There are many reasons to purchase life insurance coverage – both personal and business. For most people, however, the key purpose is to protect other individuals or entities from financial loss in the event of death.

When seeking out the type of coverage to purchase, there are essentially two primary categories that life insurance falls into.

These include term and permanent.

Term life insurance is considered to be the most basic form of life insurance coverage on the market. It consists of pure death benefit protection with no additional cash value or investment component. This is why term life is typically the most affordable form of life insurance to purchase – especially for those who are young and in relatively good health, though there are no medical exam term life insurance policies out there if that is needed.

Permanent life insurance policies have two parts – a death benefit along with a cash value allocation. These types of policies offer an insurance component that pays a stated amount of proceeds upon the death of the insured. It also offers a cash value portion that accumulates cash that can be used by the policyholder to withdraw or borrow against.

The most basic form of permanent life insurance protection is whole life.

Table of Contents

How Whole Life Insurance Works

Guaranteed throughout the insured’s “whole” life, or until beneficiary payout, whole life is considered a permanent life insurance plan. It is the simplest permanent life insurance package most readily purchased by consumers.

One reason policyholders look into whole-life insurance plans is that the premium doesn’t fluctuate during the entirety of the policy’s term. Even though whole life insurance premiums may at the outset be higher, unlike a term policy with an identical face amount, premiums do not increase as the policymaker grows older. Whole coverage may also be referred to as ordinary life or straight life insurance.

Whole life insurance policies contain two primary components. These include a death benefit and a cash value component. The death benefit can be a set amount, or conversely, it can increase over time. (An increase in the policy’s death benefit could cause premiums to increase).

The cash value component will typically contain two separate elements. One is the actual cash that grows on a pre-determined basis during the life of the policy.

Initially, the cash value of the policy grows slowly. This is largely due to a majority of the early premium going toward paying the agent’s commission, as well as other fees. Over time, however, the whole life policy cash value will steadily grow – in most cases based on a minimum guaranteed rate of return.

As it continues to grow, this portion of the cash value will eventually “endow” or become equal to the amount of the policy’s death benefit upon maturity of the policy. This normally occurs when the insured reaches the age of 100.

In some cases, policies may also offer a non-guaranteed cash value element that is made up of policy dividends or excess interest. The combination of the general cash value portion with the non-guaranteed cash value build-up can enhance the value of the policy over time.

A whole-life policy’s cash value can typically be accessed at any time by the policyholder through withdrawals or policy loans. Paying back the loan is optional. However, any portion of the loan that is not repaid at the time of the insured’s death will decrease the amount of death benefit that the policy’s beneficiary receives.

Types of Whole Life Insurance Policies

There are different types and variations of whole life insurance that are available in the marketplace today.

These include:

Participating

A participating policy will share the insurance company’s excess profits with their policyholders. This is most often done by providing dividends. The policyholder will not be taxed on the dividend because they are deemed a return of a portion of the policy’s premiums.

Non-Participating

With a non-participating policy, the insurance company will assume all future performance risks. In other words, if an insurer’s actuaries underestimate the cost of future claims, responsibility would then shift to the insurance company to make up the difference. In such a case where an overestimation of the insurer’s future claims’ costs has occurred, then the insurance company may retain this difference. Non-participating policies do not pay dividends to their policyholders.

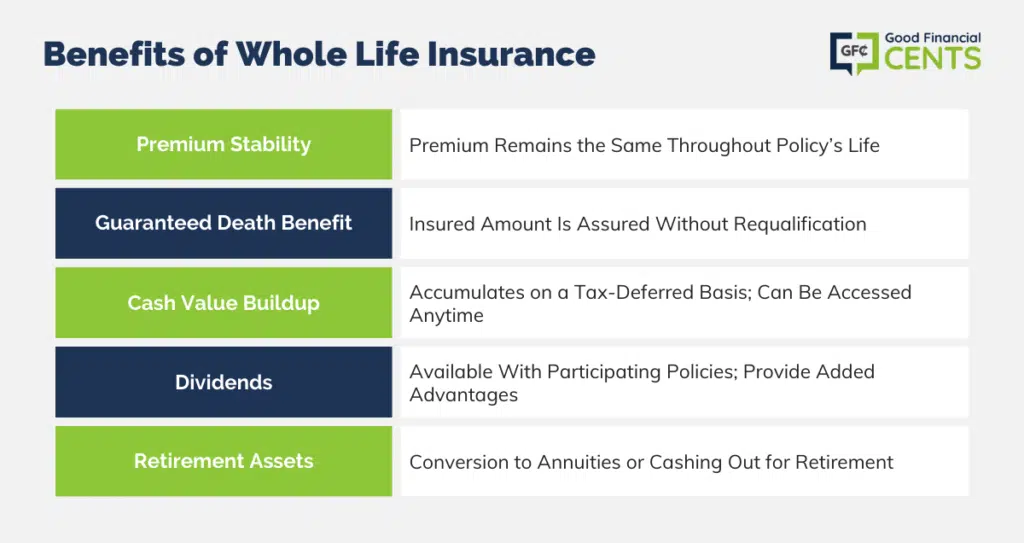

Benefits of Whole Life Insurance

There are several benefits to owning a whole life insurance policy.

First, although the premium may start out higher than term insurance premiums for the same amount of coverage, the premiums on the whole life stay level throughout the entire life of the policy. This makes the policy much easier to budget for over the long term.

Whole life insurance also offers a minimum guaranteed death benefit. Since those insured by whole life never have to requalify, they can count on a specific amount of death benefit for their survivors at a premium that never changes.

Certainly, another benefit is that they build cash value. This savings element allows insureds to build cash value on a tax-deferred basis. In addition, the policy owner can cancel or surrender the whole life policy at any time and receive the accumulated cash value.

If an insured owns a participating whole-life policy, they have the opportunity to earn dividends. These dividends provide many advantages, including additional cash value or increased death benefit.

Whole life insurance policies also offer the opportunity for additional retirement assets. For example, the insured can convert their cash value to a fixed annuity and use the income for retirement, or they can cash out and use the money for emergency funds or other bills.

Whole Life Insurance Method of Payment

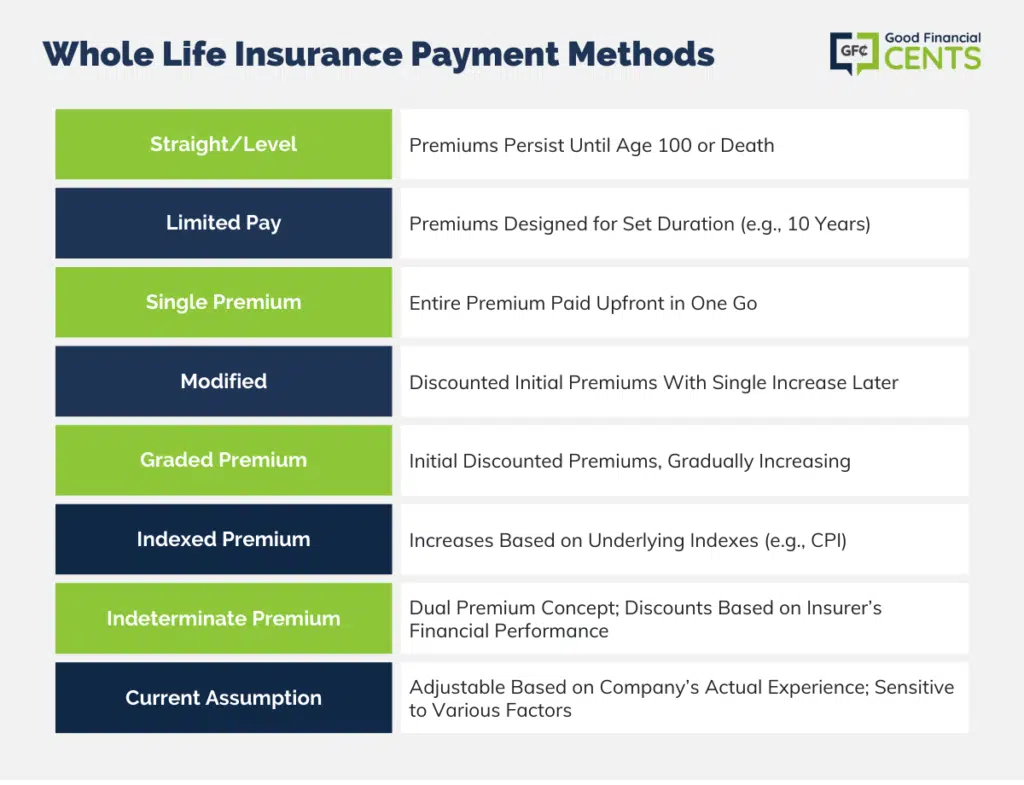

Whole life insurance policies are often classified by their method of payment.

A sampling of whole-life payment methods includes the following:

Straight/Level

The majority of whole life insurance policies are straight life. where premium payments will persist until the insured reaches age 100 or passes away. Straight whole life may also be referred to as pure or continuous whole life.

Limited Pay

As suggested by the policy’s title, the entire policy must be paid in accordance with a designated time schedule. For example, a 10-pay policy would set the premiums so that the policy would be entirely paid up after 10 years. After that, the policyholder would owe no more premium. These policies are designed for those who want permanent life insurance protection for their whole life but do not want to pay premiums indefinitely.

These types of policies will also have a higher amount of initial cash value. This is because each premium payment that is made is higher than the premium amount on a straight-life policy. Therefore, the cash component of a limited pay whole life policy will also typically accumulate more rapidly than that of a straight life policy as well. A limited pay policy will still endow when the insured turns age 100.

Single Premium

Single premium whole-life policies are considered to be “paid up” after the policyholder pays just one single premium. Because of the large sum of money initially deposited, cash value volume is substantial during the policy’s infancy. The premium is paid into the policy upfront, so purchasing at a discounted rate is typical, unlike the total premium amount of straight-life policies over a period of time.

Modified

Modified whole life insurance will require that the policy owner pay premiums throughout the policy’s life. However, an initial premium discount is offered in the early years, along with a single premium increase after several years. These policies are usually a good choice for those seeking permanent life insurance coverage but currently cannot afford the premiums.

Graded Premium

Similar to modified whole life insurance policies, discounted premiums are offered in the early years. Several premium increases are made available instead of a single offering. The premium will also grade upward over time. In this case, the premiums will usually level out higher than with a straight-life policy.

Indexed Premium

This policy’s face amount rises in response to increases outlined in underlying indexes like the Consumer Price Index (CPI) if the policy owner decides to authorize the increase. (The increase will also impact premiums). If the policyholder chooses not to have the face amount increase, in some cases, they will not be offered another option to do so. Placing a cap on the total increase permitted is normal for those choosing an indexed premium policy.

Indeterminate Premium

Intermediate premium whole life insurance policies work on a “dual premium” concept, which includes a maximum premium along with a discount that could reduce the premium. These policies are considered non-participating contracts, and they were initially developed to compete with participating life insurance policies.

The actual premium that is charged is never more than the maximum premium that is specified in the policy contract. However, these plans allow the policyholder to share in the insurer’s performance by applying discounts to the premium when the insurer is doing well financially. These types of policies will also endow when the insured turns age 100, should the policy still be in force.

Current Assumption

Current assumption policies are a type of hybrid of traditional cash-value life insurance and universal life insurance. These policies are non-participating, and they have some after-the-fact adjustment mechanisms without actually creating an actual policy owner cash dividend.

The adjustment mechanisms allow the insurer to constantly fine-tune its policy and keep it competitive in the marketplace based on actual company experience. At the time of the policy’s issue, the premium and the death benefit levels are all fixed, but only for a certain period of time, such as 5 years.

The premium and death benefit amounts are based on anticipated interest, mortality, and expenses. At the end of each policy period, the premium – as well as the death benefit (sometimes) – are recalculated, taking into account the actual accumulation account value and new experience assumptions.

Current assumption whole life insurance policies are sensitive not only to interest or investment performance on underlying assets but also to the mortality and expense experience of the insurer.

You can also get these with a variable life policy, which has an investment account instead of the savings account you get with other forms of permanent insurance.

How and Where to Obtain Whole Life Insurance Quotes

When seeking whole life insurance quotes, it is typically best to work with a company that has access to more than just one insurance company. That way, you can directly compare different policies, benefits, and premium quotes.

If you are ready to begin the quote process, I found a great company to help. I have partnered with Root Financial, which works with leading life insurers in the marketplace, and they can help you obtain all of the information that you need. In order to get started, all you need to do is fill out and submit the form on this page.

No matter what type of policy you choose, getting life insurance is vital to a good financial plan. So make sure you explore your options and get a policy that fits your family.

Conclusion – Whole Life Insurance Quotes

There are two main life insurance types: term (basic coverage) and permanent. Whole life insurance is a kind of permanent coverage. The big win with whole life? Your premium won’t change on you. There’s a death benefit (the payout part) and a cash value part that grows over time.

Different types? Yep, like ‘participating’, where you share in company profits, and ‘non-participating’, where the company handles risks. The perks? Steady premiums, a potential for dividends, and you can tap into the cash value if needed. If you’re hunting for a good deal, maybe start with Root Financial. Remember, life insurance is just smart adulting. Choose wisely!