A Medicare Advantage plan, similar to an HMO or PPO, is a type of Medicare plan that is available to Medicare enrollees. This option is also referred to as Medicare Part C. These plans are offered by private insurance companies that are approved by Medicare.

By joining a Medicare Advantage Plan, a participant essentially gets all of their Medicare Part A (Hospitalization Coverage) and Medicare Part B (Physicians Coverage). In fact, Medicare Advantage Plans are required to cover all of the services that the Original Medicare covers except for hospice care. This is because Original Medicare covers hospice care, even if the participant is enrolled in Medicare Advantage.

In addition, a Medicare Advantage Plan may offer additional coverages such as vision, dental, and/or health and wellness programs. Most Medicare Advantage plans also include Medicare prescription drug coverage.

Table of Contents

When an individual joins a Medicare Advantage Plan, Medicare pays a fixed amount of their care every month to the companies that offer these plans. These companies are required to follow strict rules that are set by Medicare.

However, each of the Medicare Advantage Plans is allowed to charge different out-of-pocket costs, and the plans may also have different rules as to how enrollees can receive their services. For example, some plans may require participants to get a referral before going to a specialist. And these rules may change every year.

Medicare Advantage Plans also have an annual cap on how much participants will pay for their Medicare Part A and Part B services throughout the year. This annual maximum out-of-pocket amount can differ from plan to plan.

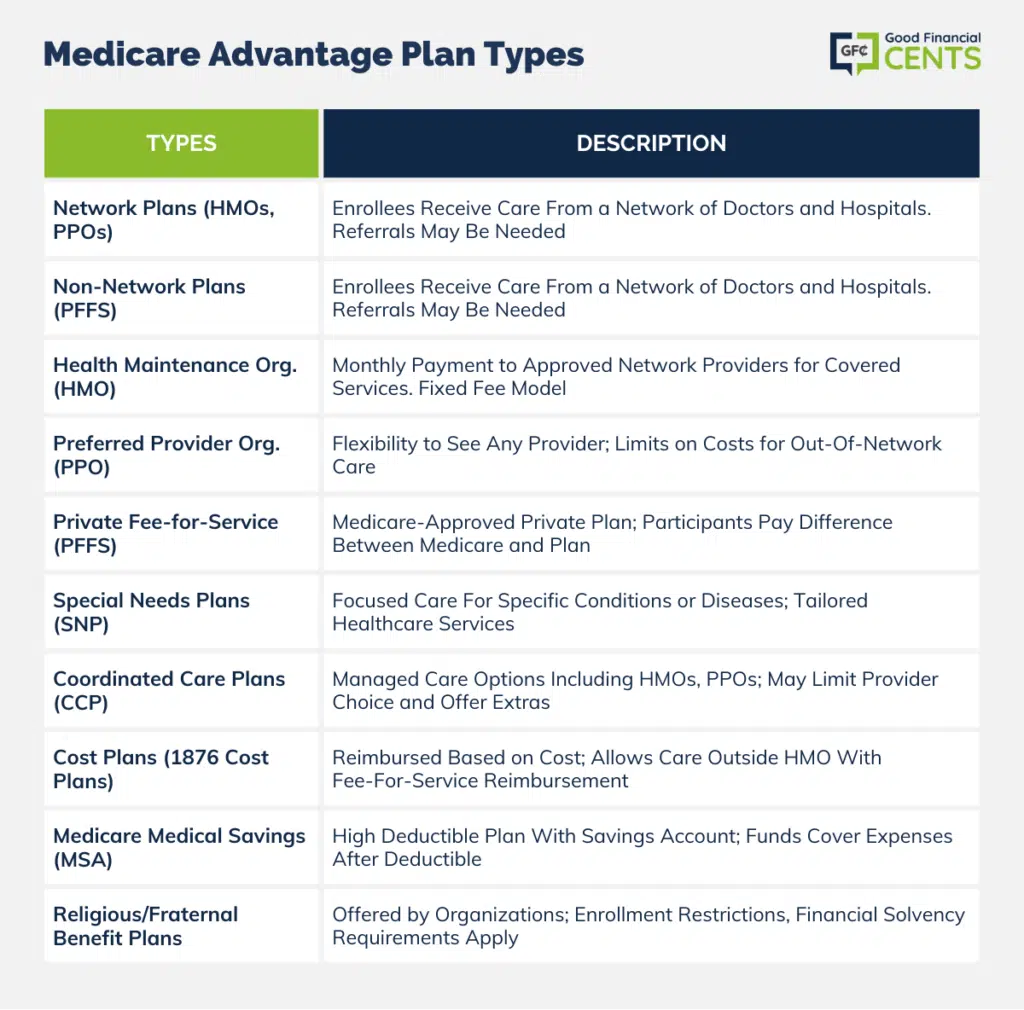

Different Types of Medicare Advantage Plans

Essentially, there are two primary types of Medicare Advantage plans. These are network and non-network. Network plans offer care to enrollees through their network of physicians and hospitals and are identified as HMOs and PPOs.

The non-network Medicare Advantage plans are a type of personal fee-for-service plan that does not require the participant to see a specific doctor or go to a specific hospital. However, the doctor or hospital that is chosen must be willing to accept the plan’s payment structure.

With a Medicare Advantage Plan, a participant may choose to stay in the traditional Medicare program or in their current managed care plan.

Or, as an alternate option, the participant may choose to receive their Medicare-covered services through any of the additional following types of health insurance plans:

Health Maintenance Organization (HMO)

These plans consist of a network of approved hospitals, doctors, and other types of healthcare service professionals who agree to provide their services in return for a set monthly payment from Medicare.

These healthcare providers will receive the same fee each month, regardless of the actual services that they provide.

Preferred Provider Organization (PPO)

These plans are somewhat similar to HMOs, however, with a PPO, the beneficiaries do not need to obtain a referral in order to see a specialist who is outside of the network. Also, participants are allowed to see any provider or doctor that accepts Medicare. However, PPOs do limit the amount that their members pay for care outside of the network.

Private Fee-for-Service Plans (PFFS)

These types of plans offer a Medicare-approved private insurance plan. With these plans, Medicare will pay the plan for Medicare-approved services while the PFFS determines – up to a certain limit – how much the care participant must pay for their covered services. In these plans, the participant handles the difference in cost between the amount paid by Medicare and the amount that the PFFS charges.

Special Needs Plans (SNP)

These types of plans provide a more focused type of health care for those who have specific health conditions. An individual who joins an SNP plan will receive health care services as well as more focused care in order to manage their specific condition or disease.

Coordinated Care Plans (CCPs)

These plans are managed care plans that include HMOs (health maintenance organizations), PPOs (preferred provider organizations), and regional PPOs. They provide coverage for health care services either with or without a point-of-service option (the ability to use the plan or out-of-plan health care providers).

Some CCP plans will limit the participant’s choice of healthcare providers. Other plans may offer benefits in addition to those offered in the traditional Medicare program, such as prescription drug coverage. Still, other CCP plans may limit the choice of healthcare providers and the supplemental benefits that may be received.

Cost Plans (1876 Cost Plans)

Cost plans are a type of HMO plan that gets reimbursed on a cost basis rather than on a capitated, or per head, amount, such as with other types of private health care plans. Cost enrollees are allowed to receive care outside of their HMO and have those costs reimbursed through the traditional fee-for-service system.

Medicare Medical Savings Account Plans (MSAs)

These types of plans will combine a high deductible Medicare Advantage Plan with a medical savings account for medical expenses. These Medical Savings Accounts consist of two parts. These are:

- A private Medicare Advantage insurance policy with a high annual deductible

- A medical savings account

The health insurance policy does not pay for covered health care costs until the deductible has been met. Then, the medical savings account will come into play when Medicare deposits money into an account for the participant. These funds may then be used for any type of health care expense – including the participant’s deductible.

Participants in these types of plans will typically pay for their medical expenses out-of-pocket for the amounts under the deductible.

In addition, there could be tax-related penalties if a participant withdraws funds from the account for any reason other than medical.

- Preferred Provider Organization Demonstration Plans (PPO Demo)

- Private Contracts

- Cost Plans

- Other Demonstration Plans

- Religious and Fraternal Benefit Society Plans – Medicare Advantage plans may even be offered by religious and fraternal organizations. These organizations are able to restrict enrollment in their plans to their members.

In these cases, the plans must meet the Medicare financial solvency requirements. In addition, Medicare may also adjust payment amounts to the plans in order to meet the characteristics of the participants who are enrolled in the plan.

Who Is Eligible for a Medicare Advantage Plan?

In order to be eligible to enroll in a Medicare Advantage plan, a participant must meet two conditions. These are:

- They are entitled to Medicare Part A, and they are also enrolled in Medicare Part B as of the effective date of enrollment in the Medicare Advantage plan

- The participant lives within the service area that is covered by the Medicare Advantage plan

There are a few exceptions, however, to these requirements. One exception is that a Medicare participant will not typically be allowed to enroll in a Medicare Advantage plan if they have end-stage renal disease that requires regular kidney dialysis or a transplant to maintain life.

If, however, a participant is already enrolled with the Medicare Advantage organization when they first develop end-stage renal disease, and they are still enrolled with the Medicare Advantage organization at that time, then they are allowed to stay in the existing plan or join another plan that is offered by this same company.

Should an individual wish to enroll in a Medicare Advantage plan, they can do so by completing a paper application, calling the plan, or enrolling on the plan’s website. They can also go directly to Medicare’s website at www.medicare.gov.

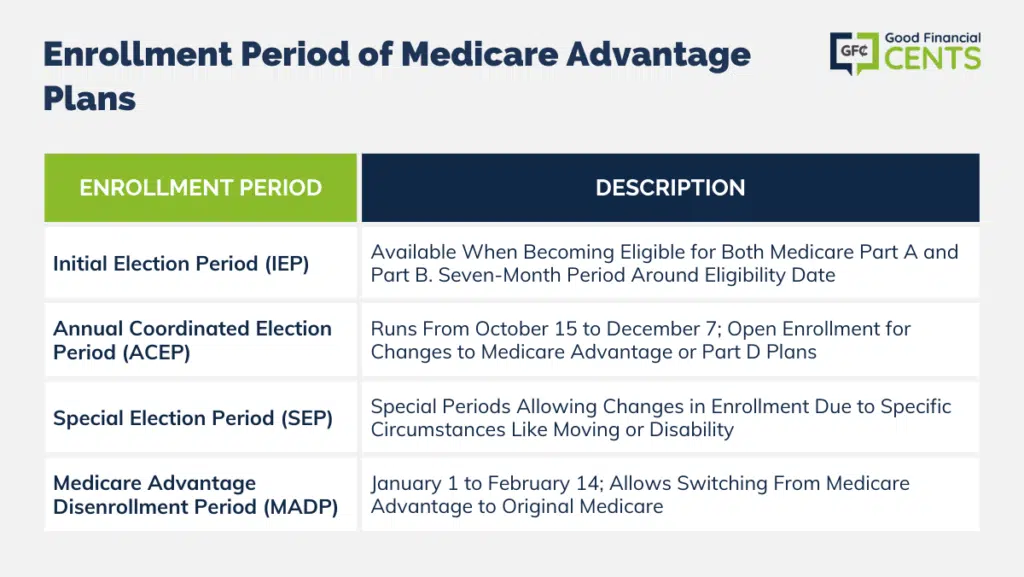

When Should an Individual Enroll in a Medicare Advantage Plan?

There are specific times, however, when an individual may enroll in a Medicare Advantage plan. These include:

Initial Election Period (IEP)

This period is also referred to as the initial coverage enrollment period. Therefore, an individual may elect to enroll in a Medicare Advantage plan when they first become entitled to both Medicare Part A and Medicare Part B.

This initial election period will begin on the first day of the third month prior to the date on which the individual is entitled to both Part A and Part B and will end on the last day of the third month after the date that the person became eligible for both parts of Medicare.

Three months prior, the month of, and three months after will essentially create a seven-month election period. This is the same election period as for enrolling in Medicare itself. Participants who are within this initial period of time will not need to wait for any other type of enrollment period. Their coverage will begin on the first day of their birth month.

For those who are enrolled in disability coverage, there is also a seven-month window for enrollment from the time that the person receives their Medicare disability benefits.

Annual Coordinated Election Period (ACEP)

During this time, a participant may elect to enroll, drop, or change their enrollment in a Medicare Advantage and/or Medicare Part D plan. Starting in the year 2011, this period began running from October 15 through December 7 of each year. This period can also be referred to as the fall open enrollment period or as the annual enrollment period.

Special Election Period (SEP)

These are considered to be special periods of time during which an individual will be allowed to enter into or discontinue enrollment in a Medicare Advantage plan. They may also change their enrollment to another MA plan or return to the Original Medicare plan at this time if they so choose.

In addition, an individual may enroll in a Medicare Advantage plan during this time if they have recently become disabled. And/or an individual may also begin receiving assistance from Medicaid. In this case, the individual will not need to wait until the October 15 ACEP enrollment period. There are also times when a special election period will be allowed. These include:

1. The Medicare Advantage plan that the participant is enrolled in is terminated. This is referred to as being an involuntary disenrollment. This will result in involuntary loss of creditable coverage for the participant.

2. The Medicare Advantage company that offers the plan violated a material provision of its contract with the enrollee.

3. The participant moves out of the area of plan service.

4. The participant recently experienced a disability.

5. The participant meets other certain material conditions as CMS may provide. These can include a delayed enrollment due to an employer’s or a spouse’s coverage being terminated or an involuntary loss of creditable group coverage.

6. The participant is receiving any assistance from Medicaid that could include the following:

- Beneficiaries who reside in long-term care facilities

- Full dual eligibles

- Partial dual eligibles

7. The participant meets other qualifications that are related to long-term facilities, low-income subsidy eligibility, Medicare Part D coverage, and other circumstances that give CMS the discretion to create a SEP.

Medicare Advantage Disenrollment Period (MADP)

This is the period of time in which individuals may dis-enroll from a Medicare Advantage plan and/or from a Medicare Advantage with Part D coverage plan and then may subsequently enroll in the Original Medicare plan – either with or without a Part D plan.

This period runs from January 1 to February 14. The individual’s new coverage will become effective as of the first day of the month following the change in coverage. A participant is allowed to make one change per year from a MAPD to another MAPD or from a Medicare Supplement Plan with a stand-alone PD to a MAPD.

Getting Quotes on Medicare Advantage Plans

When obtaining quotes on a Medicare Advantage plan, it is typically best to work with a company or an agency that has access to more than just one insurer. That way, you can obtain a comparison of quotes in order to determine which will work best for you. We can assist you with this. If you are ready to move forward, just fill out the form on this page.

Should you have any additional questions, we can be reached directly by phone by calling toll-free 888-229-7522. Our experts are happy to walk you through any Medicare Advantage plan information that you may need. So, contact us today – we’re here to help.

Bottom Line: Deciphering Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C. These plans are like the VIP pass to healthcare, offered by private insurance companies approved by Medicare.

They cover your Medicare Part A and Part B services and often throw in cool extras like dental, vision, and even prescription drug coverage. You’ve got choices between network plans (HMOs, PPOs) or non-network plans, each with its own costs and rules.

To jump in, you need to be enrolled in Medicare Part A and Part B and live in the plan’s service area – though there are a few exceptions. There are some sweet enrollment periods like IEP, ACEP, SEP, and MADP, giving you the flexibility to pick the right plan at the right time.

But it is all about making smart moves, so teaming up with pros who know the ropes can help you navigate these options like a champ.