Most of the time when you apply for a life insurance policy, you need to provide a urine sample as part of your medical examination.

This is one way the insurance company reviews your health along with also giving you a short physical, checking your medical records, and drawing a blood sample.

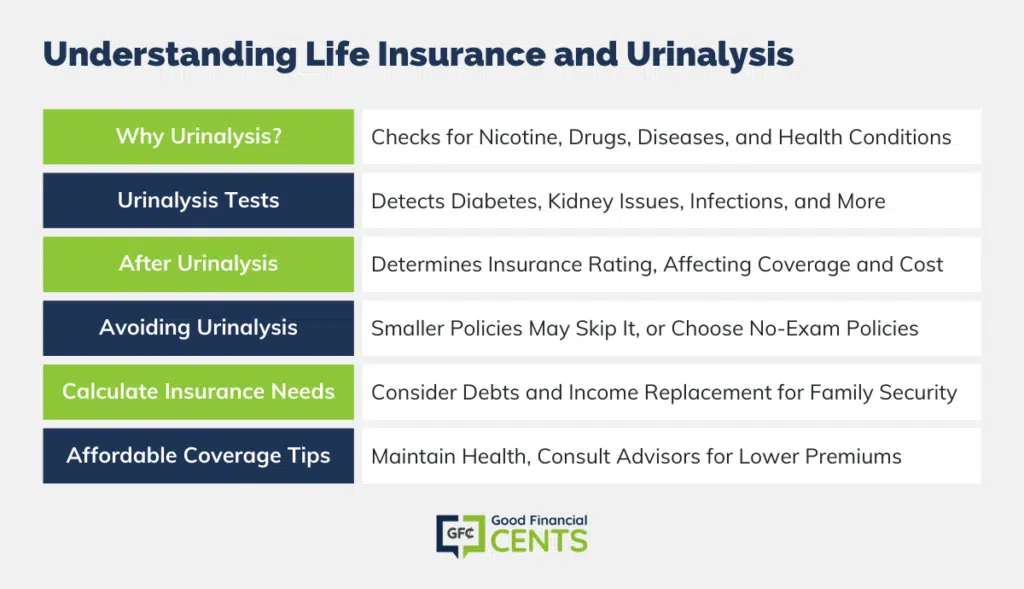

There are a few important reasons why insurance companies perform a urinalysis as part of their application process.

Table of Contents

Why Do Insurance Companies Use Urinalysis?

Insurance companies usually perform two main types of tests as part of a urinalysis. First, they do a chemical analysis of your urine. This is so they can check for nicotine or illegal drugs in an applicant’s system.

They also perform a microscopic review of your urine to check for a number of diseases and health conditions.

When you apply for a policy, the insurance company will send over a medical professional to give you a quick medical exam. You can usually pick where and when you want to meet.

Part of this exam will be to take a blood and urine sample. The medical professional will then take these samples back to a lab for the actual testing.

Urinalysis Medical Tests

A urinalysis can detect several health problems. First, the insurance company will check whether there is sugar in your urine. This is known as glycosuria and could be a sign of undetected diabetes.

The urinalysis will also review the proteins in your urine for signs of kidney disease. The urinalysis will also check whether red and/or white blood cells are showing up in your urine. Red blood cells could be a sign of a blood disorder or problems with one of your organs. White blood cells could be a sign of an infection.

Beyond these medical tests, the urinalysis also tries to detect traces of nicotine and illegal drugs as some applicants lie about their tobacco and drug use on their applications.

What Happens After the Urinalysis?

The whole medical review process, including the urinalysis, takes some time, usually a few weeks. The insurance company will use the results of the tests plus your medical records to come up with your insurance rating. This will determine whether you qualify for a policy and at what price.

Once the insurance company comes up with your rating, your insurance agent will reach out to you with the decision. If you don’t have any major health problems, you’ll likely qualify for a normal rating or may even get a discounted policy. If the urinalysis or other reviews showed some health problems, you may get a more expensive, rated policy or may be denied coverage.

In all cases, the insurance agent will tell you why the company made its decision so you’ll know if a health problem showed up. If you receive a policy offer, at this point you can decide whether or not you want to buy the coverage.

Can I Avoid the Urinalysis?

While most insurance policies require a urinalysis, not all do. If you are buying a small insurance policy, usually one that is for less than $50,000, the insurance company might not require a urinalysis. They’ll make a decision based only on your medical records.

There are also no medical exam life insurance policies that offer coverage without any sort of testing. These policies are more expensive than regular life insurance because they take on all applicants.

There will also likely be restrictions on your coverage like your coverage only applies if you live at least two years after buying the policy. While no medical exam policies have their flaws, they are a good choice if you can’t qualify for anything else.

However, if you don’t have any serious medical problems, you are better off just applying for a regular policy and going through the urinalysis. It’s a quick test and will ensure that you get the best price for your life insurance.

Calculating Your Life Insurance Needs

When you see an ad for life insurance most of them will show a random face value, which could be $300K or $500K. It makes sense then that most people assume that is the amount to purchase. But what if your needs are greater? How do you really know the proper amount of insurance to buy? Below we’ll talk through some steps on how you should calculate the exact needs of your family should one of you pass away.

You first need to figure out your current debt situation. How much is left on your mortgage, car loan, and other large expenses that need to be paid off? Adding these up should give you a baseline of the minimum amount of face value to buy.

Once you’ve looked at the major debts you then need to think about the income that will need to be replaced. Because if the insured passes away then your family will be left without a major portion of your monthly and yearly salary. So think about multiplying that number by a few years. It should be long enough that you feel comfortable that your survivors will be taken care of in the event of a death.

Aside from having the perfect kind of insurance, you need to guarantee that your family will have the money that they need. Don’t purchase too little and have your family struggle with loads of debt. Take care of the situation today and feel confident you’ve provided them some financial breathing room.

Getting Affordable Life Insurance Coverage

The urinalysis is only one part of the life insurance application. However, we need to talk about the other components that add up and affect how much you could end up being quoted for coverage. These tips outline several simple changes that you can make to get that affordable premium.

The first thing that you can do is to start a healthy diet and get regular exercise. Both of these are going to help you get better rates from the medical exam, which is going to translate into lower premiums and more money in your pocket. Getting the recommended amount of exercise every week, and making healthier meal choices can help you shed the pounds needed to help cholesterol levels and risk of heart disease.

We truly believe that your top chance at finding affordable coverage lies in finding a helpful, independent insurance advisor. These advisors can put together a list of insurers that are highly rated, and ones that look at your health situation favorably. They also can get you a quote that shows premiums for up to 10 companies at one time! It saves you energy and frustration to reach out to our employees and have them simplify your search.

There are dozens of different kinds of plans to compare and thousands of companies to choose between, but our agents can help you find the best plan in a matter of minutes. Help secure a great future for your family by contacting us today. If you don’t start the process now, when will you? Your family is counting on you so it’s time to count on us.