Cervical cancer is a severe disease and one that will affect your ability to get life insurance. However, many people who have recovered from cervical cancer can still buy life insurance.

Your insurability depends on the severity of your cervical cancer. To help you through the life insurance process, we’ve built this guide to the life insurance underwriting standards for cervical cancer.

We are going to look at the factors which impact your life insurance. Life insurance is the financial safety net your family needs if you were to pass away.

Table of Contents

- Understanding Cervical Cancer and Its Impacts

- Life Insurance Underwriting for Cervical Cancer

- The Importance of Awareness and Early Action

- Getting Quotes for Life Insurance With Cervical Cancer

- Empowering the Cervical Cancer Community

- Cervical Cancer Insurance Case Studies

- Getting More Affordable Life Insurance Coverage

- The Bottom Line – Life Insurance With Cervical Cancer

Understanding Cervical Cancer and Its Impacts

Cervical cancer is caused by the uncontrolled growth of abnormal cells in the lining of the cervix, a part of the female reproductive system.

One of the main culprits behind cervical cancer is the human papillomavirus (HPV), which is a common virus that can be passed on through sexual contact.

Regular screening tests, such as Pap smear and HPV vaccinations, can play crucial roles in early detection and prevention, respectively.

This form of cancer, if detected early, has a good prognosis. However, it’s undeniable that having cervical cancer can lead to complexities, especially when it comes to financial aspects like insurance.

A diagnosis may lead to concerns about securing life insurance due to the perceived risks associated with the disease. This worry arises from the unpredictability of cancer – the potential for recurrence or the possibility that treatments might not be entirely successful.

Life Insurance Underwriting for Cervical Cancer

As an applicant who has had cervical cancer in the past, you’re going to have to answer a lot of questions about your cancer before the insurance company will give you life insurance:

- When was the diagnosis?

- What stage cancer did you have?

- What treatments did you receive for your cancer?

- When did you complete your treatments for cervical cancer?

- Have there been any recurrences?

- Do you smoke or have any other health problems?

It’s important to answer every question on your application honestly and in complete detail. Insurance underwriters will closely examine your application. They could get nervous if it appears to be missing information, and your chances of receiving a policy will fall dramatically.

These are only some of the questions. The agent will also ask you about your general health. They will ask your weight and dozens and dozens of questions about your family history.

All of these questions are going to go into how much they charge you for insurance protection.

The Importance of Awareness and Early Action

There’s a growing need for individuals, especially women, to be more informed about cervical cancer. According to the World Health Organization, cervical cancer is the fourth most common cancer among women globally.

Awareness of its symptoms, causes, and preventive measures can make a huge difference in one’s overall health and longevity.

Securing life insurance after a cervical cancer diagnosis can be challenging but not impossible. The critical factor here is time. The more time that has passed since the diagnosis and successful treatment without recurrence, the better the chances are for obtaining insurance coverage.

Moreover, an early diagnosis and treatment increase the odds of beating the disease and improve the likelihood of securing a life insurance policy. While many insurance companies might be hesitant initially, with time and the right strategy, ensuring an approach is achievable.

Getting Quotes for Life Insurance With Cervical Cancer

When you have cervical cancer, insurance companies will base your rating on a few different factors. The most crucial factor will be how serious your cancer is. Underwriters will consider the stage of your cervical cancer as well as whether it led to any malignant tumors.

They will also consider how long it’s been since you completed treatment. Longer is better. Aside from your cancer, they will also look at your general health.

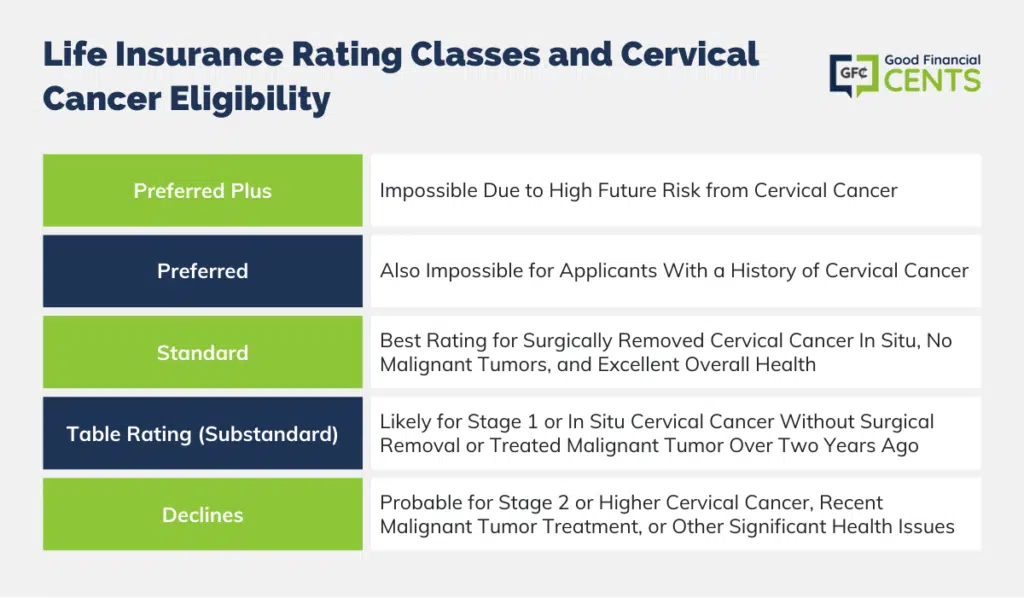

Each company has different rating classes, but here is a basic idea of what you can expect:

- Preferred Plus: Impossible for someone that had cervical cancer. The risk of future problems is just too high for insurance companies.

- Preferred: Also impossible for applicants that had cervical cancer.

- Standard: Best possible rating for someone who once had cervical cancer. The cancer must only have been in situ and had been removed surgically. In addition, the applicant must not have had any malignant tumors and is otherwise in excellent health.

- Table Rating (substandard): Most likely, the best rating for applicants with cervical cancer stage 1 or in situ that hasn’t been surgically removed. Also, the best possible rating for applicants who had a malignant tumor that was treated over two years ago. Applicant should also be in overall decent health.

- Declines: Applicants that had stage 2 or higher cervical cancer will most likely be denied coverage. Also, many applicants who had a malignant tumor treated within the past two years or applicants who have other health problems could be denied.

Empowering the Cervical Cancer Community

Life after a cervical cancer diagnosis isn’t easy. Apart from the physical and emotional toll, there are financial implications to consider, including life insurance.

Yet, it’s essential to remember that each individual’s journey with cervical cancer is unique, and generalizations may not always apply. While some face hurdles in getting insured, others might find it a relatively smooth process, especially with the proper guidance and support.

Organizations and communities dedicated to cervical cancer awareness and support play a pivotal role in empowering survivors and patients.

Through knowledge dissemination, advocacy, and shared experiences, they provide invaluable resources that can guide individuals in making informed decisions about life insurance and other aspects of life post-diagnosis.

Joining such communities can provide much-needed solace and direction in navigating the complexities of life with cervical cancer.

Cervical Cancer Insurance Case Studies

A well-planned application can increase your chances of qualifying for life insurance after cervical cancer.

Let’s show you some examples of life insurance with cervical cancer:

Case Study #1: Female, 65 y/o, diagnosed with cervical cancer (in situ) at 60. Recovered after surgery at 61, applied for life insurance right after, and she was declined.

She was pretty healthy, so her diagnosis of cervical cancer was a bit of a surprise. Fortunately, she recovered in full after surgery at 61. She assumed that because of her cancer treatment, she would never qualify for coverage.

After reading our website, she realized that wasn’t true and her mistake was applying too early. We also referred her to a company that specializes in insurance for cervical cancer survivors. By trying again this time, she qualified for a Standard rating.

Case Study #2: Female, 59 y/o, former smoker, diagnosed with Stage 1 cervical cancer at 53 and was finished with treatment at 55. He also quit smoking.

She wasn’t making the best lifestyle choices, especially since she was a smoker. When she was diagnosed with cervical cancer at 53, it prompted her to change her lifestyle.

She made some much-needed health changes, like quitting smoking. These better habits, plus cancer treatment, helped her manage a full recovery by 55. She applied, but she didn’t get great results.

We told her to go to her doctor and ask for a letter which details her health improvements. After she did this, she got a Table Rated plan.

Getting More Affordable Life Insurance Coverage

If you’re worried about expensive life insurance, don’t worry; even with a history of cancer, you can get cheap life insurance.

One of the easiest ways to save money is to cut out some of your bad habits, like smoking or excessive drinking. You don’t need a doctor to tell you both of these are bad for your health. These poor health patterns could cause your rates to go sky-high.

The most significant part of life insurance is the medical exam. The results directly correlate with how much you are going to pay. Get better results, and you get lower premiums.

Hit the gym and cut out the extra bowl of ice cream every month. It can save you hundreds of dollars on your coverage.

The Bottom Line – Life Insurance With Cervical Cancer

For anyone with a history of cancer, regardless of its type, navigating the path to securing life insurance is often riddled with stress and uncertainty.

The complexities of insurance underwriting for individuals with such a medical history mean that you may encounter numerous rejections along the way.

It’s not uncommon for cancer survivors to face multiple declines before finding a suitable insurance policy that accommodates their unique circumstances.

This guide aims to demystify the intricacies of acquiring life insurance for those with a cancer history, ensuring you have the knowledge and tools to safeguard your family’s financial future.

If, after reading, you find yourself grappling with uncertainties or lingering questions, please don’t hesitate to reach out. Our commitment is to provide clarity and address any concerns you might have.

The unpredictability of life underscores the importance of preparation. Without the prescience of a crystal ball, the future remains uncertain for all of us. Thus, the importance of not delaying the acquisition of life insurance cannot be stressed enough.

Ensure your loved ones’ protection today and embark on your journey with confidence.