We’re all about retirement planning, and we often talk about Roth IRAs and other retirement accounts and strategies.

But what about Social Security? It’s an often overlooked, though highly critical, component of your retirement plan.

There are ways to maximize your Social Security income, but the most effective strategies need to be put in place before you actually begin collecting benefits.

Getting the most out of your Social Security can be confusing because there are several different options as to when you can take it. For example, you can take benefits beginning at ages 62, 67, 70, or any age you choose.

However, know that your age at the time of retirement will affect the amount of your benefits as well as the benefits you’ll receive for the rest of your life.

When to Take Your Benefits

Table of Contents

- When to Take Your Benefits

- Taking Benefits Before Your Full Retirement Age

- Delaying Benefits Past Your Full Retirement Age

- Social Security Benefits That You Are Entitled To

- Timing Factors on the Collection of Social Security Benefits

- Calculating Your Monthly Social Security Benefit

- 6 Common Mistakes Involving Social Security

- Strategies to Maximize Your Social Security Benefits

- Just in Case Your Filing Choice Turns Out to Be a Mistake…

- Final Thoughts – How to Maximize Your Social Security Income

If you take benefits as soon as you are eligible, which is age 62, you may get your benefits early, but that will reduce the benefits you receive in the future, and not by a little, either!

Understanding Your Full Retirement Age

This is an important age to understand. Where once the age of full retirement was 65 for everyone, the age has been creeping up for those born after 1943. The new full retirement age will be 67 for anyone born in 1960 or later.

And if you were born between 1943 and 1954, the age is 66. (There are actually graduations based on age that will actually make the full retirement age an odd number, like 66 years and 3 months, based on the exact year you were born.)

Full retirement age is considered the baseline for everything related to Social Security. It is the age at which you will receive 100% of your basic Social Security benefit. If you retire before that age, your benefits will be reduced.

Taking Benefits Before Your Full Retirement Age

If you’re considering taking out your benefits before you reach full retirement, here are a few considerations to keep in mind:

What Are Your CDs Paying?

I know what you’re thinking. What does your bank CD have to do with your social security benefit? I’ll get there in a second. First, let’s look at 5-year CD rates. Scouring the net, 5-year CD rates are currently paying approximately 3.5% (as of June 2009).

Now, according to the Social Security Administration, the average retiree will be bringing home $1150 per month as their benefit check.

So based on current CD rates, a retiree would need approximately $395,000 to get the same monthly benefit. It’s hard to find a secure investment that will give you that same monthly benefit without that much in cash investments.

Obviously, there is some concern about the overall strength of the Social Security program. But for a recent retiree, they should expect to see those checks deposited for several more years to come.

What About Stocks?

Many would argue that right now is an excellent buying opportunity in the stock market (I might be one of them). But telling a soon-to-be retiree to look to the stock market for a “secure” investment is like telling an Eskimo that he needs to stock up on air conditioners. I think you get the point.

Value-oriented, dividend-paying stocks have been beaten down just as badly, if not worse than tech stocks back in 2001-2002, leaving many investors skittish about the market. A portion of the money would make sense having some stock exposure, but not nearly as secure as getting a social security check from the government each month.

Need Some Security?

Most retirees will look to bonds as their primary income source in retirement. But in a year where we saw the strength of corporate bonds in question, government agencies faltering, and many municipal bonds being questioned on how insured they really are, the only safe haven was treasuries.

There was a period when you could make more by picking up pennies in the street than you could make from treasury yields. Is that the answer for a retiree’s source of income? Opting to take Social Security at an earlier age will give you a secure income without having to find a safe place for your other investments.

Delaying Benefits Past Your Full Retirement Age

As noted above, you can take benefits as early as age 62, but the benefit will be reduced. Generally speaking, your monthly benefit will be reduced by between 5% and 7% for each year that you take benefits in advance of your full retirement age.

For example, if your full retirement age is 66 and you begin taking benefits at 62, your monthly benefit will be reduced by about 30%. If your benefit at full retirement age is $1,600 per month, it will be reduced to $1,120 ($1,600 times 70%) should you begin taking benefits at 62.

And since taking benefits early would result in a reduced monthly income, you will probably need to supplement your income with some form of earned income. But if you do, keep in mind that your Social Security benefits will be reduced if you earn above a certain amount.

You can earn up to $15,480 (2023) without having your Social Security benefits reduced. Beyond that threshold, you’ll give up one dollar in benefits for every two dollars in earnings.

If you earn $35,480 while collecting your benefits at age 62, you’ll lose $10,000 in Social Security benefits ($35,480 – $15,480 = $20,000 divided by 2). If you’re making enough money, it is possible to completely eliminate your Social Security benefit.

Ouch.

However, this isn’t entirely as bad as it might seem because the reduction in benefits now can increase your benefits later. Social Security automatically recalculates your benefits each year that you’ve had any earnings.

That means that if you are making more money than you have in many of the 35 years that are used to compute your benefits, they will be replaced by the higher income you’re earning in retirement, and that will result in increased Social Security benefits going forward.

If you delay collecting benefits until you are past your full retirement age, you can increase your monthly benefit – within limits.

The current law allows you to increase your monthly benefit by 8% per year for every year that you delay past full retirement age. So for example, if your full retirement age is 66, you can increase your benefit by 32% by delaying collecting benefits until age 70 (4 years times 8%).

If your full retirement age is 67, you can increase it by 24% by delaying benefits until age 70 (3 years times 8%).

There is no additional incentive to delay collecting benefits past age 70, so for that reason, you should assume age 70 as the latest age at which you will begin collecting your Social Security benefits.

Social Security Benefits That You Are Entitled To

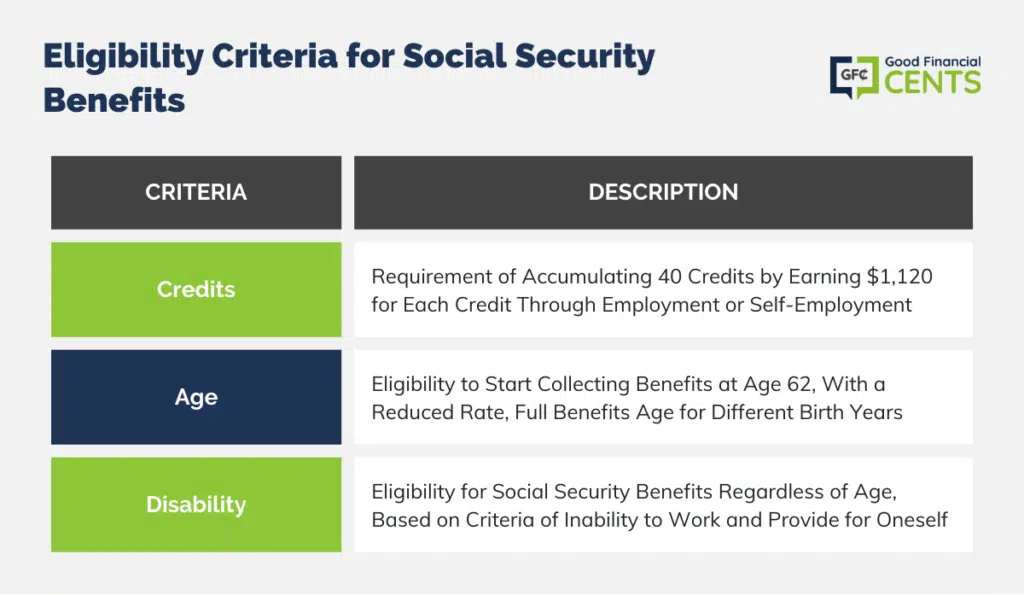

In order to be eligible to collect social security benefits, there are certain criteria that must be met:

- Credits: A person must have 40 credits accumulated before they can receive benefits. For every $1,120 an individual earns through employment or self-employment, they receive a credit. The maximum amount of credits one can earn per year is four, so once $4,480 in income is earned, the maximum credits are applied.

At the minimum, it would take a person 10 years to earn 40 credits. Only earned income counts toward credits, income from inheritance, dividends, and interest does not count as income. - Age: At age 62, persons may begin to collect social security benefits at a 25% to 30% reduced rate, Individuals born before 1938 can get full benefits at age 65. Those born after 1938 will get full benefits on a graduated basis, with the full retirement age for people born after 1960 being 67.

Once you reach the age at which you are eligible to collect social security you can apply 3 months in advance of that age. The reduction in benefits is only if you claim exactly 48 months prior to “full retirement age.” The actual calculation can be found here. - Disability: Disabled individuals can collect social security benefits regardless of age. There are different criteria that must be met, but if an individual cannot work or provide for themselves, they may be eligible to receive social security benefits.

Your spouse will be subject to the same requirement and can file for benefits in his or her own name. Your spouse can collect the benefit that is the higher of the two benefits that he or she qualifies for, or 50% of your benefit if you are the higher wage earner.

Important Note:

Timing Factors on the Collection of Social Security Benefits

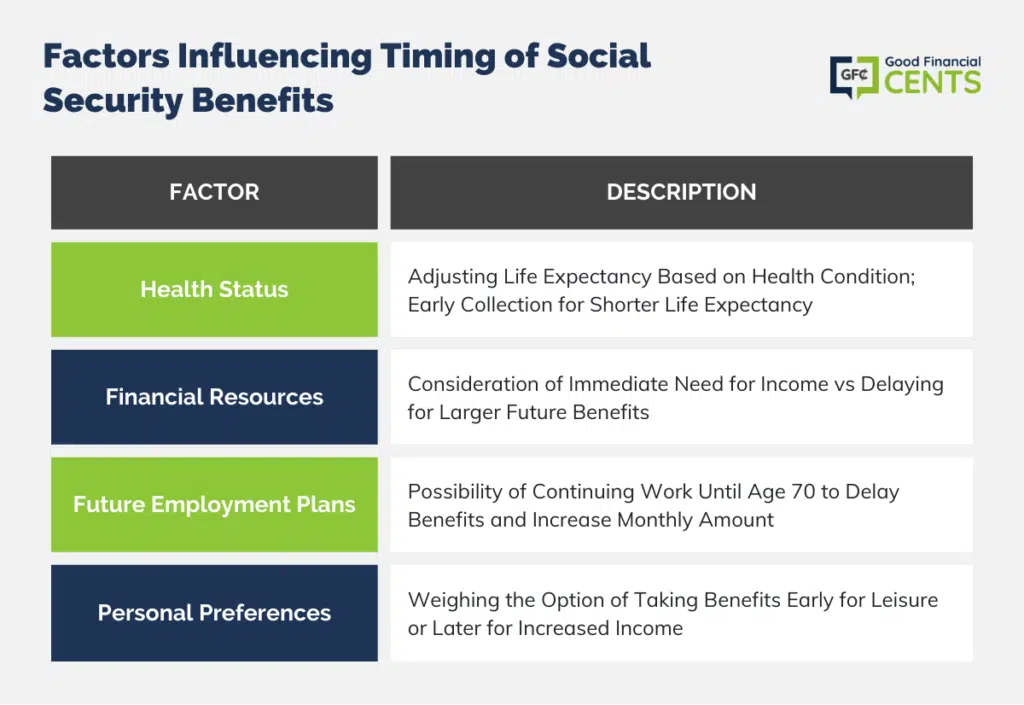

As a starting point, you need to find out exactly when your full retirement age is, and your spouse must do the same if you’re married.

Next, you need to make a reasonable estimate of your life expectancy. You can do this by going to the Social Security Administration’s (SSA) Life Expectancy Calculator.

- Health Status: If you are in excellent overall health, and your family history confirms that this tends to be the case even in old age, you might make an adjustment to the Social Security life expectancy accordingly. Conversely, if you have a condition that is expected to shorten your life, it makes sense to begin collecting benefits early.

- Financial Resources: If you’re in a situation where you absolutely need the income now and there are no other resources available, then there’s little choice but to begin taking benefits as early as possible. But if you have financial resources that will enable you to cover your living expenses for a few years, then delaying the receipt of Social Security benefits can make a big difference in your monthly benefit later on.

- Future Employment Plans: Not everyone plans to stop working when they reach their 60s. If you enjoy the work that you do and it is something that you can do until at least age 70, then delaying benefits is an obvious and profitable option.

- Personal Preferences: If it is your intention to move to the beach and to enjoy a life of leisure while you are still relatively young and in good health, then taking benefits early would work better for your situation.

Calculating Your Monthly Social Security Benefit

You can go to the Social Security Retirement Estimator to get a reasonably precise number. Benefits are calculated based on a formula that includes your highest 35-year earnings, indexed for inflation through age 59.

Though it is fashionable for people to try to minimize their taxable income (particularly the self-employed), retirement planning should make you think otherwise because the best way to increase your monthly benefit is to increase your income during your working years.

This is also an excellent reason to continue working into your 60s if you are in your peak earning years. Each year in which you earn a high income will knock out a lower-earning year and increase your monthly Social Security benefit.

There are three primary ways you can access your social security statement:

- By Phone: You can contact the SSI office via phone during their office hours.

- Online: By far the easiest route, you can obtain your statement on the SSI website, where you’ll be prompted to enter identification.

- By Mail: You may also print and submit Form 7004 by mail to receive a copy of your statement.

6 Common Mistakes Involving Social Security

These are mistakes that people make with regard to Social Security on a routine basis:

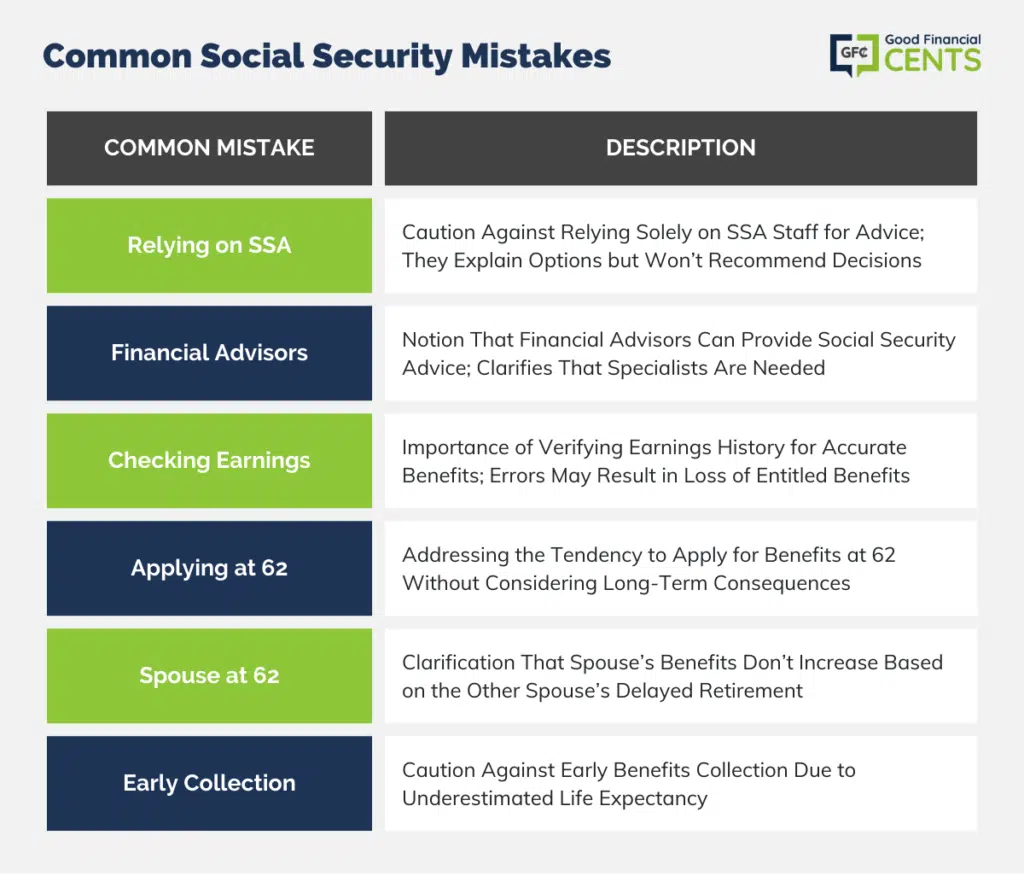

1. Relying on the good folks at the SSA to provide the right advice. SSA staff are not financial advisors, and they don’t know your personal financial situation. They can explain your options, but they will not recommend which way you should go.

2. Thinking that financial advisors can also provide the right Social Security advice. Social Security is an entirely separate category that is now increasingly being serviced by specialists and is beyond the scope of financial advisors.

3. Checking to make sure that your earnings history is accurate. Sure, it’s easier to assume that SSA records are accurate, but if they aren’t, you could be losing out on benefits you paid for.

4. Applying for benefits at 62 – just because you can. The majority of people begin collecting benefits at age 62, usually with little thought to the long-term consequences.

5. Thinking that your spouse should collect benefits at 62. This goes hand-in-hand with the mistaken notion that his or her benefits can increase based on your delayed retirement. But SSA won’t allow that.

6. Assuming that you won’t live very long. Given that the average person who is 65 will live another 20 years, collecting benefits too early in the process could prove to be a major strategic mistake.

Strategies to Maximize Your Social Security Benefits

You should start seriously thinking about this when you’re in your 50s. That’s when you will have the time and the up-to-date information available to make an intelligent decision. Once you actually go on Social Security benefits, you’ll be locked into whatever option you have chosen.

But…

There are some strategies that may get you out of that lock-in:

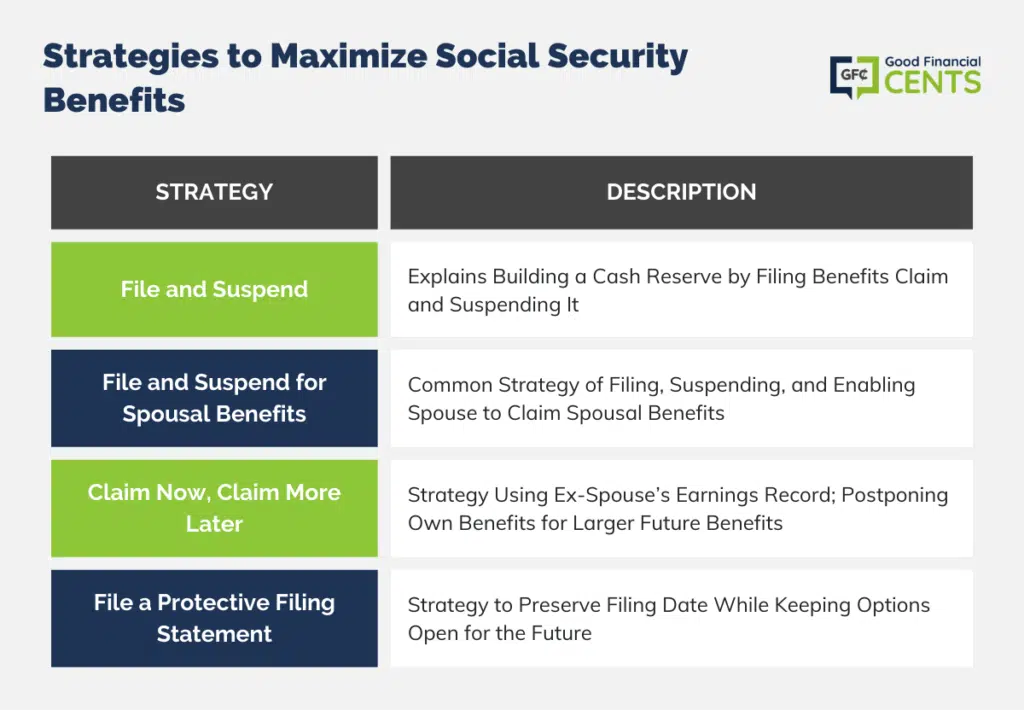

File and Suspend

This is a strategy that will help you build a cash reserve. You file your benefits claim, then suspend it. As long as you’re not collecting benefits, your monthly benefit amount will continue to increase.

But if you decide that you need cash in a hurry, you can unsuspend your claim, and the SSA will send you a check for the unpaid monthly benefits (but understand that it can take up to three months before the check will arrive).

This can also work well if, during the suspension period, you have a major health event. If you are suspending in order to build up future benefits and you have a health event that causes you to believe that you won’t live as long as you originally thought, you can go all the way back to the age at which you suspended your benefits and have them paid to you now in a lump sum.

File and Suspend for Spousal Benefits

This is actually a fairly common strategy. You file for benefits and immediately request a suspension before any benefits are paid. This will trigger your spouse’s ability to apply for spousal benefits on your record.

The SSA will not allow that unless you have already filed for your benefits. This allows one spouse to collect benefits while the other continues to build up an even larger benefit.

Let’s say that you file for Social Security benefits at age 67. This will enable your spouse to get a dependent spouse benefit. If you suspend benefit payments immediately, you can then activate them at age 70 so that you’ll get the maximum monthly benefit you are entitled to.

It’s important to understand that you have to be at least at your full retirement age, and only one member of the couple can file and suspend benefits at the same time.

Claim Now, Claim More Later

You do this using an ex-spouse’s earnings record, and it works just the same as if you were a currently married person. You have to be eligible based on your own earnings in addition to those of your former spouse.

But when you reach your full retirement age, you can file an application for divorced spousal benefits. You’ll then postpone your own benefits in favor of those of your former spouse.

You can even do this if your ex-spouse has died by filing for survivor benefits. In the meantime, your own earnings credits will be increasing, which will entitle you to a higher benefit if you switch it over when you reach age 70.

File a Protective Filing Statement

This is a good option if you’re not sure when you will file. This is not a formal application, but it will preserve a given filing date for as long as six months.

As you move toward the end of the six-month period, you can simply file again. This is an excellent way to hedge your benefits if you are at your full retirement age and still not sure of what your future holds.

For example, there may be certain financial opportunities available to you that would make collecting Social Security benefits unnecessary.

But if you aren’t sure how that will actually happen and you want to lock in collecting benefits at a certain age, the protective filing statement will enable you to keep your options open.

You can do this simply by contacting the Social Security office, either in person or in writing.

Just in Case Your Filing Choice Turns Out to Be a Mistake…

In the event that you file for benefits early and realize that you made a mistake, you do have up to 12 months from the date you filed to make a change. This is referred to as a withdrawal of application, and it’s not quite as easy as it sounds.

Should you withdraw, you will need to repay any and all benefits that you collected during the 12-month period. But once you do, it will have the effect of undoing your original filing. It’s a valuable option to have, but it is one that you can choose only once in your lifetime.

If you cannot repay the benefits you have already received or the 12-month timeframe has expired, you can still suspend your claim.

If you do this after you reach your full retirement age, you can once again build up retirement credits at a rate of 8% per year (similar to a delay in collecting benefits). The strategy will no longer be effective once you reach age 70 since there will be no increase in your benefit beyond that age.

NOTE: Congress is considering eliminating this loophole, so it is entirely possible that it will not apply by the time you’re ready to execute the strategy. Obviously, this is a pretty tricky topic; if you are thinking about retiring soon or if you have any questions, make sure you see your financial professional.

Final Thoughts – How to Maximize Your Social Security Income

Optimizing your Social Security income is a pivotal element of retirement planning. While often overlooked, it holds substantial influence over your financial stability. Critical considerations involve your retirement age and its impact on benefit amounts, with delaying benefits often proving advantageous.

Beware of common errors like relying solely on SSA guidance or claiming benefits prematurely. Tailoring strategies to your unique situation, such as ‘File and Suspend’ or leveraging an ex-spouse’s records, can further maximize benefits.

The key lies in understanding the complex interplay of factors, ensuring a well-informed decision that shapes your retirement comfort.