Medicare is the United States’ federally administered health care program.

The program was established in 1965 for the purpose of paying certain health care expenses for people age 65 and over, as well as for other select individuals, such as those who have end-stage renal disease.

When originally established, there were only two parts. These were Part A for hospitalization coverage, and Part B for doctors’ services. Over time, the Medicare program has been expanded to offer additional coverage and choices for its enrollees.

We understand that any type of insurance coverage, from the best car insurance companies, the best life insurance coverage, or the best burial insurance for seniors, can be quite confusing. Remember, we are here to help!

Table of Contents

How Coverage Works

The Medicare program today is divided into four parts, and each of these covers a different area. These parts include:

- Part A – Hospital Coverage: Part A coverage will help an enrollee pay for inpatient care in a hospital or in a skilled nursing home facility. It also covers some types of home health care, as well as some hospice care. In most cases, there is no cost for participating in Part A.

- Part B – Medical Coverage / Doctors’ Care: Part B helps to pay for doctors’ services, as well as for a variety of other medical services and supplies not covered in Part A. Those who are enrolled in Part B will be required to pay a monthly premium. In 2015, most people pay a premium of $104.90 per month. This can vary, however, based upon the individual’s income and on whether they file their tax return jointly with a spouse or as a single individual. This article goes in-depth about the income limits and fees that high earners -“Medicare IRMAA brackets“- may have to pay regarding Part B and Part D coverage.

- Part C – Medicare Advantage / Managed Care: Part C is also referred to as Medicare Advantage. It provides a managed care approach to delivering Medicare-covered services, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Those who are eligible for Parts A and B may alternatively choose to receive all of their services through a Medicare Advantage provider organization under Part C. The premium one pays for Part C will depend upon the plan that is chosen, as well as on the enrollee’s geographic location. You can learn more about this coverage HERE.

- Part D – Prescription Drug Coverage: Part D helps to pay for prescription drugs doctors prescribe for the treatment of a patient. The premium charged for a Part D policy will depend upon the prescriptions you are taking, and thus, the actual plan that is chosen.

Recipients of Medicare, also referred to as beneficiaries, are able to choose coverage via the Original plan – which is actually Parts A and B – or they may choose Part C – which is Medicare Advantage.

Who Qualifies?

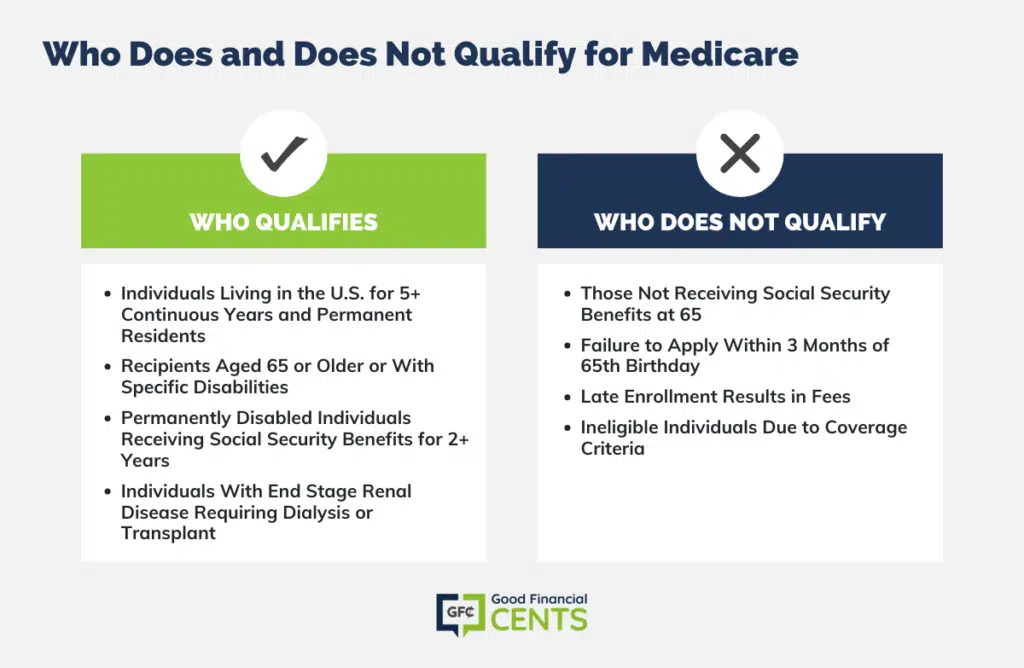

In order to be eligible, an individual must have lived in the United States for at least 5 continuous years, and also be a permanent resident of the U.S.

In addition, qualified recipients of benefits must be at least 65 years of age or over, or have a specific type of qualifying disability.

For a person to be considered permanently disabled, they must be entitled to receive benefits from Social Security, and they must have been receiving those benefits for a minimum of two years.

An individual who is diagnosed with end-stage renal disease and who also requires kidney dialysis or a kidney transplant may also be considered eligible for benefits from the program.

Adults Over 65

Most adults in the United States are eligible for Medicare when they turn 65. Individuals must be U.S. citizens or permanent residents and enroll in the Medicare program to qualify.

Individuals who are already receiving Social Security benefits will be automatically enrolled in the Medicare program. Approximately three months before their 65th birthday, an enrollment package will be sent and must be completed to activate coverage.

Medicare Part A, which covers hospitalizations, requires no payment. However, adding Part B – which is for doctor visits, outpatient procedures, or additional coverages, such as prescription drug coverage, does cost money. The premium is determined based on income level. So, individuals must decide what plan is best for them when enrolling and what they can afford to have.

Individuals With Disabilities

Medicare coverage is also available to individuals with disabilities regardless of their age. Once an individual has been collecting Social Security disability payments for twenty-four months, they become eligible for Medicare during the 25th month.

An enrollment package will be sent a few months before a person becomes eligible for Medicare coverage. If a person with a Social Security disability does not receive the enrollment package, they should contact their local Social Security office to request a packet.

Like an individual who is over age 65, disabled persons who have been getting Social Security disability payments are automatically eligible for Medicare. There is no reason to decline coverage, as Medicare Part A costs nothing and covers hospital care and nursing facility care.

However, if a disabled individual would like, they can decline Medicare Part B coverage, which would require premium payments. There is a card that comes with the enrollment package that the individual can mail back declining Part B coverage.

Who Does NOT Qualify for Medicare

People who are not already receiving Social Security benefits will need to contact their local Social Security office to apply for Medicare coverage. This should be done three months before the individual’s 65th birthday.

The enrollment period begins three months before the month of the 65th birthday and ends three months after. If one enrolls during this time frame, there is no cost for enrollment and coverage should begin at the start of the 65th birthday month or shortly thereafter (if one applies after their birth date).

If, however, one does not apply during that enrollment period, then fees apply. So, it is important to apply on time, and as close to the three-month prior date as possible. This will ensure everything is done correctly and coverage starts at the beginning of the individual’s birth month.

How to Enroll

To begin receiving benefits, an eligible individual must enroll through the Office of Social Security. There is only one exception to this rule, in that those who are already receiving benefits through Social Security or the Railroad Retirement Board are automatically enrolled when they turn age 65.

All other potential recipients must submit an application for coverage during the open enrollment period. This period of time begins three months prior to the applicant’s 65th birthday and it ends seven months after.

Those who do not enroll in Part A and/or Part B when they are originally eligible are allowed to enroll between January 1 and March 31 each year. For those who do, their coverage will begin on the following July 1.

Medicare Is Not Medicaid

Because their names sound so similar, people can oftentimes confuse Medicare with Medicaid. These two programs, however, are not the same. Medicaid is a joint state and federal program that provides medical assistance to those who meet very specific low-income requirements.

In addition to medical necessity, a person must be considered at his or her state’s poverty level in terms of income and assets for Medicaid qualification purposes.

Through the Social Security Act, those who have income and resources not considered to be sufficient to meet the cost of their needed medical care, as well as certain long-term care needs, can qualify for Medicaid’s benefits. Therefore, Medicaid is considered a “means” test program.

When determining which assets “count” toward qualifying for Medicaid, funds and property are divided into three different classes.

These include the following:

- Countable Assets: Countable assets include any personal assets that the individual either owns or controls. These funds are required by Medicaid to be spent on the applicant’s care before he or she will be able to qualify for Medicaid’s benefits. Some examples of countable assets may include cash, stocks and bonds, and deferred annuities (provided that the annuities have already been annuitized).

- Non-Countable Assets: Even though non-countable assets are still acknowledged by Medicaid, the particular types of assets are not necessarily utilized when making a determination regarding an applicant’s eligibility for Medicaid benefits. Non-countable assets can include household belongings, such as furniture, appliances, term life insurance policies, a burial plot owned by the Medicaid applicant, and the applicant’s primary residence – as long as the value of the home does not exceed a certain amount.

- Inaccessible Assets: Assets that are inaccessible are those considered to be resources that would have had to be spent on a person’s care; however, the assets have instead been transferred to another individual or into a trust. This transfer has therefore made the asset inaccessible. With inaccessible assets, Medicaid has the right to review the applicant’s financial records at the time that the application for benefits is made. In most cases, if assets were transferred within a certain amount of time prior to a person’s application, Medicaid may deem the individual as being disqualified from receiving benefits – at least for a certain period of time.

What Is Supplemental Insurance and What Does It Cover?

Medicare supplement insurance plans are a type of insurance coverage supplemental to what Medicare covers. This type of coverage can pay for some – or in some cases, all of the copayments and/or deductibles so that the enrollee does not need to pay such expenses out-of-pocket.

Medigap insurance is specifically designed to supplement Medicare’s benefits, and it is regulated by both federal and state law. A Medigap policy must be clearly identified as being Medicare Supplement insurance, and it must provide benefits that help to fill in the gaps in Medicare’s coverage.

Although the benefits are identical for all supplement plans of the same letter (i.e., all Plan A policies offer the same coverage options), the premiums may vary from one insurance carrier to another, as well as from one geographic area to another. There are even three states that do not use the letter system but have different ways of designating their plans.

What Is Medicare Advantage and How Does It Work?

A Medicare Advantage (MA) plan, similar to an HMO or PPO, is a type of Medicare plan available to those who are eligible for “Original Medicare”, or Parts A and B. This option is also referred to as Part C. These plans are actually offered by private insurance companies approved by Medicare.

Each of the Advantage Plans is allowed to charge different out-of-pocket costs, and they may also have different rules as to how enrollees can receive their services. For example, some plans may require participants to get a referral before going to a specialist. And, these rules may change every year.

MA Plans also have an annual cap on how much participants will pay for their Part A and Part B services throughout the year. This annual, maximum out-of-pocket amount can differ from plan to plan. You can get a full understanding of how MA plans can be a benefit to you HERE.

How to Find the Best Coverage

When seeking Supplemental or Advantage coverage, it is best to work with a company that has access to more than just one insurer.

That way, you can obtain information on numerous different benefits and quotes to see what your options are and what benefits are available to you.

When you’re ready to begin the process, you can use the form on this page and a top independent agent will work with you to get the best policy at the best rates.

Final Thoughts on Understanding Medicare

Medicare, the federally administered U.S. health care program established in 1965, aids those aged 65 and over, plus those with end-stage renal disease. Evolving from just Part A and B, Medicare now encompasses four parts. Part A covers inpatient and hospice care; Part B, doctors’ services. Part C, known as Medicare Advantage, offers managed care options. Part D aids prescription drug costs.

Eligibility criteria involve age, U.S. residency, and qualifying disability. Medicare can be confused with Medicaid, but they’re distinct programs. Supplemental insurance and Medicare Advantage provide additional coverage. Researching options through reputable sources ensures the best policy.