Determining what type of life insurance to purchase at age 52 calls for several factors that may otherwise not be considered at any other age. At age 52, considerations that may not otherwise be a factor start to come into play.

For example, a 52-year-old may start to think about the unexpected health scenarios and whether or not their family will be cared for in the event of one.

It is never too late or too early to buy a life insurance policy, however, age 52 could be the sweet spot as there is still a good chance that you are mostly healthy and can capitalize on a low rate.

Regardless, it is something that should definitely happen as it is not a pleasant thought to leave your family unattended financially.

If you’re past your 50s, you may think you can skip out on the life insurance plans. More than likely, you still have a mortgage, credit card bills, car payments, and several other debts that would be passed on to your family.

Every year we hear of families that are struggling to pay bills that were left behind by a family member because they didn’t have insurance coverage as they were getting closer to retirement. It’s easy to see why life insurance is still an important purchase life insurance at age 52.

Table of Contents

Is Whole or Term Life Insurance Best at Age 52?

When considering life insurance, there are always multiple options to choose from. Perhaps two of the best options to make a selection from at this stage in life are either whole-life coverage or cheap term life insurance coverage. Term life insurance is one of the most sought-after types of insurance as it is not only inexpensive but it allows for a decent amount of flexibility in coverage. The coverage on this policy expires at the end of the term, depending on what length you have selected.

Whole life insurance is slightly different from that of term life insurance. Make your premium payments under whole life insurance, you are insured. Additionally, the policy starts to accumulate value over time and is actually looked at as an asset.

This means that you can borrow from it in certain cases, almost making it a type of investment. For anyone who doesn’t want to worry about losing coverage at the end of a term, these whole-life plans are an excellent option. Because you will never lose the insurance coverage, you’re going to pay more for these types of plans.

Determining which type of insurance to use is mainly dependent on what your needs are as a 52-year-old. The insurance provider is always another important decision to make. If you are not clear on what type to buy or which insurance provider to use, it is never a bad idea to seek the guidance of an experienced insurance provider.

The rates for term life insurance vary depending on how much insurance you actually need. Starting at $250,000, the rate that you will pay starts at $16.08. For $200,000 of coverage, the rate jumps up to $32.20. For $500,000, the rates will start at $55.32.

The rates are for those who are considered healthy adults. This would include those who lead a healthy lifestyle, have no pre-existing illnesses, and those who do not smoke. Of course, there are various other factors that affect your insurance rates so the best bet is to get several quotes and consider all factors. Here are some quotes for $250,000 of coverage:

| Sex | 10 Year | 20 Year | 30 Year |

|---|---|---|---|

| Male | Protective – $29.40/month | SBLI – $50.90/month | Banner – $90.34/month |

| Female | Protective – $23.97/month | SBLI – $38.72/month | Banner – $66.94/month |

The problem with these quotes is everyone is different. If you’re a smoker, you might as well disregard these quotes. This is because smoking cigarettes or using tobacco drastically increases your chances of health problems. If you want to get rates like the example above, it’s time to put down those cigarettes once and for all.

Similarly, if you’re looking for the lowest rates possible on your life insurance, it’s time to improve your health. You can do this through diet and exercise. Both of these are going to help you improve your overall health which is going to translate into more savings on your insurance policy.

Just like smoking increases your risk of health problems, diet and exercise LOWER your risk of health problems. It’s time you start using that gym membership that you’ve been paying for.

Aside from deciding which policy type and where to buy the plan, you’ll also have to calculate how much insurance coverage you need. Not having enough life insurance coverage could be as bad as not having any coverage at all. There are several different things you need to account for when deciding how much coverage to purchase. The first thing is your debt, and you’ll also need to calculate your annual salary.

While it is a good idea to obtain insurance as fast as possible, it is never a good idea to jump into a plan without doing your due diligence. Seeking the help of a professional is as easy as filling out the form on the side of this page.

Obtaining life insurance for people over 50 takes working with an agent who is used to that market. Since the policy needs of people in their 50s vary much more than people who are in their 20s, 30s, and 40’s having the flexibility of an agent really is a need. To get the best insurance rates available to you, you’ll need to compare prices with different companies. Just like you would with a TV or a new vehicle.

Impact of Health and Lifestyle Choices on Premiums

Your health and lifestyle choices play a pivotal role in determining the premiums you pay for life insurance. Insurers meticulously assess risk factors, tailoring premiums to your individual health status and lifestyle habits. Smoking, excessive alcohol consumption, and a sedentary lifestyle are viewed as high-risk attributes, often resulting in elevated premiums due to the increased likelihood of future health complications.

Maintaining a balanced diet, regular exercise regimen, and abstaining from tobacco and excessive alcohol can significantly reduce your life insurance premiums. Such habits indicate a lower risk profile, promoting longevity and decreasing the likelihood of chronic health conditions.

Furthermore, insurers value preventative health measures such as regular check-ups and health screenings, as these practices foster early detection and management of potential health issues. Active engagement in your health not only improves overall well-being but also enhances your appeal to insurers, facilitating more competitive premium rates.

Cultivating a healthy lifestyle and making prudent health choices is a strategic investment. It not only improves your quality of life but also optimizes your life insurance premiums, ensuring robust coverage that aligns with your financial and personal aspirations.

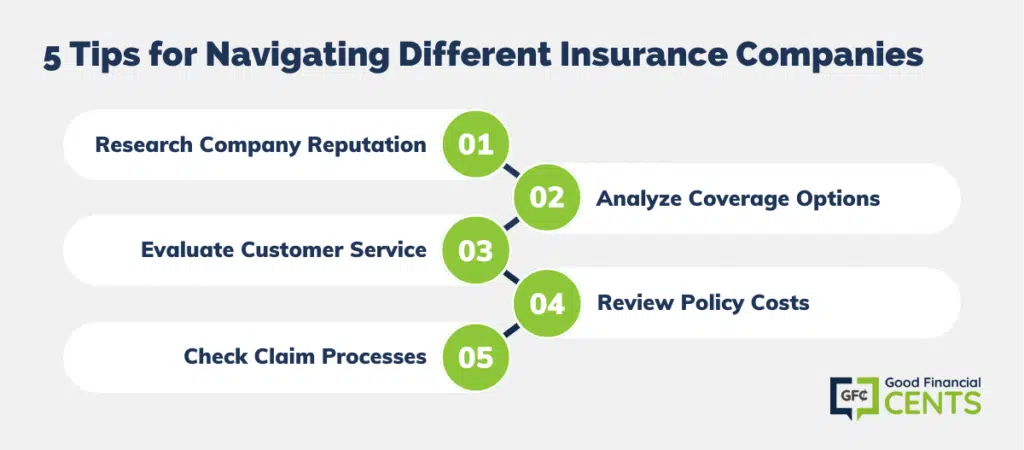

Tips for Navigating Different Insurance Companies

Navigating the multitude of insurance companies requires a strategic approach to ensure that you secure the best policy for your needs. Here are some essential tips for effective comparison:

1. Research Company Reputation: Investigate the insurer’s market reputation, customer reviews, and financial stability. A company with a solid reputation is more likely to provide reliable coverage and customer service.

2. Analyze Coverage Options: Assess the variety and flexibility of the policies offered. Ensure the company provides coverage that aligns with your specific needs and preferences.

3. Evaluate Customer Service: Consider the responsiveness and helpfulness of the company’s customer service, as this will impact your overall experience and satisfaction.

4. Review Policy Costs: Compare the premiums, deductibles, and additional costs across different insurers, ensuring you receive competitive and reasonable rates.

5. Check Claim Processes: Investigate the claim filing and approval processes of each insurer. A smooth, straightforward claim process is crucial in times of need.

Bottom Line: Best Life Insurance Options at 52

Choosing the best life insurance at age 52 requires careful consideration of various factors, including policy types, health, lifestyle, and different insurance providers. Whole and term life insurance offers unique benefits to meet diverse needs.

Maintaining a healthy lifestyle can significantly influence premium costs, making proactive health choices essential. When selecting an insurance company, thorough research, comparison of policy costs, and evaluation of customer service and claim processes are crucial steps to ensure a decision that offers comprehensive coverage, financial security, and peace of mind.