Stop if you’ve heard this before, life insurance carriers all have factors that help place you in a rating class. And it’s obvious that they do this because they’re checking your risk profile. They have to know how much to charge based on how much risk you bring to them.

One of the risk factors that high-risk life insurance companies will be looking at is if you use any tobacco, either cigarettes or chewing tobacco.

If you are one of the many Americans who use a form of smokeless tobacco, whether is be dip, snuff, or anything in between, it is still possible to receive life insurance at affordable rates.

Despite extensive research showing that smokeless tobacco is far less harmful than cigarettes, many life insurance companies treat them as one in the same.

Because of this, many life insurance companies will charge at least double the rates of non-smoker rates because they view the health hazards to be just as serious as smoking.

It is for this reason that you need to be aware of all the different variables in life insurance so that you do not end up paying any more than necessary.

Table of Contents

- Life Insurance Rates for Smokers

- What Are the Best Life Insurance Companies for Tobacco Users?

- Life Insurance for People Who Chew Tobacco

- Factors That Affect Life Insurance Premiums for Chewing Tobacco Users

- Why You Need an Independent Agent

- Final Thoughts on Life Insurance for Chewing Tobacco Users

Life Insurance Rates for Smokers

Many people would like to quit smoking but need coverage now. It is recommended to go ahead and take out a policy now and then after 12 months, with the help of an insurance agent, take advantage of the lower non-smoker premium.

This can be done by either taking out a new policy or applying for a health class reconsideration with an existing insurance policy.

Paying the higher premium for twelve months not only will give you the motivation to quit smoking but it will ensure that you are thoroughly covered.

Skimping or putting off insurance is never advisable as it can lead to financial disaster that can rarely ever be recovered from in the event of misfortune.

How much money will quitting your tobacco usage save you? A lot! In fact, people who are put in the smokers or tobacco rates category pay around double for insurance coverage compared to someone who’s not in that category.

If you’re looking for more motivation to quit your tobacco, saving thousands of dollars on your life insurance coverage should help. With some companies, you could even pay three times as much as other applicants that don’t use chewing tobacco.

But, what about if you don’t want to get chewing tobacco? Can you still save money? Yes, there are still several ways that you can save money. The best way is to find an insurance company that views chewing tobacco more favorably than other companies.

Because every company is different, they all have different views and algorithms that spit out wildly different premiums.

What Are the Best Life Insurance Companies for Tobacco Users?

If you would like to stick with one of the well-known insurance companies and use tobacco products, there are still options available. There are 30-year policies available that lock you into lower rates for the term of the policy.

Other options are permanent insurance including whole life insurance and universal life insurance.

It is important to be aware that combining non-smoking insurance with other insurance such as diabetes or heart disease can rule out any benefit or savings that might have come with just being insured under one of these special cases.

Life Insurance for People Who Chew Tobacco

This isn’t the case with all life insurance companies though. Some differentiate between the types of tobacco and consider smokeless tobacco to be less detrimental to one’s health than smoking tobacco.

Knowing your options and doing your research can save you at least 50% on life insurance premiums if you are a user of smokeless tobacco products. Over the life of your insurance term, this can be substantial money.

In order to qualify for this you do not need to test negative in a nicotine test as is the case in many life insurance policies. As it is always the case with life insurance policies, your premium will be based on your unique situation.

If you are searching for life insurance and are a user of chewing tobacco, it is best to operate through an independent life insurance agent who is knowledgeable on policies and different insurance companies.

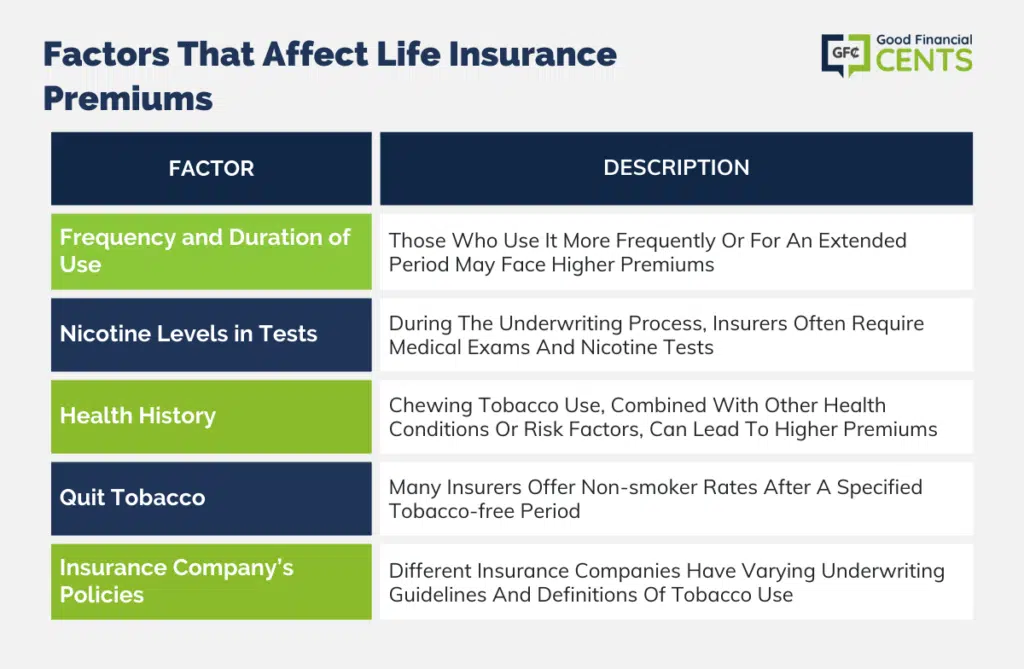

Factors That Affect Life Insurance Premiums for Chewing Tobacco Users

Life insurance premiums for chewing tobacco users are influenced by various factors that underwriters consider when assessing risk. Understanding these factors can help you navigate the application process and potentially secure more favorable rates.

Here are the key elements that affect life insurance premiums for individuals who use chewing tobacco:

Frequency and Duration of Use: Insurance companies will inquire about how often you use chewing tobacco and the duration of your habit. Those who use it more frequently or for an extended period may face higher premiums.

Nicotine Levels in Tests: During the underwriting process, insurers often require medical exams and nicotine tests. Nicotine byproducts in your system can lead to higher premiums. The results of these tests play a significant role in determining your rate class.

Health History: Your overall health and medical history are crucial factors. Chewing tobacco use, combined with other health conditions or risk factors, can lead to higher premiums. Underwriters assess your health through medical records and exams.

Quit Tobacco: If you’re considering quitting chewing tobacco or have already quit, inquire about eligibility for non-smoker rates in the future. Many insurers offer non-smoker rates after a specified tobacco-free period.

Insurance Company’s Policies: Different insurance companies have varying underwriting guidelines and definitions of tobacco use. Shopping around and comparing quotes from multiple insurers can help you find more competitive rates.

Why You Need an Independent Agent

Unlike traditional insurance agents, Independent agents can help you compare rates and policies from dozens of companies at once, without having to call them yourself.

The reason they can offer this is because they can get appointed with as many companies as they want. It’s a win-win for both parties.

Working through an independent insurance agent is advisable as it is the case that everyone’s personal situation is different and there is no “one size fits all” when it comes to insurance.

Trying to cheat the system by lying on the application or otherwise committing fraud is never advisable. Even if you end up saving money in the short term, the consequences can be huge.

This is especially true since there is a two-year period of time following the death of the insured when the insurance company can research the truth about a person’s medical history.

Client Example: A 40-year-old male looking to obtain $250,000 of term life insurance at preferred best health.

The best non-tobacco policy he can get is $145 a year. If you are a tobacco chewer, you would not qualify for this super cheap rate, but it may be possible to get it at $265 per year.

Still might seem high but if you compare that to rates for life insurance for smokers, you’re looking at around $450 a year.

Speaking with a qualified agent is the best bet when purchasing any type of insurance no matter what your current medical status is.

Not only will they be able to advise on your specific case, but they can assist in finding you the cheapest possible rate that ensures you will be fully covered in the event of death.

Regardless if you have any preexisting conditions or in poor health, or if an app has been declined in the past we will be able to find a policy to fit your needs. Even if you have to purchase a no physical exam life insurance.

These plans are more expensive than a traditional life insurance policy, but you can put a price tag on the safety net that life insurance provides.

This is more valuable than any insurance policy as it gives you the peace of mind of knowing that your family and loved ones will be provided for. The world of insurance is a complicated one, and should not be left to an Internet search in order to determine which is best for you.

Don’t be concerned about qualifying for a plan even if you use chewing tobacco. It’s our mission to help our clients get affordable and quality insurance that fits the needs of their families. We will remind you that it’s a great time to stop chewing!

Debt, stress, and unpaid bills. These are all issues that will affect your family if you decide not to purchase protection in the form of life insurance. Don’t make a difficult situation more difficult by creating financial strain on your family. Take the first step today and call one of our available agents.

Final Thoughts on Life Insurance for Chewing Tobacco Users

Navigating life insurance as a tobacco user, whether you smoke or chew, requires careful consideration of various factors. Insurers often charge higher premiums to tobacco users, but the extent of the increase can vary among companies.

Quitting tobacco not only benefits your health but can also lead to substantial savings on insurance premiums.

When shopping for life insurance, it’s essential to explore different insurers, as their underwriting guidelines and policies regarding tobacco use differ.

Working with an independent agent who understands your unique situation can help you find the most competitive rates and coverage that suits your needs.

Remember,

Non smoking nicotine user (Snus and e cig)

50 years old. Self employed, active lifestyle.

I need a better deal for term life. Would like 15-20 year policy.

I live in Arkansas but travel for work 10 months/ year.

Thanks.

@Jim Be sure to call our toll-free # and we’ll be happy to review your options.