While Johnson Bank is relatively young (it was founded in 1970), it has a strong corporate foundation. The institution was founded by the family behind the SC Johnson brand, bringing their philanthropic attitude into the realm of financial services.

To this end, the bank puts its emphasis not on specific mortgage products but on the idea of creating custom mortgages that meet the particular needs of its customers. The firm still offers conventional mortgages, but it also works with a variety of community groups to provide grants and access to other resources that complement traditional loans.

While Johnson Bank is a relatively small lender, it focuses on personalized experiences. This makes the organization a natural fit for borrowers who want additional support and guidance to navigate the mortgage market.

Table of Contents

Johnson Bank Mortgage Rates

Johnson Bank Mortgage Options

Johnson Bank provides a lending process that is consumer-focused and aimed at making home buying simple and accessible. This can make working with the firm particularly beneficial for first-time homebuyers who want assistance throughout the lending process.

The institution offers a wide range of loan types but provides little detail on the specific qualifications and provisions of each loan on its website. Ins“tead, Johnson Bank seems to be intent on working more closely with customers by providing basic information online and making it easy to connect to an agent who can help users identify the right loan for their needs.

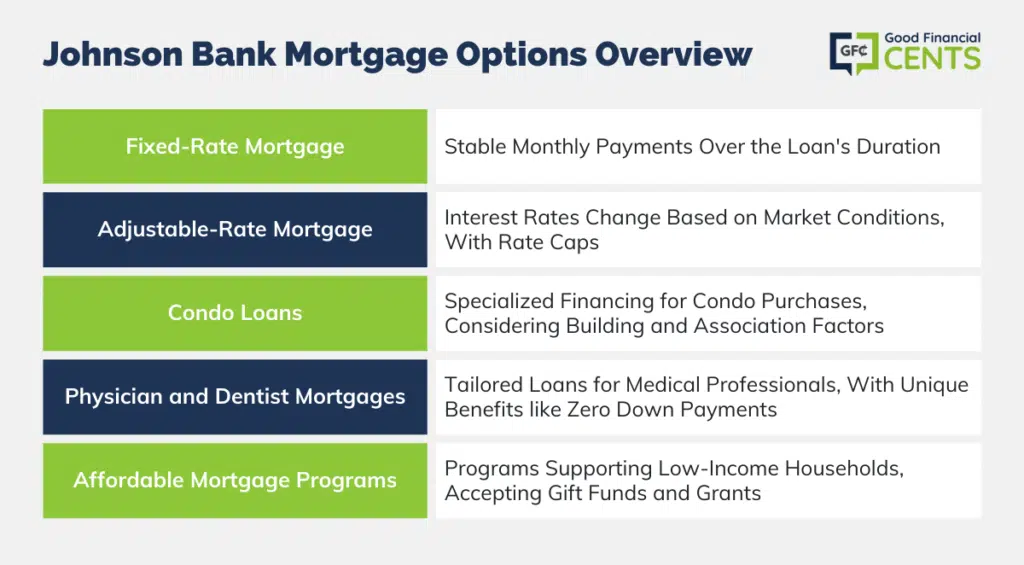

With this in mind, here’s a look at the mortgage options available from Johnson Bank.

Fixed-Rate Mortgage

Johnson Bank highlights fixed-rate mortgages as one of the loan programs available for homebuyers. The lender emphasizes the loan’s stability, as going with a fixed rate ensures that monthly payments remain the same over the life of the loan.

Adjustable-Rate Mortgage

These loans feature rates that change based on external market conditions. They are usually configured as fixed for a certain term and then change every year after the predetermined initial period. Johnson Bank emphasizes that these mortgages feature interest caps that keep rates from increasing past a certain point and lower rates.

Condo Loans

The financing process for purchasing a condo can be quite different from that of obtaining a standard home. Johnson Bank offers specialized expertise in structuring loans for condo buyers, providing insights into the larger issues that emerge with condos. In particular, this involves assessing circumstances surrounding the building and condominium association and understanding how that impacts the value of the home.

Physician and Dentist Mortgages

Physicians and dentists often choose to house their offices in their homes, creating unique cost dynamics and making certain types of properties more attractive than others. Johnson Bank offers specialized loans with specific benefits like zero down payments for medical doctors and dentists.

Affordable Mortgage Programs

Programs include Home Possible Advantage loans, Community Mortgage, Guaranteed Rural Housing, down payment grants, Wisconsin Housing and Economic Development Authority grants, and Community Mortgage.

Johnson Bank Customer Service

The online customer experience with Johnson Bank is not what you would expect from a traditional lender. Most banks tend to either focus on the online lending process, letting you fill out an application and get quotes online, or emphasize personal interactions and funnel users to branch locations.

Johnson Bank mixes these two experiences, providing a variety of web resources to help guide homebuyers through the lending process but ultimately requiring prospective customers to speak to a loan officer.

Johnson Bank does not provide quotes or a mortgage application online. Neither does it offer further details about their loan options, requiring prospective borrowers to seek detailed information about their mortgage products and the qualification requirements for them through a bank representative. However, the lender does still provide a wide range of resources on its website to help users navigate the lending process.

Johnson Bank offers guides on home purchase and construction, detailing what the mortgage process looks like in each situation. The lender blends video content with text guides, giving users a few options for gaining a deep understanding of the loan process.

Aside from these resources, the bank offers eight different calculators to help users evaluate their personal situation and a home financing library featuring guidance on a variety of issues pertaining to the lending process.

These resources, coupled with the company’s customer-centered approach and customized options, create a robust online experience even without the ability to complete applications online.

As a relatively small, geographically focused lender, Johnson Bank doesn’t get a great deal of attention from major industry analysis groups. For this reason, there isn’t much online data available on their customer experience.

Nevertheless, as part of the SC Johnson brand, the bank aims to provide highly ethical, community-focused operations that emphasize corporate accountability.

Johnson Bank Grades

The Johnson Financial Group was founded in 1970, eventually evolving into a few organizations that complement and support one another, including Johnson Bank, Johnson Wealth, and Johnson Insurance. The bank is an Equal Opportunity Lender and a Member FDIC firm.

The bank’s history is centered around Wisconsin, where it is headquartered in Racine and operates many branches. Expansion into other states has been more recent.

The Better Business Bureau gives Johnson Bank a strong A+ rating. The company is a BBB-accredited business, and there have only been two customer complaints filed for its headquarters.

The bank’s reputation isn’t only strong in its home state. The Arizona Office of the Comptroller of the Currency recently analyzed a variety of institutions in the state as part of a Community Reinvestment Act program. This kind of work fits naturally with Johnson Bank’s focus on improving communities, and that vision comes through in its rating.

The analysis rated the bank as outstanding overall. It received outstanding ratings for lending and investment and was highly satisfactory for service.

All of this information was collected on Jan. 9, 2019.

Johnson Bank Mortgage Qualifications

Mortgage shoppers may find it difficult to pin down the exact qualifications of a given mortgage from Johnson Bank. If you’re browsing options online as a first step, you’ll quickly notice the bank doesn’t dig deep into the specific loan qualifications for its products online. Instead, the lender’s goal to be a customer- and community-focused bank means that it focuses on personal interactions with mortgage agents.

These agents will work closely with potential borrowers to gather financial details and go over the loans that are available. From there, you can get into specific qualification requirements as well as the pros and cons of how well borrowers meet various standards for loans.

To some extent, this focus on delving into qualifications later in the process is due to the variety of specialty loans and grant programs it offers, which could apply to certain borrowers.

Generally, the higher the credit score, the better the chance of securing a loan, as detailed below:

| Credit Score | Quality | Ease of approval |

|---|---|---|

| 760+ | Excellent | Easy |

| 700-759 | Good | Somewhat easy |

| 621-699 | Fair | Moderate |

| 620 and below | Poor | Somewhat difficult |

| N/A | No credit score | Difficult |

Johnson Bank Phone Number & Additional Details

- Homepage URL: https://www.johnsonbank.com/

- Company Phone: 888.769.3796

- Headquarters Address: 555 Main Street, Suite 400, Racine, WI 53403

The Bottom Line – Johnson Bank Mortgage Review

Johnson Bank, with its foundation in the philanthropic legacy of the SC Johnson brand, provides a refreshing take on personalized mortgage services. Its approach of crafting custom mortgage solutions rather than offering one-size-fits-all products distinguishes it from other lenders.

With a rich blend of online resources and emphasis on one-on-one consultations, the bank ensures that borrowers receive comprehensive support throughout the mortgage process.

Despite being relatively small and geographically concentrated, Johnson Bank has garnered positive reviews and ratings, cementing its reputation as a reliable and community-focused lender. Prospective borrowers can confidently consider Johnson Bank for a tailored mortgage experience.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Johnson Bank Mortgage Product Description: Johnson Bank Mortgage, a subsidiary of the renowned Johnson Financial Group, offers tailored mortgage solutions rooted in a legacy of philanthropy. With a unique approach of personalizing loan offerings, the bank stands out in its mission to serve diverse homebuying needs. Summary Johnson Bank Mortgage, founded by the SC Johnson brand’s philanthropic family, emphasizes crafting custom mortgage experiences tailored to individual customer needs. Rather than presenting a one-size-fits-all offering, the bank leans towards a consumer-centric approach, especially assisting first-time homebuyers. By providing a mix of online resources and in-person consultations, they ensure borrowers receive comprehensive guidance throughout the mortgage process, blending modernity with tradition in their service delivery. Pros Cons

Johnson Bank Mortgage Review

Overall