Life insurance is one of the most important investments that you can ever make for your loved ones. If something tragic were to happen to you, and you didn’t have life insurance coverage, then your family would be responsible for a mountain of debt and other expenses.

It’s important that you find the best plan for you. That means that you’re going to need to compare the different types of plans and you will need to find the best insurance company for you. Every insurance company is different, all of them have different products and will give you different rates based on their medical underwriting and rating system.

When you are considering the purchase of a life insurance policy, it is vital to ensure that you have the right type and amount of protection for your specific needs. You should also ideally research the life insurance company you are considering buying the policy through. Here, the company should be reliable and stable financially, and it should also have a good name for paying out its policy holder claims. One insurer that meets these parameters is EquiTrust Life Insurance Company.

The History of EquiTrust Life Insurance Company

EquiTrust Life Insurance Company is one of the smaller life insurance and annuity providers in the overall insurance market place. While EquiTrust is not typically thought of as being a household name, the company is known for offering an excellent selection of quality financial vehicles that can help consumers with growing and protecting their wealth. These consist primarily of single premium life insurance policies and indexed retirement annuities.

Through its products, the company focuses on offering new financial ideas that can substantially help its customers to meet their specific needs. It also prides itself on its stellar customer service. EquiTrust has a broad range of niche products, so the company’s policy holders can be more assured that they will be able to change, add, and alter their products or product mix, as their personal and family financial needs change over time.

In many ways, EquiTrust can be considered as more of a niche insurance company, as they tend to specialize in indexed products – namely indexed life insurance and indexed annuities. Because of this, consumers who are in the market for this type of financial product will find a lot to choose from in EquiTrust Insurance Company’s product mix. This applies particularly to those who are seeking the opportunity to grow funds on a tax deferred basis, while at the same time keeping their principal safe.

EquiTrust Life Insurance Company Review

Many of the insurance products that are offered by EquiTrust Life Insurance Company include underlying equity and index related financial vehicles – which can help policy holders with increasing their opportunity for a higher return.

The company works in conjunction with Guggenheim Partners – a global investment and advisory company – which provides portfolio management for many of EquiTrust Life Insurance Company’s products.

Equitrust has more than $14 billion in invested assets – of which a majority are considered to be investment grade. However, a certain percentage of these assets are not deemed to be investment grade (in the investment class of A or better), which in turn, can make the insurer ratings agencies a bit more leery about the company’s overall financial strength in the event of a downward moving market. Equitrust Life Insurance Company is headquartered in West Des Moines, Iowa.

Insurer Ratings and Better Business Bureau Grade

EquiTrust Life Insurance Company is considered to be stable financially, and because of that, the company has earned the following ratings from the insurer rating agencies:

- B++ from A.M. Best Company

- BBB+ from Standard and Poor’s

The company also has earned a Comdex rating of 43.

Also, even though EquiTrust Life Insurance Company is not currently an accredited business of the Better Business Bureau (BBB), the BBB has given the company a grade of A+, based on a range of A+-F.

In the last three years, EquiTrust Life Insurance Company has settled four customer complaints (of which one complaint has been closed within the past 12 months). Of the four total customer complaints, three were regarding complications with the company’s product and service, and the other was regarding advertising and sales issues.

Life Insurance Coverage Offered by EquiTrust Life Insurance Company

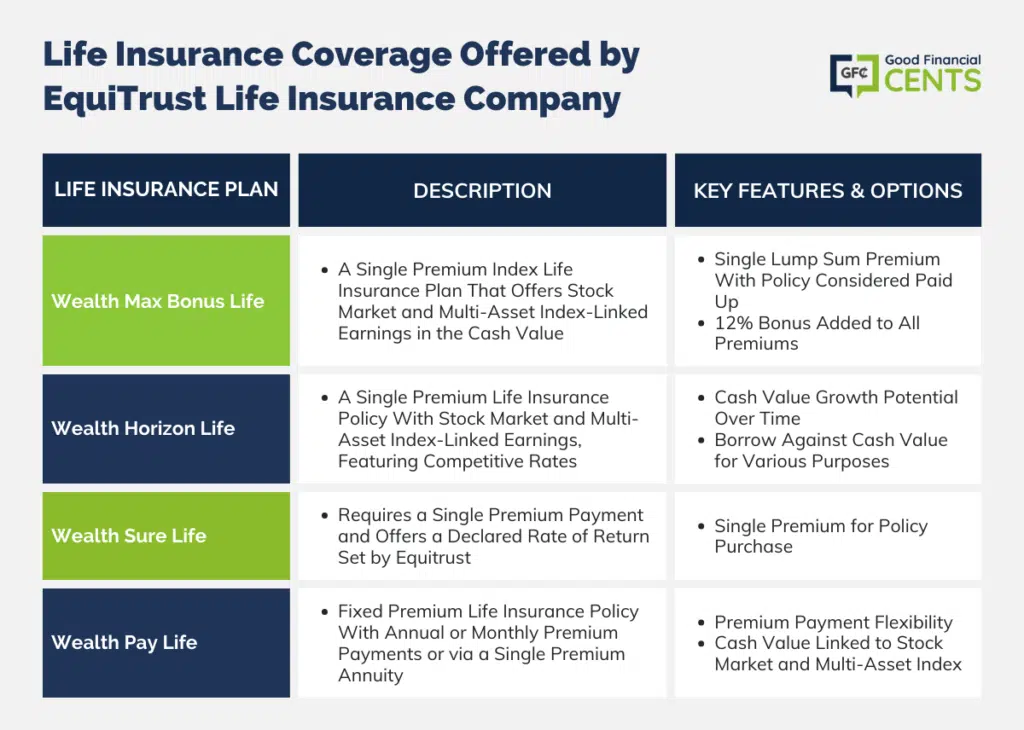

EquiTrust offers many options for life insurance coverage. Because of this, policy holders can choose the option that best fits their needs – and, they may also be able to change or alter their coverage as their needs evolve.

All the life insurance plans that are offered through EquiTrust are permanent, meaning there is death benefit protection and a cash value/savings component. The funds that are inside of the policy’s cash value can grow and compound over time on a tax deferred basis. There is no tax due on the increase of these funds until the money is withdrawn by the policy holder.

Even if an individual has certain medical conditions, it can still be possible to qualify for a life insurance policy through EquiTrust. This is because there are no medical tests or exams required to obtain coverage.

The life insurance policies that are offered by EquiTrust include the following:

Wealth Max Bonus Life

With the Wealth Max Bonus Life plan, the policy holder will be able to get stock market and multi-asset index-linked earnings in the cash value. This policy is a single premium index life insurance plan, so there is just one single lump sum premium required, and then the policy will be considered paid up. Also, there is a 12 percent bonus that is added to all premiums.

Wealth Horizon Life

The Wealth Horizon Life plan is also a single premium life insurance policy that offers both stock market and multi-asset index-linked earnings. This plan has highly competitive rates so that the cash value could grow quite a bit over time. The policyholder can borrow against the cash value at any time to do any number of things: debt pay off, vacation, or even supplement retirement income.

Wealth Sure Life

The Wealth Sure life insurance policy also requires just one single premium to purchase the plan. Here, the policy holder will get a declared rate of return that is set by EquiTrust.

Wealth Pay Life

The Wealth Pay life insurance option from EquiTrust is a fixed premium life insurance policy, meaning that the premiums will be due annually or monthly by the policy holder. The premiums could alternatively be paid via the money in a single premium annuity. In this plan, the return of the cash value is also linked to stock market performance and the performance of a multi-asset underling market index.

EquiTrust Burial Insurance

When the time comes to plan for the future, it is important to consider any and all of your current and future financial obligations. These can include any mortgage and other personal debts that you’ve incurred, as well as the ongoing living expenses of those in your life who count on your income for their everyday living expenses. One item that is sometimes overlooked, though, is that of funeral and other final costs. But doing so could end up putting your loved ones and survivors in an awkward financial position, as they may need to dip into savings or other assets to get the costs paid.

Today, the average cost of a funeral in the United States runs between $8,500 and $10,000.This is especially true when you consider the price of a memorial service, flowers, and related transportation, as well as other items like a burial plot and a headstone.

Many families just simply do not have this amount of money that is readily available, so they may end up having to take it out of savings – or worse yet, put these expenses on a credit card (in turn, leaving them in financial hardship for months, or even years, to come). In any case, having life insurance can mean the difference between your loved ones being able to move on, or having to drastically change their lives – during an already difficult time for them.

Other Products and Services Offered

EquiTrust Life Insurance Company also offers retirement annuities. These products can allow you to save money on a tax deferred basis, and then to obtain a guaranteed lifetime income stream in the future. This revenue can continue coming for the remainder of your life – regardless of how long that may be.

EquiTrust offers four types of annuities. These include the following:

- Index: With an index annuity, the return on the funds is based on the performance of an underlying market index, such as the A&P 500. When the index performs well, an excellent return can be gained. If, however, the underlying index performs poorly for a given period, the account is solely credited with a 0%. This can allow for ongoing protection of principal, regardless of what occurs in the market. EquiTrust offers several different options regarding index annuities. These include the Market Twelve Bonus Index, the Market Power Bonus Index, the Market Booster Index, the Market Ten Bonus Index, the Market Value Index, the Builder Bonus Index, and the DynaMARC Index.

- Multi-Year: The multi-year annuity – Certainty Select – allows you to lock in a competitive rate of interest for a duration of 3, 5, 6, 8, or 10 years.

- Traditional Fixed Rate: With EquiTrust’s Choice Four options, you can choose from a variety of different durations, with annual reset interest.

- Immediate: With an immediate annuity, the income payout can begin either now or later – and, it can be for a set number of years, or for the remainder of your life. EquiTrust’s immediate annuity product is the Confidence Income plan.

Although many of the products that are offered by EquiTrust Life Insurance Company may be suitable only to a small segment of the population, for those who do fit into this niche, the product offerings can be quite attractive.

How to Get the Best Premium Rate on Life Insurance Coverage from EquiTrust Life

If you have been seeking the best premium rates on life insurance coverage from EquiTrust Life Insurance Company – or for that matter, from any life insurance carrier – then it is recommended that you work with an independent life insurance agency that can offer you suggestions from multiple insurance companies. That way, you will be able to shop and compare the policies, coverage, and premium prices of many different options. Once you’ve looked at your options, you can choose the one that will work best for your needs, and for your budget.

When you are ready to move forward in this life insurance policy comparison, we can help. We are an independent life insurance broker, and we work with many of the leading insurance carriers in the industry today. We can support you with gathering all the appropriate details that you need to make a smart purchase – quickly and stress-free.

We can provide you with many different life insurance policy quotes, all from your computer. If you are prepared to make a purchase, then all you need to do is just simply here and fill out our short quote form.

We know that the process of shopping for life insurance coverage can be somewhat overwhelming. There are a lot of different variables that you need to think about – and you want to make sure that you are going in the right direction regarding coverage, benefits, and premium price.

But the good news is that all of this can be accomplished when you are working together with an experienced life insurance ally on your side. So, contact us today – we’re here to help.

The Bottom Line – EquiTrust Life Insurance Review

EquiTrust Life Insurance Company offers a range of options to secure your family’s financial future. Specializing in indexed products, EquiTrust provides innovative financial solutions. They have earned solid financial ratings, ensuring policyholders’ peace of mind. However, EquiTrust may not be as well-known as some larger insurers, and customer complaints have been reported in the past. Their life insurance policies are permanent, requiring no medical exams, making it accessible to various individuals. EquiTrust also offers retirement annuities, allowing you to grow savings tax-deferred and secure a guaranteed lifetime income stream.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

EquiTrust Life Insurance Review

Product Name: EquiTrust Life Insurance

Product Description: EquiTrust Life Insurance Company offers a diverse range of life insurance and annuity products, specializing in indexed life insurance and indexed retirement annuities. Their policies provide permanent coverage with death benefits and a cash value component, allowing for tax-deferred growth of funds. EquiTrust stands out for its innovative financial solutions and strong customer service.

Summary of EquiTrust Life Insurance

EquiTrust Life Insurance Company stands out for its indexed life insurance and indexed retirement annuities, designed to grow and safeguard wealth. These policies offer stock market-linked earnings and the flexibility to borrow against cash value. EquiTrust’s partnership with Guggenheim Partners ensures expert portfolio management. They also offer burial insurance for final expenses and various annuities for retirement planning. EquiTrust maintains financial stability with solid ratings from A.M. Best and Standard and Poor’s.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Specialization in Indexed Products.

- Strong Financial Stability.

- No Medical Tests for Life Insurance.

- Diverse Policy Options.

- Competitive Rates.

Cons

- Less Recognition.

- Few Customer Complaints.

- Limited Non-indexed Products.

- Some Non-investment Grade Assets.

- Limited Immediate Annuities.