| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

The average American has only a little over $200,000 saved for retirement by age 65. It’s a small wonder that 50% of married couples and 70% of individuals receive 50% or more of their retirement income from Social Security.

But that doesn’t have to be you. In fact, you don’t even need to wait until you’re 65 to retire. It’s possible you can retire in 10 years – as in 10 years from where you are right now. It doesn’t matter if you’re 25, 35, or 45, with the right mix of discipline, commitment, and financial strategies, it’s a goal you can reach.

Many thousands of others have already done it, which means you can too. And you can do it even if you have no money saved for retirement right now.

Here’s how…

But first, let’s touch on a few important concepts.

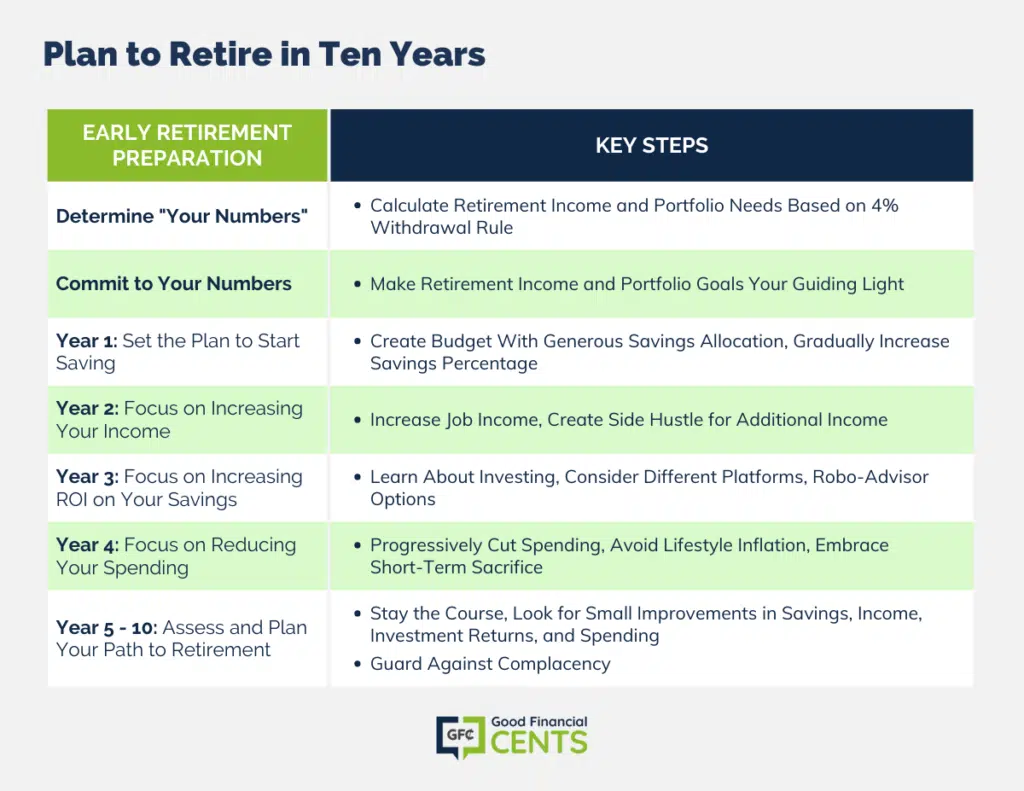

Determine “Your Numbers”

Table of Contents

What are your numbers? The amount of income you’ll need each year to live in retirement, and the amount of money you’ll need in your portfolio to produce that income.

Let’s say you decide you’ll need $40,000 per year to live in retirement. It’s possible to determine the amount you’ll need to have saved to provide that income.

It’s known loosely as the safe withdrawal rate. It’s a theory mostly, but one that’s been shown to be reliable in a number of studies.

It holds that if you withdraw it no more than 4% from your investment portfolio each year, you’ll have an income for life, and your portfolio will remain intact.

It works something like this: if you earn an average of 7% on your portfolio in retirement, and withdraw 4% for living expenses, that will leave 3% in the portfolio to cover inflation.

If we look at the rate of inflation going back to 1990, it ranged between 1.1% to 5.3% per year, with an average of something less than 3%. Over the past 20 years, the average has been closer to 2%. But since early retirement will bring long-term planning consequences, let’s go with 3% as an average.

Can You Earn an Average of 7% Annually for the Rest of Your Life?

Investing is all about playing the long-term averages, and that’s what works in your favor.

Here’s how:

The average return on stocks has been about 10% per year going all the way back to 1928. It varies quite a bit from one year to the next, but that’s the return you can expect over 20 or 30 years.

Meanwhile, safe investments, like high-yield online savings accounts, are currently paying between 1% and 2% per year. But to be conservative, let’s go with 1.5% for our calculations.

If you create an investment portfolio comprising 65% stocks and 35% in high-yield online savings, you can achieve a 7% average annual return.

Here’s how it breaks down:

65% invested in stocks at 10% per year will generate a 6.5 % return.

35% invested in high-yield online savings at 1.5% per year will generate a 0.525 return.

The combination of the two will produce an average annual return of 7.025%. That will allow you to withdraw 4% each year for living expenses and retain the remaining roughly 3% in your portfolio to cover inflation.

If you’re planning to rely on your investments for the rest of your life, you’ll need to build some safety into your portfolio. A 35% allocation in safe assets means that even if the stock market takes a big hit, your portfolio won’t go down with it.

Another important point on this front is that though interest rates are low by historical standards right now, that situation could change. If interest rates were to return to 5%, the savings allocation would make a much bigger contribution to your annual returns, and do it risk-free.

Back to “Your Numbers”

Now that you can see how the 4% safe withdrawal rate works mechanically, it’s time to determine your portfolio number.

If you need $40,000 in income, you can determine your portfolio size by multiplying that number by 25. Why 25? If you really like math, you can divide $40,000 by 4%, and you’ll get $1 million.

But for those of us who don’t like mathematical formulas and number-crunching, it’s easier to simply multiply your income number by 25 to get your portfolio size.

If you multiply $40,000 by 25, you’ll get $1 million. It’s just a simpler calculation, and it’ll get you to the portfolio amount you need quickly.

Commit to Your Numbers

I’ve used $40,000 as an income number for retirement, but it’ll be different for everyone. For example, if you have other income sources you expect to continue in retirement you may need less. But if you want a little bit more fun and luxury in your life, you’ll probably need more.

I’ve only used this number as an example. You can come up with an income number that will work for you. As you can see from my calculations above, your portfolio number will be determined by your income number.

You’ll need to know both.

For example, if you think you’ll need $50,000, you’ll need to build a portfolio of $1.25 million ($50,000 X 25). If you need $100,000 in income, your portfolio will need to reach $2.5 million ($100,000 X 25).

To reach your goal, you’ll need to work toward three objectives:

- Saving the money needed to build your portfolio.

- Earning a return on your investments will not only help you build your portfolio but also keep it growing once you retire.

- Implement spending reductions and controls that will enable you to live on what will probably be less money than you are right now.

If you plan to retire in 10 years, you’ll need to commit to all three. Your retirement income and portfolio numbers must serve as a guiding light from now on. As you can easily imagine, retiring in 10 years is a tall order. You won’t get there by taking shortcuts. You’ll need to achieve all three objectives to reach your goal. That’ll take a 100% commitment but it’s the only way to make it happen.

Now let’s look at creating a timetable.

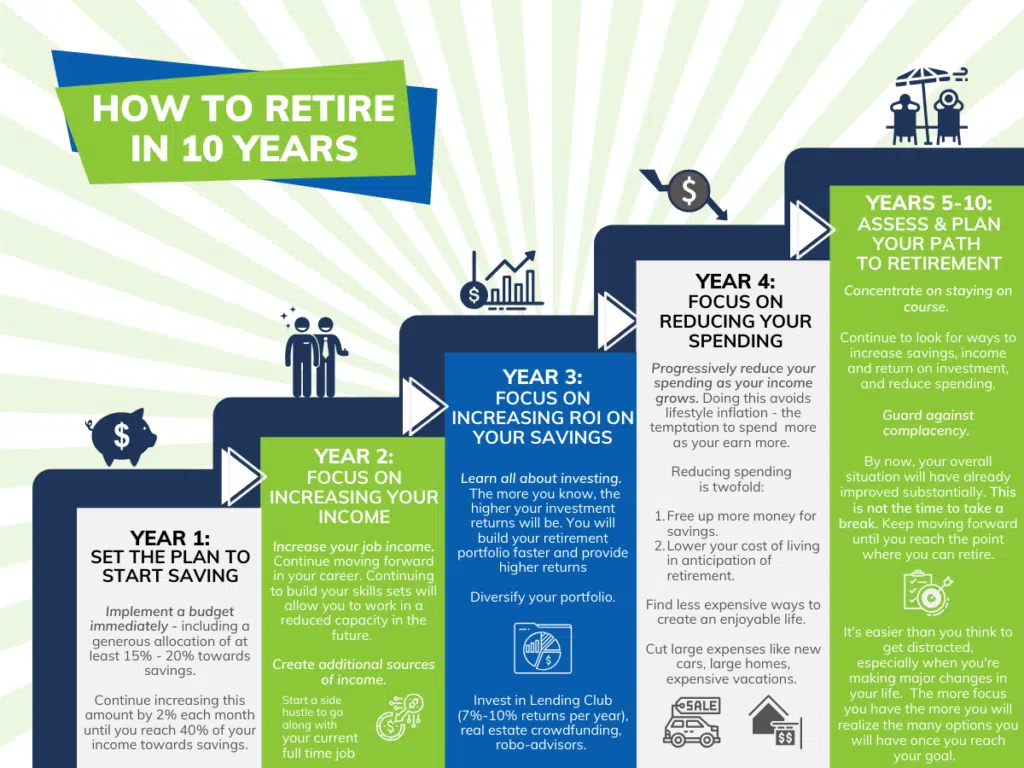

Year 1: Set the Plan to Start Saving

The average person probably saves between 10% and 15% of their pay toward retirement. But if you hope to retire in 10 years, you’ll need to save a lot more. Like 30%, 40%, 50%, or even more.

That’s going to take more than a little bit of sacrifice, and it may not happen right away. That’s why you may need to commit the better part of the first year to getting this phase in full working order.

The best way to start is by implementing a budget immediately. If you’ve never done that in the past, you may need to get help. You can do that by selecting a budgeting application that will show you how.

Your budget should include a generous allocation toward savings. It’s possible that at the beginning of the year, you’ll only be able to commit to 15% or 20%. Don’t be discouraged – that’s an excellent start if you’ve never been a saver in the past.

But as you move forward, you’ll need to increase the percentage. For example, you might start by saving 20% of your income. But you can double that percentage by increasing it by 2% each month for 10 months. That will get you to 40%, which may work for you.

If it won’t, commit to continued, gradual increases in savings, even if you have to move them into Year 2.

You should know that anyone who’s committed to a high savings level has found that it gets easier over time. That’s why it’s so important to start in the first year.

Year 2: Focus on Increasing Your Income

There are two ways you can do this: increase your job income or create additional sources of income.

Let’s look at the benefit of each.

- Increase Your Job Income: Early retirement shouldn’t mean abandoning your career plans. By continuing to move forward on your job, higher income should follow. That will provide the extra funds to save even more money. But there’s a second purpose for building up your career. If for any reason you may need to rely on a source of earned income when you retire, returning to your current career can be the easiest and most profitable way to make it happen. Most likely, you’ll be able to work in some reduced capacity, like part-time, remote work, contract, or freelancing within your industry, or even with your current employer. Continuing to increase your income on your job will also help if you find it will take longer than 10 years to reach your retirement goal.

- Create Additional Sources of Income: What I’m talking about here is creating a side hustle to go along with your full-time job. Not only will this generate additional income while you’re preparing for retirement, but it can also provide a valuable post-retirement income source. That would keep you from needing to go back to your current career to earn additional income. One of the best ways to create a side hustle is by making money online. It will not only enable you to make money no matter where you choose to live after retirement, but it holds the potential to make a lot of money. I’ve managed to create seven different income sources using this method. You can do something similar. Begin building a side hustle in Year 2, and you’ll have plenty of extra income when retirement arrives.

Year 3: Focus On Increasing ROI on Your Savings

By Year 3 you should be committing to learning all you can about investing. The more you know, the higher your investment returns will be. It will not only enable you to build your retirement portfolio faster, but it can also provide higher returns when you finally retire.

There are ways you can increase your returns, largely by moving into different investment platforms.

For example, if you want to dramatically increase your fixed-income earnings, investing at least some of your bond portfolio in a Lending Club can increase your interest income dramatically. Many investors are reporting returns of 7% to 10% per year.

You may also want to allocate part of your stock portfolio toward some type of real estate investing. That will not only provide high returns, but it will also diversify your portfolio in years when stocks are not performing well. Fundrise can provide returns similar to stocks, and sometimes higher. Check out the many different ways you can invest in real estate to improve your return on investment.

If you’re not having much luck with investing, or you don’t have a serious commitment to it, look into investing through a robo-advisor. Those are automated, online investment platforms that provide full portfolio management for a very low fee. That includes building your portfolio, rebalancing it as necessary, reinvesting dividends, and even minimizing your investment-related taxes.

A robo-advisor like Personal Capital. They charge a higher fee, at 0.89%, but also provide financial planning advice, as well as regular access to live investment advisors.

Year 4: Focus on Reducing Your Spending

Cutting your spending is a strategy that needs to be implemented in Year 1. But those reductions will need to become progressive as each year goes by. And it’ll be even more important as your income grows, since there’s always a temptation to spend more as you earn more. That process even has a name – lifestyle inflation. You’ll need to avoid it.

The Purpose of Reducing Spending Is Twofold:

- To Free Up More Money for Savings

- To Lower Your Cost of Living in Anticipation of Retirement

Both are equally important. But the second part may be even more so. That’s because early retirement almost certainly requires you to change lifelong spending patterns.

For example, if you’ve been used to living in a large home, driving a late-model car, and taking expensive vacations, it may take you several years to unwind those patterns. Put another way, you’ll need to find less expensive ways to create an enjoyable life. And you’ll need to have that well underway before you finally retire. Unfortunately, retirement and an opulent lifestyle are incompatible.

Focus on ways you can reduce your spending. You’ve probably already guessed that involves a lot more than clipping coupons and cutting your cable TV subscription. In fact, it may require either cutting some very large expenses – like your housing and transportation – or reducing or eliminating dozens of smaller expenses.

There will be tough choices to be made. After all, cutting spending is something like going on a money diet. You’ll do well to think about your ultimate objective – early retirement – to help you embrace the short-term sacrifice.

Ultimately, retirement is about lowering your living expenses to a point where you can live comfortably without working. You may need to remind yourself of that on a regular basis.

Year 5 – 10: Assess and Plan Your Path to Retirement

At this point, you’re moving into the second half of your decade-long early retirement preparation. Generally speaking, you’ll want to concentrate mainly on staying the course. But at the same time, you’ll want to look for ways to increase savings, income and return on investment, and reduce spending.

You may not need to do anything dramatic in those areas at this point. But you should be alert to any ideas or strategies that can improve your performance in each. Small improvements in multiple strategies can dramatically speed your progress. That should be your goal at this point.

But perhaps most important will be guarding against complacency. By now, your overall financial situation will have already improved substantially. This is not the time to take a break. Keep pressing forward until you reach the point where you can finally retire.

Final Thoughts

Why am I stressing the importance of commitment to your early retirement goal? It’s easier than you think to get distracted, especially when you’re making a major change in your life. But while early retirement is certainly possible, it’s not easy. You’ll need to maintain laser beam focus to reach the goal in 10 years.

It will help you to realize the many options that will be open to you once your early retirement goal. Free from needing to make a living, you’ll have the choice to spend your time enjoying your life more, or pursuing opportunities that may even have the potential to make you wealthy.

It’s the kind of thing that happens once financial stress is gone from your life. But before you reach that point, you’ll need to be fully committed to getting there.