Editor’s Note:

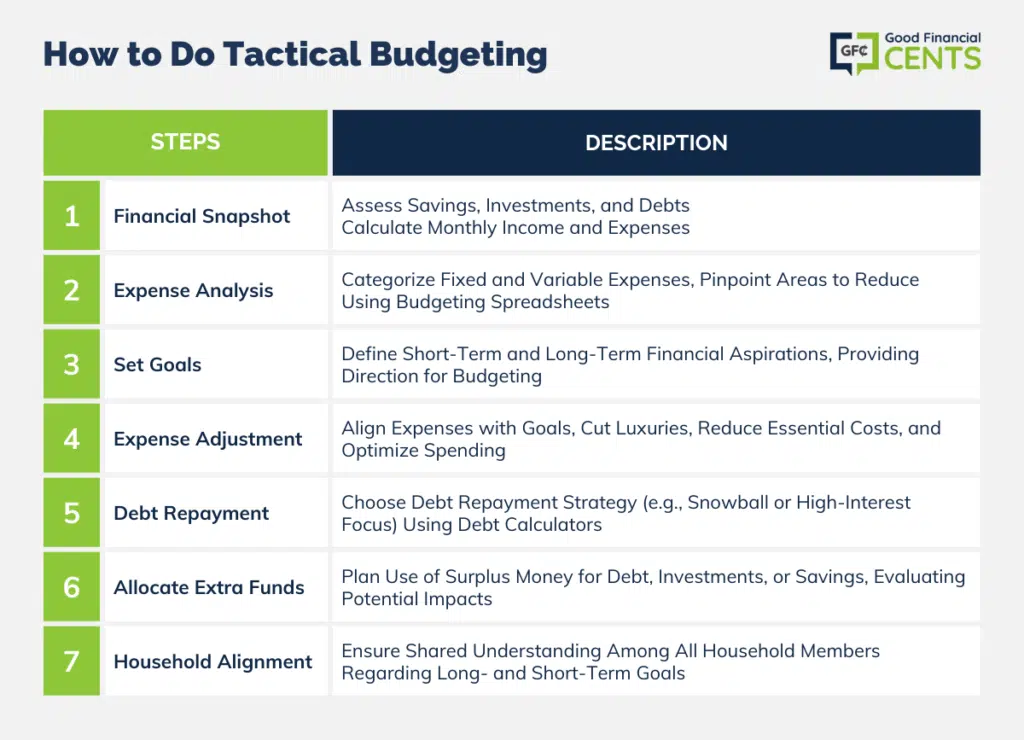

Tactical budgeting, or strategic budgeting as it is sometimes known, is an intense type of financial planning.

Many companies use tactical budgeting to determine where to allocate financial resources and investments to achieve optimal profits.

You can do the same thing with your family budget to meet both short-term and long-term financial goals.

Table of Contents

Getting Started

Before you can do anything, you need to get a clear picture of your finances. Gather every financial statement you can to determine how much you have in savings, investments, and debts.

When you have those numbers, use the same statements to get an estimate of your monthly income and monthly expenditures. If your expenses exceed your income, you should pay special attention to the next three steps.

Examine Your Expenses

There are two basic types of expenses: fixed and variable.

Fixed expenses, which may include rent, mortgage, or car payments, generally stay the same from month to month. Variable expenses frequently change. Examples of variable expenses may include groceries, gifts, and the cost of entertainment or eating out.

You should examine both categories of expenses carefully and make notes of those that can be reasonably reduced or eliminated altogether. The easiest way to examine expenses is to do some sort of budgeting spreadsheet.

Set Short-Term and Long-Term Goals

A big part of tactical budgeting involves strategic planning. You need to decide what you would like to do with your money. Do you need to pay down debts? Are you trying to save for retirement or a child’s education?

Are you interested in buying a house, a car, or another big item in the near future? Think about it and write down several short-term and long-term goals. These ideas will determine what you do next.

Adjust Your Expenses Accordingly

Budgeting is simple math. If you have a financial goal and need x amount of dollars, you will need to find x by increasing your income or adjusting your expenses.

Since increasing income isn’t always an option, reducing the amount you spend may be the easiest way to come up with extra cash.

Go over your expenses and notes and make an effort to eliminate the things you don’t need. This may include cigarettes, alcohol, lattes, dining out, cable expenses, and other luxuries.

You can also reduce the amount you pay on necessities by switching insurance companies, finding a cheaper Internet provider, refinancing loans, clipping coupons, and taking advantage of small things like paperless billing and other programs designed to lower expenses.

Pay Down Debt

After adjusting your expenses, you will most likely discover extra money that can be used to pay down debt. Getting rid of debt will almost always help you free up even more money because having debt is expensive.

Very few debts are interest-free, and the more interest you pay the more money that debt costs you in the long run.

There are two basic ways to pay down debt. You can use the snowball method and eliminate the smallest debts first before moving on to larger debts. Or you can use the second, more common method and give priority to the debts with the highest interest rate.

Both methods work and will help you achieve almost similar results. To see which method will save you more, you can use one of the many free debt calculators that can be found on the web.

Allocate Extra Money

If you do not have a lot of debt or if you have a goal that is separate from paying down debt, such as saving for a new car or house, you will need to decide how you will allocate any extra money you make over the coming months.

You could invest the money or put it into a savings account. Whatever you decide to do, make sure that you take the time to evaluate all of your options and research the potential consequences of your actions.

Get Everyone on Board

Although most households have one person who is primarily in charge of the finances, tactical budgeting tends to work best when everyone is on the same page.

When the entire household is aware of both long- and short-term goals, there are fewer arguments and more productive discussions about spending and saving.

If you are the only one who handles the finances, consider sharing the burden and getting others involved so that you can reach your goal faster and with less hassle.

The Bottom Line – How to Do Tactical Budgeting

Tactical budgeting, a strategic approach to financial planning, offers a pathway to achieving both short-term and long-term financial objectives. To embark on this journey, one must begin by comprehensively assessing their financial situation.

Analyzing expenses, and distinguishing between fixed and variable costs, is a pivotal step. Setting clear short-term and long-term goals forms the foundation of tactical budgeting. To realize these objectives, adjustments to expenses become necessary.

Cutting unnecessary luxuries and optimizing essential expenses can free up funds. Moreover, debt reduction is pivotal, as it can alleviate the financial burden and save money in the long run.

Allocating surplus income wisely and involving the entire household in the process can enhance the effectiveness of tactical budgeting, ensuring a more secure financial future.