When looking at overall financial planning, life insurance coverage can be an integral part.

That’s because the profits from a life insurance policy can be used for a multitude of things, including the settlement of debt by survivors, ongoing payment of everyday bills by a spouse and other dependents, and/or for paying one’s funeral and other financial expenses.

In fact, even when just factoring in potential final costs, the dollar figure can often be more than $10,000 given the expense of a memorial service, flowers, and transportation, as well as a burial plot and headstone.

(If an individual requires any uninsured medical or hospice expenses, the cost can be even higher for those you leave behind).

Before committing to acquire a life insurance policy, it is important to ensure that you are choosing the right type and amount of coverage. It is also essential to take a closer look at the insurance company you’re considering making your purchase through.

That is because you want to ensure that the insurer is secure and stable financially and that it has a reliable, positive name for paying out its policyholder claims.

One insurance carrier that has a 100+ year history, and that meets these criteria – is Mutual Trust Life Solutions.

Table of Contents

- The History of Mutual Trust Life Solutions

- Mutual Trust Life Solutions Review

- Insurer Ratings and Better Business Bureau Grade

- Life Insurance Policies Offered by Mutual Trust Life Solutions

- Other Products and Services Sold

- How to Find the Best Premium Rates on Life Insurance Protection

- The Bottom Line – Mutual Trust Life Solutions

The History of Mutual Trust Life Solutions

Mutual Trust Life Solutions traces its roots back to 1904. Over the past 110+ years, the company has grown and expanded exponentially, and it now offers its life insurance and annuity products in 49 of the U.S. states, as well as the District of Columbia.

Today, Mutual Trust is a wholly owned subsidiary of Pan American Life Insurance Group (PALIG), which is a leading provider of insurance and financial services throughout the Americas. Mutual Trust is headquartered in Oak Brook, Illinois.

Mutual Trust Life Solutions Review

As its name implies, Mutual Trust Life Solutions is a mutual insurer. This means that the company has no shareholders, rather it exists for the benefit of its policyholders. And, while not guaranteed, policyholders may be eligible to receive dividends from the company.

These may be taken in the form of cash, or used for increasing the amount of insurance coverage that they have.

For the year 2016, Mutual Trust Life Solutions continued to experience positive financials, with a 16 percent increase in sales, and a continuation of its dividend scale – even considering the historically low interest rate environment in the United States.

At the end of 2016, Mutual Trust Life Solutions held capital of more than $900 million, and assets of over $5.5 billion (when combined with that of Pan American Life Insurance Group). The company has also maintained a risk-based capital ratio of more than 600 percent.

With that in mind, Mutual Trust Life Insurance Solutions is a financially stable company. It also pays out its claims promptly to its policyholders and their beneficiaries.

Insurer Ratings and Better Business Bureau Grade

Due to its firm financial footing, Mutual Trust Life Insurance Company has attained outstanding ratings from the insurer rating agencies. These include an A (Excellent) from A.M. Best Company and an A (Stable) from Fitch Ratings.

Also, even though Mutual Trust is not currently an accredited business through the Better Business Bureau (BBB), the BBB has given the company a grade of A+. This is on an overall grade scale of A+ through F.

Over the past three years, Mutual Trust has only had to close out one customer complaint through the Better Business Bureau (which occurred within the previous 12 months).

This claim was based on problems with the company’s products and services.

Life Insurance Policies Offered by Mutual Trust Life Solutions

Mutual Trust Life Solutions offers a wide variety of life insurance policies to choose from. These include both term and permanent coverage.

With term life insurance, you will have death benefit protection, without any cash value or savings build-up. This can help to keep the policy affordable.

Term life insurance offers protection for a set number of years. The term life insurance plans that are offered through Mutual Trust Life Solutions have the options of 10 years, 15 years, 20 years, and 30 years.

During the time that is chosen, the death benefit on the policy remains level, and the amount of the premium will not increase.

After the time has elapsed, policyholders have the option of keeping the coverage as an annually renewable plan, which provides a level amount of death benefit until the insured turns age 98. (The premium will, however, increase over time with this option).

These policies also have the option of being converted over to a permanent life insurance policy, without having to provide evidence of insurability.

This conversion may occur at age 65, or at the insured’s issue age plus the length of the level premium period plus five years – whichever is the earliest.

There are also individual riders that may be added to one’s term life insurance policy through Mutual Trust. For example, with the addition of the optional waiver of premium rider, conversion is guaranteed – even if the term insurance policy is under a waiver claim.

In this case, the premiums on the permanent policy can continue to be waived (provided that certain conditions have been met).

Mutual Trust also offers permanent life insurance coverage. With this form of life insurance, there is a death benefit, as well as a cash value component in the policy. Mutual Trust Life Insurance Solutions has a focus on offering whole life insurance through its Horizon Value plans.

Here, the amount of the policy’s death benefit is guaranteed never to decrease (if the premiums are paid).

Also, the monetary value can increase on a tax-deferred basis. There will be no tax due on the growth in the assets that are inside of the cash value unless or until they are withdrawn.

Policyholders can either borrow or withdraw cash from the policy, for any need that they wish, including the payoff of debt, the supplementing of retirement income, or even for taking a pleasant, long-awaited vacation.

Also, because Mutual Trust Life Solutions is a mutual insurer, those who own a whole life plan may be eligible to receive dividends (although dividends are not guaranteed). When receiving a bonus, it is a return of premium, so it will not incur income tax.

The Horizon Value whole life insurance policies from Mutual Trust offer several additional benefits, including non-forfeiture, which means that the policyholder may opt to obtain either a reduced paid-up policy, or a term policy if his or her plans or budget changes.

Policyholders may also choose to add an accelerated death benefit rider – with chronic and terminal illness provisions – if they want to customize their coverage further. These options are available at no additional premium cost.

With this type of addition, it can be possible to accelerate a portion of the policy’s death benefit if the insured becomes chronically, permanently, or terminally ill.

Funds can be used for paying medical bills, or any other need that the policyholder sees fit.

Other Products and Services Sold

In addition to providing an extensive list of life insurance policy options, Mutual Trust also offers retirement annuities. Today, given our much longer life expectancies, one of the key worries of those who are retired (as well as those who are planning to retire soon), is outlasting their income.

An annuity can help alleviate that concern by providing the option of a fixed lifetime income – regardless of how long you live. These products also offer certain tax advantages during the savings (or accumulation) phase.

Mutual Trust offers the Integrity Plus Series of flexible and single premium deferred annuities. With a single premium annuity, only one single payment is required, while a flexible premium product allows you to make deposits over time.

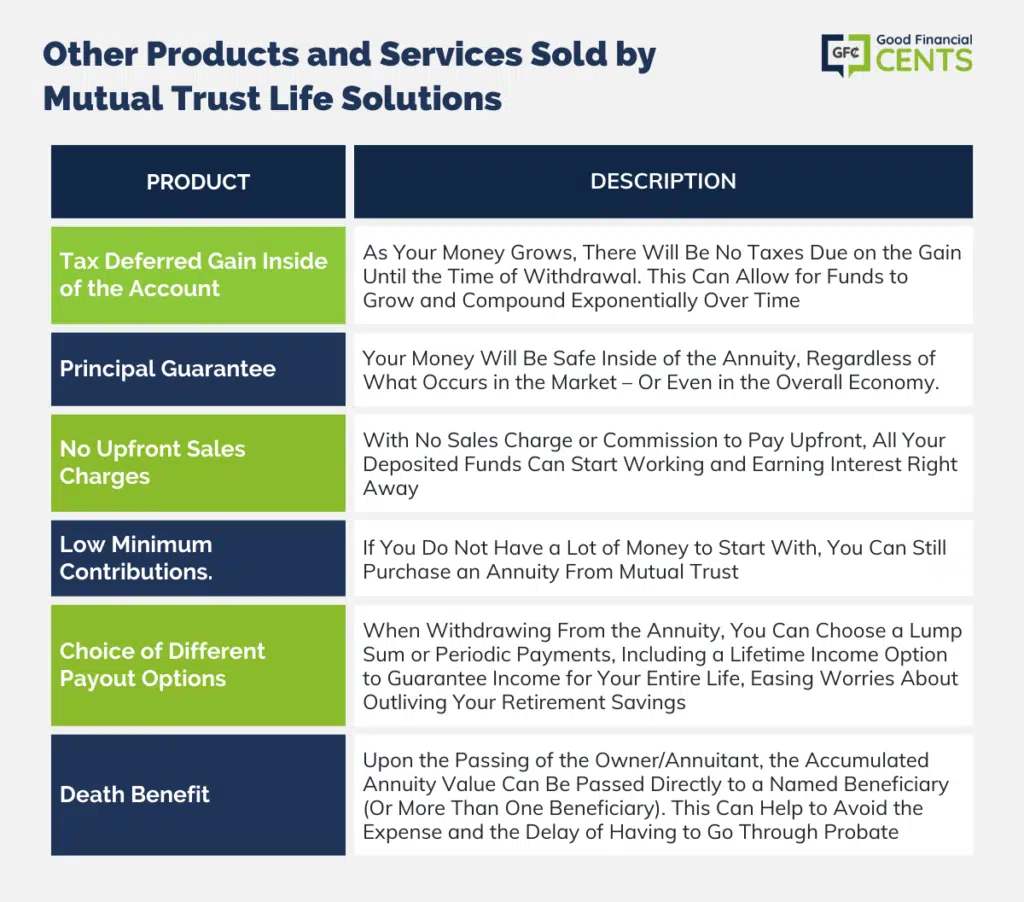

All the annuities that are offered by Mutual Trust Life Solutions allow for the following:

- Tax Deferred Gain Inside of the Account. This means that as your money grows, there will be no taxes due on the gain until the time of withdrawal. This can allow for funds to grow and compound exponentially over time.

- Principal Guarantee. This means that your money will be safe inside of the annuity, regardless of what occurs in the market – or even in the overall economy.

- No Upfront Sales Charges. With no sales charge or commission to pay upfront, all your deposited funds can start working and earning interest right away.

- Low Minimum Contributions. If you do not have a lot of money to start with, you can still purchase an annuity from Mutual Trust.

That is because the flex annuities offered by the company can begin with a minimum premium of just $300, and the single premium annuity products may be started with a minimum contribution of $5,000.

- Choice of Different Payout Options. When the time comes to start withdrawing money from the annuity, there are a variety of different options to choose from.

These can include taking out the entire lump sum or taking out an income stream on an annual, semi-annual, quarterly, or monthly basis.

There is also the lifetime income option whereby the insurance company will continue to pay out an income to you for as long as you live – regardless of how long that may be. This can help with reducing the worry of outliving your retirement income.

- Death Benefit. Upon the passing of the owner/annuitant, the accumulated annuity value can be passed directly to a named beneficiary (or more than one beneficiary). This can help to avoid the expense and the delay of having to go through probate.

How to Find the Best Premium Rates on Life Insurance Protection

If you are seeking the best premium rates on life insurance protection from Mutual Trust Life Solutions – or from any insurance carrier – it is typically recommended that you work with an independent life insurance agent or broker.

You will be able to choose from many different policies, insurance companies, and premium costs – and from there you can decide which will be the top option for you.

When you are ready to purchase, we can assist. We are an independent insurance brokerage, and we work with many of the best life insurance companies in the marketplace today. We can provide you with all the essential factors you need for making a well-informed life insurance buying decision.

We can do so for you swiftly and efficiently – all from your computer. If you are ready to see what coverage and premiums you qualify for, then just simply fill out our quote form to get started.

We understand that the purchase of life insurance may not always be an easy task. There are many different variables to choose from – and you want to make sure that you are going with the best plan possible for your – and your loved ones – needs.

But the good news is that – even with all the plans and alternatives to consider – this process can be made much easier when you are working with an expert in the field. So, contact us today – we’re here to help.

The Bottom Line – Mutual Trust Life Solutions

In navigating through the labyrinth of financial planning, ensuring a stable and reliable safety net for loved ones becomes paramount.

Mutual Trust Life Solutions, with a robust history exceeding a century and a solid financial foundation, asserts itself as a potential ally in this journey.

Offering a range of life insurance and annuity products, the company not only prioritizes the financial security of its policyholders but also provides potential dividends, demonstrating a commitment to its policyholders’ interests.

Meticulous in selecting a life insurance policy and company means ensuring a beacon of stability in unpredictable futures, and Mutual Trust Life Solutions presents a noteworthy option for consideration amidst a sea of choices.

The annals of its performance, product range, and customer trust provide a comforting assurance of its resilience and dedication in sailing through the complex waters of life’s financial uncertainties.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Mutual Trust Life Solutions Review

Product Name: Mutual Trust Life Solutions

Product Description: Mutual Trust Life Solutions provides a robust range of life insurance policies and annuity products designed to safeguard financial futures and provide reliable investment solutions. With a rich history exceeding a century and a diverse lineup of insurance offerings, including both term and permanent life insurance options, the company stands firm in catering to varied client needs, ensuring financial stability for beneficiaries and providing potential investment growth through its annuity offerings.

Summary

Embodying a legacy of trust and stability, Mutual Trust Life Solutions curates a suite of insurance and financial products that not only offer a financial safety net but also avenues for financial growth. From term life insurance, providing temporary yet cost-effective coverage, to whole life insurance that amalgamates lifelong coverage with a cash value component, the company comprehensively caters to diverse financial and life-stage needs. Additionally, its annuity products present a sustainable approach towards retirement planning, ensuring clients can safeguard their financial future while enjoying tax-deferred asset growth. The company’s product variety, coupled with a customer-centric approach, enhances its appeal to a wide spectrum of clientele, ranging from young professionals to retirees.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

-

Diverse Product Portfolio: A broad array of insurance policies and annuities catering to various needs, from financial protection to investment growth.

-

Stable Financial Footing: With superior ratings from A.M. Best and Fitch, Mutual Trust showcases solid financial stability, ensuring reliable claim payouts and financial deliverance.

-

History and Experience: Over a century of experience in the insurance domain signifies expertise, trustworthiness, and a deep understanding of evolving client needs.

-

Customer-Centric: A mutual insurer, it operates for the benefit of policyholders, and while not guaranteed, policyholders may receive dividends, enhancing overall policy value.

-

Retirement Solutions: Offering annuities with flexible and single premium options, they ensure varied client requirements for retirement planning are met effectively.

Cons

-

Digital Presence: Details about the ease of digital access, online policy management, and digital claim filing process might need further exploration and enhancement.

-

Limited Global Presence: Predominantly serving the U.S. market, global clients or those seeking international coverage might find options limited.

-

Policy Cost: Depending on age, health, and policy specifics, some clients may find premiums to be higher compared to other insurers, impacting affordability.

-

Customer Service: Insights into customer service experiences, responsiveness, and claim processing times are vital to understanding potential areas of improvement.

-

Market Competition: With a plethora of insurance providers available, Mutual Trust faces stiff competition, which may offer more innovative or cost-effective solutions.