Life insurance is a major component of almost any overall financial plan – regardless of one’s age or employment status. That is because loved ones could be faced with massive debts to pay – including the cost of a funeral and other financial expenses – if the unexpected should occur.

The proceeds that are received from life insurance policies are income tax-free, so loved ones can use the entire amount of the funds for their needs. This can help them to avoid financial hardship, at an already difficult time in their lives.

When you are in the process of seeking life insurance coverage, several key factors are essential to keep in mind before making a long-term commitment to a policy. These should include obtaining the proper type and amount of insurance coverage, as well as making sure that the insurance company that you are purchasing the policy through is secure and stable financially and that it has a good, solid reputation for paying out its claims to policyholders and beneficiaries. One company that meets these criteria is Geico Insurance Company.

Table of Contents

The History of Geico Insurance Company

Geico has been in business since 1938. Over the past 80 years, the company has grown and expanded exponentially, and today the company is ranked as the second-largest private passenger auto insurance company in the United States.

The name Geico is an acronym for Government Employees Insurance Company, which goes back to the company’s beginnings. The founder of Geico, Leo Goodwin, initially targeted a customer base that consisted primarily of United States government employees and military personnel.

The company now insures military and government personnel, as well as private consumers. In 1996, Geico became a wholly owned subsidiary of Berkshire Hathaway, which is headed by the world’s most famous investor, Warren Buffett. For the past several years, Fortune magazine has named Berkshire Hathaway’s property casualty insurance operation as the most admired in the U.S.

Presently, Geico is made up of its primary unit, the Government Employees Insurance Company, along with several affiliates, including:

- Geico General Insurance Company

- Geico Indemnity Company

- Geico Casualty Company

- Geico Advantage Insurance Company

- Geico Choice Insurance Company

- Geico Secure Insurance Company

Geico is headquartered in Chevy Chase, Maryland (near Washington, DC). The company also has some regional offices that are dotted throughout the U.S., including locations in:

- Buffalo, New York

- Dallas, Texas

- Fredericksburg, Virginia

- Indianapolis, IN

- Lakeland, Florida

- Macon, Georgia

- San Diego, California

- Tucson, Arizona

- Virginia Beach, Virginia

- Woodbury, New York

There are also several service centers, which are in Iowa, Kansas, and Hawaii, as well as some claims centers, which can be found in Houston, Texas, as well as in Seattle, Washington, and Marlton, New Jersey.

Geico Life Insurance Review

Today, Geico insures more than 18 million auto insurance policies – and growing – and the company has more than 30 million vehicles insured. It is one of the fastest-growing major auto insurers in the country, employing more than 40,000 associates, and providing customer service 24 hours per day, seven days per week, and 365 days per year. As of year-end 2022, Geico had assets under management of more than $32 billion.

The company has also earned a long list of various awards and accolades over the years. For example, Geico was named to Ward’s 50 top group of financially high-performing insurers for the 21st consecutive year in 2011. This award recognizes that Geico achieved outstanding financial results in the areas of safety, consistency, and performance.

Also, Geico was rated as being superior by consumers in 2007, for its customer advocacy. Forrester defines this as being “the perception by customers that a firm (Geico) does what’s best for them, and not just what is best for its bottom line.”

Geico was also rated as #1 by the Kanbay Research Institute for being the most desired insurer among consumers based on the following factors:

- High regard for customer service.

- Focus on staff training and development.

Likewise, the owner of Geico, Berkshire Hathaway, was named as being a leading company in world insurance markets. These rankings include

- The #1 global insurance company by revenues in 2013, based on an analysis of companies in the Global Fortune 500.

- The #2 writer of private passenger auto insurance by direct premiums was written in 2013. (Before reinsurance transactions, include state funds. Based on the U.S. total, including territories).

Also, Geico achieved the highest overall score in Forrester Research’s 2014 U.S. Mobile Auto Insurance Functionality Benchmark. With perfect scores in policy information and management categories, Forrester proclaimed Geico as “The pocket auto insurer.”

Geico’s Mobile App and insurance site received a #1 ranking on Keynote’s 2015 Mobile Insurance Scorecard, competing against top insurers. Geico is also ranked first for technical quality, according to Keynote KCR (Keynote Competitive Research).

While the company has traditionally been known for its vehicle coverage options, Geico doesn’t just offer auto insurance. The insurer offers a broad range of coverage products and services, including life insurance, homeowner’s insurance, and even identity theft protection.

Insurer Ratings and Better Business Bureau Grade

Due to its stable financial footing, as well as its timely payment of customers’ insurance claims, Geico has been given high ratings from the insurer rating agencies. These include the following:

- AA+ from Standard and Poor’s

- Aa1 from Moody’s

- A++ from A.M. Best Company

Also, although Geico is not an accredited company through the Better Business Bureau (BBB), the company has been given a grade of B by the BBB. This is on an overall grade scale of A+ to F.

Life Insurance Products Offered Through Geico

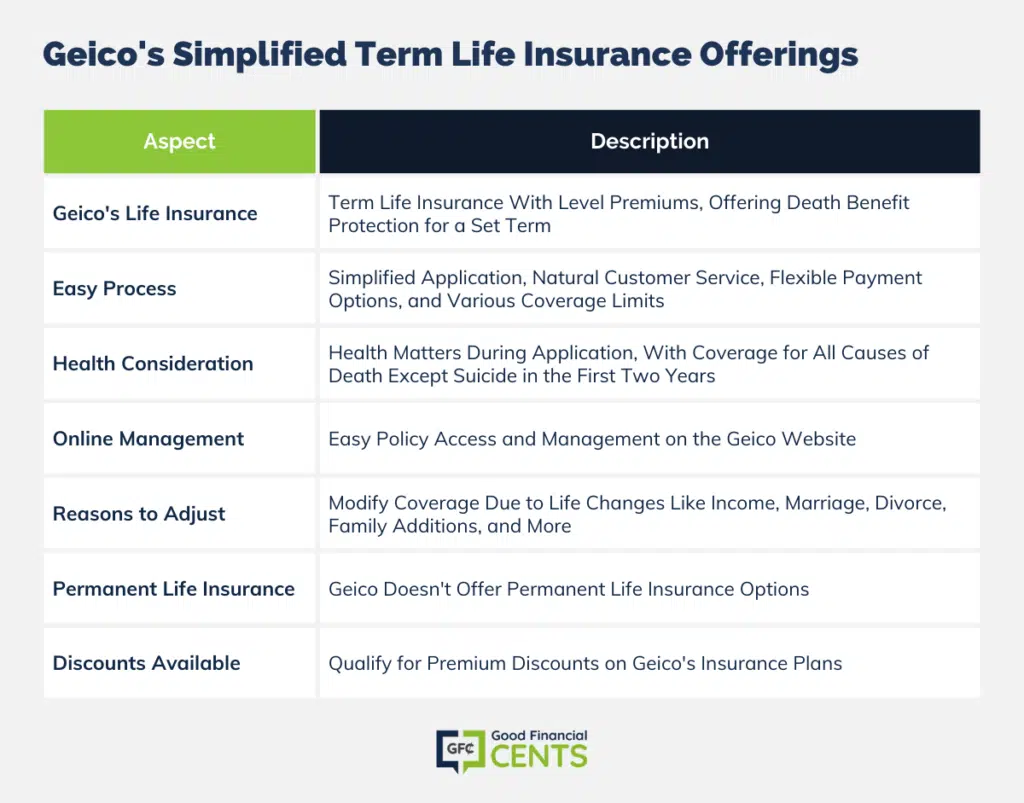

Customers of Geico can obtain life insurance coverage via Life Quotes, Inc. The company offers a term life insurance policy, which provides pure death benefit protection, without any cash value or savings build-up. Because of this, the premiums for term life insurance can typically be quite affordable – especially for those who are young and in good health at the time of policy application.

As its name implies, term life insurance is purchased for a set period – or term – such as five years, ten years, 15 years, 20 years, or even 30 years. In most cases, the amount of the death benefit coverage, as well as the sum of the premium, will remain level throughout the term of the policy.

And, provided that the premiums are paid on time, the company that issues the term life insurance policy will not be able to cancel the coverage. Once the term of a policy reaches its end, the insured may opt just to purchase a new policy (if he or she qualifies based on their then-current health).

As with its other forms of insurance coverage, getting life insurance via Geico can be a natural process. For example, by teaming up with Life Quotes, Inc., customers can expect the following benefits:

- Easy paperwork/application process.

- Natural customer service process.

- Convenient payment plans for paying the premium, which include monthly, quarterly, or annual payment options.

- A full range of coverage limits to meet each customer/policy holders’ needs.

When applying for life insurance through Geico/Life Quotes, Inc., an applicant’s health is considered. Once approved, the life insurance policy will typically cover death due to any cause, other than that of suicide within the first two years of policy ownership.

Once an individual has been approved for life insurance coverage through Geico/Life Quotes, policyholders can access their policy directly through the Geico website. This can make it easy to check coverage, as well as to make changes to one’s account, such as address and other contact information, and the name of the policy’s beneficiary.

The Geico website also helps to prompt a policyholder with various information that may assist them in reviewing their life insurance coverage, and in deciding whether to alter their coverage limits in the future. For example, some of the reasons why someone may want to change the amount of their coverage include:

- A change in household income/employment status

- Marriage, divorce, or becoming widowed

- The birth or adoption of a child

- Retirement

- New grandchild(ren)

- Selling off one’s home and purchasing another

Now, Geico does not offer permanent life insurance coverage – which includes whole life, universal life, indexed universal life, variable life, or variable universal life – all of which include both death benefit protection and a cash value component.

Purchasers of many of the insurance plans that are offered through Geico may qualify for a premium discount.

Other Products and Services Available

While Geico is a primary insurer of automobiles, it also provides a wide selection of other products such as life insurance and other types of coverage, such as:

- ATV Insurance

- Condo insurance

- Co-op insurance

- Personal watercraft insurance

- Mobile Home Insurance

- Overseas insurance

- Commercial Auto insurance

- Ridesharing insurance

- Snowmobile insurance

- Collector Car insurance

- Mexico Car insurance

- Jewelry insurance

How to Get the Best Rates on Life Insurance From Geico Insurance Company

If you have been seeking the best rates on term life insurance from Geico – or from any insurer – it can be beneficial to work with an independent life insurance agent or broker. In doing so, you will be better able to compare side-by-side the policies and the premium prices from numerous different insurance carriers. From there, you will then be able to choose which one will be the best for you.

When you are ready to move forward with the life insurance purchase process, we can help. We are an independent life insurance brokerage, and we work with many of the top life insurance carriers in the marketplace today. We can assist you with obtaining all the pertinent details that you require for making a well-informed buying decision, and we can do so for you quickly, easily, and conveniently – all without you having to meet in person with an insurance agent. If you are ready to get started, then all you should do is just simply fill out our quote form.

We understand that the purchase of life insurance coverage can be somewhat overwhelming. There are many different variables to consider – and you want to be sure that you are making the best decision regarding the type and amount of coverage for your specific needs. The good news is that the life insurance purchasing process can be done so much easier when you are working with an expert on your side. So, contact us today – we’re here to help.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Geico Product Description: Geico, officially known as the Government Employees Insurance Company, is one of the largest auto insurance providers in the U.S., recognized for its iconic gecko mascot and memorable advertising campaigns. Beyond auto insurance, Geico offers a suite of insurance products, including homeowners, renters, and life policies. The company emphasizes affordability, ease of use, and quick claim processing. Summary of Geico Founded in 1936 to serve government employees, Geico has transformed over the decades into a household name catering to a broad audience. Their extensive auto insurance offerings are complemented by a wide array of other insurance products, ensuring comprehensive coverage for various customer needs. Embracing technological advances, Geico has developed user-friendly online tools and a mobile app to streamline policy management and claims reporting. With a strong emphasis on customer service and competitive pricing, Geico maintains a significant market share and enjoys high levels of customer retention. Pros Cons

Geico Review

Overall