Although most people don’t like to talk about it, life insurance is an important part of any financial plan. Why does it matter?

The proceeds from a life insurance policy can make the difference between your loved one continuing with their lives or struggling financially for many years in a case of the unexpected.

Life insurance benefits can be used for any number of different reasons, such as paying off debts (in turn, reducing the monthly payments), as well as for setting up an ongoing monthly income so they can continue to pay for regular living expenses.

Before moving forward with the purchase of a life insurance policy, though, it is important that you first make sure that you are getting the proper type and amount of coverage. It is also recommended that you ensure that the insurance carrier you are purchasing the coverage through is secure and stable financially and that it has a reputation for paying out its policyholders’ claims. One life insurance company that meets these criteria is the Cincinnati Life Insurance Company.

Table of Contents

- The History of Cincinnati Life Insurance Company

- Cincinnati Life Insurance Company Review

- Insurer Ratings and Better Business Bureau (BBB) Grade

- Life Insurance Coverage Offered Through Cincinnati Life Insurance Company

- Other Products and Services Offered

- How to Find the Best Life Insurance Premium Quotes with Cincinnati Life Insurance Company

- The Bottom Line – Cincinnati Life Insurance Review

The History of Cincinnati Life Insurance Company

The Cincinnati Life Insurance Company has been providing wealth enhancement and protection products to its customers ever since 1950 when four independent insurance agents got together to form the company. Their dedication and commitment to the independent insurance agency system has continued to remain the company’s focus. Thus, the mission of Cincinnati Life Insurance Company is “Everything Insurance Should Be.”

The parent company of Cincinnati Life Insurance Company, Cincinnati Financial Corporation, is a Fortune 500 company, and it is included in the 2017 Fortune 500 list of the largest U.S. companies. Cincinnati Financial Corporation works via a family of insurance and financial services subsidiaries, which includes the Cincinnati Insurance Company. This company in and of itself also has four subsidiaries, and together this insurer and its affiliates are among the top 25 property and casualty agencies in the United States. All of these companies also are known for their strong financial foundations. In turn, this can help the policyholders of these companies to meet their financial needs.

Cincinnati Life Insurance Company Review

The Cincinnati Insurance Companies has been named a recipient of the 2023 Campus Forward Award in recognition of their steadfast dedication to recruiting and hiring emerging talent, their strong focus on fostering diversity and inclusion, and their investments in supporting and retaining the upcoming generation of talent.

The parent company of Cincinnati Life Insurance Company has earned numerous awards and accolades, such as being ranked among the largest U.S. companies, according to the 2016 Fortune 500 list. It has also earned the designation of one of Forbes Most Trustworthy Companies as of May 2017.

Cincinnati Financials’ headquarters facility received a 2016 Energy Star certification, which recognized its successful efforts to save energy, reduce pollution, and increase efficiency. Other awards of note include being one of the top 75 North American public companies based on its 2015 assets and revenues and being one of Newsweek’s 2016 Top Green Companies in the U.S. concerning its environmental performance using eight key performance indicators.

Also, the Cincinnati Insurance Company earned a spot on the Forbes America’s Best Employers list in May of 2023, and a ranking as number 21 in Best’s Review of July 2022. The company is headquartered in Fairfield, Ohio.

Insurer Ratings and Better Business Bureau (BBB) Grade

Due to their strong financial figures, Cincinnati Financial Corporation and the Cincinnati Insurance Companies have earned high rankings from the insurer rating agencies. For the Cincinnati Insurance Companies, these include an A+ from A.M. Best, an A+ from Fitch, an A1 from Moody’s, and an A+ from S&P Global Ratings. About the Cincinnati Life Insurance Company, these ratings are an A from A.M. Best, an A+ from Fitch, and an A+ from S&P.

Also, while the Cincinnati Life Insurance Company is not an accredited company through the Better Business Bureau (BBB), it has been given a grade of A+ from the BBB (which is on an overall grade scale of A+ to F). Over the past 36 months, the Cincinnati Life Insurance Company has only had to close out one customer complaint through the Better Business Bureau. This was about problems with the company’s product and services.

Likewise, the Cincinnati Financial Corporation also has a grade of A+ through the Better Business Bureau, and this entity has been BBB accredited ever since January 1, 1981. Within the past three years, this financial organization has closed out a total of 14 customer complaints. Of these, 11 have focused on problems with the product and service, and another three were in relation to billing and/or collection issues.

Life Insurance Coverage Offered Through Cincinnati Life Insurance Company

The Cincinnati Life Insurance Company offers a full line of both term and permanent life insurance coverage. With term life insurance, there is death benefit protection only, with no cash value build up – which can mostly keep the premiums very affordable. These plans offer protection for the insured for a specified number of years.

Term life insurance is often deemed as being “temporary” life insurance coverage. Because of this, it can be a viable alternative for those who are seeking coverage for just a certain amount of time, as well as those who may not have a large budget for life insurance premiums. The Cincinnati Life Insurance Company offers term life insurance coverage for periods of 10, 15, 20, 25, and 30 years. The company’s LifeHorizons Termsetter and the Termsetter ROP offer various options that can provide insureds with the flexibility to build an insurance program based on their specific needs.

Cincinnati Life Insurance Company also provides several permanent life insurance plans with which to choose. With permanent life insurance, there is both a death benefit component, as well as a cash value component. The cash value in these policies is typically able to grow and compound on a tax-deferred basis, which means that there is no tax due on the growth unless or until the money is withdrawn.

The company has both whole life and universal life insurance coverage. Whole life insurance offers a set amount of death benefit, as well as fixed interest rate by which the cash value can grow. Once approved for a whole life insurance plan, the premium cannot go up – even as the insured’s age increases, and even if he or she contracts an adverse health condition.

The LifeHorizons Guaranteed Whole Life insurance can be a good alternative for those who are seeking estate conservation, business continuation, charitable giving, and other goals that can be solved with life insurance. There is also an option for those who already have certain health conditions to obtain coverage still. In many cases, those who already have a term life insurance policy through Cincinnati Life Insurance Company can convert that plan over into a whole life policy.

Cincinnati Life Insurance Company also offers universal life insurance coverage. This is also a type of life insurance protection in that it has both a death benefit and a cash value component. Universal life insurance is considered to be more flexible than whole life insurance. One reason for this is because the insured on a universal life policy can, within certain guidelines, allocate the amount of his or her premium that will go towards the death benefit and the amount that will go towards the cash value portion. The insured may also be able to change the due date of the premium, based on his or her then-current needs.

The LifeHorizons Simplicity Universal Life insurance policy via Cincinnati Life Insurance Company has a flexible death benefit and premium, which can allow policyholders to keep pace with their changing life circumstances, while at the same time also building up tax-deferred cash value.

With this particular plan, policyholders can obtain competitive and affordable premium rates, along with flexible premium payments and death benefit. There are also various riders available that can help to customize further the plan to fit an insured’s needs and goals better.

The LifeHorizon Lifesetter UL universal life insurance policy is also available via Cincinnati Life Insurance Company. This plan offers death benefit guarantees to age 121, as well as flexible guaranteed period to meet the policy holder’s changing insurance needs over time.

There are also several business life insurance options available through Cincinnati Life Insurance Company. These can assist business owners and executives to find and retain good, quality employees, as well as to ensure that their companies can move forward, even in the event of the unanticipated.

Just some of the business life insurance solutions that are offered via Cincinnati Life Insurance Company include:

- Business Continuation: A company owner’s business continuation can be funded using life insurance, which can help to stabilize and to maximize the value of the business overall.

- Key Employee Protection: Because employees add considerable value to every business, their value can be protected using life insurance proceeds. The funds from a life insurance policy can be utilized for covering the economic impact of losing a key employee unexpectedly.

- Executive Benefits: Life insurance can also be used for funding certain executive benefits. By offering a high-quality benefits package, key employees can more easily be attracted out in the market place, and once a part of a company, they are also much more apt to remain on board.

Other Products and Services Offered

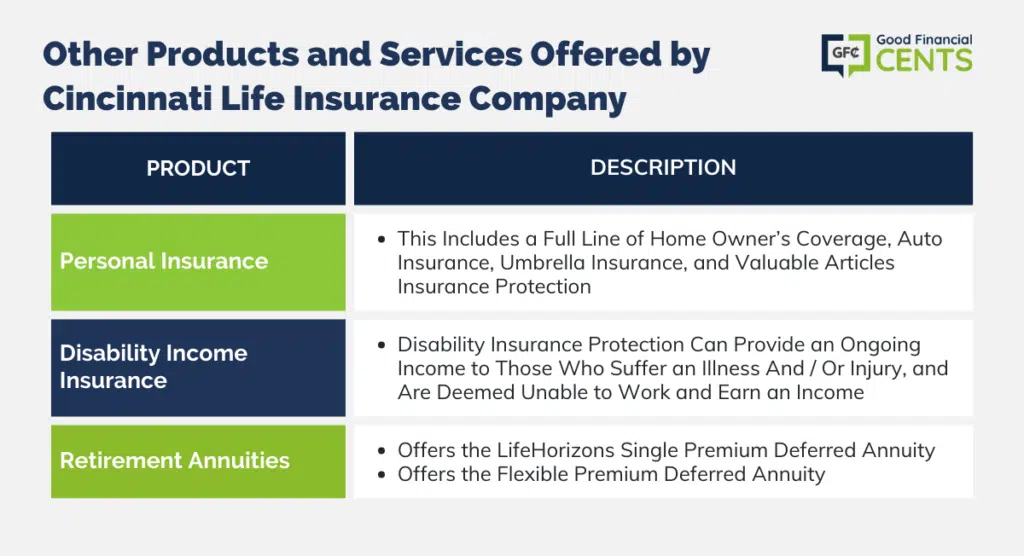

In addition to providing quality and affordable life insurance coverage options, the Cincinnati Life Insurance Company offers other products to their customers, including:

- Personal Insurance: This includes a full line of home owner’s coverage, auto insurance, umbrella insurance, and valuable articles insurance protection.

- Disability Income Insurance: Disability insurance protection can provide an ongoing income to those who suffer an illness and / or injury, and are deemed unable to work and earn an income.

- Retirement Annuities: With so many consumers fearful of not having enough income in retirement, an annuity can help to solve this issue. The Cincinnati Life Insurance Company offers the LifeHorizons Single Premium Deferred Annuity, as well as the Flexible Premium Deferred Annuity. Both provide safe and proven ways of savings for retirement, and of ensuring an income when it is needed the most.

Cincinnati Life Insurance Company has an extensive list of various business insurance and financial offerings, such as:

- Business Auto Coverage

- The Bridge Endorsement

- Business Liability Insurance

- Commercial Property Insurance

- Crime Insurance

- Cyber Risk Insurance

- Inland Marine Insurance

- Management Liability Insurance

- Professional Liability (Errors and Omissions)

- Surety Solutions

- Umbrella Liability Insurance

- Personal Liability

- Workers’ Compensation Coverage

How to Find the Best Life Insurance Premium Quotes with Cincinnati Life Insurance Company

If you are in the process of seeking life insurance coverage, it is best to work with an independent life insurance brokerage or agency that has access to multiple insurance carriers. This can help you to shop and compare policies and premium prices in a more unbiased way, and from there to choose the one that will suit you best.

When you’re ready to start the process of finding the right type and amount of life insurance for you, we can help. We are an independent life insurance broker, and we work with many of the top life insurance carriers that are in the marketplace today. We can assist you with obtaining all of the details that you require for making a well-informed life insurance buying decision. So, when you are ready to proceed, all you have to do is to click here and fill out our quote form.

We understand that finding the right life insurance for your needs can be somewhat overwhelming. You want to ensure that you’ve got the best type and amount of coverage for your needs. But working with an ally on your side can be quite beneficial. So, contact us today – we’re here to help.

The Bottom Line – Cincinnati Life Insurance Review

The Cincinnati Life Insurance Company, part of the Cincinnati Insurance Companies, stands as a reputable choice, backed by decades of experience and financial stability. With a range of life insurance options, including term and permanent policies, they cater to various needs. Their commitment to financial security extends beyond life insurance, encompassing personal, disability income, and retirement annuities. Additionally, they offer a comprehensive suite of business insurance solutions. For those seeking reliable coverage and competitive rates, exploring Cincinnati Life Insurance Company’s offerings is a prudent step in safeguarding one’s financial future.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Cincinnati Life Insurance Review

Product Name: Cincinnati Life Insurance

Product Description: Cincinnati Life Insurance offers a comprehensive range of life insurance solutions, both term and permanent, providing financial security and peace of mind. With a solid history dating back to 1950 and strong financial stability, the company stands as a trustworthy option for individuals and businesses seeking reliable coverage.

Summary of Cincinnati Life Insurance

Cincinnati Life Insurance Company, a subsidiary of the esteemed Cincinnati Insurance Companies, has been a stalwart in the insurance industry since its inception in 1950. Specializing in life insurance, they offer a diverse selection of policies, including term and permanent options. Term life insurance policies provide essential death benefit protection for a set number of years, making them an affordable choice for those seeking temporary coverage. On the other hand, permanent life insurance policies, such as whole and universal life, come with both a death benefit and a cash value component, allowing for lifelong coverage and the potential for cash value growth on a tax-deferred basis.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Financial stability

- Diverse coverage options

- Tailored business solutions

- Comprehensive product range

Cons

- Limited customer feedback

- Regional availability limitations