Remember the good old days of whistling while you work in regard to your 401(k)? Your company used to have a very nice match to your 401(k). Your balance was at an all-time high and retirement seemed like just over the horizon.

Then 2008 came along and the whistling turned into more of a whimper. Don’t worry, I was whimpering, too. For those that are 59 1/2 and still working, I might have a reason for you to whistle again. The reason behind it is called the 401(k) in-service distribution.

I took a call from a client recently whose employer was getting ready to switch 401(k) providers again (3 times in the last 5 years) and was frustrated with the new investment options.

He is over 59 1/2 and had heard that he might be able to rollover his 401(k) to an IRA and also continue to fund his 401(k). I was excited to share with him that he, in fact, could do this and that the procedure was called an in-service distribution.

Table of Contents

Rules on 401(k) In-Service Distribution

1. First things first, you HAVE to be 59 1/2. No matter how much you dislike your current plan and you want to withdraw it all, it’s not an option until then.

2. This doesn’t just apply to 401(k)s. Any type of retirement plan will work, too. This includes 403b, 457, and pensions, too.

3. Be sure to rollover the money to an IRA if you don’t need it. By doing a 401(k) in-service withdrawal you will be taxed.

Reasons to Do a 401(k) In-Service Distribution

An in-service distribution allows you to rollover your vested balance from your profit-sharing plan to an IRA. You will have to determine first if you are eligible. Some plans may restrict from doing so.

Here are some reasons why you might want to:

- Control: Who doesn’t like control? With an IRA, you are the account owner and have more control over your assets, free from the restrictions your employer-sponsored plan can impose.

- Diversification: Many employer-sponsored plans offer limited investment options. In contrast, most IRAs typically provide a wider range of investment choices across virtually every asset class. This flexibility can help you better diversify your retirement assets to meet your individual investment goals.

- Beneficiary Options: Typically, IRAs allow non-spouse beneficiaries to “stretch” an inherited IRA over their lifetimes. This type of beneficiary distribution option is not available in most employer-sponsored plans, which may limit distribution choices for your beneficiaries.

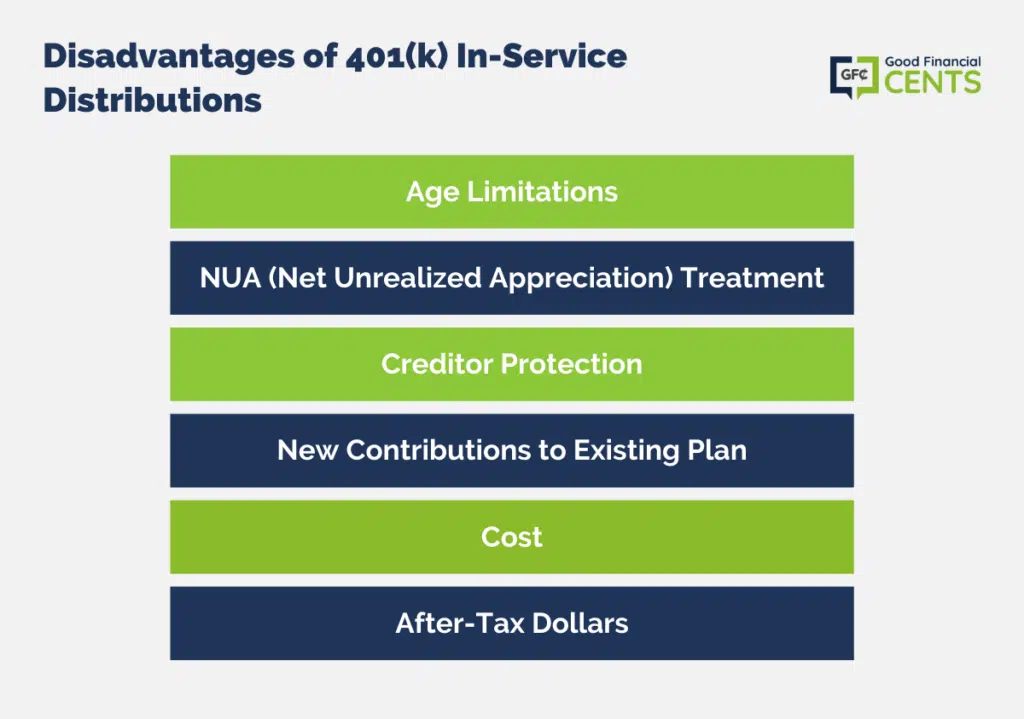

Disadvantages of 401(k) In-Service Distributions

With every advantage, there may be disadvantages. Please consider:

- Age Limitations: In qualified plans, the age 55 rule allows participants who stop working at age 55 or older to take distributions without the 10% IRS premature distribution penalty. In an IRA, you may not take distributions until age 59½.

For this reason, if you plan to retire early, you may want to preserve penalty-free access to your retirement funds by not moving all of your 401(k) assets to an IRA before retirement.

- NUA: Net Unrealized Appreciation (NUA) tax treatment is not an option for distributions from IRAs. Therefore, if you hold highly appreciated company stock in your employer-sponsored plan, the rolling of that stock to an IRA eliminates any ability you may have to take advantage of NUA tax treatment.

- Creditor Protection: While IRAs now have federal bankruptcy protection, other IRA creditor protection is still determined by state laws. Qualified plan assets continue to have broad federal creditor protection.

- New Contributions to Your Existing Plan: Taking an in-service distribution may affect your ability to contribute to your employer-sponsored plan. Be sure to consult with your plan administrator before implementing this. Learn more here about Roth IRA contribution limits.

- Cost: Fees related to having your own IRA could be more costly than the investment options inside the 401(k).

- After-Tax Dollars: After-tax dollars are generally segregated in a qualified plan, and can often be distributed separately. However, after-tax dollars complicate things if rolled into an IRA.

If you move after-tax money into an IRA, that money becomes part of the non-deductible “basis” of the IRA and will not be separately accessible.

To avoid paying tax again on your IRA “basis” when you take an IRA distribution, you must maintain careful records of the “basis” in your IRAs. This can become more of an issue in regards to doing a Roth IRA Conversion.

Where to Rollover

If you do not have a brokerage account already in place. These are the top providers to set up a rollover to an IRA:

Note:

The Bottom Line – In-Service Distribution- 401(k) Rollover While You’re Still Working

The concept of 401(k) in-service distribution provides an avenue for individuals aged 59 1/2 and above to potentially enhance control, diversification, and beneficiary options regarding their retirement funds by rolling over into an IRA while still contributing to their 401(k).

However, the choice is accompanied by certain drawbacks like age limitations, potential cost increments, and complex tax implications, especially regarding after-tax dollars.

Before proceeding with such a decision, it’s imperative to thoroughly evaluate the advantages against the disadvantages and possibly consult with a financial advisor to ascertain the most beneficial route tailored to individual retirement goals and circumstances.

I’m 61 years, I have 401k I would like to avail an in service withdrawal distribution from my 401k. Am I being tax here?

Can I still continue to distribute to my 401k? Also I have a loan that I am almost done.

I need money for emergency purposes.

Please advise. Thanks Etfr

Need reply please

Hi Elmar – You’ll have to see if your employer and plan will permit the in-service withdrawal. If they do, you’ll have to pay tax on the money. But since you’re over 59.5 you won’t have to pay the 10% early withdrawal penalty. Since you’re still employed and want to contribute, maybe you should look into taking another 401k loan. It won’t have any tax consequences.

I am availing an in-service distribution recommended by my provider. How much am I allowed out of my plan and how much tax am over 59 1/2 yo

Also I have an existing loan balance of $3000

Hi Grace – Since these plans have so many variations, the best thing I could recommend is discussing it with the plan administrator. That way you can get specific answers based on your actual situation.

Am I to understand that even if my employer allowed in-service 401(k) rollover to an IRA, only those older than 59 1/2 could do it? What does the Government care as long as I don’t take possession of the money?

What tax law allows for in-service distributions?

I found that the rules related to Inservice Withdrawals to be quite complex. I have a small business with a 401k plan and have used Steidle Pension Solutions to handle our administration. They are great (and affordable)! After detecting a withdrawal that was handled improperly by a previous TPA, I contacted Steidle to find out what I should do. They walked me through the voluntary compliance program and got the plan running properly again. I appreciate their hard work and friendly assistance with all of our plan needs.

Hi Jeff, good article. Just one clarification — The Minimum age is 59 1/2 years, but still qualified plans allow in-service distributions after 55. Can you please elaborate on that?

I am doing In-Service Withdrawals of my After Tax 401k contributions directly into my Roth IRA for the Basis and Traditional IRA for the gains. The question is: Once that money is in my Roth IRA, are all the gains on that money tax free?

Thanks for your advice. DJ

I hope so……..

I am doing the same thing…. but with a 403b plan !! (if they allow it)

So how about getting an answer here !!!! ????