Buying a used car is a time-honored money-saving strategy, and for good reason. According to Q1 2023 Experian data, the average monthly used car loan amount is about $209 less than a loan for a new car.

Avoiding expensive monthly car payments is especially important when faced with financial uncertainties. That’s probably why research firm IHS Markit found that the average car age on the road today is nearly 12 years old. Buying a used car is more popular now than ever — but it does take some extra consideration.

Table of Contents

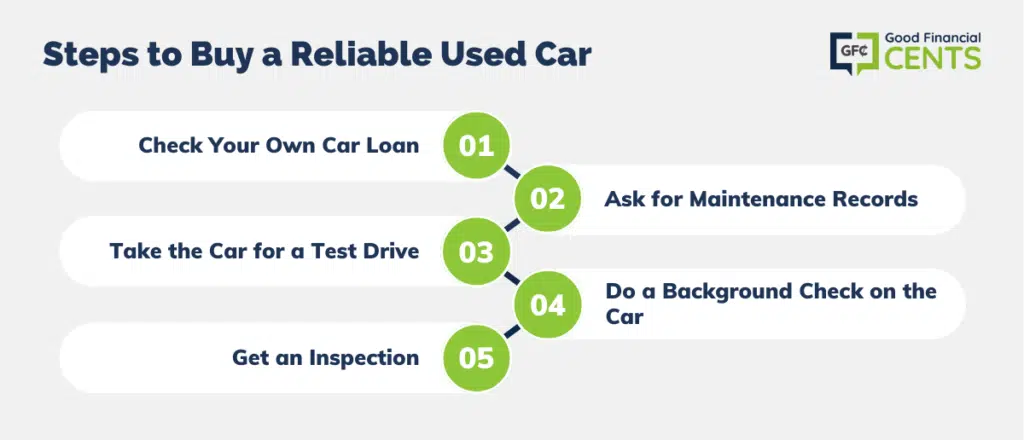

How to Buy a Reliable Used Car

There are always risks to buying a used car. If you buy a lemon, you might end up spending far more on it than if you’d just bought a new car. Here’s how to find the best reliable used car at a good price.

1. Check Your Own Car Loan

If you’re still paying off a car and you’d like to trade down to save some money, the first thing to do is check your existing car loan. If you sell your car for less than you owe on the loan, you could end up having to pay the outstanding balance out-of-pocket.

You can request a “payoff estimate” from your lender to see how much it’ll cost to pay off the remainder of your loan in full. Then, look up your car’s value on Kelley Blue Book or a similar site. Keep in mind that you’ll likely get a lot more money for selling it yourself versus trading it into a dealership.

2. Ask for Maintenance Records

Whether you buy a used car from a dealership or through a private seller, it’s important to review the car’s history. If regular maintenance isn’t done, repair issues and costs can compound down the road — when you own the car. Scrutinize its maintenance and repair records to get an idea of how well it was taken care of and what’s recently been worked on.

Not everyone keeps meticulous records, unfortunately. But if they’re available, records are a good source of information about the reliability of the car.

3. Take the Car for a Test Drive

It’s possible to buy a car over the Internet and have it delivered right to your home. Although it sounds convenient, buying a car without a first-hand test drive is very risky.

Get behind the wheel yourself to test it out on road conditions you plan on experiencing. For example, if you often drive on the highway versus surface streets. A test drive helps you feel whether the car is comfortable for your personal anatomy and offers a real-life sense of obvious repair issues that weren’t apparent in the maintenance records.

4. Do a Background Check on the Car

Regardless of whether a car’s previous owner kept good maintenance records, the car’s VIN and a CARFAX report can surface valuable information, like recalls, ownership history, service records, and more.

Also, ask to see the title of the car and look for “salvage,” “rebuilt,” or “flood” written on it. The exact terminology and the color of these special titles vary by state, but they all indicate one important thing for you: be cautious — the vehicle has a checkered past that might pose a safety or financial risk.

5. Get an Inspection

Always remember to get an inspection done by an independent mechanic. If you buy your car from a dealership, it might be “certified pre-owned” or already have an inspection report (from the dealer’s mechanic, which might be biased).

One example of this is Avis. Known more as a rental car company, Avis, through their Avis Car Sales division, has become one of the Top 50 dealer groups for used vehicle volume.

All Avis Certified vehicles selected for Avis Certification must pass a multi-point inspection process completed by certified mechanics, including ASE-Certified and ASE Master Technicians. This is exactly the type of inspection you want before you purchase a used car. I share some of my car-buying tips on their site so you can check them out there.

But if you want to be 100% confident, then get the car inspected by a third party. Ask the seller if they’re willing to join you as you take the car to your mechanic, or have the seller take it to your chosen mechanic.

If that’s not an option, ask your preferred mechanic if they do on-site inspections. If that’s not even a possibility, there are mobile mechanic companies that specialize in doing on-site inspections, like Lemon Squad or CARCHEX. These companies are also handy if you’re buying a car from out of state.

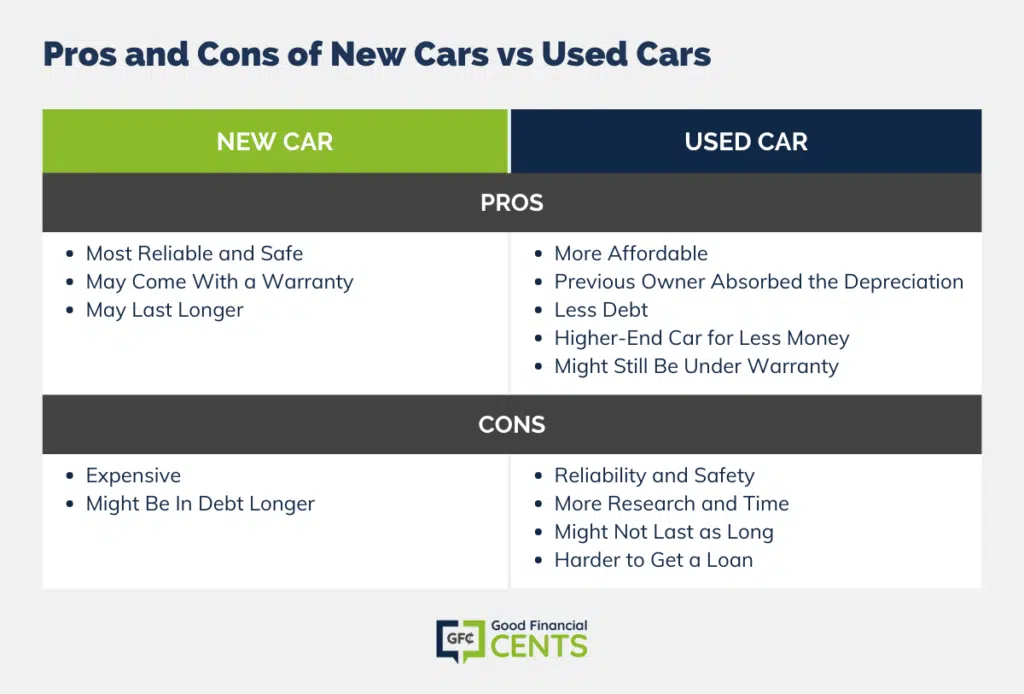

Pros and Cons of Buying a New Car vs a Used Car

Buying a used car is the best option in many cases, but it’s not the only choice. Here are the benefits and disadvantages that you can expect when buying a new car versus a reliable used car.

New Car

Pros

- Most Reliable and Safe: Things can still go wrong with new cars, but in general, they feature the newest safety features and have zero wear and tear on them.

- May Come With a Warranty: New car warranties aren’t all-encompassing and generally only protect certain features, such as the drivetrain. Still, it’s something you’re less likely to find with a used car.

- May Last Longer: Since you’re buying a car that no one’s driven around, there’s a good chance it’ll last you longer than a used car.

Cons

- Expensive: Not only are new cars wildly more expensive than used cars, but as soon as you drive them off the lot, new cars depreciate immediately. According to Edmunds, your new car’s value drops by 9% as soon as you drive it off the lot and depreciates by 19% during the first full year.

- Might Be In Debt Longer: According to the same Experian study, on average, new-car loan terms were about four months longer than a used car. That’s not a huge difference, but taking out a bigger loan for a longer time period means even more money spent on a car that’s already lost much of its value.

Used Car

Pros

- More Affordable: Used cars are definitely the way to go if you’re looking for a car that won’t break the bank. They’re also cheaper to insure and register.

- Previous Owner Absorbed the Depreciation: The car’s original owner took the biggest hit on depreciation so you don’t have to. Even a used car that’s just a few months old gives you a nearly brand-new car without losing a chunk of its value right away.

- Less Debt: If you’re buying a cheaper car, you won’t need to take out as big of a loan for it. You might not even need a loan at all if you’ve saved up enough money — a target that’s a lot easier to reach for used cars.

- Higher-End Car for Less Money: Another perk of buying a used car is that you can often get a nicer used vehicle at a higher trim level, for example, than if you’d paid full price for a basic model.

- Might Still Be Under Warranty: If you buy a newer used car or a car from a dealership, it might have a short warranty associated with it.

Cons

- Reliability and Safety: You’ll need to do your due diligence when buying a used car. It’s especially important to have any potential used cars looked over with the experienced eye of a mechanic before you put your money on the line.

- More Research and Time: You’ll need to put in more time and legwork than with a new car. This includes doing extensive research about the build quality and reliability of the car, checking maintenance records, professional assessments, and more.

- Might Not Last as Long: There’s a reason used cars are cheaper — they’ve already gone through some of their expected lifespan.

- Harder to Get a Loan: Many lenders have limits on how old or how many miles a used car can have because the car is collateral for the loan. If you’re buying a really old car or it has high mileage, you might have some trouble finding financing for it.

The Bottom Line – Saving Money by Buying a Used Car

Buying a used car — the right way — is about more than just saving money upfront. That savings will resonate throughout the rest of your financial life.

For example, if you buy a $20,000 used car instead of a $32,000 new car but keep all of the other loan details the same ($5,000 down payment, 4.5% APR, five-year loan term), your monthly payment will be almost $230 less.

Now, if you take that savings and put it in a high-yield savings account, you’ll have almost $14,000 saved up by the time your car is paid off. That’s almost enough to buy another car outright in cash or a hefty emergency savings fund. By being thoughtful about your next used car purchase, you can find a dependable car while also hitting your other financial goals.