I started to write a post that helped 20-year-olds decide how much life insurance they needed to buy when something hit me – I’m not 20 anymore!

Instead of trying to remember what time frame I was in my 20s, I thought it would be better to go to the source directly. My junior advisor, Tyler, is 24, married, and working on his first child. He had the foresight to be a term life insurance policy before even getting hired by me.

Let me tell you that this is rare – extremely rare – for 20-year-olds. So here’s the decision process he went into buying life insurance and how much as a 20-year-old…

When I first started to look for Life insurance, I had many options to choose from and had to determine whether term vs whole life was best for me. It turns out the most suitable type of insurance for me was Term Life Insurance. Term life insurance is the cheapest form of life insurance, especially for someone my age. Term insurance does not have a cash value that you can borrow against such as in a whole life insurance policy. Term insurance is strictly life insurance.

The next thing you have to decide is how much term insurance do I need. This amount is different for everyone, no matter your age. Typically you want to do a multiple of your income to protect your loved ones. This can be 4, 5, 6, 7 (x) your income. If you have kids you may even want to go higher such as 8, 9, 10, or more (x) your income.

Just imagine if you were to die (cheery thought, right?), would your family suffer financial loss? If so, you’ll need to give them a safety net, which is where life insurance comes in.

It gives them time and resources to find a way to permanently replace their income without having to worry about paying for basic expenses. In my case, I do not have any kids right now, but we are planning on having kids in the near future. I also have a mortgage and a car payment that I would not want my wife to struggle with if something were to happen to me.

Debts are the single most important factor in your life insurance needs. This can be anything from mortgages and car payments to student loans and credit card bills. You don’t want to leave your loved ones with thousands of dollars of debt and no resources to help them pay it off.

Table of Contents

Sample of Annual Premium Per Age

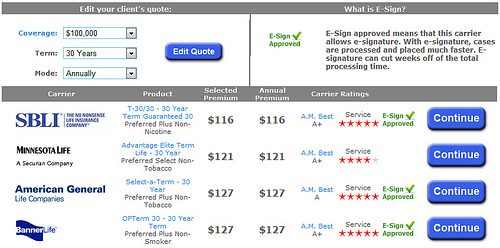

I ran several quotes just to give me a range on what kind of annual premium I was looking at.

Here are the results:

$500,000 30-Year Term Life Policy for 20-Year-Old

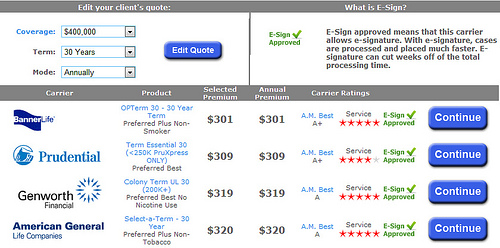

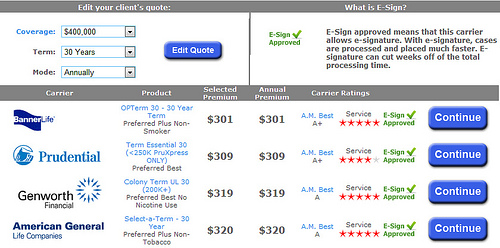

$400,000 30-Year Term Life Policy for 20-Year-Old

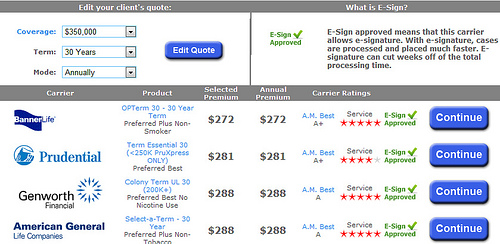

$350,000 30-Year Term Life Policy for 20-Year-Old

For me, the best option is probably the $500,000 policy. Right now at my age, it is cheap enough for me to afford it, leaving my wife with more than enough money to pay our debts and put away money for our future kids’ college.

Life Insurance for Spouse as a 20-Year-Old

I am also wanting to get life insurance for my wife. Since she is planning on becoming a stay-at-home mom, her income will not be needed in the future. My income will be sufficient to pay the bills. Since we will not be dependent on her income I am just going to get enough insurance on her to pay off our mortgage. I did quotes on her to give me an idea of the cost.

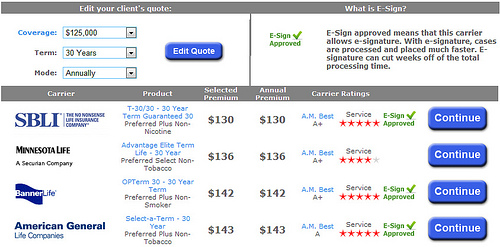

$125,000 30-Year Term Life Policy – Female

$100,000 30-Year Term Life Policy- Female

Now that I have a basic idea of what everything is going to cost, I have decided to go with a $500,000 policy for myself and a $100,000 policy for my wife. These policies will cost a yearly premium of $476. This is a great price for the peace of mind that it will give us (and other 20-year-olds) if something were to happen to one of us.

As you can see, life insurance coverage is much more affordable than most applicants think. Before you run out to buy a plan, the quotes above are only generic examples. There are so many different factors that alter your premiums.

Speaking of your health, you kick the bad habits like smoking cigarettes. Unless you want to pay double for your coverage, you need to let those cigarettes go.

It is important to keep in mind that while you are in your 20’s these policies are going to be SUPER cheap. If you put off getting a policy then you are going to pay much more. For example, a person looking to get an over-50 life insurance policy will probably pay twice as much as what Tyler is paying.

If you’re in your 20s, you have a huge advantage, you’re going to pay almost nothing for your life insurance, but even if you’re outside of your 20s (even WELL outside of your 20s) you can still get affordable life insurance coverage.

There are thousands of different companies on the market, and all of them can sell you a life insurance policy that they claim is “the best coverage available” but how are you supposed to choose between all of these companies and policies?

This is why working with an independent agent is so important, we can help you navigate the murky waters of the life insurance journey. The joy of working with us is you are actually working with 50 companies through one agent.

With an independent agent, you don’t have to worry about being sold expensive policies or being sold additional policies that you don’t need. We help you find the perfect company and plan to fit your needs.

There are millions of 20-year-olds who don’t have a life insurance policy, and for some of them, that’s okay. But there are millions of those that need a plan. If you’re one of those, don’t wait any longer.

Aspects of Life Insurance for a 20-Year-Old Spouse: A Comprehensive Overview

| Aspects | Description |

|---|---|

| Cost Comparison | Annual Premiums of $476 for $500,000 and $100,000 Policies Offer Affordable Peace of Mind |

| Premium Factors | Health and Age Impact Premiums; Quitting Smoking Is Crucial for Cost Savings |

| Age Advantage | Insurance Is Highly Affordable in Your 20s; Delaying Increases Costs, but Affordable Options Exist Even Beyond the 20s |

| Independent Agent Benefits | Access 50 Companies Through One Agent for Unbiased Advice and Tailored Coverage |

| Take Action Now | Don’t Wait; Delaying Can Lead to Higher Costs. Act Now to Secure Your Future |

Conclusion

The journey to securing life insurance in your 20s, as illustrated by the experience of a 24-year-old junior advisor, underscores the importance of early planning and informed decision-making. Choosing between term life and whole life insurance, determining the right coverage amount based on income multiples, and considering future responsibilities such as family and debts are crucial steps in the process.

The affordability of life insurance at a young age presents a significant advantage, offering substantial coverage at low premiums. Engaging an independent agent can further streamline the process, providing access to a plethora of options and ensuring a tailor-made policy. Proactive measures, health consciousness, and an early start are the keys to securing financial peace of mind for oneself and loved ones.