Regardless of whether you have someone counting on you for their financial support, you could still leave your loved ones in a state of financial hardship if they don’t have the funds that are needed for your final expenses.

Today, the cost of a funeral and other related expenses, such as a memorial service, transportation, flowers, a headstone, and a burial plot, could cost more than $10,000 – a significant amount of money that many families just simply do not have.

But they could access the necessary funds through a burial insurance policy.

Burial insurance, which is also often referred to as funeral insurance or final expense coverage, is designed specifically for paying an insured’s final expenses.

Typically, these policies will provide between $5,000 and $25,000 in coverage – which means that other potential debts may also be paid for using these proceeds, such as credit card balances, uninsured hospital costs, and the expenses incurred from hospice care.

When you are considering the purchase of a burial insurance policy, be sure you have the right type and amount of protection, and that you also purchase this coverage from a reputable insurance carrier.

In doing so, reviewing the financial strength and stability, as well as claims payment history, of a carrier can be helpful. One insurer that offers burial insurance coverage – and that meets the criteria of financial strength and stability – is Colonial Life Insurance Company.

A History of Colonial Life Insurance Company

Colonial Life Insurance Company has had one primary mission throughout its 80+ year history. That is to help America’s workers preserve and protect the essential things that they have worked so hard to build.

The company was formed back in 1937 when its founders – Edwin F. Averyt and J. Clifton Judy – started the Mutual Accident Company in Columbia, South Carolina.

The initial product offered by this insurer was accidental death benefit coverage – and over the years, the company has grown and expanded to provide a wide array of products and services to its policyholders.

Over time, Colonial Life has also earned a long list of awards and accolades: the first company to introduce worksite marketing of voluntary benefits via payroll deduction (in 1955), the first to implement computer technology in its insurance business (during the 1970s), marketing the company’s products via Section 125 plans (in the 1980s), and offering online enrollment systems for employee benefit plans.

Also, for eight consecutive years in a row, Colonial Life Insurance Company won 34 first-place awards from brokers for products, services, and innovation via the Benefits Selling magazine Readers’ Choice Awards.

Colonial Life Insurance Company Review

Today, Colonial Life Insurance Company has more than 3 million policyholders, primarily via roughly 87,000 company benefit plans. The company’s products are offered through more than 10,000 sales reps and are supported by more than 1,200 home office professionals.

Colonial Life is secure and stable from a financial standpoint, with more than $1.8 billion of insurance coverage in force, and sales of more than $960 million annually.

The company consistently receives strong industry ratings, due in large part to its strong investment portfolio, as well as its long-term profitable growth.

Today, Colonial Life Insurance Company is a wholly owned subsidiary of UNUM – a giant insurer that offers supplemental insurance via the workplace. The company is still headquartered in Columbia, SC.

Better Business Bureau and Grade Insurer Ratings

Based on its strong financial foundation, along with its timely payments of policyholder claims, Colonial Life Insurance Company has received high ratings from the insurer rating agencies. These include:

- A Strong From A.M. Best Company

- A Strong From S&P

- A3 Good From Moody’s Ratings

- A- Strong from Fitch Ratings

At this time, Colonial Life Insurance Company is not currently an accredited company through the Better Business Bureau (BBB), nor has the BBB provided this insurer with a grade of between A+ and F based on customer complaints, financial stability, or quality of service that is provided.

The parent company of Colonial Life Insurance Company, UNUM Group, has a Better Business Bureau grade of A-. UNUM, over the past three years, has closed out 80 customer complaints through the BBB (and of these, 33 complaints were closed over the previous 12 months).

Of the 80 customer complaints, 66 had to do with problems with the company’s product and service, 11 were related to billing and collection issues, two had to do with advertising and sales issues, and one was related to delivery issues.

Life Insurance Coverage Offered by Colonial Life Insurance Company

Colonial Life Insurance Company offers life insurance coverage that can be tailored to the needs of its policyholders. In doing so, this can help to provide the necessary financial security that an insured’s family may need in case of the unexpected.

There are also life insurance coverage options available for an employee/policyholder’s spouse and children – which in turn, can help to provide even more financial protection for a family’s needs during difficult times.

As an insured’s needs change, he may also be able to update their life insurance coverage through Colonial Life to best fit their new situation, such as getting married or divorced, buying or selling a home, having or adopting a child, retiring, and buying or selling a business.

To help its customers better understand the overall value that life insurance coverage can provide, Colonial Life Insurance Company works in conjunction with Life Happens.

Just one of the many benefits here includes helping consumers to determine how much life insurance coverage they need, based on their specific situations.

Colonial Life Insurance Company’s life insurance products can be purchased as an individual’s primary coverage, or they may also be obtained as supplemental coverage for a personal insurance policy and an employer-provided plan.

The company makes it easy to file a life insurance claim by offering online claims filing. There is also a way to download life insurance claim forms directly via the company’s website, and to then either return to the company by fax or mail the paperwork in.

Life insurance policyholders can also make updates to their account directly via the Colonial Life Insurance Company website.

Products and Services Offered

In addition to life insurance coverage, Colonial Life Insurance Company also provides other forms of insurance, as well as financial-related products and services.

For example, when regular medical insurance does not pay for certain items, insureds can experience high out-of-pocket costs, such as copayments, deductibles, and coinsurance, as well as the cost of necessary prescription medications.

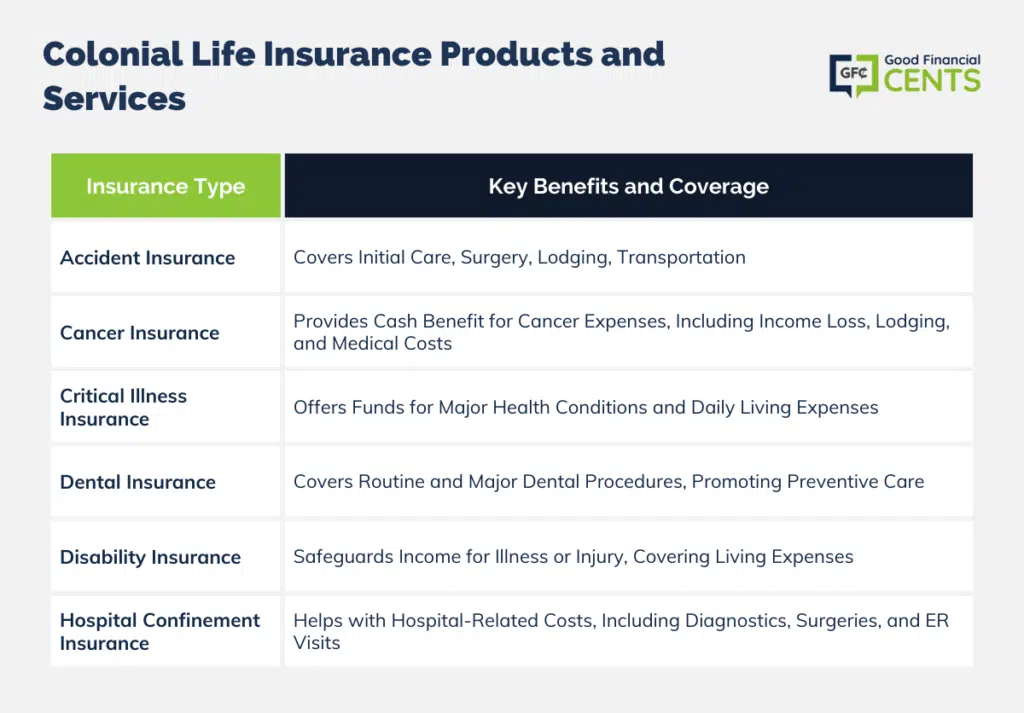

The company also offers an extensive list of voluntary benefits that can be accessed via employee benefit plans. These include a full range of protection that includes:

- Wellness – Colonial Life Insurance Company promotes healthy lifestyles and preventive measures by offering benefits for various wellness and health screening tests.

- Medical – The medical benefits that are provided by Colonial Life can help insureds get the help they need with the direct medical costs that are associated with qualifying illnesses and accidents.

- Financial – Colonial Life Insurance Company also assists with the indirect, out-of-pocket expenses that can accompany illnesses and accidents, such as the expenses that major medical insurance coverage often does not provide.

Because insurance can often be somewhat confusing, Colonial Life Insurance Company also offers services that can help people better understand their benefits.

The company has experienced benefits counselors on staff who can help policyholders with simplifying the entire benefits process.

Counselors are available to answer questions and to walk individuals through the whole process of benefits enrollment.

More Products and Services That Are Provided Through Colonial Life Include the Following:

- Accident Insurance – Accident insurance can provide a broad range of advantages, including initial care that is required, as well as surgery, transportation, lodging, and follow-up care.

- Cancer Insurance – If an individual is diagnosed with cancer, the bills can start to add up. But with a cancer insurance policy, an insured will receive a cash benefit that may be used for any number of needs, such as loss of income, lodging, meals, child care, or even for copayments and deductibles on other insurance coverage.

- Critical Illness Insurance – Critical illness insurance can help to complement other health insurance coverage by providing funds if an individual has been diagnosed with conditions such as stroke, heart attack, end-stage renal failure, major organ failure, and coronary artery bypass issues.

The money that is paid out from critical illness coverage may be used for paying everyday living expenses, and other costs that are related to the insured’s condition.

- Dental Insurance – Dental insurance can help to provide an insured (and also his or her family members) with coverage that is needed for both routine and more costly dental procedures, such as cleanings, fillings, sealants, tooth removal, crowns, and dentures.

Also, dental insurance coverage can also provide benefits for regular dental appointments, which in turn can help to prevent other, more costly dental needs from occurring.

- Disability Insurance – For many people, the ability to earn an income is their most valuable asset. That is because other assets would not be possible to acquire without it.

If an insured becomes ill or injured and is not able to work, then having a disability insurance policy can help them to continue paying everyday living expenses like rent or mortgage, utilities, groceries, and other bills.

- Hospital Confinement Insurance – When an individual is in the hospital, there can be far more costs than those that are covered by regular medical insurance.

With a hospital confinement insurance policy through Colonial Life Insurance Company, an insured may be able to cover the expenses that are associated with situations like diagnostic tests, outpatient surgery, doctor appointments, and trips to the ER.

The Best Premium Rate on Life Insurance Coverage From Colonial Life Insurance Company

If you are seeking the best premium rates on life insurance coverage through Colonial Life Insurance Company – or any other insurer – it is recommended that you first consult with an independent life insurance agency or brokerage.

That way, you will be better able to compare – in an unbiased manner – the plans and the premiums that are available to you.

When you are ready to begin this life insurance comparison process, we can help.

We know that it can sometimes be difficult to determine just how much life insurance protection you need. There are many variables here to consider. But the process can be so much easier when you are working together with an ally on your side. So, contact us today – we’re here to help.

The Bottom Line – Colonial Life Insurance Review

Colonial Life Insurance Company, with a rich 80+ year history, underscores a dedication to providing financial security through its diverse insurance offerings, from its initial accidental death benefits to its current, more comprehensive range.

The company has earned commendation not only for its innovative approaches in the insurance sector but also for maintaining robust financial stability, thereby securing a stronghold in the market.

Despite some complaints, the extensive array of insurance products, especially its burial insurance, provides notable options for individuals seeking financial coverage for life’s unpredictability.

Always a prudent step, potential customers are encouraged to explore, compare, and critically assess insurance options, ensuring chosen policies align precisely with their unique needs and contexts, thereby fortifying their financial futures effectively and thoughtfully.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Colonial Life Insurance Review

Product Name: Colonial Life

Product Description: Colonial Life Insurance Company specializes in offering a plethora of insurance products aimed at safeguarding policyholders and their loved ones against financial adversities. With a rich legacy and a broad suite that encompasses life insurance, accident insurance, and supplemental health policies, they devise strategies that cater to varied customer needs, providing essential monetary cushions during critical life events.

Summary

Diving deeper into the offerings, Colonial Life weaves a safety net for individuals and families through targeted products such as burial insurance, aimed at alleviating the financial burden of end-of-life expenses, and accident insurance, ensuring out-of-pocket costs are mitigated in unforeseen events. Their innovative cancer and critical illness insurance policies stand out by providing monetary benefits that can be utilized according to the insured’s discretion upon diagnosis, thereby supplementing medical and non-medical expenditures. Additionally, the company offers voluntary benefits and fosters wellness through certain health and medical perks, creating a balanced approach towards health and financial security, especially amidst life’s unpredictable scenarios.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Diverse Product Suite: Colonial Life offers a wide array of insurance products, catering to various needs and providing policyholders with a one-stop-shop for their insurance requirements.

- History of Stability: The company has a stable history and has garnered respect for its financial strength, ensuring reliability for its policyholders.

- Award-winning Services: Colonial Life has received numerous awards and accolades for its products, services, and innovations, reflecting positively on its reputation and service quality.

- Customizable Policies: Tailoring life insurance coverage and other product offerings according to the changing needs of policyholders shows a customer-centric approach.

Cons

- Customer Complaints: A noted number of customer complaints, particularly related to product and service issues, have been registered, pointing towards potential customer service and policy management issues.

- Lack of BBB Accreditation: The absence of current accreditation and a rating from the Better Business Bureau (BBB) might be seen as a red flag by potential customers looking for external validations of a company’s customer service and business practices.

- Complexity of Offerings: The extensive range of products and services might be perceived as complex or overwhelming for individuals seeking straightforward, simple insurance solutions.

- Online Presence: Some users might find their online services, including claim filing or policy management, to be less user-friendly or intuitive compared to more digitally advanced competitors.