Graduating college is one of the most exciting moments in life, a milestone that opens the door to your future.

All the late-night study sessions, painstaking papers, and student loans have paid off as you proudly receive your diploma.

As you walk across the stage and into the real world, you’ll be faced with the task of paying for your hard-earned education.

Table of Contents

How to Pay Off Your Student Loans

Student loan repayment can seem daunting – but it doesn’t have to be.

With an understanding of how the student loan repayment process works and a strategy in place, you can pay your student loans off with ease.

Ready to get started?

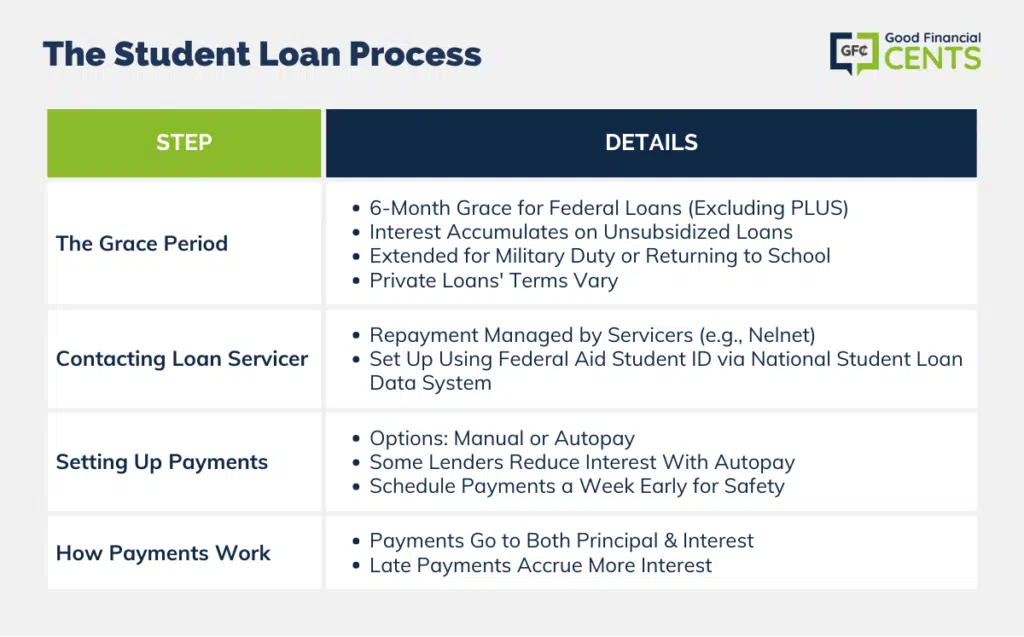

The Student Loan Process

To effectively pay off your loans, you need to understand how student loans work.

Here are a few key parts of the process to get you started.

The Grace Period

If you’re frantically scrambling to figure out how to make payments on your federal student loans as you search for jobs, relax. Lenders understand that it might take you a little time to get on your feet after graduation.

Federal student loans, barring PLUS loans, come with the advantage of a six-month grace period from the day you graduate or fall below half-time status onward.

That means you don’t have to start making payments until your 6 months are up. During that time, interest will continue to accumulate on any unsubsidized loans.

The grace period can be extended if you enter active duty in the military or decide to go back to school full-time.

Private loans function differently, with some lenders offering grace periods comparable to federal student loans. Others might require you to make payments while you’re in school or as soon as you graduate, so be sure you understand the terms of your agreement.

Contacting Your Loan Servicer

While you may have obtained your federal student loans through a government website, you don’t repay them there.

The government utilizes a handful of loan servicers to process your payments and manage your repayment plans.

The loan servicer, an institution like Nelnet, Great Lakes, or Navient, will contact you about setting up your account with your Federal Aid Student ID, which you can find or set up with the National Student Loan Data System.

You can also find the name of your servicer there if you’d like to get the ball rolling and address any questions. They’ll be able to help you land on the best repayment plan for your needs.

Setting Up Payments

Making payments on your student loans is a simple process.

You’ll have the option to make manual electronic payments each month or enroll in autopay, which helps to guarantee you never make a late payment that could damage your credit score.

Another benefit of autopay from certain companies, such as College Ave – is that when you set up autopay, you may receive an interest rate reduction, helping you save money in the long run.

Other federal services, banks, and credit unions should offer automatic payments as a way to pay.

Another way to ensure your payments are made on time is to schedule the payment for a week prior to the due date to allow any delays or issues with payment processing to be resolved.

How Payments Work

If you’ve taken a look at your loans, you’ll notice they’re broken down into two amounts: principal and interest.

Each of your payments, likewise, is applied to both principal and interest. When you’re making your payments on time on a standard repayment plan, most of your payment will be applied to the principal.

If you’re behind on your payments, however, more of your monthly payment will go towards interest and fees and less to paying down the principal.

With a basic understanding of how student loan repayment works, let’s take a look at some alternate repayment options and tips to pay down your student loans quickly.

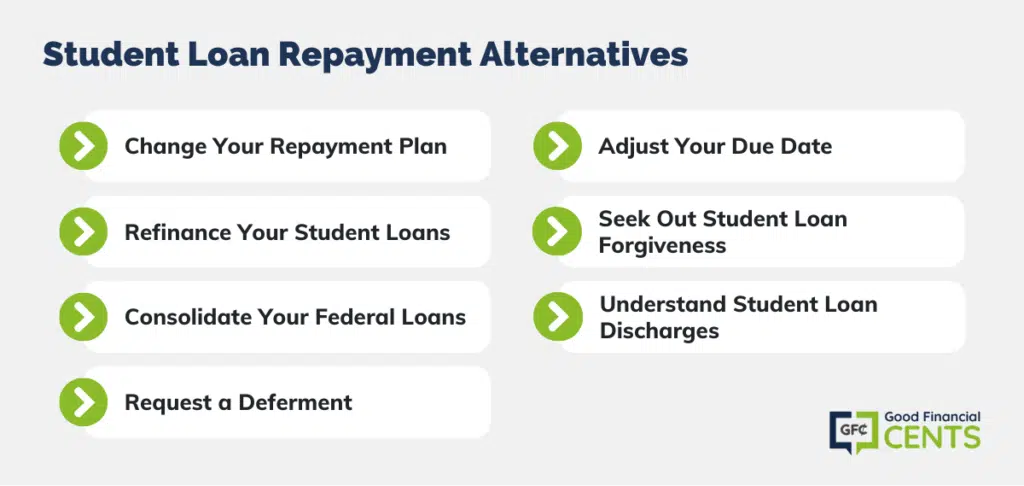

Student Loan Repayment Alternatives

Sadly, you can’t wish away your student debt. Most likely, you’ll have to repay your student loans in full over time.

There are, however, a number of repayment plans. And in some cases, your student loans can be forgiven altogether.

If you’re struggling to stay on top of your payments, you may be able to make them more manageable with the strategies below.

Change Your Repayment Plan

If the amount due on your student loan payment each month exceeds your budget, you could benefit from an income-driven repayment plan.

This plan uses your income as the basis for setting more manageable payments.

You can apply for an income-driven repayment plan through your servicer, and you’ll need to submit your tax records or a recent pay stub along with the application.

Refinance Your Student Loans

If you have a private student loan, you won’t be able to use an income-driven repayment plan. You can, however, benefit from refinancing your student loans.

College Ave can help you refinance your loans quickly and easily, lowering the amount you pay each month. They can even receive an interest rate discount if you enroll in autopay.

You can apply for free on their website and get instant access to the rates you’re eligible for, with low fixed and variable interest rates.

Other great refinancing options include Splash Financial and Credible.

Consolidate Your Federal Loans

Likewise, the federal government offers a Direct Consolidation Loan to help make your loan repayments more bearable. This particular loan reduces rates by merging all of your federal student loans into one.

It can also work to simplify your repayments if you have more than one servicer. By making one singular payment each month, you avoid the risk of letting any individual payments slip through the cracks.

Request a Deferment

If you plan to be able to make your payments but need a breather due to a job loss or other unexpected event, you can request a deferment or a forbearance on your federal student loan.

You may incur interest during the deferment, but it can provide you with a few months’ time to get your finances on track.

Adjust Your Due Date

While student loan repayment dates are set to accommodate common payroll schedules, many individuals get paid on different timelines.

If your student loan payment is always due before you get paid, you may be able to change the monthly due date to fit your schedule.

Once again, you should contact your student loan servicer to see if adjusting your due date is a possibility.

Seek Out Student Loan Forgiveness

There are a handful of circumstances that can lead to the discharge, forgiveness, or cancellation of your federal student loans.

Here’s a brief overview of each type of loan dismissal.

- Teacher Loan Forgiveness: After teaching for 5 years at a school or institution serving low-income families, you could be eligible for forgiveness of your federal student loans up to $17,500.

- Public Service Loan Forgiveness: If you are a full-time employee of a nonprofit or the government, your student loans could be forgiven after you complete 120 monthly payments.

- Perkins Loan Cancellation: If you are a teacher or work in a number of public service-related positions, your Perkins Loans could be forgiven. The longer you serve, the larger the portion of your loan that is forgiven.

Understand Student Loan Discharges

- Bankruptcy Discharge: In some cases, when you declare Chapter 7 or 13 bankruptcy, you may be able to have your loan discharged in an adversary proceeding.

- Closed School Discharge: If your college or university closes its doors while you’re in school or within 120 days of your withdrawal, your Direct Loans and FEEL Loans may be forgiven.

- Death Discharge: If you pass away, your student loans will be discharged completely. Likewise, if your parents pass away, their PLUS Loan will be dismissed as well.

- TPD Discharge: If you become permanently disabled, your federal student loans may be forgiven with proof from the VA, SSA, or a doctor.

You may also be able to get an unpaid refund discharge if you withdrew from school early or a false certification discharge in cases of identity theft or unauthorized signatures and payments.

Check with your servicers to see if you’re eligible for any of the options above.

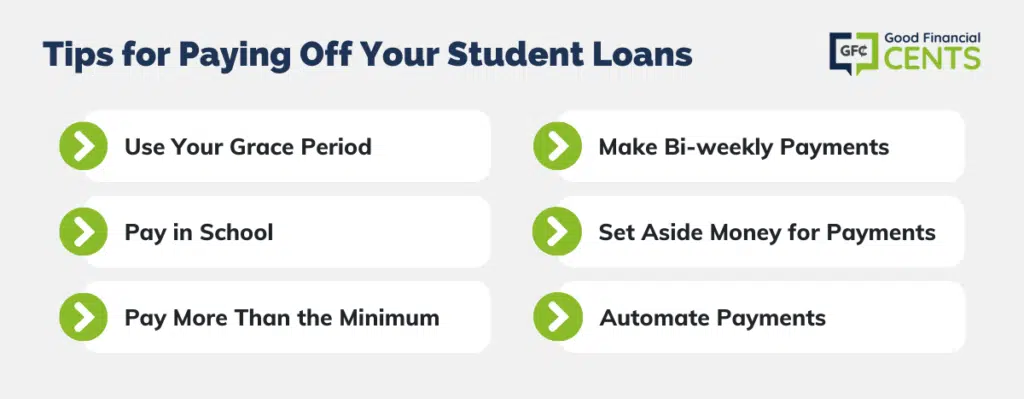

Tips for Paying Off Your Student Loans

While student loan forgiveness is an option for some people, most individuals will have to pay back their student loans.

In addition to consolidating your student loans or enrolling in an income-driven repayment plan, consider some of the following tips to pay off your student loans faster.

- Use Your Grace Period: If you’re able to, take advantage of the grace period by paying down the interest on your loan for a few months. Your future self will appreciate it.

- Pay in School: If you’re serious about getting out of student debt quickly, start making payments before graduation, whether it’s a private or federal loan.

- Pay More Than the Minimum: If you have the means to pay above the minimum due, go for it. The more aggressively you attack your student debt, the better.

- Make Bi-weekly Payments: Split your monthly payment in half, paying twice a month. You’ll make one extra payment a year (hardly noticeable) and shave time off your repayment.

- Set Aside Money for Payments: Whether it’s an unexpected inheritance, a raise, or a birthday gift, put that windfall of money towards your student loans.

- Automate Payments: This one can’t be emphasized enough. Autopay streamlines your repayment and keeps you on track, taking the stress out of student loans.

Bottom Line

Paying off your student loans is only stressful if you let it be. It’s easy to let yourself get overwhelmed by the total amount of your student loans, but there’s no reason to.

Instead, think of the relief you’ll feel when your loans are paid off and set out to accomplish that goal.

By getting ahead of your student loans, understanding all of your options, and planning payments strategically, you can pay off your loans as painlessly as possible.