If you ever took a traditional economics course, you learned that human beings make rational decisions about their finances, and choose things that are in their best interests.

But you only have to look around you to find evidence that human beings are far from rational, particularly when it comes to finances.

We all consistently make irrational and stupid choices that cost us more, both in the short and the long run, because we are not always capable of deciding what is in our best interests.

This understanding of how real people make real financial decisions comes from the (relatively) new field of Behavioral Economics. This discipline looks at the intersection of psychology and economic theory, and it paints the human animal as a far more irrational creature than Adam Smith ever imagined.

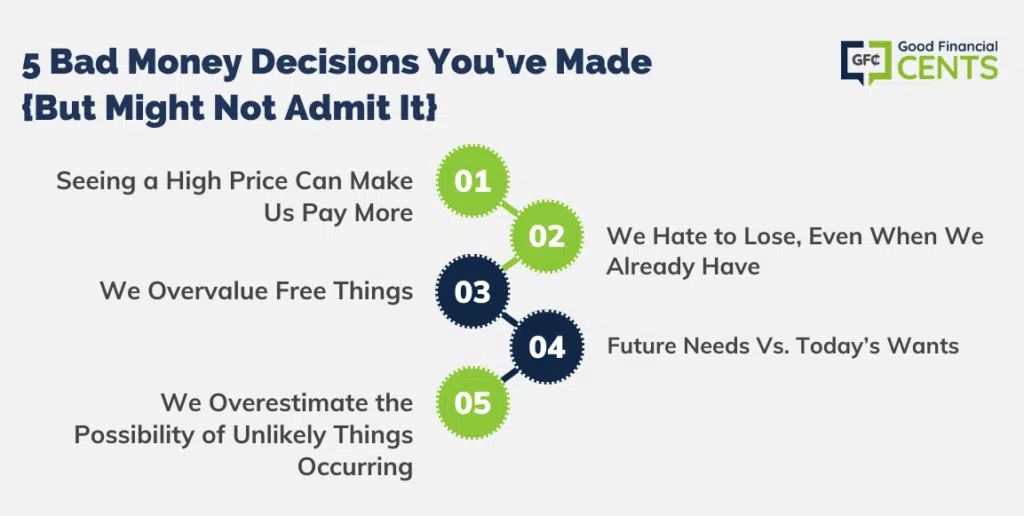

Check out these five ways that humans make poor money decisions, and see if you can recognize any of your past blunders:

Table of Contents

Seeing a High Price Can Make Us Pay More

We like to think that we know a fair price when we see one, but the truth is that we’re remarkably suggestible. For instance, take a look for the most expensive wine on the menu the next time you are out to a nice dinner. Often, you will see a single bottle listed at $100 or even more, while the rest of the wines are listed at about $25-$50 per bottle. That one expensive bottle is listed on the menu to make the $50 bottles seem much cheaper in comparison.

Many restaurants literally only keep one bottle of the expensive stuff, because they don’t intend for anyone to actually buy it. It’s there to sell the $50 wine, which would have otherwise seemed far too expensive compared to the other options.

What’s happening here is something Behavioral Economists describe as anchoring. Once we have a number in our heads, it anchors our expectations for price. Dan Ariely, in his book Predictably Irrational, tells how Williams-Sonoma was frustrated at poor sales of its bread machine, priced at $275. The solution they came up with was to offer another model—one that was larger and priced at $400.

Suddenly, sales of the cheaper model rose, while no one bothered with the spendy version. This was because shoppers suddenly had something to compare the original to, and $275 no longer seemed like too much to spend—at least not compared to $400.

We Hate to Lose, Even When We Already Have

If you’ve ever held onto a tanking stock because it’s “sure to regain its value,” then you have been a victim of loss aversion. Loss aversion is a psychological quirk that makes us work much harder to avoid a loss than we will to achieve a gain.

You can see loss aversion in nearly every aspect of life. This is the reason why we keep those bread machines we spent nearly $300 on, even though we never make bread in them—and we could certainly get something for them at a garage sale. The simple fact that we will never see that $300 again is enough reason to let the machine gather dust, because we’ll kick ourselves for “only” getting 10 bucks on a resale.

Loss aversion is also why we are so unwilling to cancel memberships to gyms we don’t attend, clubs we don’t go to, and cable packages we don’t use. We think about how much it will cost to rejoin if we were to quit—forgetting that every month we’re allowing more money to go down the drain for fear of “losing” the original enrollment fee.

It’s very difficult for us to remember that that money is already gone.

We Overvalue Free Things

How many times have you ordered a book that you’re not entirely certain you want, just to make sure you qualify for free shipping from Amazon?

When you do that (and we all do), you end up paying more money overall and end up with an unwanted item, to boot.

For some reason, the word “free” seems to scramble our brains. When we are offered a free item or service, we forget what other costs there might be to that item or service because we are so focused on the fact that we’re not paying money. What’s really interesting is that we are willing to pay more in order to get something free. That’s why Amazon offers free shipping for orders over $25, and why many marketers and retailers give out free gifts with purchase.

Future Needs Vs. Today’s Wants

We think things in the future are less important than things happening now. Human beings have a very hard time planning for the future. Apparently, 75% of Americans nearing retirement have less than $30,000 saved, which is a pretty horrifying statistic. But before we write off three-quarters of the retiring population as irresponsible laggards, we should look at our own behavior.

- How many times have you bought something with a credit card without a specific plan to pay it off?

- How often have you promised yourself you’d diet only to be tempted off the path the moment you see a box of donuts?

- How many times have you left work for yourself to do in the morning, only to curse yourself the next day?

What’s going on here is something called hyperbolic discounting. That’s a 50¢ word for our unconscious feeling that now matters more than later. We know that we ought to put money aside for retirement, but man is that far away! And the money is here now. So, we tend to think that retirement will take care of itself, while the money can be put to “good use” now.

We Overestimate the Possibility of Unlikely Things Occurring

Our brains are wired to think that things we can easily come up with an example of are likely to happen. This is something called the availability heuristic. What that means is that we think we’re much more likely to win the lottery or win big in Vegas than is statistically possible just because we can think of examples of people who have won.

Since we can think of those examples, we think the outcome is more likely. And every time you read a news story or see a movie about such winners, your brain believes that your winning is even more probable.

Even if you are able to sidestep the availability heuristic, you may still fall victim to a similar gambler’s fallacy. This is when you believe that something is “due” to happen because it hasn’t for quite some time. For example, you might bet on a coin coming up heads on the 21st toss after it has come up tails every time for 20 tosses. It seems as though the coin is “due” to come up heads, but it’s still only 50/50 odds.

Otherwise, rational investors may find themselves following the gambler’s fallacy by avoiding buying stocks that are going gangbusters, for fear that there has to be a fall eventually. Statistics may show a general regression toward the mean (i.e.—everything evens out eventually), but general statistics are meaningless when talking about individual events.

Irrational Money Decisions Affecting Your Life

Approaching all of our financial decisions rationally is remarkably difficult to do. It pays to think about the money choices we make and try to figure out what our motivation is each time. A little mindfulness and self-knowledge can do wonders for combating irrational decisions.

Great post Jeff. Your point #2 is one that I’ve had to coach a few clients who brought individual stock positions into our relationship. Seems to be more of a male thing in my experience. Even the most rational client can have trouble going ahead with the idea that this money can be far better invested elsewhere.

This is a great list of common mistakes. Number five, I think, is especially important. People often have a difficult time with probability. It’s why poker professionals can take advantage of amateurs, and win year after year. It’s why rational investors can outperform the market in stocks, bonds, housing, and many other areas. It’s why people are often under-insured. And it is why people play the lottery: even though, according to statisticians, buying a lottery ticket does not significantly improve your odds of winning (statistically speaking).

#1 on the list is crazy, man. CRAZY. Pisses me off how companies and advertisers prey on our weaknesses/mental glitches; but it also pisses me off that we can’t think more rationally. It’s hard to believe that we cant’ see what’s really happening, or at least that we can’t look at what a price is, just htat price alone, and decide if it’s a reasonable price.

I’m definitely guilty of paying more for free things. Free shipping really gets to me!