Life insurance coverage is an essential financial tool.

The proceeds from these policies can often make the difference between loved ones dealing with long-term financial hardship or being able to move forward with paying off debts or paying their everyday living expenses in the case of the unexpected.

When considering the best life insurance policy for you, it is important to determine the type and the amount of coverage that you require, as you don’t want those you care about to be underinsured.

An equally important part of the equation is the life insurance carrier from which you purchase your plan.

Something to consider as well is whether your prospective insurance company provides key person insurance.

It is often overlooked or not considered when planning for the future, but it can be the difference between a business making it or not upon the death or health of any employee whose knowledge, work, or overall contribution is considered uniquely valuable to the company.

Take the time and see if it’s something you need to get for your business or firm.

You will want to be sure that the carrier is strong and stable from a financial standpoint. Another key criterion is that the carrier has a good reputation for paying out its claims. One company that meets these factors is Aflac.

Table of Contents

The History of Aflac Life Insurance Company

Aflac (American Family Life Insurance Company) began offering insurance coverage to its customers more than 60 years ago.

The coverage that this company is considered to be “voluntary” in that the policies can supplement other insurance coverage that an individual may already have.

The founders of Aflac are three brothers – John, Paul, and Bill Amos. In starting this company, the brothers saw a need for financial protection if a medical need occurred. Aflac had its beginning in Columbus, Georgia, and it started with just 16 employees and 60 sales agents.

In just the first year, Aflac had more than 6,400 policyholders and roughly $388,000 in total assets. Over time, the company grew and expanded its list of coverage offerings to its policyholders.

One way that the company grew exponentially was by offering its products to the workplace. Here, large numbers of employees of a company could sign up for protection at one time. As the company grew, it started to offer its products internationally, and in 1974, the products were offered in Japan.

Within just one year of this occurrence, Aflac has written roughly $25 million in insurance premiums. During that same year, the company also started trading on the New York Stock Exchange.

The 1980s were a time of substantial growth for Aflac – and in 1982, the company had more than $1 billion in assets. In the decade of the 1990s, the company began its now-famous advertising campaign, which features the Aflac duck.

In the mid-1990s, the company also introduced a SmartApp. This allowed agents to issue insurance business electronically – which sped up the process a great deal and allowed customers to be covered much more quickly as well.

Due in large part to its innovative advertising strategy, 9 out of 10 people recognize the Aflac name and the brand. Ever since its beginning back in 1955, Aflac has put the customer first. It does so primarily by paying out its policyholder claims in a timely and efficient manner.

Today, Aflac – a Fortune 500 company – has more than 50 million policyholders. In addition to just offering protection products, Aflac is also involved in the communities in which it serves.

For example, in 2011, the company contributed more than $1 million to the Red Cross for tsunami relief in Japan.

And, in 2012, the company was rated number 69 on Newsweek’s “Green Rankings” of the largest 500 companies. By the year 2013, Aflac had appeared on Fortune magazine’s list of the World’s Most Admired Companies for the 13th time.

The company continues to grow and prosper, due in large part to helping its customers protect against the loss of income and assets, as well as helping them to pay supplemental medical expenses. Aflac has a wide reach in terms of attracting potential customers.

Its key distribution channels include individuals at the work site, in retail locations, and in their homes. Presently, Aflac is the number one provider of voluntary insurance at the worksite in the U.S.

Aflac’s Insurer Ratings and Better Business Bureau Grade

Aflac has very high life insurance company ratings that are provided by the insurer rating agencies. These ratings are indicative of the company’s overall financial strength, as well as its timely benefit payout to the company’s policyholders.

These ratings include the following:

- A+ from A.M. Best

- A+ from Standard and Poor’s

- As3 from Moody’s

In addition, Aflac is also an accredited member of the Better Business Bureau (BBB). It has been a member of the BBB since January 1, 1958. Also, the company has been given a grade of A+ from the Better Business Bureau (on an overall grade scale of A+ to F).

This puts them on par with other top life insurance companies like Transamerica or Banner.

Throughout the past three years, Aflac has closed a total of 497 complaints through the BBB. Of these 497 complaints, 357 had to do with problems with the company’s products or services.

Another 96 of these complaints were concerning billing or collections issues, 25 had to do with advertising or sales issues, 11 were about delivery issues, and eight were in regard to guarantee/warranty issues.

There are also 20 customer reviews that have been posted on the Better Business Bureau’s website in regard to Aflac.

Life Insurance Products Offered by Aflac

Aflac offers several options for life insurance coverage. These include both term and permanent protection. With term life insurance, a policyholder is covered with death benefit protection only, without any type of cash value or savings build-up.

Term life insurance is purchased for a certain period, or “term,” such as ten years, 15 years, 20 years, or even 30 years, depending on the policyholder’s needs.

Permanent life insurance coverage offers both death benefit protection, as well as cash value, build. With a permanent life insurance policy, the coverage can last throughout the policyholder’s life, provided that the premiums remain paid.

This type of life insurance protection will also allow tax-deferred growth of the funds that are inside of the cash value component. This means that there are no taxes due on the growth of these funds unless or until they are withdrawn.

A permanent life insurance policyholder may be able to borrow or withdraw these funds for any reason at all – including the payoff of debt, the supplementing of retirement income, or the assurance that a child or a grandchild will be able to pay for their college expenses.

There are no medical questions to be answered on the Aflac life insurance policies. This means that even those individuals who may have certain health conditions can still qualify for life insurance coverage.

The plans offered by Aflac are also portable. This means that if an individual purchases a plan as a part of his or her employee benefits package if they leave the company, they may still take their life insurance coverage with them.

Aflac also offers juvenile life insurance coverage. With these plans, a child may be protected by providing insurability as an adult, as well as by providing them with a jump-start on the road to financial independence.

The company also offers AD&D coverage (accidental death). With the Aflac accidental death coverage, if the insured passes away due to injuries that are sustained from a covered accident, then an additional amount of proceeds will be paid out to his or her named beneficiary.

On the insurance plans that are offered through employers by Aflac, there is typically no direct cost to the company. Rather, employees can pay for their coverage via direct payment of the premiums through their weekly paychecks.

Aflac offers a life insurance calculator directly on its website. This can help an individual with determining just how much life insurance coverage they may require based on their specific situation.

Other Products Offered

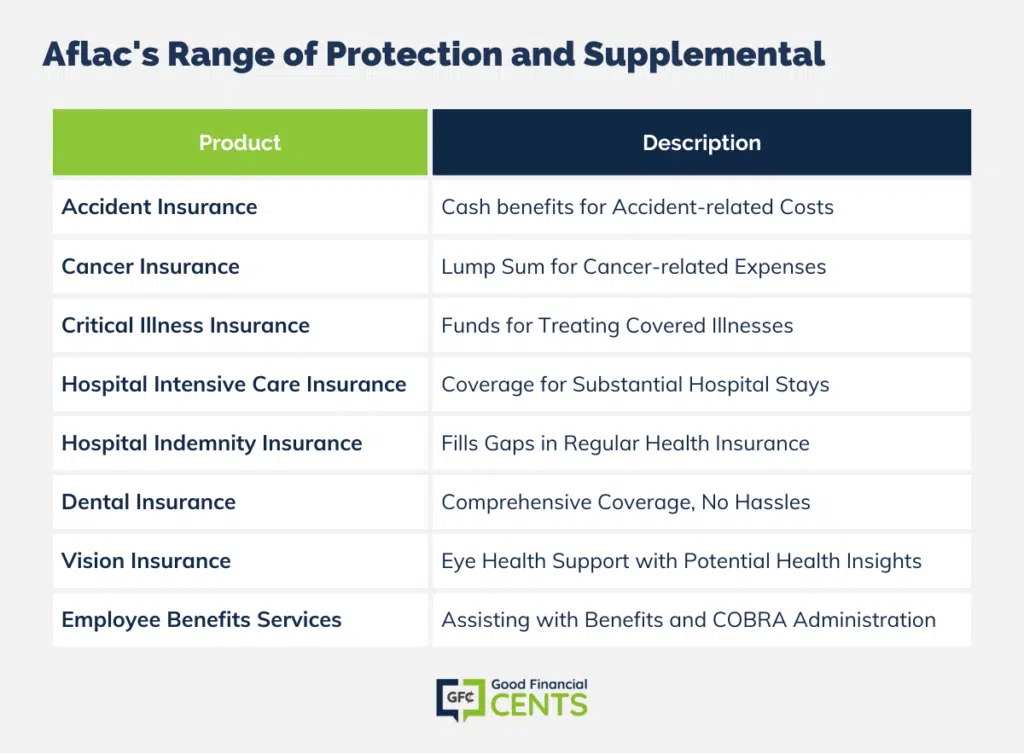

In addition to just life insurance coverage, Aflac offers a wide range of other protection and supplemental products.

These include the following:

- Accident insurance – The accident insurance plan via Aflac offers cash benefits to help provide financial support during the various stages of accident care, as well as recovery.

These proceeds may be used by the policyholder to help with paying for emergency treatment, or for treatment-related lodging and transportation.

- Cancer insurance – The cancer insurance coverage that is offered via Aflac can help to provide a lump sum of proceeds that may be used for a wide variety of needs, such as treatment, living expenses, or uninsured medical procedures.

- Critical illness insurance – Critical illness insurance protection can help to provide funds for helping with the cost of treatment of a covered illness. Having funds available can provide the peace of mind that may be required to help an individual recover.

- Hospital intensive care insurance – Charges from a hospital stay can often be substantial – and in some cases, these may or may not be covered through a regular health insurance policy. With that in mind, a supplemental hospital insurance plan through Aflac can help.

With Aflac, these funds can be made available very quickly, as the company has a one-day payment of claims.

- Hospital indemnity insurance – With hospital indemnity insurance, policyholders can also be assured that uncovered expenses from their regular health insurance can be fully or partially taken care of.

- Dental insurance – The dental insurance coverage that is offered through Aflac provides a wide variety of benefits, with no networks, deductibles, or pre-certification requirements to deal with. Just go through your local dentist and have your insurance information with you.

- Vision insurance – Regular eye exams can do much more than just help with correcting one’s vision. These can also help to point out other health-related issues, such as high blood pressure or cholesterol, diabetes, or even a brain tumor.

Having this coverage can be well worth the premium cost.

Also, Aflac also helps its clients/employers with setting up benefits, such as through cafeteria plans. COBRA administration is also available through Aflac.

How to Get the Best Quotes on Life Insurance Coverage

When searching for life insurance coverage, it is important to work with an independent company that can help you in finding the very best rates. An independent company or agency will not be associated with just one single insurance carrier, but rather with multiple carriers.

Because of this, you will be much better able to compare life insurance policies, benefits, and premium rates – and from there you can determine which of these will be the best for you and your specific needs.

If you are ready to begin the process of finding the best life insurance plan, then we can help you. We work with many of the top-rated life insurance carriers in the marketplace today, and we will assist you with obtaining all of the details that you require for making an informed purchase decision.

We can do so for you very quickly, easily, and conveniently – all from your home computer, and without the need to meet in person with a life insurance agent. When you are ready to begin, just fill out the quote form on the side of this page.

We understand that the purchase of life insurance can be somewhat overwhelming. There are a number of variables that you need to be aware of, and you want to be sure that you are choosing the proper type and amount of insurance coverage.

The good news is that today, there are many options that are open to you. We will assist you with finding the one that best fits your specific coverage needs. So, contact us today – we’re here to help.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Aflac Life Review

Product Name: Aflac Life

Product Description: Aflac Life is a segment of Aflac Inc., a leading supplemental insurance provider best recognized for its duck mascot and its focus on providing policies that cover out-of-pocket expenses not covered by primary health insurance. Established in 1955 and headquartered in Columbus, Georgia, Aflac Life offers a range of insurance products including life, accident, and critical illness coverage. With its mission to help provide financial protection and peace of mind, Aflac has become a household name in the insurance realm.

Summary of Aflac Life

Founded in 1955, Aflac Life has carved a niche for itself in the insurance industry by concentrating on supplemental insurance products. While its offerings include life insurance, Aflac is particularly known for its accident and critical illness policies that are designed to complement primary health insurance by covering additional expenses such as deductibles, copayments, and other non-covered costs. Aflac’s distinctive model revolves around its fast claims process, often touting that many claims get processed within a day. The company’s broad network and presence, both in the U.S. and Japan, underscore its commitment to safeguarding clients against unforeseen health and life challenges. With its signature duck mascot and a focus on straightforward, easy-to-understand policies, Aflac Life has entrenched itself as a trusted partner for millions.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Specialized Coverage: Aflac’s emphasis on supplemental insurance ensures individuals get support for expenses not typically covered by standard health insurance.

- Swift Claims Process: Aflac prides itself on quick claim processing, often within a day, providing timely financial relief to policyholders.

- Clear Communication: With its easy-to-understand policy descriptions and transparent terms, Aflac prioritizes clear communication with its customers.

- Strong Brand Recognition: The iconic Aflac duck and the company’s marketing campaigns have cemented its status as a familiar and reliable brand in the insurance world.

Cons

- Niche Focus: Aflac’s specialization in supplemental insurance means it might not be the go-to choice for more traditional or comprehensive insurance needs.

- Plan Limitations: Some customers might find certain plan specifics or coverage limits restrictive based on their individual needs.

- Price Variability: Depending on individual circumstances and the chosen policy, some clients might find Aflac’s premiums less competitive than other insurers.