I get asked pretty frequently about what the requirements are to become a Certified Financial Planner™ and what I went through to achieve the designation.

Knowing there are over 800,000 people who can be considered “financial advisors” to some degree, I knew I had to differentiate myself.

But it wasn’t all about being different; it was also about having a deeper understanding and appreciation of the financial planning process.

I knew becoming a CERTIFIED FINANCIAL PLANNER™ professional (CFP®) was the answer to enhance my career. I found it fitting to not only share my experience but to have a few other CFP® professionals chime in with their experiences, too.

But before we dive into how let’s take a step back. Let me tell you more about how I got inspired to become a CFP. For those of you who don’t already know, here is what a CFP does and how they are different than other financial planners.

I love my job. I can’t tell you how lucky and fortunate I feel to be able to truthfully say this. Is my job easy? H-E-Double-Hockey-Sticks no! Being a financial advisor requires a certain skill set I had no idea I had until I got started in the business.

But I’m not here to tell you how successful I am. What I want to do is to address the most common question I get from prospective advisors:

I’m interested in becoming a financial advisor. What do you consider the best way to get started in your industry?

Whew. That might seem like an easy question to answer, but SO much has changed since I got into the business over 15 years ago.

Table of Contents

- How I Got Started: A Look Back In Time

- The Steps You Need to Take To Become a CFP™

- Going Solo – The True Costs of Starting Your Own Financial Planning Firm

- GFC 056: The 7 Rules on How to Become (and Stay) a Successful Financial Advisor

- Resources for Aspiring Advisors

- Can You Become a Part-Time Financial Planner?

- The Bottom Line – How to Become a Certified Financial Planner (CFP)

How I Got Started: A Look Back In Time

Pretty soon, it would be the end of a good run — graduation was approaching. I had just had one of the best interviews of my life with A.G. Edwards and Sons (they were purchased by Wells Fargo).

It was so good. In fact, I felt I had secured a position with their corporate office in St. Louis, and I would soon be living the dream of riding the corporate ladder to the top.

It all looked good; then the “Dot Com” bubble burst. Things changed. And not for the better. A. G. Edwards, at the time, had been in existence for 117 years and never had any company layoffs. Never.

That is until I was getting ready to graduate. Of course, right? My future, which once had visions of me living in St. Louis, was gone. Now, what I’m going to do?

Um… How About Plan B?

Part of me getting the opportunity to have a great interview was because I was already interning at the local A.G. Edwards office in my hometown. I landed the internship as kind of a desperate measure between my junior and senior years.

I had one of those pucker moments where I realized that other than my work history of local retail jobs and my military experience, there was nothing really outstanding on my resume.

It hit me how I would be graduating in a year, and I still needed to get up and do something, and I needed to do it now.

Through a connection, I inquired about a summer internship at the local A.G. Edwards branch, and I was lucky enough to get it. It was like any other internship you would imagine: filing, paper shredding, and all the administrative tasks that no one else in the office wanted to do.

Although the tasks were remedial, I treated the internship like a real job.

I showed up on time, dressed the part, did everything that was asked of me (and above), and made a lot of good impressions on the staff.

Amazing What a Little Bit of Effort Will Do

Along the way, I was asked by one of the assistants of the top producers in the branch if I could help file away some financial statements that had been piling up on them. I’m the intern, of course, I’ll help. As I started to file them away, I realized their filing system was a little bit outdated.

In fact, it was a mess. So, I took it upon myself to re-setup their file system, which I thought would help them out in the long run. Turns out, the little extra effort made a very good impression.

As it turns out, the top producer was looking to hire someone part-time to help out his assistant with their day-to-day tasks.

At this time, I was getting ready to be a senior in college. I was already working 15 to 20 hours a week at a mall job. But I thought it was a good opportunity to get my foot in the door.

In my senior year, I was hired to work 8 a.m. – noon, Monday, Wednesday, and Friday (most of my classes were on Tuesdays and Thursdays), and then I would also work at my mall job in the evenings and weekends.

I didn’t think much of the job at the time about what it may turn into. Turns out it would lead to much, much more. I continued working for them and helping them out with their day-to-day tasks. Then, along the way, the broker had asked me if I’d be interested in cold-calling for him.

I had never done anything of the sort, but I thought, oh, what the heck, we’ll give it a try. Every once in a while, I would call randomly from a list he had purchased of residents in the local community.

I was calling just to set appointments for him with a basic spiel, and, to both his and my amazement, I landed him a few appointments.

That’s when it started to happen.

My first nameplate – how exciting!

As graduation was getting closer, it turned out this producer, whom I had helped with his filing, was looking to hire a junior broker. He had asked if I was interested, but initially, I turned him down, primarily because I had bigger dreams.

I had planned on working a corporate job up in St. Louis, and I also felt I was way too young to handle people’s money. I had noticed many of the top clients who came into the branch were at least twice, if not three times, my age.

I felt I had no business advising them on their retirement planning. So I kept plugging away, hoping for the next bigger and better thing.

As graduation approached, I realized the bigger and better thing was not coming. I didn’t want to graduate without having something lined up, so I accepted his offer.

I was going to be a junior broker.

I didn’t have the same ring as a “corporate executive” or an “investment banker,” but I was still excited about the prospects of what could come. Most everything in life I’d ever tried out or even attempted, I had always succeeded, so naturally, I thought this would be no different.

I still didn’t know if this was what I would do for the rest of my life, but I was excited for the opportunity to see what could happen. And as they say, “the rest is history.”

If you’re at the same point in your life where you’re truly considering the possibility of becoming a CERTIFIED FINANCIAL PLANNER™, you might be wondering what exactly the process looks like from beginning to end. Well, here’s exactly what it takes.

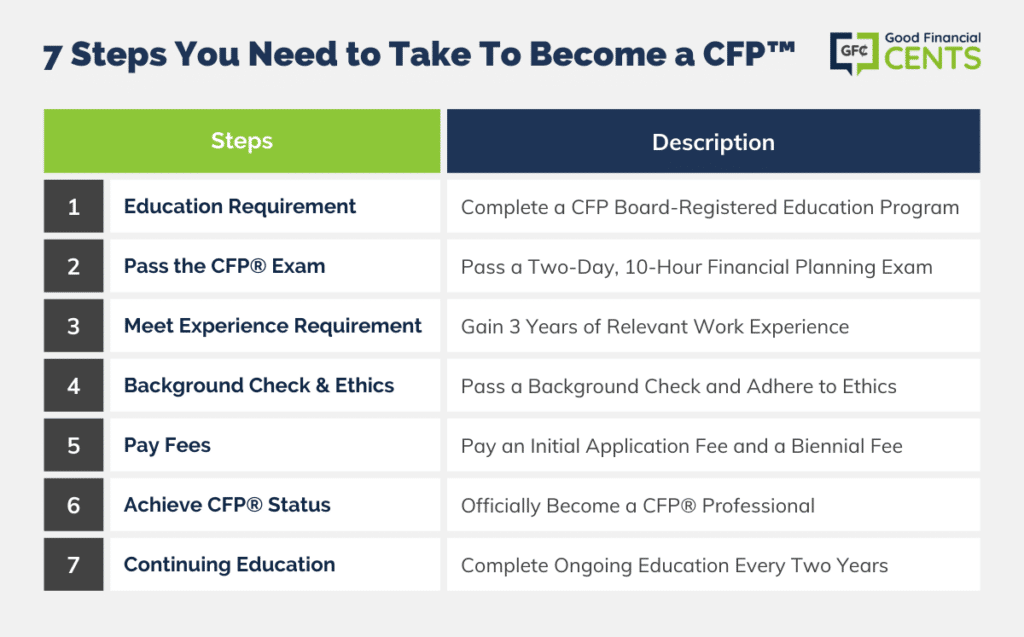

The Steps You Need to Take To Become a CFP™

1 | Complete the Education Requirement

Before you can even apply to the CFP® program, you have to satisfy the preliminary education requirements. At this point in my career, I decided to pursue the CFP® certification.

I was more than five years removed from college with my Bachelor’s in finance, so I easily satisfied the education requirement. Currently, the CFP Board allows three different paths to achieve these requirements.

Taken directly from the CFP.net website:

Complete a CFP Board-Registered Education Program

- There are more than 300 academic programs at colleges and universities across the country from which to choose.

- These programs include credit and non-credit certificate programs and undergraduate and graduate degree programs.

- They use various delivery formats and schedules, including classroom instruction, self-study, and online delivery.

- Many of the CFP Board’s Registered Programs also offer in-house educational programs for individual companies.

Academic degrees and credentials that fulfill the educational requirements include:

- Certified Public Accountant (CPA) – inactive license acceptable

- Licensed attorney – inactive license acceptable

- Chartered Financial Analyst® (CFA®)

- Doctor of Business Administration

- Chartered Financial Consultant (ChFC)

- Ph.D. in Business or Economics

- Chartered Life Underwriter (CLU)

Request a Transcript Review

Certain industry credentials recognized by the CFP Board or the successful completion of upper-division level college courses may satisfy some or all of the education requirements set by the CFP Board.

Bachelor’s Degree Requirement

A bachelor’s degree (or higher), or its equivalent, in any discipline from an accredited college or university, is required to attain CFP® certification.

The bachelor’s degree requirement is a condition of initial certification; it is not a requirement to be eligible to take the CFP® Certification Examination.

After you pass the CFP® Certification Examination, you will be required to provide evidence (official transcript from the degree-granting institution) that you hold a qualified bachelor’s degree or higher degree.

Jim Blakenship, CFP® and author of Getting Your Financial Ducks in a Row shares his experience on achieving the CFP® designation:

I took the American College Chartered Financial Consultant (ChFC) course, which fulfilled the education prereq. The ChFC course was provided by my employer at the time (an insurance company). I followed this up with a CFP self-study course from Dalton.

Then I went to a two-weekend live review from Dalton. The Dalton courses were much more useful than the American College course, in my experience.

2 | Pass the CFP® Certification Examination

Wholey Moley, what an exam!

The CFP® Certification Examination was by far the most challenging exam I’ve ever taken (and hopefully ever will).

The two-day, 10-hour exam applied all the key areas of comprehensive financial planning. Although all questions are multiple-choice, they are arranged in a way where every question “almost” sounds right. That’s what makes the test so challenging.

The exam is administered three times a year – generally on the third Friday and Saturday of March, July, and November, at about 50 domestic locations.

I took mine at the University of Missouri-St.Louis in November of 2007. The application deadline is approximately seven weeks prior to each exam date (e.g., February 1, June 1, and October 1).

To apply to take the exam, complete the online application, download an application, or call 800-487-1497 to have one mailed to you.

Completed applications, including payment of the $200 non-refundable application fee, must be received by the deadlines printed on the applications – there are no exceptions.

How I Prepared for the Exam

My previous firm had an arrangement with Kaplan University, which offered a “boot camp” style class. Once a month, for nine months, I traveled to St. Louis to sit in on a four-day (8 a.m. – 6 p.m.) lecture. I’ve never drank more Diet Coke and coffee in my life!

Our instructor was insanely smart and helped us trudge our way through all the concepts. Imagine learning about estate planning for 9+ hours a day. Are you jealous yet?

After all the sessions, we then had a final recap with a different instructor a month before the actual exam. If you can’t do this, there are other options for CFP prep courses to get you through.

Reflecting back, I really don’t know another way I could have absorbed so much information in such a small amount of time. If I had to do the CFP program by self-study, I would probably still be without the designation (no joke).

Richard T. Freight, CFP®, who also authors the blog Think Beyond the Numbers, confirms my suspicions by sharing his experience with the CFP self-study program:

“After failing to discipline myself with self-study, over the course of 3 years, I took the individual courses (5 in 1998) at 3 different community colleges and universities, often traveling an hour each way, twice a week, to pass the exams. Then, I took Ken Zahn’s “blitz” 3-day course to pass the overall exam.

I know it sounds like the old walking uphill both ways to school in the snow, but it wasn’t a cakewalk by any means. My overall exam had a pass rate of 49% across the U.S. that year.”

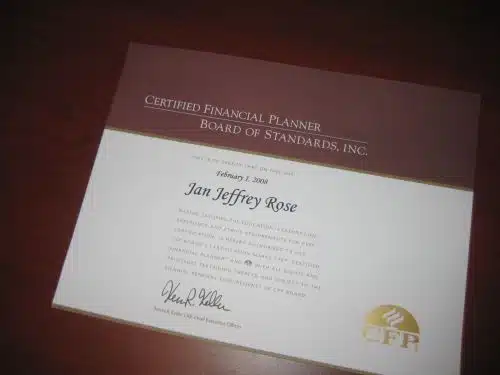

Test Results

I sat for the exam in November of 2007 and didn’t receive my test results until early January. Talk about suspense. I just happened to be home the day when the mail came.

I remember seeing the thin, little white envelope from the CFP Board, and my heart sank. Why was the envelope so thin? Was it a bad sign? I nervously paced inside and finally just ripped the envelope open….Congratulations, you passed.

I screamed with excitement and then called my wife to share the good news. Typically, each testing period has about a 50% pass rate, and this was about the same with my group.

This is why I was so thankful I passed. When you receive notice you passed, you then have to satisfy the remaining requirements.

3 | Meet the Experience Requirement

In March of 2007, I began the Kaplan University CFP® course. At that time, I had been a financial advisor for five years, which satisfied the experience requirement. The CFP Board requires you to have at least three years of qualifying full-time work experience.

According to the website, the experience can be gained in a number of ways, including:

- the delivery of all, or of any portion, of the personal financial planning process to a client.

- the direct support or supervision of individuals who deliver all or any portion of the personal financial planning process to a client.

- teaching all, or any portion, of the personal financial planning process.

Joe Pitzl, CFP® shares how he got a head start in completing his experience requirement:

“To get a head start on fulfilling my experience requirement, I held three financial planning internships and filed tax returns in a tax firm for two years while in school (it counted for about a year collectively). I then worked for a year as a full-time financial planner before taking and passing the exam. Six months later, I had officially fulfilled the 3-year requirement and became a CFP®.”

4 | Background Check… Do You Pass?

Applicants for CFP® certification must pass the CFP Board’s Candidate Fitness Standards, which describe conduct that may bar an individual from being certified.

This is one of the aspects that makes being a CFP® professional so much more prominent; we are held to a higher standard than your typical financial advisors.

The board will conduct a background check as you make your commitment to adhere to the CFP Board’s Code of Ethics and Professional Responsibility and Financial Planning Practice Standards. Brian Plain, CFP® shares a similar accelerated approach to achieving his designation:

“Apparently, I’m a glutton for punishment as I fulfilled my education requirement through the accelerated 9-month program at Northwestern and then did a 4-day live review course prior to taking my exam…for the first time.

Getting the “fail” letter in the mail was deflating, but it also made me appreciate the experience so much more when I received my “pass” letter the next time I sat for the exam. Needless to say, I still have the letter!”

5 | Time to Pay Your Dues

After you verify those three steps, it’s time to pay up (yeah, the $200 fee from before was just to apply). You’ll have to pay a one-time, non-refundable initial certification application fee of $200 for the background check. In addition, you will be responsible for a biennial certification fee of $455.

To me, this cost is minimal compared to the amount of knowledge I have gained through the whole process. Jason McGarraugh, CFP® gives a detailed account of his path to becoming licensed:

“I went the Degree Plan route. After spending 4 years getting a BBA in Corporate Finance at Texas Tech, I graduated without any of the Financial Planning knowledge that I wanted. Circa 2000, I discovered that Texas Tech actually had a Master’s program in Financial Planning.

I spent 2 1/2 years working on my Master of Science in Personal Financial Planning, which included the necessary CFP® courses with additional classes to round out the degree plan. After graduating, I spent a semester working for a private school in Singapore that taught the CFP® courses there.

I moved back to Lubbock in May of 2003 and began the two-month live review with the professors at Tech to prepare for the July exam.

I made enough money In Singapore to pay for the review and a few months of rent with some friends who were also taking the review. I studied 6 days a week for two months and passed the exam on the first go-round.

I probably put in about 250 hours of study and class time. I made it a point to take one random day off a week to relax. It took about a month to get the results back, and during this time, I was interviewing for jobs.

By early October 2003, I was fully licensed for insurance and securities and working with Waddell & Reed in Fort Worth, TX (plan B). I reached my 3 years in October of 2005 thanks to 12 months of experience as a Peer Financial Counselor with Tech’s Red to Black program.”

6 | Congratulations! You Are Officially a CERTIFIED FINANCIAL PLANNER™ Professional

Once everything is complete, you will get a notice you are officially a CFP®, and you can refer to yourself as one. After making it this far, you deserve it.

Now it’s time to order new business cards and make the appropriate updates to your website. I never thought I would be so excited over “three little letters,” but all the time invested to achieve those letters makes them extra special.

7 | Continuing Education Requirements for a CFP®

Once you pass the exam, you’re not done, however. Every two years, you’ll have to satisfy continuing education requirements to keep your CFP® credentials. The CE requirements consist of:

- 2 hours from a CFP Board-approved program on CFP Board’s Standards of Professional Conduct.

- 28 hours from one or more of the accepted subject topics.

It’s up to you where and how you complete the CE requirements. You just have to make sure it’s a pre-approved program by the CFP board. There are plenty of resources nowadays to do this.

One of my favorites is mini quizzes found in trade journals such as Financial Advisor Magazine and the Journal of Financial Planning. It’s always nice to learn something new and get credit for it, too!

Are you still considering becoming a financial planner? Think you’re ready? Keep reading.

Going Solo – The True Costs of Starting Your Own Financial Planning Firm

In 2011, I embarked on one of the most exciting business transitions of my life – I formed my own registered investment advisory firm. I get a lot of questions from advisors wanting to know about the process.

- How does it work?

- How much does it cost?

- Is it worth it?

Plus, I have friends and blogging friends who are also curious and would love a look behind the scenes of starting a financial planning business. Since I have over 5 years under my belt of starting my own firm, I thought I would share a little bit of how it all went down.

I’m also trying to get a sense of how much I have spent in the past year in doing so… thank goodness for my CPA! Before I begin, let’s first start with a jump back to my story so you can understand exactly what has happened since getting my “three little letters” approved.

The First Step

In 2007, three other advisors and I left A.G. Edwards and Sons, which had recently been bought out by Wachovia (now Wells Fargo) and started Alliance Investment Planning Group. We were an independent financial planning firm under the independent broker-dealer LPL Financial.

LPL Financial was the largest independent brokerage firm, and the big difference between them and Edward Jones or Merrill Lynch (or any major brokerage firm), at least from the advisor standpoint, is they allow you to create your own company at the local level.

That’s why we operated as a DBA (doing business as) Alliance Investment Planning Group. Essentially, in the relationship, I was an independent contractor utilizing their services, and then LPL held my licenses: my Series 7 and my insurance licenses.

Keep in mind many advisors don’t take this step, although it’s becoming more popular. From a payout standpoint, it definitely pays to take some risks. Let me explain…

With A.G. Edwards, my payout was 40%.

That meant for every commission or fee earned, I would give the company 60% of every dollar. That was my price for having the company name behind me, back office support, my fully furnished office (phone, computer, desk, etc.), a receptionist, and anything else you would need to run an office.

For many, it takes away all the added pressure of running a business so you can just focus on your existing clients (and also acquire more).

Unfortunately, if you’re an obsessed entrepreneur like myself, it just wasn’t quite enough.

Moving to LPL meant we now became true business owners. We had to find our own office building, buy our own computers, desks, printers, filing cabinets, phone systems, 47″ TVs (I will argue to this day it’s a necessity!), receptionist, etc. Why would anyone want to deal with that?

Because the payout increased from 40% to 90%, yes, that’s a pretty substantial raise. What made it even more substantial is we were able to split costs 4 ways. (We eventually added 3 more advisors, so everything was split 7 ways.)

This meant more money in my pocket! My revenue increased dramatically because of this. In fact, it has increased 4-5 times more where I was when I left A.G. Edwards in 2007.

Trapped in a Box

My practice continued to grow, and, honestly, I had no reason to change. No reason whatsoever. There was, however, this one little thing that occurred, which eventually made me realize a change was not only coming, it was inevitable.

That “occurrence” was this blog. As my blog continued to take off, and I got tired of the compliance hurdles, I knew I needed to make a change. If you have a Series 7 license, anything you do online comes with great scrutiny, and everything, I mean EVERYTHING, has to be pre-approved first.

Note for those who aren’t familiar with this industry: If you have a Series 7, you have the ability to sell a security (stock, ETF, mutual fund, variable annuity) and earn a commission.

If you can earn a commission, FINRA has fairly strict rules on how you discuss these types of securities. That’s what makes blogging such a challenge for advisors with their 7.

Pre-approval is very time-consuming, but it wasn’t the most frustrating part. I was also limited in what I could say and how I could say it.

As an example, my post 7 Financial Advisors I Would Like to Punch in the Face would never have been approved. Never! And that’s why I enjoyed writing it so much more.

Dropping the 7

Getting the freedom I wanted required me to drop my Series 7 and then form my own RIA (registered investment advisory firm) with the state of Illinois. There were a lot of hurdles in my way because I didn’t know how it all worked.

- I didn’t know if I could stay with LPL Financial.

- I didn’t know if I could still be in the same office building with my current partners.

- I didn’t know how to even begin.

I had a lot of fact-finding to do. Thanks to some good contacts, I learned it was possible to operate in the same office as my other partners. I would just like to create a separate entity. Ergo, Alliance Wealth Management, LLC, was born.

I had to get a new phone number, order new business cards, and change my literature to reflect these changes, too. Now, the question was who was going to be my custodian. The custodian is the provider who offers statements as a trading platform to buy and sell investments, among other things.

LPL Financial has an RIA platform, and I just didn’t know if it would all work out. Sure enough, it did. This was an easy transition for many of my clients since they would continue to get the same statements, and most would keep the same account numbers.

Another note: this was probably the most confusing part of the whole process, which was hard for my clients to fully understand, especially since I was still with LPL.

The easiest way I explain it is I just switched departments within LPL’s business structure. Before, I was an independent agent/contractor with them.

Now, my firm, Alliance Wealth Management, LLC., is a client utilizing their custodial services. LPL no longer holds any of my licenses, and they are not responsible for me. Instead, the State of Illinois is now responsible for me. Clear as mud? Good. 🙂

So, once I found out I could be in the same office and I could stay on with LPL as my custodian, it was time to begin the process. That’s when I contacted a compliance attorney who would set up all the documents I would need and help me get registered with the state.

I also needed to set up a new LLC and then contacted my CPA, who helped me through the process. In May of 2011, the transition was ready to begin.

Setting up Shop

As mentioned above, I ended up sticking with LPL Financial as my RIA custodian. So, in that regard, there wasn’t any cost in switching. A few other ones I looked at were Schwab, TD Ameritrade, E*Trade, and Fidelity. The biggest reason for me sticking with the LPL was:

- Less Paperwork. It still was A LOT, but less if I would completely switch.

- Easier Story for My Clients. I had left A.G. Edwards in 2007 and was going through another change I thought might be too much.

- Convenience of Billing. (see below)

With most of my revenue coming from assets under management (I earn a % of my client’s assets invested with me), LPL takes care of calculating the fee, deducting the fee, and then sending me the appropriate payment.

When I researched a few other custodians, I learned this was something I had to do on my own, and it honestly did not excite me at all; so, as far as costs associated with being with LPL, mostly it’s just ticket charges.

Mutual funds were ranked anywhere from $5 to $26.50; equity trades are approximately $15, and other investments, such as bonds or UITs, are somewhere in the $50 range.

Note that I don’t do a lot of these trades, so I don’t know the exact cost. Most of my trading costs involve mutual funds, stocks, and ETFs.

The Major Expenses

Compliance

The first major expense was compliance. I had to find someone to set up my ADV (client brochure) and begin the process of setting up my advisory firm with the State of Illinois. LPL had a few vendors who they referred me to, and I tried calling a few of them, but their timelines did not mesh with mine.

Their costs ranged anywhere from $ 2,000 to $ 5,000, depending mostly on what state they were located. The ones in New York seemed to charge the most. Through my blog, I met another advisor who had gone in the RIA direction, and he referred me to his compliance guy, who he had used.

The setup fee was $3,000, and he took care of the entire process; and let me tell you, the $3,000 was totally worth it.

Total cost: $3,000.00. Recurring cost: $2,000 per year.

LLC Setup

The second major expense was getting the LLC set up; fortunately, I lived in the state of Illinois, where just setting up an LLC runs you around $450 to $500 (note: heavy sarcasm).

I could have set it up myself, but I honestly didn’t feel comfortable, so my CPA helped in the process. The total cost there was $850.

Total Cost: $850. Recurring cost: $250 per year.

Business Lost

The other major cost for me was the business I lost. I had a decent amount of money tied up in variable annuities and some 529 and 403(b) accounts I wouldn’t be able to transfer.

In addition, I had a relationship with a local credit union where I was their choice advisor, and they would refer all their investment business to me.

This was another relationship I had to give up if I was going to start my own firm. While it’s hard to tell the exact numbers, I’m estimating that I gave up approximately $36,000 every year of recurring income to go the RIA direction.

Total revenue lost: approximately $36,000 per year.

Insurance

Oh, the joys of having your own business. With my profession, you need both business liability insurance and professional liability insurance (E&O). The business liability runs us $1,470 per year (this also includes worker’s comp for my new employee) and $3,654 per year for E&O.

The E&O is about $1,000 more per year than I was paying with LPL, but I decided to go with a carrier that specializes in investment advisers.

Total cost: $5,124 per year. Recurring: same.

Office Expenses

Since the office was already set up, we already had phone systems intact, and the way it worked before was we all just split the phone bill equally ways with my other partners. Now that I had to have my own dedicated phone line, I had to add two full extensions and a fax line for my new office.

Luckily, we were able to program those new lines on the existing phone systems, so there wasn’t the cost of having to buy new phones.

Furthermore, one of my partners in the office has a good friend who works for the local phone company, so I was able to get the installation costs waived, which was a big source of savings, but having to get my new phone systems still added on an additional $140 a month to have my own phone system.

Total cost: $140 per month. Recurring: same.

New Fax Line

One area where I was able to cut costs was the fax line. I figured I was paying approximately $30 a month just to have an open fax line, and that was without sending any faxes. I looked into some online providers, and the one I settled on was Nextiva.

For $60 for the entire year – $5 a month – I was able to have a fax line that works directly with my email system. It was very reliable, and I would definitely recommend it to any small office that needs a fax line but doesn’t send hundreds of faxes per month.

Total cost: $60 per year. Recurring: same.

New Letterhead and Business Cards

Since I had a new business name, new phone number, and new email address, I had to get new stationery.

I didn’t change the logo very much, so our logo graphic designer was able to make changes fairly easily. Overall, I think I had to pay about $200 to get new stationary and business cards, which wasn’t that bad.

Total cost: $200. Recurring: none.

New Website

Now that I had a new business, I knew I had to have a new website, especially one that looked slick, but I wasn’t crazy about having to pay $300-$500 to set this up.

I was lucky in that a friend of mine offered to essentially set it up for free. I already purchased the domain for $10, and I got a snazzy-looking website. There’s nothing like saving a little bit of money!

Total cost: $10. Recurring: $10 per year.

Banking Costs

The other most annoying fee is with our local bank. We currently have free checking with complete online access, and my wife is a big fan of being able to pay stuff online; but now, instead of getting paid as an individual, I get paid into my business account, Alliance Wealth Management LLC.

The LLC has its own separate tax ID number, and my bank does not allow to do online transfers when you have two tax ID numbers.

(Side note – I also have another LLC set up for my online business.) To be able to transfer money between the three different tax ID numbers, the bank charges us $35 a month to do so.

Right now, we are paying it, as it is a convenience, and we’ve been with this bank since I was sixteen years old. I will say that we are exploring other options.

Recurring cost: $35 per month.

The Current Rent

Before beginning the transition, my total overhead was $1,075 per month. I am sure many people would look at that and laugh. Yes, I lived in the Midwest, where things are cheap.

Since I’m still occupying the same office, I have the same printer, desk, computer, and bookshelf that I had before, so there weren’t any greater expenses on that end.

We had a 3500-square-foot building that we paid just about a dollar a square foot a month for rent. We also had one assistant and all the typical expenses you would have in a professional office. All those expenses are split seven ways, which makes my share ridiculously inexpensive.

Those costs include the other phone system, postage, Direct TV – that’s for my 47-inch television in my office – heating and air conditioning, electricity, taxes, and insurance.

Recurring Cost: $1075 per month.

Other Costs of Running a Financial Planning Practice

What I’ve pretty much outlined up above are the essential costs that I must have to run the business. These others are add-ons, meaning I could probably get by without them, but they definitely make running a practice much easier:

- Blue Leaf: Blue Leaf is an online account aggregation program that I’m testing. It gives my clients the ability to log in and sync all of their accounts together, whether they be with me, their existing 401(k), or any statements held elsewhere.

Cost: $250 per month. Try Blueleaf for free. You can test drive their service, and if you decide to sign up with them, mention me, and you’ll get 2 months for free.

- Marketing Library: This is an article-writing provider that runs me $20 per month. I use this for newsletters to existing clients as well as getting article ideas for the blog.

Cost: $20 per month (Canceled as of 06/06/2013)

- Morningstar: With this Morningstar subscription, I am able to do detailed analyses of existing client portfolios as well as break down potential new client portfolios.

Cost: $160 per month (Canceled as of 06/06/2013)

- Erado: Erado is my email archiving company that houses all my emails for compliance purposes.

Cost: $375 per year

- Arkovi: Arkovi is a social media archiving company. They keep a log of all my social media efforts between my RSS feed, Facebook, YouTube, LinkedIn, and everything else.

Cost: $40 per month

- The Birthday Company: This is a service that I use to send out birthday cards to existing clients. It’s an automated process that I enjoy, and I get positive feedback from all my clients.

Cost: Approximately $15-$20 per month

Association Costs

As a CERTIFIED FINANCIAL PLANNER™ professional, I also have the dues I have to pay.

Total Cost: $325 every 2 years.

I’m also a member of the Financial Planning Association.

FPA is the largest membership organization for personal financial planning experts in the U.S. and includes professionals from all backgrounds and business models.

Total Cost is $395 per year.

Lastly, I have kept my insurance license open, and that costs me roughly $180 every 2 years.

Total Costs

As you can see, it’s not cheap to start your own financial planning firm, but I can say that it’s definitely worth it. I’m exactly where I need to be to grow my practice and my blog on my terms.

The one cost I haven’t mentioned yet is hiring additional employees after starting my own RIA. That has brought on a whole new set of challenges, but once again, it has been worth it.

Now that I was all set up, success just came knocking on my door… right? Right? Not so fast. Let’s talk about what it takes to go from setup to success.

GFC 056: The 7 Rules on How to Become (and Stay) a Successful Financial Advisor

First, how do you define success?

Success can come from many aspects: life, career, family. Often, I get asked how I became a financial advisor and what has led to my success. When someone views me as successful, I’m always flattered. While I do consider myself successful, I’m also very humble.

By industry standards, I’m just a pea. I’m not a rainmaker, not a million-dollar producer, not one of Forbes’s Top 100 financial advisors. I don’t have hundreds of millions under management.

Most big-time producers would probably chuckle if they knew the size of my book of clients. So, why do others and myself consider me to be successful? Because I love what I do (and it shows), and I get paid very well to help people each and every day.

Being a financial advisor is not easy. That’s something I really didn’t know when I got started in the business because of my naivety and inexperience– but I quickly found out.

How Hard Is It to Get Started?

When I began my career with A.G. Edwards & Sons in 2002, I was in a training class of around 55 people. My class ranged from 23-year-olds, like myself, starting their careers to 50+-year-olds attempting a third career.

After completing training and being “in production” (better known as licensed to sell) for a year, our class of 55 had been slashed to less than half.

At my five-year anniversary mark, there were only 5 of us left. If you’re a numbers geek and you use my class as an example of your odds of surviving, then you have a 91% chance you are going to fail if you decide to become a financial advisor.

How do you like your odds? As I reflect on my career, I’m truly thankful for the many blessings that have been bestowed on me. There have been many emotional roller coasters along the way, but I know the following basic fundamental principles have been the foundation of my success.

So, you didn’t think I was blowing smoke. I recruited two other successful financial advisors, Russ Thornton and Brian Plain, to give their take on what it takes to truly succeed in our business.

1. Abide by the Golden Rule

One of the keys to my success has much to do with how I was raised. My family has always taught me to live by the golden rule:

Treat others the way that I would like to be treated.

It’s such simple advice which rings true in every situation. I apply this basic principle in life and, most importantly, in my career. If a client calls me while I’m on the phone, I’m sure to call them back as soon as I can.

Why? I hate having to wait for someone to call me back, and I don’t want my client to have to wait. It’s the same thing with emails and sending out paperwork. Brian concurs,

Always do what’s right for your client. This will often mean giving up short term financial gain. Do what’s right for your client because it is the RIGHT thing to do. Do it early and often and you’ll see it come back to you in spades.

2. Give 110% (and Then Some)

This business is not for everyone. I’ve seen many people get started and think to themselves that they have what it takes, only to see them fizzle out in under a year.

What made me different? Because I wanted it. In my first year, I spent all day and 2-3 nights per week cold calling. Yes, I was the annoying guy who would interrupt your favorite TV show by asking you the following:

Hi, Mr. So and So. My name is Jeff Rose, and I’m calling from A.G. Edwards here in Carbondale. I’m just calling you today to see if you are an investor and if you are open to new investment ideas from time to time.

That was it. That was my magical spiel. Imagine saying that 100-200 times a day.

If you weren’t jealous of me yet, then I’m sure you’re jealous now. After cold-calling, I started hosting lunch and dinner seminars. I used to beg/invite potential clients to a free meal so they could hear me talk about some general investment message.

I used to do one of these every 6 weeks or so, trying to get my name out there. In addition, I would sacrifice weekends setting up booths at trade shows.

I would and have driven over 2 hours to meet with somebody, hoping they would do business with me. There were many highs and lows, and I’ve enjoyed every moment.

3. Be Persistent, Not Pushy

When I first started in the business, I had no clients given to me, and it was up to me to find new ones. When I came across someone who was a potential prospect, I was very eager to convert them into a client. I was so eager I would follow up more so than was properly necessary.

I learned along the way you have to wait until people are ready to act, BUT you still want to make sure they think of you when the time is right. That’s why it is important to follow up: phone call, e-mail, even draft handwritten notes.

Just make sure when you do follow up, it’s not too often. Russ adds a bit of his experience in working in a Wall Street firm,

A Wall St. brokerage firm is a sales firm. I’m not criticizing sales because it’s a critical function in any healthy business. In fact, though I’m an independent advisor today, I’m still selling my advice.

I guess my point is that you should understand up-front and make a career choice on the basis of what you want and are willing to sell to people.

4. Shut Up and Listen!

Have you ever been to a cocktail party and got stuck having to listen to a person who felt the need to tell you EVERYTHING about them even though you never asked?

Don’t worry, I won’t do this to you. One thing about me is I’m a very curious person by nature. I like to ask a lot of questions, and most importantly, L-I-S-T-E-N. Brian adds,

Be an educator and share your knowledge. A successful advisor talks WITH clients, not AT clients. Making things simple and understandable isn’t easy, but it is essential.

5. Learn How To Be a Teacher

A child mis-educated is a child lost. – John F. Kennedy

One of the surprising aspects of my job is how much I play the role of educator. Most people I work with don’t have the desire to know or understand what the beta or standard deviation is on their portfolio.

All they know is they have worked their butt off to save as much as they have, and that money has to last them the rest of their life.

And they are hiring me to help them through the process. Some part of the process is easy – I need X amount of dollars per month to survive – while other aspects can be confusing – I’m looking to set up an A-B Trust to protect my assets from estate tax.

Whatever the circumstance, it’s imperative all parties have a good understanding of what we are trying to accomplish. Without a general understanding and education of the financial goals at hand, any major bump along the way could jeopardize the desired result. Russ points out,

When it’s all said and done, it’s the client’s money. You can give them the best advice and listen to anything and everything they’re willing to share with you, but they have the final say in any decisions that are made.

I’ve found the best way to work with clients is to be a caring educator. No, I’m not trying to teach them everything I know, but I want my clients to have a thorough understanding of their choices and the possible consequences of each choice they might make.

6. Give a Darn

If you really want to be a successful financial advisor, you have to genuinely care about the people (your clients) you are helping. You can’t look at them as “how much money they have” or “how much you make off of them.”

In 2008, when the market was falling, I couldn’t care less about how much I lost. I was more concerned about all my retired and soon-to-be-retiring clients and how this would affect them. If you don’t care—truly, genuinely care—people see right through you.

7. Have Some Faith

See, the LORD your God has given you the land. Go up and take possession of it as the LORD, the God of your fathers, told you. Do not be afraid; do not be discouraged. – Deuteronomy 1:21

I can remember in my first year of becoming a financial advisor, and I had one of the worst earning months of my short career. I made less in a month than I made when I was still working part-time at GNC, making $6/hour while I was in college!

Luckily, I was still young and didn’t have a family to support, and I made it. Well, I wouldn’t necessarily say I made it, but I did survive. What also helped me was having God on my side and giving me the strength and power to not doubt myself and continue forward in order to succeed. Brian ends with,

“Worry about the things you can control. Always take care of your clients and do right by them. Don’t be afraid to let them know how they can help you grow your practice. If you’re consistently exceeding your client’s expectations, they’ll likely become your best source of potential referrals.”

Russ concludes,

“There are very few certainties in life. And there are perhaps even fewer in the financial services world. But, I sleep comfortably at night knowing I’m doing work I love and working hard to take the best possible care of my clients. I consider my clients part of my extended family and do my best to treat them as such.

Sure, there will be problems and obstacles that inevitably pop up along the way, and there’s only so much I can do to minimize these, but I am comforted by the knowledge there is no one else out there who could care about my clients as much as I do.”

Thanks to Brian and Russ for contributing!

Resources for Aspiring Advisors

A great organization I’m a proud member of is the Financial Planning Association. It’s a tremendous resource for consumers and financial professionals.

For someone who is hoping to get into the financial planning business, FPA offers a residency program (think of it as an internship), which is a client-centered training experience using comprehensive and detailed case studies.

By completing the 6-day internship program, candidates will be eligible for 30 hours of CFP Board continuing education credit or three months of financial planning work experience. You can learn more by visiting the FPA’s website.

Can You Become a Part-Time Financial Planner?

The question came from Derek:

“Hey Jeff, First thing I want to say, great blog! I’m currently in the workforce and entertaining a new profession as a financial planner. I really enjoy keeping up with the markets, and many of my friends and co-workers come to me for advice on their investments.

I’ve been doing some research on getting into the business, and it seems daunting as many of the big brokerage firms want you to work crazy hours the first couple of years. I’m not ready to give up my day job and was considering giving it a go part-time. What do you think about the likelihood of being a part-time financial planner?”

Derek is NOT the 1st person to ask me about becoming a part-time financial advisor. In fact, many people who have a love for investing, numbers, and helping people have emailed asking me something similar.

To all of those who are interested in the financial planning profession on a part-time basis, this video is for you.

To make sure I hadn’t missed anything regarding being a part-time financial advisor, I asked some of my colleagues to share their thoughts on the matter.

Here are some comments from fellow financial advisors about whether you can do it part-time:

Part-time Financial Planning

I think if a person wants to pursue a part-time or “on the side” financial planning business, they need to first decide how they want to do it. Let’s assume for a minute it’s possible.

- Do they want to get into financial planning because they think it’s interesting?

- Because they want to help others?

- Because they have a personal interest in finances and investing?

- Or is it something else?

None is better or worse than the other, but I think getting clear on this upfront will help clarify the rest of the thought process. Also, beyond an immediate friends and family circle, how will they market and attract new clients?

- If they want to help others, they can outsource much of the financial planning and investment management (if any) work. In this scenario, they would be relationship managers first and foremost.

And, if they have capable planning resources they’re partnering with, this helps address the potential concerns clients may have about working with a “part-time” planner.

- If they want to write plans and get into the technical side of planning, this might work, but I’m skeptical. Outside of a full-time job, how will a person have time to find clients, do the actual planning work, service/keep clients, and still have a personal life?

I’m not saying it can’t be done, but I think it would be difficult, assuming you can even find clients beyond immediate friends and family who would be willing to work with you if you’re doing this on the side.

If you’re only spending 20% of your time doing planning work, are you going to charge 20% of full-time planners’ fees?

- Also, just because someone has an interest in personal finances, it doesn’t mean they’ll be a good planner.

See Michael Gerber’s E-Myth about potential issues when a “technician” who likes to do the work is trying to grow and run a business. It can be a challenge for those not going into it with both eyes wide open.

- Though not strictly “financial planning,” many professional third-party asset management platforms offer a solicitor arrangement where you can set up and manage client portfolios by contract on a per-client basis.

This might be another variation on outsourcing some or all of the work I mentioned above.

I know I’ve raised more questions than I’ve answered. I’m frankly not sure if it can be done, but rather than assume it can’t, I think anyone interested needs a thorough understanding of what role they want to play in the financial advice/planning industry before moving ahead.

The Bottom Line – How to Become a Certified Financial Planner (CFP)

Navigating the path to becoming a Certified Financial Planner™ involves dedication, commitment, and a genuine passion for the financial planning process.

Drawing from personal experiences and insights from fellow CFP® professionals, it’s evident that obtaining the CFP® designation can greatly elevate one’s career.

The journey, while challenging, offers rewards in the form of deeper knowledge, differentiation from peers, and immense job satisfaction.

Aspiring advisors looking to make their mark in the industry can benefit from understanding the steps to become a CFP™ and exploring the resources available.

Regardless of the changes in the industry, the foundation remains passion, skill, and continuous learning.

I want to make the transition, but have an army reservist commitment on a contract to finish… 2 weeks full time, 10 weekends a year. This would also provide me with health insurance. I can quit my FT job, but would I still be competivie in the hiring process to get on a team? Also, the army reserves is a pool of people that could be a natural market for me to tap into for emerging affluence category clients

I wish I had read your story BEFORE I entered Financial Services. I made so many mistakes including becoming a Stockbroker. I finally decided to go the CFP route after wasting 10 years. But I love what I’m doing now. According to my mentor Dr. Philip Pennartz who entered Financial services at age 63 after retiring from Dupont: “It’s never too late to start a new career.” He worked very successfully until 83!

Very informative information. Thanks for taking the time to share with others. I am an ER Nurse looking for something else to do after a possible early exit from medicine. I always been interested in helping people and recognize the need for many to have honest, Godly people to help them with their finances. I commend you for including rule #7 in your blog. God’s blessings can be amazing and empowering when recognized.

Keep up the good work!

Sincerely,

Dan A.

Mr. Rose,

My questions are linked to your part-time financial planning question/answers. Here is what I would like to do, I want to provide financial advise to people “on the side so to speak”, and for free. I’ve always had an interest in personal finance (& read lots of books, go to seminars, etc) and wish to hold classes and offer advise to people (generally this would most likely be for other workers in my agency, folks from my church, etc…and this could involve folks I do not know). I was military for 26 years and now work for TSA. I am financially secure and just wish to help people in this area. I see the vast majority of people with practically no knowledge on personal financial planning, and want to help in this area. By the way, some of my motives for this is because I made some naïve financial choices when I was younger, due in large part with a great intent to save and invest, but not having a solid understanding on choices, risks involved, growth potential, and potential consequences of actions (or inaction). Furthermore, I was also taken advantage of (as a young military troop) by a pretty predatory whole-life insurance company (with a track record of bad practices targeting young military troops…surfaced in courts years later). After some of those choices, I began self educating myself by attending financial seminars and classes and a lot of reading. After educating myself (and while still in the military), I did provide basic savings/investing classes and advise for my troops so they would have a much better understanding of the impacts of knowledge and actions and (hopefully) set themselves up for financial success and prepped so as not to be taken as I was early on.

So now, I would like to do something like this for others (as I mentioned); however, I do not know if there is certification requirements (such as CFP), if there would be any legal issues (what are the requirements to be able to do this); and if there are applicable efficient/beneficial courses to this end, all the better in order to provide the best advise possible.

So, any recommendations to this aim?

What is your reply to Lewis McDonald? That pretty well summarizes my question too. I would love to do what he describes as well. Full or part time. How does one properly prepare? etc.

Hi Jeff, As I read about the education requirement for becoming a CFP and look into online programs, I notice that the time involved ranges from 12-18 mos. for completing the 5-7 courses. But it seems that after completing the coursework most everyone takes an intensive CFP exam review course before taking the exam itself. My questions are: 1. Do you think taking the courses on an accelerated basis (closer to 12 mos. than 18 mos.) is realistic for a midlife person with a ‘day job,’ working spouse and busy family? 2. Do you think doing the coursework on an accelerated basis makes it more difficult to pass the CFP exam? (I’m wondering if the intensive exam review will help make up for taking the courses more quickly).

Thanks for all the information. You have not provided The address where to apply for an application and education evaluation to become a CFP.

Hi Raj – It varies by state, so there are 50 possibilities! Check the web for the licensing board in your state.

Jeff, big fan of you! Just one funny spelling – would it be “doing business ass” or “doing business as”?

In an article with many thousands of words a typo or two is bound to happen, despite our best efforts. Hope you found the article informative anyway!

Hi Dave,

First of all, thanks for sharing this. I’m from the Caribbean and I’ve been looking to get a certification of my financial planning expertise. That’s how I found about CFP.

Quick question, how can a non usa-resident can apply for a CFP? Is there a international or foreign courses online or at least a program semi-presence that I can apply to?

I called the CFP Standard Board and they told me they don’t have any local program for my country. But they also told me to reach a CFP professional and look for help and advice on how to get the certification.

Any recommendations?

Thanks in advance,

Rolphy

I would suggest getting experience in (or at least a good start on it) BEFORE taking the exam. I had education, passed the exam, but for the life of me could not land a job (during the downturn) and too much time passed by the time offers started coming in, so couldn’t get the experience requirement in before 5 yrs. 🙁

That’s an unfortunate situation Laura. Bad timing was the culprit, but that isn’t something you could have known at the time. I hope you’ve found something that’s working for you. Sometimes the “road not taken” moves you into something even better. I hope that’s been true for you?

Jeff, awesome piece that gives people a great insight into what goes into starting your own financial planning practice.

Before I started my own practice in June 2013, no-one was able to tell me what it would be like day-to-day. Had I known, I would have prepared myself for a harder journey than it was.

During that first year, I wrote a book titled “The First Year: The Diary of a New RIA Owner” which spells out what the day-to-day is like – from emotional challenges, marketing, working with clients, websites, networking, marketing, and everything else a small business owner has to become good at. You can find it here: http://www.amazon.com/dp/B00L7311CK or get a sample here: http://financeforteachers.com/freebook

(Thanks for letting me plug my stuff – appreciate it!)

Do you find that as a financial planner (CFP) your occupation is focused more around selling financial products? I love helping people with financial advice and I think it would be a dream occupation for me, but the thought of selling mutual funds and insurance products is a bit of joy killer.

Also, with great movement towards self-education and self-direct accounts, do you think professional planners becoming a bit of thing of the past?

Or is being a fee-only consultant removes these concerns?

I have never worked in an environment that has sold products – I’ve always been a Fee-Only advisor. I agree with you and selling products was off-putting to me, so I chose to start my career in the Fee-Only segment of the industry. However, I do have to “sell” my services which is a little bit different.

The self-help world is interesting. There are a lot of resources and information available but I don’t think this means the end to the profession of an advisor. In the same light that I could put a whole work out and diet plan together, yet I don’t. If I wanted to I could, but I know that should I want to do it, I would hire people to put it together and hold me accountable. The same rings through true for financial professionals – we know the truth from the noise, help people understand what is right for their situation, and become their accountability partners.

Thanks for your questions,

Dave

Dave, thank you for sharing your story. I’m also interested in possibly getting into personal finance sometime in the future. I was wondering if you would suggest that if you are currently working in a totally different career field (as I am) would you begin by getting some education around financial planning first? I have a friend who did a masters in finance but now can’t get a job that will get him his certifications to be a financial planner. I wouldn’t want to end up in that type of situation. What would you recommend as a good first step especially if you don’t want to sell life insurance? Is it inevitable that getting into financial planning will involve starting out selling life insurance?

Jon,

Great questions. Firstly, I would sign up to take the CFP classes. This was a big factor in how I got my first job with no experience. They saw I was a self-starter and that impressed them.

If you don’t want to do the commission route, you don’t have to – however it will be harder to get a job. Take lots of local owners out for coffee, ask them what their advice would be and get on their radar. Maybe there will be an opportunity for you by doing this (my most recent mentee got a job offer doing this).

Hey, I just taught my son to pee standing up too — it’s awesome! I’m loving not changing diapers (though we have had a few accidents. Oh well.).

Are you a CFP yet? If someone has a bachelor’s degree in a non-finance field, how can they get started on being a CFP? How much can a paraplanner expect to make a year?

Ken,

I am a CFP, just like Jeff. THere are a number of CFP classes online or at local college campuses that allow you to study without having a finance related degree. All they ask is that you have a bachelor’s degree.

Paraplanning salaries will vary based on experience and knowledge. THe bottom end will be about $40,000, but can go as high as $65,000.

Their salaries can be as high as 80K.