When mapping out both your short– and long-term financial goals, life insurance should often be a key consideration. That is because the proceeds from life insurance can help to ensure that your loved ones will be protected financially in case of the unexpected.

But, just like any other important planning concept, there is not just a one-size-fits-all solution when it comes to choosing a life insurance policy. Rather, the plan should include the proper type and amount of coverage to fit your specific and unique needs.

Before you commit to purchasing a life insurance policy, you should also ensure that the insurance carrier that you’re buying the policy through is secure and stable financially and that it also has a good, positive reputation for paying out its claims promptly.

One insurance company that can help you in determining these factors is Progressive.

Table of Contents

The History of Progressive Insurance Company

Progressive has been in the business of offering insurance coverage for approximately 80 years.

The company was initially formed back in 1937, when its founders, Joseph Lewis and Jack Green, began the Progressive Mutual Insurance Company, to provide vehicle owners with protection and security.

Ever since its very beginning, Progressive has taken a unique approach to offering its insurance coverage. For example, the company was the first insurer to allow its policyholders to pay for their auto premiums in monthly installments rather than annually.

Over the years, the company has grown and expanded exponentially, and it has also added more coverage products and services to best fit the needs of its policyholders.

The company also moved out of its mutual status and became a publicly traded entity in 1951. And, by 1994, Progressive had surpassed $2 billion in written premiums.

Progressive makes it relatively easy to do business with them by offering online claims reporting, as well as the ability for its policyholders to log in and update their policy information, make premium payments, and more.

Today, Progressive Insurance Company is focused on its core values, along with diversity and social responsibility.

The company also has a wide array of honors and recognition to its credit, such as being listed on Advertising Age magazine’s annual list of the world’s most influential and creative thinkers, being recognized by Training Magazine on its Training Top 125 list, and being ranked as the #1 car insurance website by Keynote Competitive Research.

Progressive is headquartered in the Cleveland, Ohio suburb of Mayfield Village.

Progressive Life Insurance Review

Today, Progressive has written more than $18 billion in auto insurance premiums. The company continues to come up with innovative ways to give its customers attractive policies and quality service to meet their needs.

The company runs well-recognized television commercials, featuring the character Flo, who is the Progressive Messenger, touting the many benefits of its coverage, and its ease of using the price quote system to help with finding the right coverage and price.

Insurer Ratings and Better Business Bureau (BBB) Grade

Based on its financial backing and track record, Progressive is considered to be a stable insurance company. When it comes to life insurance, though, this insurer does not provide the policies directly.

Although Progressive is not an accredited company via the Better Business Bureau (BBB), the company has been given an overall grade of A- by the BBB. This is on a grade scale of A+ through F.

Efinancial has been an accredited company of the Better Business Bureau since June 1, 2000. This company has been given a grade of A+ by the BBB.

Over the past three years, Progressive has closed out 4,782 customer complaints via the Better Business Bureau, of which 1,994 have been closed out in the past 12 months.

During the past three years, Efinancial has closed out just five total customer complaints. Two of these have been closed out within the past 12 months.

Of the five total complaints, three were regarding advertising and sales issues, and the other two had to do with problems with the company’s products and services.

Life Insurance Products Offered By Progressive

In providing life insurance coverage to its customers, Progressive partners with the company Efinancial.

So in the life insurance arena, Progressive does not underwrite the coverage for its customers but rather just promotes the policies and acts as the conduit for marketing and getting the information to the customer.

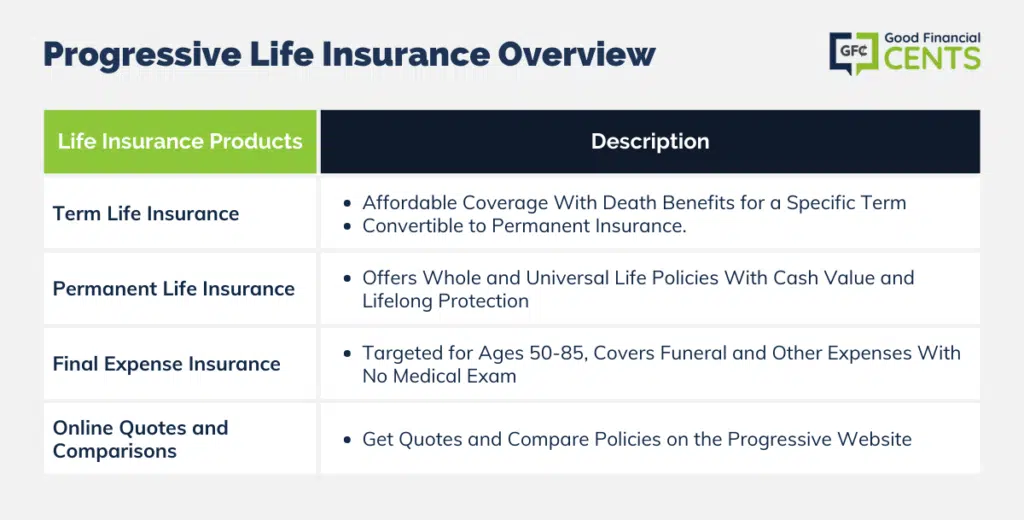

There are a variety of different policies to choose from – including both term and permanent plans. With term life insurance, there is death benefit coverage provided, but no cash value or savings build-up. This can help to keep the premium more affordable.

As the name suggests, term life insurance is offered for a set term or period, such as 10, 15, 20, or even 30 years. During this time, the coverage will typically remain level, and the premium that is charged will also not go up.

Often, insureds are allowed to convert their term life insurance coverage over into a permanent life insurance policy without having to take a medical exam or even provide any additional evidence of insurability.

There are also many different types of permanent life insurance options offered through Progressive / Efinancial. These include whole life and universal life insurance plans. Permanent life insurance provides death benefit protection, as well as a cash value component.

The funds that are in cash value can grow and compound on a tax-deferred basis. This means there is no tax due on the growth of these assets unless or until they are withdrawn.

The money from a permanent life insurance policy’s cash value can typically be used for any need or want for the policyholder, such as taking a vacation, paying off debts, supplementing retirement income, or even paying for a child’s or a grandchild’s future college education costs.

The life insurance policy quotes that are provided by Progressive Insurance also include final expense coverage. Final expense life insurance is typically geared towards those who are between the ages of 50 and 85, and the death benefit is usually in the range of $2,000 to $25,000.

These plans are often purchased with the intent of having the proceeds pay for the insured’s funeral and other final expenses – which today can range upwards of $10,000.

In many cases, there is no medical exam required to qualify for a final expense life insurance policy – and, once you have been qualified for a plan, the premium cannot be raised, nor can the coverage be canceled (provided that the premium is paid).

Final expense life insurance coverage is also often referred to simply as funeral insurance or burial insurance.

There are many different types of life insurance plans that may be acquired through Progressive – so finding the one that best fits in with your needs and with your budget is possible.

However, that being said, there can be many advantages and drawbacks to consider when moving forward with life insurance through Progressive Insurance Company.

First, although Progressive is not the actual underwriter of the policy, the company does provide customers with web support via the Progressive website.

Also, clients and potential clients can obtain life insurance quotes round the clock by going online to the Progressive insurance website – and, these quotes are provided from some different companies so that site visitors can immediately compare benefits and costs on the spot.

While buying life insurance through Progressive may be convenient in some ways, it can also make things more difficult, as the company is not considered to be a specialist in the life insurance niche.

Also, should the time come to file a claim on a life insurance policy, the beneficiary will need to contact the actual insurance company – not Progressive – to file a claim and collect the benefits.

(The online claims processing services that are offered via the Progressive website are only for auto insurance claims, not for life insurance).

Therefore, it will still be important to check out the actual insurance company that is chosen to determine whether or not it offers additional services that may be important to you, such as grief counseling, assistance with special needs trusts, and overall financial planning.

Other Products and Services Available

While you can get information and quotes on life insurance through Progressive, this insurer is not a life insurance company per se. Rather, the main product that is offered through Progressive is auto insurance.

In the auto insurance space, Progressive has an outstanding reputation – and the company will help you to not only obtain rates for its auto coverage but also quotes from other, competing for insurers so that you can compare and contrast which policy may be the best one for you.

Progressive offers much more than just insurance for your car. The company also offers policies for the following:

- Personal watercrafts

- Business vehicles

- Snowmobiles

- Segway HTs

Likewise, the company can also assist in finding homeowner insurance coverage. Through its Homequote Explorer, Progressive offers quotes on homes, as well as for other structures and related needs, such as:

- Barns

- Pools

- Fences

- Personal belongings

In the commercial insurance arena, Progressive offers quotes on coverage for commercial vehicles, trucks, vans, tow trucks, and dump trucks. And, to protect one’s business, the company also provides quotes for general liability, workers comp, contractors coverage, and professional liability insurance.

How to Get the Best Premium Rates Through Progressive Insurance Company

While you can obtain a variety of life insurance quotes through Progressive, it can often be best to work with an independent life insurance agent when seeking the best policy and premium rate for your needs.

By working with someone who focuses on life insurance coverage, you can have your questions answered so that you know exactly what it is you are getting – and why the option was chosen may be the best alternative for you.

If you are ready to determine what type and amount of life insurance policy will be the best for you, we can help.

We are an independent life insurance brokerage, working with many of the best life insurance carriers in the marketplace. We can assist you with getting all the important details that you need for making a well-informed purchase – all conveniently from your computer.

You won’t even have to meet in person with a life insurance agent. If you are ready to move forward with the process, then all you need to do is just simply click here and fill out our form.

We understand that the purchase of life insurance can seem a bit challenging. There are so many different variables, policies, and insurance companies to choose from – and you want to make sure that you are heading in the right direction.

But the good news is that this process can be done so much easier by working with an ally on your side who can point you in the right direction. So, contact us today – we’re here to help.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Progressive Life Review

Product Name: Progressive Life

Product Description: Progressive Life offers an array of life insurance products tailored to fit the varied needs of individuals and families seeking financial protection. Renowned for its commitment to customer service, the company provides policies ranging from term to whole life insurance, with several customizable options. Their innovative approach ensures that policyholders receive coverage that aligns with their unique life circumstances.

Summary of Progressive Life

Progressive Life, while popularly known for its comprehensive auto insurance, also excels in the life insurance domain. Their term life insurance policies provide cost-effective coverage for specified durations, ideal for those with temporary financial obligations. For individuals seeking permanent coverage, the company’s whole life insurance offers lifelong protection with potential cash value accumulation. Progressive stands out with its rider options and easy-to-navigate online platform, making policy management straightforward for users. By emphasizing transparency and customer engagement, Progressive Life remains at the forefront of offering tailored insurance solutions in a rapidly changing world.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Reputable Brand: As a recognized name in the insurance industry, Progressive Life carries a badge of trustworthiness.

- User-Friendly Digital Experience: Their online platform and tools make policy management and claims processes seamless.

- Customizable Policies: With a range of riders and policy adjustments available, customers can personalize coverage to their needs.

- Competitive Pricing: Progressive often offers competitive rates, especially when bundling multiple insurance products.

Cons

- Limited Advanced Life Options: Compared to life insurance specialists, Progressive might not offer as many advanced life insurance products or investment-linked policies.

- Varied Customer Service: Depending on the region or specific agent, the quality of customer service can sometimes be inconsistent.

- Overlapping Product Push: Being a multi-product insurer, there might be upselling or cross-selling of other insurance products to life insurance customers.

- Policy Limitations: Some of their policies may come with limitations or restrictions that might not suit everyone.