b) plan if you are age 50 or younger. If you are ages 50 and older, you can contribute up to an additional $7,500 in what is known as a “catch up contribution.” The total contribution for those 50 and older is now up to $30,500 per year.

How to Do a 403(b) Rollover

Since many people work for several employers during their working years, it is fairly common for people to have several retirement plans, including 401(k)s and 403(b)s, they need to roll over.

If you do a direct rollover of funds into a traditional IRA account, you will avoid the mandatory 20% federal income tax withholdings assessed on retirement funds withdrawal.

You can open an IRA account at any financial institution offering this type of account. Generally, speaking, you will need to complete the 403(b) rollover by the 60th day following the day distribution is received.

The IRS does allow for two exceptions to the 60-day rollover rule, however. In the case of financial hardships or unforeseen circumstances, you may be allowed an exemption.

Exemptions are not guaranteed and the IRS will require proof of financial hardship, such as hospitalization or any other kind of financial crisis. Unforeseen circumstances can come in different forms, but they typically include situations where your funds are frozen in your account for some reason.

Typically, you only need to complete a signed contribution form which is required by the IRA trustee in order to roll over the funds into the IRA account. You will need to check with the specific financial institution regarding its rollover policies prior to conducting the transaction to avoid delays in processing.

To roll your 403(b) into a traditional IRA, you will also need to consult with the plan administrator of your 403(b) account to make sure you are completing the appropriate paperwork. Some will require a distribution request to be completed before assets can be rolled over.

Meanwhile, some administrators will also need a letter of acceptance from the IRA trustee/financial institution. These documents will provide proof that funds are being transferred to a legitimate retirement plan account.

One Important Note: You’ll need to make sure the rollover is processed as a ‘direct’ roller, meaning that fund distributions are payable and sent to only to the IRA trustee. If the fund distribution is made payable to you, your plan administrator is required to keep a deduction of 20% for federal tax withholdings. Rolling over a 403(b) account into an IRA needs to be done correctly or you will face stiff tax penalties for early withdrawals.

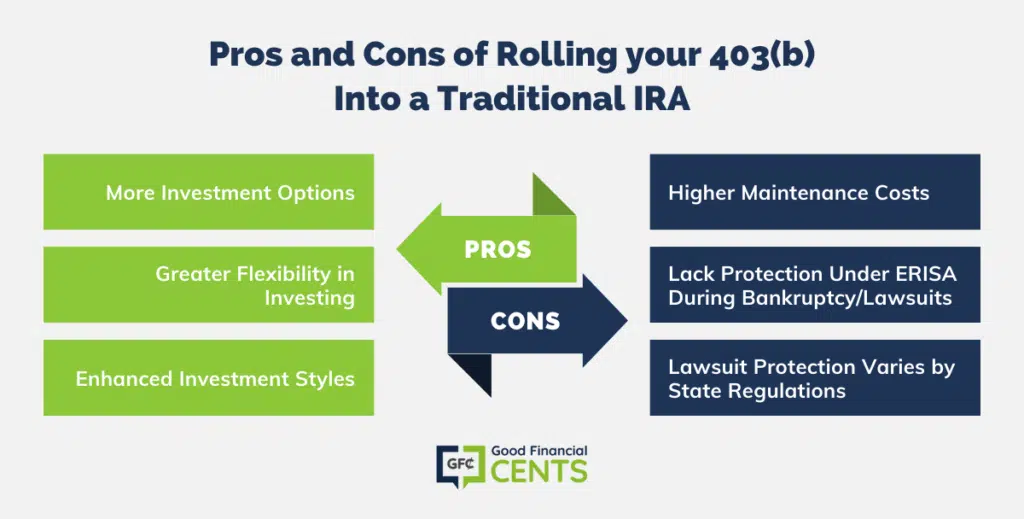

Pros and Cons of Rolling Your 403(b) Into a Traditional IRA

While the benefits of rolling an old 403(b) into a new account can vary depending on the situation, the biggest benefit you’ll likely receive is the gift of having more options than you had before.

Generally speaking, IRAs offer more investment options than 403(b) plans. The biggest advantage you get when you roll over a 403(b) into an IRA is the fact that IRAs offer greater flexibility when it comes to how you invest your money. Once your funds are rolled over, you can invest them into mutual funds, index funds, and even individual stocks.

If your 403(b) plan offered fairly limited investment options, having a traditional IRA will make you feel like you have unlimited options at your fingertips. And if you prefer a certain investment style – such as investing mostly in index funds – having a traditional IRA makes it much easier for you to stick to that plan for the long haul.

The biggest disadvantage that comes with rolling an old 403(b) into a traditional IRA is that an IRA may cost more money to maintain over time. Where you may not have paid transaction costs for your 403(b), you will find that running a traditional IRA can be costly.

Another disadvantage that comes with traditional IRAs is the fact that, in the event you ever file for bankruptcy or are on the receiving end of a lawsuit, your funds in an IRA are not protected by the Employee Retirement Income Security Act. This act was established to ensure invested monies are designated especially for retirement and cannot be used for debt purposes.

With lawsuits, it’s a different story. It really depends on the type of lawsuit you are embroiled in and, most importantly, the rules created in the state you live in.

Another Option: Convert Your 403(b) to a Roth IRA

If you don’t want to roll your 403(b) into a traditional IRA, you can consider rolling it into a Roth IRA instead. Since Roth IRAs are funded with after-tax dollars, however, there are huge tax considerations to contemplate if you choose to roll your 403(b) into this type of account.

When you roll your 403(b), 401(k), or other tax-deferred retirement account into a Roth IRA, you’ll have to pay income taxes on the amount you roll over that year. This can result in a huge upfront expense if you have a lot of money saved in your 403(b) already, but many people do it anyway for myriad reasons.

Since Roth IRAs are funded with after-tax dollars, they work differently when you use them and when you’re ready to begin taking distributions. Here are some of the benefits you can get from rolling your 403(b) into a Roth IRA:

You Won’t Have to Pay Income Taxes When You Begin Taking Distributions.

Since Roth IRAs are funded with after-tax dollars, you can begin taking tax-free income distributions when you are ready to retire. If you think you might be in a higher tax bracket when you retire several years or decades from now, having an income stream that is not taxed can be a huge boon for your finances.

Owning a Roth IRA Can Help You Diversify Your Tax Liability in Future Years.

If you also have a 403(b) or 401(k) plan, adding a Roth IRA is a smart way to diversify your tax liability. Where you’ll pay income taxes on distributions from tax-deferred accounts when you retire, you won’t need to when you take distributions from your Roth IRA.

You Don’t Have to Take Required Minimum Distributions (Rmds) At Any Age.

Where most tax-advantaged retirement accounts like 401(k)s and 403(b)s require you to begin taking required minimum distributions (RMDs) at age 73, the Roth IRA has no such requirement. If you want to keep your money in your account for a lifetime, the Roth IRA will let you do so with no penalty.

Your Heirs Won’t Face a Tax Bill When They Inherit Your Roth IRA.

Since Roth IRAs are funded with after-tax dollars, they make it easy for your heirs to inherit tax-free money when you die. If you’re worried about leaving your heirs with a huge tax bill and lots of red tape, you can rest assured that your Roth IRA will leave neither.

Where to Open a Roth IRA

You have a lot of options to choose from when you decide where to open a Roth IRA. Pretty much any broker can help you start an account, but some of those accounts might come with hidden management and trading fees that can add up quickly. Here are my three top picks for your Roth IRA and a few reasons why they’re solid investments.

M1 Finance

With M1, each of your investment accounts is presented as a pie filled with up to 100 slices of stocks and ETFs. Upon opening your Roth IRA with M1, you set goals for your account. To keep you on track to meet them, M1 has 60 goal-oriented pies for you to choose from.

But if you’d rather create your own pies, choosing what to invest in and how much to allocate to each slice, you have the freedom to do so. Opening an account is free, but to start investing in your Roth IRA, you’ll need to make a $500 initial deposit.

M1 gives you the freedom to drive your investments without the hindrance of maintaining them, transforming robo-advising. M1 Finance is fee-free and has no minimum investment cost after your first deposit, giving you expert account management on flexible terms.

Betterment

Betterment is the epitome of hands-off retirement investing. When you create your account with Betterment, you’ll complete a questionnaire assessing your goals and risk tolerance. After that, Betterment designs a portfolio around your answers, picking where to invest and balancing your account to keep you on target.

Betterment also gives you the option to automatically meet the IRS’ maximum contribution, adjusting your monthly investments if the limit changes. Betterment does charge a fee to manage your account, between .25% and .40%.

Those fees may actually work in your favor in comparison to the flat fees charged by some of Betterment’s competitors, making their simplified investing solution a solid robo-advisor for your Roth IRA.

Ally Invest

After its recent acquisition of Trade King, Ally has made automated investment easier than ever, including investing in a Roth IRA.

With stellar customer service reviews, user-friendly software centered around practicality and ease of use and no commissions on stock trades, Ally Invest is a solid choice for a retirement account.

Ally Invest’s Roth IRA accounts have no maintenance fees or annual fees, meaning the only account fees you’ll see are for canceling your account or completing a full transfer of all your Roth IRA funds from your Ally account.

The Bottom Line

If you have a 403(b) or several retirement accounts left with old employers, it’s smart to determine whether you should roll those accounts into a new one.

Most of the time, doing so will help you simplify your life by consolidating your retirement into one place. Plus, you may even become eligible for more or better investment options if you choose a traditional IRA or Roth IRA for your rollover.

As always, it’s smart to consult your financial advisor and tax consultant before you make any big financial moves or roll over old accounts. The more you know and the more questions you ask, the better off you’ll be.

Hello,

I am 62 years old. I still work for the same employer and have a 403B plan. I want to roll over to an IRA. I was told that I have to sever my employment in order to do so

I thought there is an IRS ruling publication 571 that allows in-service distributions if 59 1/2 or older. Thank you.

Question…I have significant dollars in a 403B plan ; from when I retired in December if 2016.

I will be 70 in December and I am aware of RMD when I turn 70 1/2.

Can I place funds before age 70 in a Roth IRA to avoid a RMD?

Thank You .

Hi Aelia – You can do the rollover, but you’ll have to take the RMD. You also can’t rollover RMD funds into another retirement plan to escape paying taxes.

This article states that a 403(b) Rollover check must be payable to and sent to the IRA custodian. Fidelity wants to send a check to me made out to my other broker which I will pass to them. Since made out to the institution and immediately passed to the broker for IRA deposit, am I responsible for taxes since “sent” to me? That doesn’t seem to make sense.

Hi DM – I don’t think so. Since it was made out to the new broker, you won’t be responsible for taxes as long as you deposit the check with the new broker within 60 days.

Hi Jeff,

I work for a public school and have, over the years, contributed to 5 different 403b companies (i.e. Valic, Templeton,etc.) I now want to combine some old 403bs through a direct roller to a deferred annuity. Is the “Plan Administrator” 1 entity working for the school district covering all 5 different 403b’s OR is there an administrator for each of the 5 403b’s. I called Templeton and they told me no problem but the school district says I have to pay 10% if I take out $$ before 59.6. I am 59.1 and I clearly stated I want to do a rollover, not a distribution, but they say it is not allowed. 100% of this money was from my funds with zero match from the district. I made all the contributions why would I not be allowed to move it from one retirement vehicle to another? I also contribute to the required retirement plan. How would the school district know if Templeton said I could roll it over and I did?

THANKS,

Lynn

Hi Lynn – You should have one admin for each 403(b) plan, so the rules may be a bit different between each plan. The 10% is probably tax with holding for anticipated taxes. There may be a waiver, but again, it depends on the plan.

I am considering to roll over 403b fund in old employer account to Roth IRA. I am 33 years old. Do I have to pay early withdrawal penalty, and, 20% of the required federal tax withholding, in addition to my personal income tax of the funds rolled over? I am going to do direct roll over – from the old employer account to a designated ROTH IRA investment company with no money paid to me.

Thanks a lot for your help!

Young Kim

Hi Young – You’ll be doing a Roth conversion, which means you will have to pay ordinary income tax on the amount converted to the Roth, but not the 10% penalty. As to the withholding, that will depend on your employer’s rules on that. You may be able to avoid it, but then you’ll have to pay the tax when you file your return.

If the holder of a 403(b) account reaches 70-1/2 years in mid-March 2018 and transfers the 403(b) account in February 2018, a few weeks before reaching 70-1/2, to a traditional IRA at another financial institution, can the initial RMD be delayed until April 1t 2019 or does the initial RMD have to be distributed in 2018? The account wants to delay the initial RMD until 2019.

Hi Gene – I believe the RMD must take place in the year you reach 70.5, so the RMD would be for 2018.

Hello,

I work for a hospital that matches and just rolled $6500 from a previous employer’s 401k into my current 403b, should I expect any type of match funds from the hospital? Just wondering.

Hi Angela – I’ve not ever heard of any employer doing a match on a rollover balance, nor is it likely to be OK with the IRS. So my answer is no. Would be nice if they did thought, right?

I began contributing to my 403b in 1992 while working for a different school system. I took a job in a different system in 2007 and have continued to contribute. Can I roll over my 403b into an IRA, or did I have to do it as soon as I transferred school systems? I’d like to potentially use some of the funds for my son’s college tuition.

Thanks!

Hi Craig – Unless your previous employer has some restriction against it (some public plans do) you should be able to rollover your old 403b any time, either into an IRA or your new employer plan.

Hope you can provide some insight on this.

My wife, a former public school teacher, has a 403b/TSA with an insurance company. The policy matured as of 12/1/2017. She turned 70 on 1/6/2018. She has not taken out/received any funds from the 403b/TSA. Can she still roll over the 403b/TSA to a traditional IRA w/o penalty? Are there time limit constraints we need to be aware of?

Thanks

Hi John – She should be able to do the rollover, unless the plan prohibits it for some reason. Some public plans do have this quirk. You’ll have to check with the plan administrator. There shouldn’t be a penalty with the rollover. But since she turned 70 this year, she will be required to take a required minimum distribution (RMD) from the plan whether it’s in the 403B or an IRA.

While working and contributing to a company sponsored Thrift Plan, I would sometimes max out allowed pre-tax contributions but continue to make post tax contributions. When I retired I was so excited to roll over funds into an IRA that is managed, I forget about the 23000 dollars of the funds that were post tax deposits. Now that funds are in a managed account, I am thinking I lost any chance to ever withdraw the 23000 that I already paid taxes on…. Am I correct?????

Hi Tim – I’m not clear on your question. Why did you pay tax on a TSP to IRA rollover (unless it’s a Roth IRA)??? And once it’s in the account, why would you not be able to withdraw it?

Can I make more than one 60-day rollover from a 403-b plan to the same IRA in a given year?

Hi Richard – As far as I know you can. But if you’re worried about it ask your tax preparer (or a tax preparer).

Hi Jeff,

My understanding is that a 403b cannot be rolled into a 457b. Do you know why? What if you roll your 403b into a Traditional IRA, and then into a 457b? It’s all pre-tax money. Would that work?

Thank you!

Hi Dawn – My interpretation is that you can, so I can’t really address the question.

Once I retire from my current school job (I’m over age 59.5), can I still contribute to my 403b account?

Probably not Rebecca. 403B accounts can only be contributed from earned income. Since you will be retired, there won’t be anything to contribute from. Unless your plan has some sort of provision that I’m not aware of. Which is always possible. Check with your plan administrator to see.

Hello. I left work years ago. 403b still there and growing.

Could I fill out paper to move from 403B to IRA, then get the check from 403B and after that, personally open an IRA account and deposite all the money I get from my 403B?

Thank you.

You can Marcelo , but you’d be better off having the money sent from the 403b to the IRA in a direct trustee-to-trustee rollover. That will avoid the possibility of you facing an early distribution penalty.

Both my husband and I are retired and have define pensions. I also have 2 403b mutual funds accounts. I am 59 years old and retired last year. What are the pros and cons of moving some of the funds into a Roth IRA account after I’m 59.5? I know one of the cons is paying taxes on the roll over money and a pro is when get ready to withdraw money later in life, will not pay taxes on Roth IRA. Is there any other advantages of opening a Roth IRA account? Also what difference does it make if paying taxes now when you withdraw the money to open Roth IRA or later from 403B account if you will still be in the same tax rate?

Hi Ruby – There are two tax provisions that you do need to be careful about. One is your current marginal tax rate, compared to what you think it will be in the future. For example, if you think that your future tax rate will be lower than what it is now, it may not be worth it to do the conversion.. That’s because you may be paying a 25% tax rate to do the conversion now, in order to avoid a 10% tax rate when you start withdrawing the money.

The second tax issue has to do with earnings on the converted balance. While you will be able to withdraw money from the Roth IRA at any time after turning 59 1/2, you will have to pay income taxes on any portion of the distribution that represents investment earnings since the conversion. The five-year rule still applies on investment earnings after the conversion, even when you’re over 59 1/2. You’ll have to pay tax on that amount that you withdraw within the first five years, but not the 10% penalty.

There’s a big benefit to doing the Roth conversion, that has to do with required minimum distributions (RMDs). The money moved over to a Roth IRA will no longer be subject to RMDs, like other retirement plans are. You will be able to allow the Roth IRA to continue growing for the rest of your life, and only taking withdrawals when you want to.

You should discuss the conversion with your accountant before doing it. He or she will have a better idea as to what your tax situation is, and if the conversion makes sense.

I am 69 years old and recently retired from teaching at a public school where I started a 403b. Unfortunately, I’m aware of the fact that I’ll incur a transfer fee for moving the funds, but since I am retired, my understanding is that I can roll over the funds into an IRA without the funds being subject to ordinary income taxes. Is my assumption accurate? Thanks.

That’s correct IRA. Tax will only be due if you do a Roth conversion. But if you move the funds to an IRA, no tax will be due.

Jeff, one last question if I may. Can I have the taxes incurred from rolling a 403b to a Roth taken from my 403b? I’ve heard others say you need to pay those taxes from another source say a savings account.

Thanks,

Richard

You can have the taxes taken out of the 403b, but you will lose a big chunk of the balance of the account. It’s generally preferred to take the money out of non-retirement money so that you can transfer the whole 403b.

Jeff, why is it generally not advised to roll a 403b into a Roth account? Is it primarily the initial tax hit? If I’m about to retire and roll it over to a Roth that I will not have held for 5 years yet (I need another 3 years to have held the Roth for a full 5 years when I’ll be 60), would that be cause to not go that route?

If the 403b is rolled into an ira can I years later roll it into a Roth or spread that rollover over a number of years?

Sincerely thanks

Richard

Hi Richard – You will have to pay the tax on the conversion, and that’s a major reason to think long and hard. If you do the conversion before turning 59.5 you’ll have to pay the 10% penalty on any withdrawals taken before you reach that age. Waiting to do the conversion will make sense if your tax bracket will be lower at that time. Also, on Roth conversions, the five year clock starts with each conversion, and is not based on the age of the account. Of course, once you reach 59.5 that no longer matters anyway. Hope this helps.

I’d like to know if I should leave my 403b and 401k monies in my company’s plan when I retire later this year, or roll them over into my traditional IRA account. I have a pension with my company that was “frozen” in 2013, that has $100k in it. My monthly pension check for life without the 403b and 401k added in would only be $700, but it would be $1,000 with them added in. If I read your article correctly, it appears I should look at the historical rate of return on the IRA and the 403b/401k accounts to see which has been more profitable? I have approximately $150k in the IRA. I’m not a financial wizard by any means and don’t know if I would feel competent in managing my own funds in an IRA.

Hi Kathy – It really isn’t possible to say online if moving the money to a Roth IRA will make sense for you as opposed to leaving it where it is. You probably should sit down with a financial professional who knows your entire financial situation to make sure you’re heading down the right path.

Hi Jeff,

I love this article and any help would be greatly appreciated. I’m still trying to wrap my head around all the fees and penalties that seem to be buried in the fine print of my wife’s 403b plan. I’m still trying to figure out if she’s in a Tier1,Tier2 or Tier3 level. When we retire, our plan is to do a direct rollover into a Traditional IRA with the firm that holds the bulk of our retirement assets. Will we have to pay surrender charges to the annuity fund contracts to roll over her money?

Hi Gilbert – It all depends on how the surrender charges are spelled out in your contract. But also check to see if you can roll the annuity over into the IRA. It may be complicated, but if you can then problem solved.

Hi Jeff,

I know there are income limits when contributing directly to a traditional ira. Does that also apply to rollovers? If I’m single and have an income greater than 71,000 can I still do a 403b to traditional ira rollover? Thanks.

@Chas There are no income restrictions for initiating a 403b rollover to IRA.

I am 56 years old. I have a 403B from a previous employer that the employer did not contribute to. I paid all of the money in as pre-tax. My financial advisor wants to roll it to a traditional IRA in the same fund. My 403B is doing well in the current fund and the only thing that our advisor wants to do is move it out of the 403B into the IRA so that his company has control over the funds instead of the current administrator. Is this a wise thing to do?

Hi Debbie – If you’re not comfortable with the move then don’t do it. Let the financial advisor prove a tangible benefit to you – other than him having control over the money.

I am thirty days away from retiring from my current position at a public school and am 60 years old. I have a 403(B) plan of which my employer contributes to. I would like to roll the plan over to an IRA since my husband is still working and will for a few years. Would you recommend moving it to an IRA or a Roth IRA? Is there a limit to what my husband earns to limit our choosing an Roth IRA?

Thank you.

@Julie without knowing your exact tax situation and the amount in your 403b it’s impossible to give you an accurate recommendation. That being said for most clients we work with that are approaching retirement it usually doesn’t make sense to do the Roth IRA conversion.

Jeff,

I’m 59.5 and currently working at a university where I contribute to a 403b. I would like to move my current funds over to a self directed Roth 401k. Since I’m already 59.5, can I roll over my current amount and just pay taxes (how much tax?) on this amount since I am really withdrawing the money? Also, since I’m 59.5, is there any way to make my future contributions go into the self directed Roth 401k or am I going to have to make annual withdrawals from my 403b and then rollover? Thanks.

Hi Alan – I’m not sure if you mean a Roth 403b (sponsored by your employer) or a Roth IRA. You can do the rollover if your employer permits it, and if they have a Roth 403b. Your taxes will depend on your tax rate, so there’s no way to know here.

Jeff, thanks for the response. We currently have my previous IRA’s that I had with my employer converted to a self-directed Roth IRA which we are buying rental properties out of. We’ve already converted the self-directed IRA into a self directed Roth IRA. I have heard that it’s a little easier to do the rental properties out of a self-directed 401k than a self-directed IRA. Since I’m 59.5, I was wondering about rolling over my 403b into a self-directed 401k so we could buy rental properties out of it.

So I’m back to back to my original questions, since I’m already 59.5, can I roll over my current amount in my 403b into a self-directed 401k and just pay taxes (how much tax?) on this amount since I am really withdrawing the money? Also, since I’m 59.5, is there any way to make my future contributions from my work go into the self directed Roth 401k or am I going to have to make annual withdrawals from my 403b and then rollover into the self directed Roth 401k?Would it make more sense to just rollover my current 403b contributions into my current Roth IRA and just do this on a yearly basis as the funds in the 403b get collected each year? Thanks.

Hi Alan – You should be able to rollover your 403b into a (I presume) Roth 401k IF your current employer will allow it. You will pay ordinary income taxes on the conversion. You may want to spread the rollover out over several years so that it doesn’t push you into a higher tax bracket though. You can make Roth 401k contributions as long as your employer participates in the program. The Roth IRA would be a logical destination if your employer doesn’t offer the Roth 401k or the ability to do a rollover into it.

One caveat though in regard to real estate investing through a Roth 401k (or any employer sponsored plan). Unless you are investing in REITs, direct investment in real estate is generally not allowed in most retirement plans, 401k or IRA. Real estate investing is highly specialized and quite complex from a trustee’s perspective, and they may not permit it. Find this out before you begin moving any money around! Also, you’re trying to do a lot here, so please, please, please consult with a CPA or a tax attorney, as well as your plan administrators, before you do anything!

Thank you for answering all these questions. I intend to open a Roth 403(b) with my employer and have two qestions about making an UNqualified distribution after I leave my employer:

1. I already gathered that I will not pay taxes on my contributions because they are already taxed, and I will pay taxes on any earnings from my contribution. I also know that there will be a 10% tax penalty for unqualified distribution but will that 10% be on the total amount of the distribution or just the earnings part?

2. If instead of the unqualified distribution I do a rollover to a Roth IRA, will that incur any taxes or the 10% penalty?

Hi VK – In regard to the first question, the 10% penalty should apply to the earnings portion only, since that is the only part that is tax deferred. As to #2, there should be no taxes or penalties, since you’re rolling one Roth to another.

Hi Jeff, my wife has a 403b , she is a teacher with a private school, and that school does not contribute via a match. We are experiencing financial problems as I had some employees that nearly put me out of business, through theft, fraud and other things. To the point of coming close to loosing our home. We are struggling to keep the lights on. What is the possibility of her being able to withdraw money from that account. AND if possible, just a portion of it? We don’t want to take all over it out. She is 57, I’m 55.

Hi Jay – IRS regulations permit you to take a hardship withdrawal from your 403b plan in order to avoid losing your home. However, whether or not your employer will is another matter. Each employer can choose to allow them, and if they do, the specific terms of the withdrawal. You need to contact your plan administrator to find out what the rules are, but the IRS regulations are here.

I am over 60 ye as rs of age and still working with my school system. I was told that I can not take a distribution of more than 10% of my funds once a year even after I retire! I never knew this. Is this correct?

Hi Debbie – Did you get that information from the plan administrator, or a third party? Each employer is able to set rules within the plan, so it is entirely possible. But they may have various options upon retirement, which is why I suggest discussing it with the administrator.

My husband has a 403B account and worked in th same public school district for 35 years. He retired at age 57. We would like you to clarify the following questions. Your assistance will be much appreciated. Thank you

When could he have rolled over his 403B account? Are there any penalties for rolling it over immediately after retirement? Do you have to be age 59.5 to rollover the money to an IRA? What costs are involved with traditional IRA’s?

Hi Larry – He can roll it over at any time, and he can do so without penalty. He does not have to be age 59.5. As to the costs for traditional IRAs, it will vary based on the account trustee, so do investigate to look for the best combination of low fees and wide investment options.

Jeff,

Thanks for this helpful guide! My wife has an old 403b account from 10 years ago that we have just been leaving sitting there. I think it is time to perform a direct rollover of the funds into a traditional IRA just so that everything is organized in one place. Thanks for the helpful guide and demystifying this whole process!!

Dude I’m sorry… all my life (I’m 40yr old) I alway used 401k. This 403k is totally new to me. I have a 401k plan with my last company, but haven’t been with them for 10 years. Can I still roll this over now?

@ Timothy. Absolutely, you can still roll your 401k (or 403b) into a traditional IRA.

I started my 403 at a private school where they contributed. I left that district 9 years ago and now work for a public school that does not contribute, however I do contribute through my paycheck monthly before taxes. Am I able to leave wihtout penalty considering they do not math any contribution?

Hi Christie – I’m not entirely sure of what you’re asking, but I’ll do my best. I”m assuming that when you wrote “public school district that does not contribute” you meant that they have a plan but no employer match. I also assume that “leave without penalty” means that you won’t lose any money since there wasn’t an employer contribution. If that’s what you meant, then yes, you can leave without penalty or loss of your account. Just be sure to roll the money over into an IRA or another employer plan so that you avoid taxes and penalties.

Very thorough and well written post! It’s interesting to see some of the similarities and differences between 401k plans and 403b plans. The process for rolling them over seems similar. My wife and I both have 401k plans and although we have no plans to leave our current employer, when we do we will likely roll them over to an IRA immediately. Thanks!

If a 403B has only load fund choices at a current job, is an employee allowed to roll over to a traditional IRA annually?

Hi Kris – Generally not. As long as you’re still employed, the money must remain in the 403b. There are some hardship withdrawal allowances, but they won’t help you on an ongoing basis, and you will need to demonstrate a legitimate hardship at that.

I currently have a 403(b) and would like to do a direct rollover into an IRA. Once the transaction is complete, will I be able to withdraw funds for graduate school?

@nicole Yes, you should be able to.

It appears I’m understanding things right from the comments, but we’ll see. When I first started my job with my employer, I started paying into a 403b. For reasons I don’t recall anymore (it’s been many years) I was no longer able to take payroll deductions for this account. It has sat dormant for many years. As I reorganize finances right now, I wanted to see if I could move it into a traditional IRA with my current financial management firm (different than the firm who I set it up with.) Since I’m still with the same employer, am not 59 1/2, and am not under a financial hardship, am I simply stuck with the funds there? I’d like to have all my eggs in one basket, so to speak, but it appears that is not possible without paying the 20% penalty. Thanks for the helpful article!

Hi Jim – That sounds right. Unless there’s a provision to do so in the employer plan, you can’t withdraw the money from 403b until you leave the company. However, if it’s an account the company no longer sponsors, you may be able to withdraw the funds. Check with HR and see what you can do.

As a follow up to my own question, I wanted to let everyone know that Jeff was right. When I first called John Hancock (the original company I worked with to set up the plan) they told me that the only items that would allow me to withdraw or rollover the funds were leaving a job, financial hardship, or hitting age 59.5. The did not mention plan termination as an option. My Edward Jones rep had to create a form that stated that latter option, and have me and a representative from my HR office sign it. This, with an acceptance letter was enough to get the process completed.

My wife and I are both educators and have TSA Tax Qualified Annuities that we pay through payroll deduction. Are these the same as a 403b? We would like to roll our money into an IRA and use the funds for our daughter’s college expenses. Is this possible? Thanks.

@ Jim It does sound like the same thing as a 403b. If you’re still employed, however; you won’t be able to roll them into an IRA. That won’t be an option until you either retire or work for another school district.

Hi Jeff,

1. For a current 403B, are you (as advisor) able to manage the funds with a different custodian than the current employer plan custodian?

2. Does an IRA rollover at any time allow the 403B funds to be taxed as other than ordinary income?

Thank you.

How about rolling it over into an annuity?

@Anne You absolutely could, but be aware that all annuities are not created equal and you might end up buying an investment that offers limited upside and no flexibility. This article might help: https://www.goodfinancialcents.com/are-annuities-a-good-investment

Will it be wise to leave in 403b after u leave company

@Allan Personally, I’m a big fan of rolling over any old retirement accounts, 403b’s included, into an IRA after you leave your company.

I am no longer a member of INPRS, I rolled over my fund into a IRA however I will receive a check for the money I already paid taxes on that was in the fund. Is there penalties for doing this?

I am a teacher with a 403b retirement account. can I access these funds and roll it over if I still am teaching at the same job where I have accumulated my retirement funds? Thank you!

Kevin

@ Kevin In my experience, you won’t be able to. You would have to separate from the school district to be able to do the 403b rollover.