If you’ve ever shopped for any kind of insurance policy (and I’m sure you have), you know there are thousands of options out there.

When you’re shopping around for insurance coverage, regardless of what type of plan you’re looking for, it’s vital you find a reputable company.

You need a carrier who is going to stand the test of time and has a reputation for paying out their policies promptly.

To help you on this journey of finding the perfect insurance provider, we are doing the dirty work.

If you haven’t heard of Illinois Mutual, that’s okay.

We are going to give you all the information you need about the company to make an educated decision.

Table of Contents

History of Illinois Mutual Life Insurance Company

As you can probably guess, the company was founded in Illinois.

More specifically, they were established in Peoria, Illinois in 1910.

After over 100 years, they are still headquartered in Peoria, Illinois.

Over the past 100 years, they’ve experienced a lot of growth. They’ve grown from the small Illinois insurance company they started as, into a company with over 1,000 independent agents.

In 2023, you can expect the same life insurance policies and types of rates from Illinois Mutual as last year, which is a good thing.

Ratings and Finances

One way of determining the quality of a company is by looking at ratings from outside ratings.

When you’re talking insurance, the biggest third-party companies are A.M. Best, Moody’s, and the BBB.

In 2016, Illinois Mutual was upgraded to an A-, or excellent, rating from A.M. Best.

The BBB, has an A+ rating and has been BBB-accredited since 1943. Just like in school, an A+ is the best possible rating. If you were worried about the financial security of Illinois, fear no more.

Illinois is no small fish.

They had over $1,000,000,000 in total assets in 2016. One thing to be aware of is the states Illinois Mutual can service. Unlike other insurance carriers, they aren’t licensed in every state.

They cannot sell any insurance in New York, D.C., Alaska, Montana, or California, but the company does have over 18,000 independent insurance agents across the country.

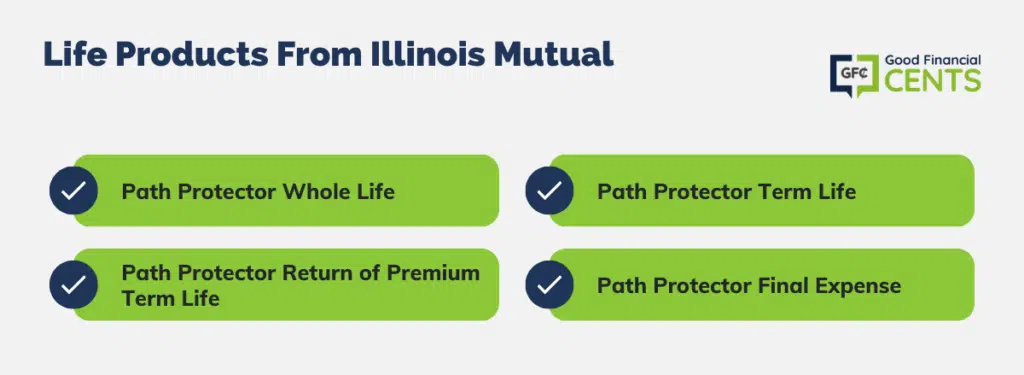

Life Products From Illinois Mutual

Let’s start by outlining their life insurance policies. As a company, they started with life insurance plans, so we are going to start with their bread and butter.

They have four different life insurance plans to choose from:

- Path Protector Whole Life

- Path Protector Term Life

- Path Protector Return of Premium Term Life

- Path Protector Final Expense

To help you make the best decision, we are going to detail each of these options. You want to ensure your family will have the life insurance protection they need.

Path Protector Whole Life

Illinois whole life insurance policy is similar to most other companies’ plans.

It is effective for as long as you pay the premiums, or until you reach 121 years old. They guarantee your premiums are never going to go up, and they also promise you won’t ever lose the death benefit coverage.

As with most whole life plans, this policy builds cash value.

The money grows tax-deferred. You can use this money to pay for emergency expenses.

If you take out a loan on the cash value, that’s going to eat into the insurance payout.

Path Protector Term Life

If you don’t want whole life coverage, you can buy their term insurance policy. These plans are available in a variety of lengths: 10, 15, 20, or 30 years.

Path Protector is a great choice for anyone who wants cheap coverage. You can buy a plan that fits your needs at an affordable price.

One of the advantages of buying a term plan through Illinois Mutual is you can convert your term policy to a whole life insurance plan without having to prove insurability.

They offer a few riders you can add to your policy. They have a child insurance rider, a disability waiver of premium rider, and a terminal illness accelerated death benefit rider.

Path Protector Return of Premium Term Life

This return of premium term life insurance policy offers much less protection than the standard term insurance plan. The ROP policy can give you anywhere from $25,000 – $250,000 in coverage.

What makes these plans different is if it expire, then you’ll get 100% of the premiums refunded back to you.

One thing to note, if you add riders to the policy, you won’t be refunded the amount for the additional coverage, just the main policy.

Path Protector Final Expense

Final expense plans (sometimes called burial insurance policies) are designed to cover any of the small bills and expenses your loved ones would have to pay. These plans are much lower than traditional plans.

These are a great option for an older applicant who no longer has a mortgage or massive debts, but wants to protect their loved ones against having to pay medical bills or funeral costs.

Disability Insurance From Illinois Mutual

Illinois not only wants to offer you life insurance coverage, but it also wants to protect your salary.

If something awful were to happen to you while you were off the job, you could struggle to pay any monthly bills, like mortgage or food and Worker’s Compensation won’t help.

The Business Expenses Power policy is geared towards business owners who are looking to protect their business in case of a disability.

It’s an excellent option, but we are going to be focusing on their traditional plan.

Their Personal PayCheck Power plan can give you long-term disability insurance coverage.

The plan is available to anyone from the ages of 18 – 60 and is renewable until age 65. The plan has benefit lengths of anywhere from 67 months to 10 years.

Worksite Insurance

Aside from disability insurance and life insurance, Illinois Mutual also sells worksite insurance.

These are voluntary benefits that a business owner can offer to his/her employees.

They have several benefits they sell:

- Accident Insurance

- Critical Illness Insurance

- Short-Term Disability Insurance

- Worksite Term Insurance

- Voluntary Short-Term Disability

If you’re a business owner, these can be excellent options to give your employees. Each of these can give your employees the protection they need for peace of mind.

Just like with any other insurance company, there are pros and cons to Illinois Mutual.

One of the benefits is their rates for both life insurance and disability insurance are competitive with the other companies with similar plans.

They have over a thousand independent insurance agents, but they can only sell in 46 states.

Compared to the other heavy hitters out there, this is extremely behind the curve. If you live in one of the states where they can’t sell, you’re out of luck.

How and Where to Get Insurance

Regardless if you’re looking for life insurance or disability insurance, it’s important you find the perfect plan for you and your family.

Because every company is different, it’s important you do some bargain hunting before you buy a plan.

Shopping around before you make the decision can save you hundreds of dollars every year on your plan.

Luckily, we’ve spent the time to do all of the research for you. If you’re looking for the best carrier, feel free to look at our other insurance company reviews.

The Bottom Line – Illinois Mutual Life Insurance Review

Illinois Mutual Life Insurance Company, with a history dating back to 1910, has evolved into a reputable provider offering various insurance options.

They offer comprehensive life insurance plans, including whole life, term life, return of premium term life, and final expense options. Their disability insurance plans provide additional financial security, and they also offer worksite insurance for businesses.

The company boasts strong financial ratings and a long-standing BBB accreditation. Pros include competitive rates and flexible coverage options.

However, their limited state reach, serving only 46 states, may be a drawback for potential customers residing outside their service areas. Conducting thorough research and comparing options remains essential in finding the ideal insurance provider for your needs.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Illinois Mutual Life Insurance Review

Product Name: Illinois Mutual Life Insurance

Product Description: Illinois Mutual Life Insurance offers a diverse range of insurance products, including life insurance, disability insurance, and worksite insurance. With over a century of history and strong financial ratings, they provide policyholders with peace of mind and financial security.

Summary of Illinois Mutual Life Insurance

Illinois Mutual Life Insurance, established in 1910, has grown into a reputable insurance provider offering a variety of coverage options. Their life insurance portfolio includes whole life, term life, return of premium term life, and final expense plans, catering to diverse needs. Additionally, they offer disability insurance with flexible options for individuals and business owners. The company’s worksite insurance plans, including accident, critical illness, and short-term disability coverage, provide added protection. While Illinois Mutual boasts competitive rates and financial stability, its limited state reach may be a drawback for potential customers residing outside their service areas.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Diverse Insurance Portfolio

- Competitive Rates

- Financial Stability

Cons

- Limited State Availability

- Rate Variability

- Geographic Restriction

Hi,

I want individual long term disability insurance. How do I get it?

Hi Monica – Check with providers in your area, and look for referrals from people you trust. Specific companies offering coverage vary by state, as do their rates.