If you’re reading this article in your 20s and are serious about investing, you rock.

If you actually set out to invest money while you’re in your 20s, and you do it on a regular basis, do you know what your retirement will look like? In one word: Awesome!

Over the years, I’ve made some great investments and some poor ones. Learn from me. I’ve been there and done that.

If it wasn’t for me stumbling into becoming a financial advisor, I’m not confident I would have started investing in my 20s, even though I majored in finance.

In fact, many of my friends didn’t. I kept hearing the same lame excuses: “I’ll wait till later,” or “I don’t have enough to invest right now,” or “I don’t know where to start”.

Well, check out some of our great reviews for tips on investing, such as our Ally Investing Review or our Fundrise Review.

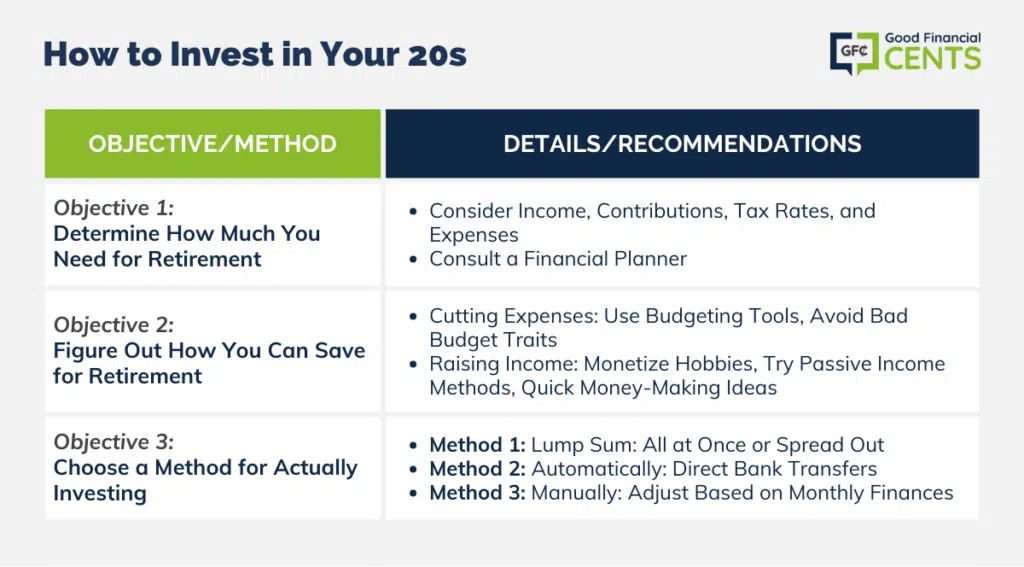

How to Invest in Your 20s

- Determine How Much You Need for Retirement

- Figure Out How You Can Save for Retirement

- Choose A Method for Investing

- Chose Where To Invest

- Tips: What To Do BEFORE Investing

If you’re reading this post, you can no longer hide behind any of these excuses. It’s time to get started before regret sucker punches you in the financial gut.

If you’re just starting out investing, you may not have enough money to invest with an investment advisor face-to-face. That’s okay. I’m going to show you what to do.

Table of Contents

Objective 1: Determine How Much You Need for Retirement

The first objective is to determine how much you need to invest for retirement. There are a variety of factors that go into this equation, including but not limited to:

- Expected income over time

- Expected contributions over time

- Expected tax rates over time

- Expected market returns

- Expected expenses in retirement

The list goes on and on, my friend. If you can afford it, sit down with a financial planner or financial advisor and ask them what they think you should invest on a regular basis. It’s worth it to pay someone to figure out this figure for you.

Objective 2: Figure Out How You Can Save for Retirement

The second objective is to figure out how you can actually save for retirement. It seems obvious, but unless you have some money rolling in, you’re not going to get anywhere when it comes to saving for retirement – unless you land an inheritance or win the lottery, but let’s not place our bets there.

When you’re in your 20s, you’re probably not making much money. Perhaps you have a minimum-wage job, and you’re working on developing your skills for a career. Maybe you’re in your late 20s and have already started your career, but you’re awfully busy, and your responsibilities have you living paycheck to paycheck.

Where in the world are you going to find this money for saving for retirement?

Well, there are really only two realistic options: cutting your expenses or raising your income. Let’s explore both.

Cutting Your Expenses

If you’re not on a budget, you’re probably wasting a lot of money. Listen, only millionaires and the like can afford to forgo a budget, and even then, they are probably wasting a ton of dough.

So, if you don’t have a budget in place yet, let me give you a few recommendations . . . .

- First, take a look at some of the best (and free) online budgeting tools. Experiment with some of them. See what works for you.

- Second, take a look at some of the reasons some budgets suck. As you work your newfound budget, make sure you avoid some of these characteristics that make for horrible budgets. You don’t have to learn the hard way if you do a little research to get this right in the first place.

- Third, consider doing some tactical budgeting. This is extreme budgeting, and it will help you be more strategic when it comes to cutting expenses and analyzing your situation.

If you have cut your expenses down to the essentials, it’s time to look at raising your income.

Raising Your Income

In order to invest more money for retirement, you might have to raise your income. The beauty of investing in your 20s is that you don’t have to shovel a lot of money toward the future because of a wonderful thing called “compound interest.”

Here are a few recommendations for raising your income . . .

First, take a look at some side hobbies that can actually make you money. Many of these can be accomplished in your spare time, and if you already enjoy these hobbies, why not do them and make a little side money at the same time?

Second, discover some passive income ideas to put your earnings on autopilot. Passive investing is a fantastic idea. Why? Because it means you work once and earn forever – well, at least for a long period of time. Many jobs require you to work and get paid, work and get paid. Passive income means working and get paid, get paid, and get paid again.

Third, check out my slew of ideas to make money fast. You know, if you’re in a pinch, you’re going to need to make a lot of money very quickly to start building the foundation you need to invest in your 20s. That’s why I recommend trying out some methods to make money very quickly. Some of them might not be sustainable in the long term, but they’ll help you get the immediate job done.

Objective 3: Choose A Method For Actually Investing

In a few moments, you’ll read about where to invest your money in your 20s. But before we get to that, let’s take a look at a few methods you can use to invest.

Method 1: Invest a Lump Sum

If you have a bunch of money saved up already, you might want to simply invest a lump sum. That’s cool! Some people simply invest their stash of cash all at one time. Others decide to take that lump sum and spread it out a bit over a few months or years.

The latter option is smart because it will allow you to take advantage of dollar-cost averaging (so you buy at more of an average price per share rather than a potentially high price).

Method 2: Invest Automatically

This is probably the best and most doable method for most in their 20s. Once you’ve figured out how much you should and can invest, you can simply have that amount go directly from your bank account to your investment institution of choice. Set it up, and don’t worry about it! Many times, you can increase this amount over time as you get new jobs and pay raises. Before you know it, you could be investing 5,000 dollars or more a year without even feeling it.

Method 3: Invest Manually

This method is nice for those who want to throw most of their extra dough into investments. Say, for example, most months, you can invest around $100, but this month you can invest $250. Manual investing allows you to adjust your investing based on your actual circumstances.

Where to Invest in Your 20s

Next, you’re going to have to determine where you’re actually going to invest your money.

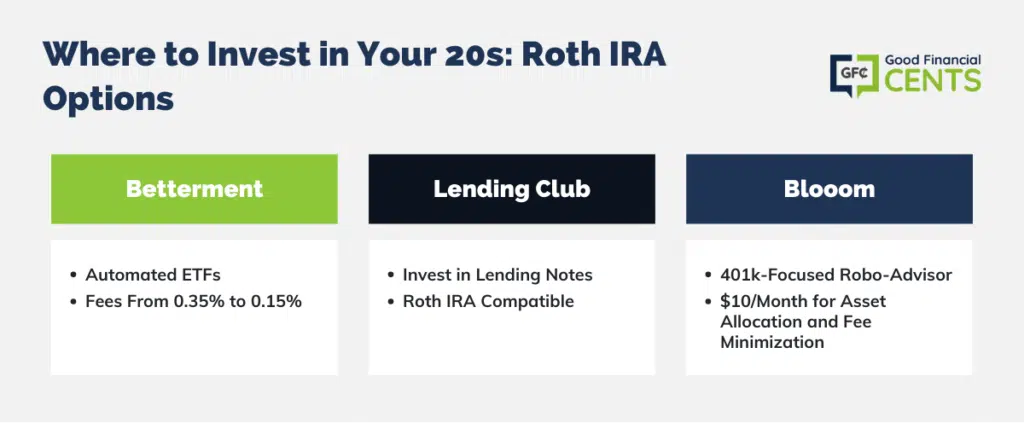

Roth IRA Options

I recommend using a Roth IRA. I love the Roth IRA. Why? If you expect to pay a higher tax rate in the future than you do now, the Roth IRA can help you pay taxes on your investments now so you don’t have to pay taxes when it comes time to withdraw from your investment account.

Seriously, consider the Roth IRA.

There are a few ways you can invest using a Roth IRA (or a personal investment account if you already have retirement covered) . . .

Betterment

Betterment is a great choice if you want to automate the investment process.

Betterment uses ETFs, known for their low fees and flexibility, to invest your money. Betterment helps you diversify your investments and professionally manage your portfolio using preprogrammed software designed to help you reach your investment goals.

One of the nice things about Betterment is their low fees. And, the more you invest, the more you save in fees. You can start out with fees as low as 0.35% annually and work your way down to paying as little as 0.15% annually (see Betterment’s pricing for details).

Read our Betterment Review.

Lending Club

If you want to try something unique, give Lending Club a shot. Instead of investing your money in stocks and bonds, with Lending Club, you’ll be investing in notes.

That’s right, you’ll be lending money to others who need it – and making a profit. You can find quality borrowers through Lending Club and make some solid returns.

Best of all? You can use a Roth IRA with Lending Club. Didn’t expect that, did you?

If you want to learn more about Lending Club, read my Lending Club review for investors.

Blooom

Blooom is one of your go-to investment platforms for starting a 401(k). Why? Because they’re a robo-advisor specifically created to manage your contribution plan.

This expert platform has one goal and one goal only- to help you reach your 401(k) target. Along those lines, they work to make sure your assets are allocated properly and help you avoid unnecessary fees.

Blooom both advises you on these fronts and manages your investments, requiring no effort from you but always granting you access to your account information. These valuable services come in at $10 a month, simplifying your retirement strategy.

Before You Invest in Your 20s

If you’re in your 20s, and you want to invest, you’re thinking in the right direction; however, you may have some other financial obstacles that you should overcome before you start investing.

I went into some detail regarding my financial planning steps here. But let’s summarize some of the key goals you should accomplish before you start investing your dough.

Your Freedom Fund

Common financial advice suggests you have an “emergency fund” or a “rainy day fund.”

A freedom fund is essentially the same thing; I just want to think of it differently.

Why call it a freedom fund? Because having cash reserves gives you the freedom to:

- Take a much-needed vacation if you’re overworked and stressed from your job.

- Look for a new job if you have a horrible boss who doesn’t treat you with respect or value your contributions.

- To move if you hate your home or city and want to press the reset button and try living somewhere.

There’s power in freedom, and that’s exactly what a freedom fund offers.

Listen, if you have an emergency, one of the last places you want to take money from to pay for emergency expenses is your investment accounts – especially if they’re in a slump.

When you invest, you should invest for the long term. Think years. Don’t assume you won’t need money in the next month or two for an emergency. You know, often, emergencies don’t warn folks of their arrival dates. They just happen – and they can happen at the worst possible times.

Before you begin, get your freedom fund in place. Shoot for eight months’ worth of expenses.

Debt

This is a biggie. Do you have car loans? Student loans? Homing pigeon loans? Pay them off!

Debt, in many ways, is like the anti-investment with a twist. It’s designed so that you will pay.

It’s not that you might pay. You will pay. Investments go up and down, but debt always digs a hole (at the very least, what you owe, and many times with interest).

The good news is that paying off student loans, car loans, or whatever kind of loan you have is a lot like making an investment with a guaranteed return. You can rest assured that when you pay off some debt, you won’t have to pay interest on that money anymore. Isn’t that beautiful?

Student loans are a big topic lately. I met with a college grad who got all his student loans from cosigner parents. He was amazingly worried, but when we looked at his overall debt, he got his plan in action and paid it off.

Hint:

There are some tips later in this article to help you find the cash to accomplish these goals. But if you can’t wait, take a look at our SoFi review.

Congratulations!

If you’re in your 20s and finished reading this article, bravo!

But it’s not enough to have read this article. Follow the advice. Don’t become one of those 65-year-olds who regret not investing in their 20s. Now go and invest!

Please note this article may contain affiliate links that, when clicked, result in me earning a commission.

Bottom Line – How to Invest in Your 20s

Investing in your 20s can set the foundation for a secure financial future, allowing you to capitalize on the power of compound interest.

By establishing clear objectives – determining retirement needs, identifying savings methods, and choosing the right investment approach – you set yourself on the path to success.

Leveraging resources like Roth IRAs and platforms such as Betterment or Lending Club offers diverse options tailored to younger investors.

However, before diving into the investment world, prioritizing a freedom fund and eradicating debt are paramount. These steps ensure you’re not only prepared for unforeseen challenges but also ready to optimize your investments without hindrance.

Financial empowerment starts young, and the strategies highlighted provide a roadmap to thriving in the years ahead.

This is really helpful! I was hesitant as well and did not know where to begin. A friend referred me to MC-Wealth and they have been very patient with me while explaining the various investment plans and benefits that would suit my requirements. I can now see why starting investing early on can be so beneficial later on in life!

Its about the people in there 20 who invest their money and if they don’t have money to make the investment they can then that’s okay the advisor will expect income over time.

Well put Justin!

This is a well written article, but shouldn’t they invest in the stock market. As a 20 year old they can stand to gain and lose money, so they should invest in volatile stocks for high risk and high reward?

Hi Braeden – That’s what I was hitting on with Objective #3. But if you’re investing for the first time it’s important to set the stage. That means getting your income where it needs to be, getting out of debt, setting up basic savings and deciding where to invest.

My wife and I went with Roth IRA’s very early on. I worked multiple side hustles on top of my 9-5 (I still do); I think side hustles are underrated. If you’re in your 20’s, you really have no excuse. You should be bubbling with energy! Put in the 80+ hour workweeks upfront (front-load your savings and pay off all debts). It’s how the wife and I became millionaires in our early thirties.

Very few People Focus on Investing in a Retirement Fund in their early twenties. Very nice article and written well elaborately. ETF and REITs could also be better alternatives.

Investing is NOT one of the things that cross an ordinary young adult’s mind. A lot of other things take up a lot of space in their heads: partying, working hard, and trying to make a name for themselves. Trust me: I have been there, I have done that. But this article is a real eye-opener. It makes me want to go back in time and make my 20-year old self read this.

Maybe you should send the url link from this article to every 20-something you know, with a note that you were once in your 20s and one of your greatest regrets is that you didn’t invest in your 20s, but they have a chance to avoid making the same mistake. You might positively influence a few people.

When it comes to investing, we should start investing as early as possible. The earlier we start, the more money you make at the time of retirement. We also need to have a proper investment plan. I had started investing from the age of 24. I still feel I should have started investing from the age of 21. I have invested most of the money I have earned till date in stocks. I am currently trying to find some passive income sources 🙂

Congratulate yourself for beginning investing at 24! Most people start later, and some never start at all. 24 is an excellent time to begin, since that’s the age when you start to become more stable, especially in your career.

Great article!

As a 20-something myself who invests, it was critical for me to first eliminate my credit card debt first.

It also makes it easier to borrow for investment purposes, such as rental property.

Getting out of debt should definitely be a top priority for anyone in their 20s – especially if it’s student loans or credit card bills! As a recent college grad who is fortunate enough to have neither of these, I want to spend and invest my money wisely, so your tips will definitely come in handy. Thanks for sharing!

I’m so glad you started this post talking about having money saved first and getting out of debt before focusing on investing. Especially with young professionals, it’s tempting to ignore these and get straight to investing. The lawyers who I’m friends with are notorious for this. With a little guidance, they’ve been able to rethink investing and understand that you have to have a good solid foundation before you get to the fun stuff (i.e. investing).