We do not do a lot of business with Equitable Holdings, Inc., but the company has always performed well when we have worked with them.

This Equitable Holdings, Inc. company review was one of our more interesting because, though they were an honorable mention for our best life insurance company ratings, I really had not learned that much about them until now.

When people go to purchase a life insurance policy, there could be any number of different reasons why.

For example, it could be for either personal or business purposes, meaning that the beneficiary of the policy may be a family member, a loved one, or even a charitable organization.

But regardless of what the coverage is for, there are still certain factors that you will need to keep in mind as you go through the life insurance purchasing process.

One of these criteria is the amount of protection that you are obtaining. This is because you will want to ensure that those who receive the life insurance proceeds will have enough funds to do what the coverage was intended for.

Yet another key item that people may not be aware of when buying a life insurance policy – but should be – is the importance of the insurance company when they are obtaining the coverage.

This is because the insurer should ideally be stable and strong financially, and it should also have a good and positive reputation for paying out claims to its policyholders.

That way, you will have more assurance that if and when a claim may need to be filed, your policy beneficiary (or beneficiaries) will be receiving their promised funds.

One company that has great respect in this area is Equitable Holdings, Inc.

The History of Equitable Holdings Inc.

Equitable has been in the business of insuring its customers ever since the year 1859. This is when its founder, Henry Hyde – who was already in the insurance industry – left his current position at the Mutual Life Insurance Company of New York in order to begin his company.

He initially named the firm Equitable Life Assurance Society of America.

By the tenth year of its operation, Equitable Life Assurance Society of America had more new business than any other company worldwide.

As Equitable continued to grow, it built a new headquarters in 1870 – a skyscraper that included steam elevators. And, after an expansion just nine years later, the company’s building became the tallest building in the world at that time.

In the late 1800’s, Equitable marketed the very first joint and survivor annuity. The company also began the practice of paying out life insurance death claims immediately. In addition, the insurer appointed its very first female agency manager.

Throughout the years, the company continued to grow substantially. In 1992, it converted from a mutual to a stock company.

It also became a member of the Global AXA Group – and, by 2015, it had celebrated its 7th consecutive year as the best insurance name around the globe (as measured by the Interbrand annual report).

Equitable Holdings Inc. Review

Equitable offers a wide range of products and services to its customers. These include insurance and investments to help with both growing and protecting wealth. The company also offers employee benefit plans and other financial services for businesses.

Overall, Equitable employs approximately 166,000 people in 64 countries, and worldwide the company has 103 million total customers. This large institution is extremely active in the communities through which it works, as well as in providing scholarships for college students.

For example, via the Equitable Achievement program, the company assists both students and parents to take the next step towards college, as well as helps educators to take steps towards success.

Also, through the Equitable Foundation, the company directs philanthropic and volunteer activities. The company also has a strong commitment to Corporate Responsibility.

Equitable is also known for being one of the world’s Top 10 insurers, according to the Insurance Journal. This ranking is based on the company’s non-banking assets.

Financial Strength and Ratings

Equitable is considered to be an extremely strong company from a financial standpoint. It also pays out its insurance claims quickly and consistently to its policyholders. For these reasons and more, the insurer has been provided with high ratings from different agencies.

These include the following (as of early and mid-2023):

- A from A.M. Best Company (Superior). This is the third highest out of a total of 16 possible ratings.

- A1 from Moody’s. (Excellent). This is the third highest out of a total of 21 possible ratings.

- A+ from Standard & Poor’s. (Strong). this is the fifth highest out of a total of 21 possible ratings.

Also, Equitable has been an approved business of the Better Business Bureau (BBB) since 1937. The company has been provided with a grade of A+ from the BBB (on a grade scale of A+ to F).

Throughout the previous 3 years, Equitable has closed a total of 37 objections through the Better Business Bureau (13 of these were closed during the preceding 12 months).

Of these 37 complaints, 20 had to do with the company’s products/services, four had to do with the company’s advertising/sales, and 3 had to do with the company’s billing/collection issues.

Life Insurance Products Offered by Equitable

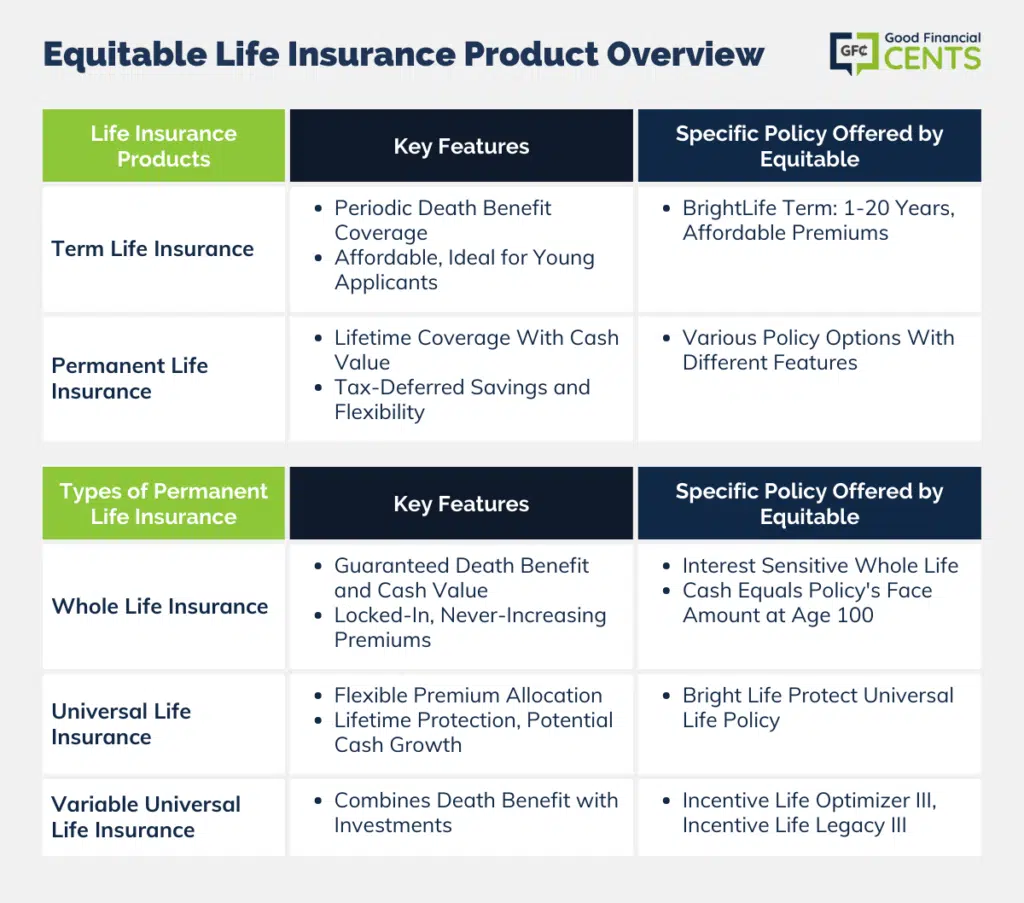

Equitable offers a wide variety of different life insurance coverage products to choose from. This can allow its customers to better “customize” their policies to more closely fit their coverage needs. Life insurance products that are offered include both term and permanent options.

Term Life Insurance Coverage

With a term life insurance policy, a death benefit is offered for a specific period of time.

In most cases, the premium will be level for that time frame, and after the time has expired, the insured will need to re-apply for coverage if he or she still requires protection – unless the policy provides the ability to convert over to a permanent policy.

Because term life is considered to be the most basic form of life insurance – and it does not provide cash value build-up – it can often be purchased very affordably. This is especially the case if the applicant is younger and in relatively good health at the time of application.

Equitable offers the BrightLife Term product. This offers affordable premiums, which are guaranteed to stay level for time periods of 1, 10, 15, or 20 years, depending on which policy is chosen.

Once the time frame has elapsed, the premium amount will increase each year. In order to qualify for a BrightLife term insurance policy, an applicant will only need to answer eight simple questions on the application for coverage.

The policies can be very large and are available for more than $1 million of life insurance.

Permanent Life Insurance Coverage

With a permanent life insurance policy, there will be both death benefit protection and cash value. As long as the premium is paid, a permanent life insurance policy will typically remain in force for the remainder of the insured’s lifetime.

This is the case regardless of his or her increasing age, and whether he or she contracts an adverse health condition.

Permanent life insurance also includes a cash value or investment component in the policy. Here, the policyholder is permitted to accumulate a savings or investment fund on the side on a tax-deferred basis.

This means that there is no tax due on the gain in the account unless or until the funds are withdrawn.

The funds in this account can be withdrawn for any reason. Likewise, they may be borrowed, usually at a very favorable interest rate. This can be done for any reason that the policyholder sees fit.

There are several types of permanent life insurance that are offered through Equitable. These include:

Whole Life Insurance

Whole life insurance is considered to be the simplest of all of the permanent life insurance options. This is because the death benefit is guaranteed, and the cash value will grow at a set rate of interest over time. The premium amount is also locked in, never to increase.

Equitable offers Interest Sensitive Whole Life. This is a permanent policy with a guaranteed minimum cash value that increases every year and equals the policy’s face amount when the insured reaches age 100. (Although the policy account value may be enhanced by additional interest).

Universal Life Insurance

Another type of permanent life insurance policy is universal life. Here, too, the policy has both a death benefit and a cash value component.

However, these policies are more flexible because the policyholder can – within various guidelines – choose how much of the premium will go towards the death benefit, and how much will go towards the cash value.

Equitable offers the Bright Life Protect Universal Life Insurance Policy. This is a flexible premium policy that offers the opportunity for lifetime insurance protection, as well as the potential accumulation of cash value via the allocation to a select account and/or a fixed account within the policy.

Variable Universal Life Insurance

A variable universal life insurance policy is a type of permanent life insurance that combines death benefit protection with an investment opportunity.

Here, the policyholder will obtain the protection of a death benefit, and via the cash value component, they can choose various equity investments such as mutual funds. This can allow the funds to grow much more than those that are in a whole life insurance policy.

There can, however, also be more risk due to the market exposure.

Equitable offers the Incentive Life Optimizer lll variable universal life insurance policy. This offers death benefit protection, along with the potential for cash value accumulation via a customized and professionally managed investment portfolio.

There is also the Incentive Life Legacy lll variable universal life insurance policy. This policy was created more for those who are seeking affordable permanent life insurance, but who would also like to put their premium to work through market-sensitive investment options.

Other Coverage Products Available

In addition to life insurance, Equitable also provides a number of other coverage products, as well as investments and advisory services.

Just some of the other offerings provided by Equitable include the following:

- Individual Retirement Accounts (IRAs)

- Retirement Accounts – 401(k), 403(b), 457(b) Plans

- Mutual Funds

- Benefit Plans – Vision, Dental, Life Insurance, and more

How to Find the Best Life Insurance Premium Quotes on Coverage

When searching for the top life insurance premium quotes for coverage – whether it is on a policy via Equitable, Banner Life, or any other life insurer – it is typically the best course of action to work with an agency or brokerage that has access to multiple insurance carriers.

This is so that you can directly compare several different policies, benefits, and premium prices, and then you can determine which one will work perfectly for you and your specific coverage needs.

This is not only true for your purchase of life insurance but for other forms of coverage as well, such as auto insurance and health insurance, make sure to obtain more than one or two quotes so that you are getting the best rate for your needs.

We know that the buying of insurance coverage can be an important decision. With all of the various things to be conscious of – as well as the many carriers – it can be difficult to choose.

That is why it is important to have someone to walk you through the process of determining which will be the greatest for you. Reach out to us today.

The Bottom Line – Equitable Holdings, Inc. Review

Equitable Holdings, Inc. manifests as a steadfast and venerable institution in the financial and insurance sector, boasting a historical trajectory marked by innovations, robust financial health, and a steadfast commitment to policyholder assurance.

With its impressive array of life insurance products, each tailored to meet diverse needs, and a proven track record of stability and claim payout, it underscores its potency in safeguarding client interests.

Furthermore, the company is not solely financially oriented but also devoted to community and educational uplift through various programs and foundations.

Equitable’s intricate blend of legacy, financial products, and community involvement positions it as a notable entity, assuring both its financial and social impacts.

Thus, whether for personal assurance or safeguarding future generations, Equitable provides a trustworthy avenue, intertwining financial acumen with a distinguished history.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Equitable Holdings, Inc. Review

Product Name: Equitable Holdings, Inc.

Product Description: Equitable Holdings, Inc. offers a multifaceted array of financial and insurance products, ranging from various life insurance coverages to assorted investment vehicles, catering to both individual and corporate clientele. Not only does it provide foundational life insurance options such as term and permanent policies but also facilitates financial planning and wealth management through its diverse investment and retirement accounts, ensuring holistic financial management and safeguarding.

Summary

Catering to a spectrum of client needs, Equitable Holdings, Inc. ensures a comprehensive suite of offerings, extending from tailored life insurance solutions to strategic investment opportunities. The life insurance products, which span from basic term life to more complex variable universal life policies, are complemented by a wide array of investment options, encompassing annuities, IRAs, and various retirement and brokerage accounts. Moreover, Equitable demonstrates a rich history of blending financial acumen with innovative offerings, such as pioneering the first joint and survivor annuity, thus enabling it to formulate products that are not only financially sound but also adapt to the evolving market and client needs. Furthermore, it integrates community service and philanthropy into its business model, offering programs and scholarships that reflect a balance between corporate responsibility and profitable enterprise.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Historical Stability: With a lineage tracing back to 1859, Equitable brings a sense of historical stability and trust in its financial dealings.

- Diverse Offerings: Equitable provides a wide range of products, ensuring varied options to cater to the distinct financial and insurance needs of its clients.

- Corporate Responsibility: Engaging in various community and philanthropic activities reflects a commitment to social responsibility, beyond its business pursuits.

- Strong Financial Ratings: The company holds impressive ratings from multiple rating agencies, reflecting strong financial health and reliability in claim payouts.

Cons

- Complaints and Objections: In the past years, Equitable has encountered several objections and complaints, particularly concerning products/services and advertising/sales, which might raise concerns about customer satisfaction and transparency.

- Potential Complexity: The wide array of products, while advantageous to some, may be perplexing to clients who seek straightforward and simple financial solutions, especially in navigating between various life insurance and investment products.

- Market Risk: Some insurance products, like variable universal life insurance, expose clients to market risks, which might not be suitable for all, especially those seeking stable investment avenues.

- Global Focus: While its expansive global reach with 103 million customers is remarkable, it may, at times, dilute the focus from domestic market dynamics and localized customer service nuances.