If you are suffering from anemia, getting life insurance can be tricky.

When you apply, your rating is based on the severity of your anemia, its cause, and how well you are treating your condition.

Depending on your situation, anemia might not affect your rating at all. To help get you prepared for your application, here are the life insurance guidelines for someone with anemia.

Table of Contents

Life Insurance Underwriting for Anemia

The insurance company is going to ask you hundreds of questions. Some of them are going to revolve around your anemia:

- When were you diagnosed?

- What is the root cause of your anemia?

- Have you been hospitalized because of your anemia?

- Have you had any symptoms like headache, fatigue, or dizziness in the past six months?

- What were the results of your last blood lab tests?

- Are you currently taking iron supplements or any other medications for your condition?

This is your chance to show the company you are controlling your anemia. If your application seems incomplete, your chances of getting a bad rating or rejection go way up.

The insurance company is also going to ask you dozens of questions about your overall health. Your anemia is only one of the factors that they are going to look at when deciding your insurance rates.

There is an insurance company that will give you an affordable policy. Don’t let anemia keep you from getting the coverage that your family deserves.

The Importance of Monitoring and Treatment

For individuals with anemia, regular monitoring and consistent treatment play a crucial role in obtaining favorable life insurance rates. Many insurance companies will look favorably upon applicants who have a proven track record of managing their condition, following prescribed treatments, and attending regular check-ups. This shows insurance providers that the applicant is committed to managing their condition and reducing potential health risks.

Regular check-ups can also provide a comprehensive health history that showcases the improvement or stability of the anemia over time. This information can be valuable when applying for life insurance, as it may lead to a more favorable rating. In contrast, ignoring a doctor’s recommendations or being inconsistent with treatment can be viewed as negligence, increasing the risk to the insurer and potentially resulting in higher premiums or even policy denial.

Lifestyle Choices and Its Impact

Aside from the medical side of anemia, insurance providers also evaluate an applicant’s lifestyle choices. For many, living a healthy lifestyle can complement their anemia treatments and improve their overall well-being. This includes maintaining a balanced diet rich in iron and vitamins, engaging in regular exercise (as per doctor’s recommendations), avoiding excessive alcohol consumption, and refraining from smoking.

Smoking, in particular, can compound the health risks associated with anemia. The reduced oxygen-carrying capacity of anemic blood combined with the negative cardiovascular effects of smoking can be a red flag for insurance companies. Therefore, individuals with anemia who also smoke may find it even more challenging to get favorable rates.

On the flip side, those who make positive lifestyle choices and can demonstrate a commitment to their health might find insurers more receptive and might benefit from better policy terms.

Life Insurance Quotes With Anemia

Your insurance rating primarily depends on the severity of the anemia and your treatments. Applicants who have their iron levels under control and aren’t anemic because of a more serious illness might be rated the same as someone without anemia. If an applicant’s anemia is more serious, it can become a bigger problem.

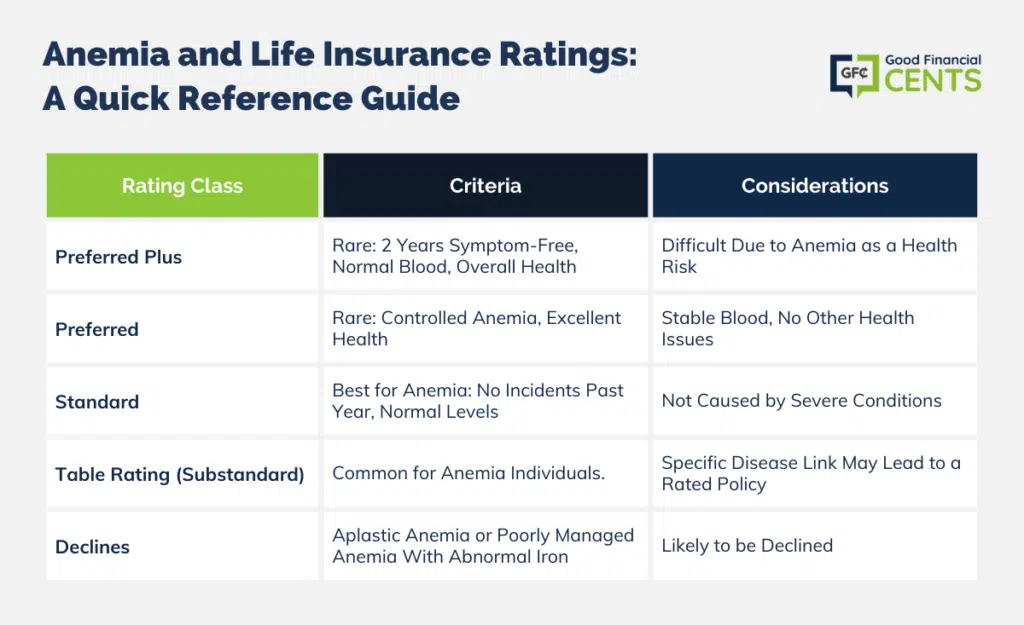

Insurers are also going to consider your overall health and your medical history when you apply. While each insurance company uses slightly different standards for anemia, there are some common rating classes:

- Preferred Plus: Possible in very rare cases. It should have been two years since your last episode of symptoms, and your blood levels should be normal. In addition, you should not have any other problems. Still, it’s difficult to qualify for anemia because it still counts as a health risk.

- Preferred: A bit more likely, but still rare, for applicants who don’t have any issues with their anemia and are in great health. Once again, your blood level needs to be under control, and you should have any other health issues.

- Standard: Most likely best rating for someone with anemia. Applicant should not have had any incidents in the past year, should have normal blood levels, and the anemia shouldn’t be caused by sickle cell anemia or aplastic anemia disease. Applicants should also be in decent health.

- Table Rating (Substandard): Most likely rating for someone with anemia. Applicants who have anemia because of sickle cell anemia or Crohn’s disease most likely won’t get anything better than a rated policy.

- Declines: Applicants that have anemia because of aplastic anemia disease. Also, applicants who aren’t properly treating their anemia and have abnormal iron levels are likely to be declined.

Anemia Insurance Case Studies

Each applicant is different. There are no two identical applications. To give you an idea of what you could be facing, here are some clients we’ve worked with before:

Case Study #1: Female, 38 y/o, had anemia at 35 as a result of pregnancy, taking iron supplements, and the condition is now under control

This applicant was diagnosed with anemia after being pregnant when she was 35. She followed her doctor’s orders diligently and regularly took her iron supplements. As a result, her anemia was under control and didn’t lead to any problems.

She applied for life insurance at 38, but she only received a rated policy. We thought that insurers were paying too much attention to her past medical record of having anemia and weren’t considering her current good health.

We suggest she go to her doctor and get a document explaining her health and the improvements. She sent this to the insurance company, and she got a preferred plan.

Case Study #2: Male, 58 y/o, diagnosed with Sickle Cell Anemia at 55, applied for life insurance right away and was rejected.

When this applicant was diagnosed with sickle cell anemia at 55, he was in a rush to get life insurance. When he applied, though, his application was rejected. This was because of a couple of mistakes.

First, the client applied too soon after his diagnosis; it would have been better to wait a couple of years. Second, he hadn’t given the iron supplements enough time to take effect.

At this point, we recommended the client take another blood test. At this point, he received a rated life insurance policy.

Purchasing life insurance with anemia can be difficult, but it’s definitely possible for most applicants. We’ll be able to match you up with companies that understand this condition and help you with your application.

Choosing the Right Policy for Anemia Patients

For individuals with anemia, it’s crucial to select a policy that aligns with their needs and financial capabilities. Term life insurance, which provides coverage for a specified period (e.g., 10, 20, or 30 years), may be a suitable choice for many. These policies are often less expensive than whole life insurance, which provides lifelong coverage and has an investment component.

Additionally, those with mild forms of anemia may consider no-exam life insurance policies. These policies might offer quicker approval processes since they don’t require a medical exam, but they can come with higher premiums due to the increased risk for the insurer. It’s essential to weigh the pros and cons, consider the severity and type of anemia, and consult with insurance professionals to ensure the chosen policy is the best fit for the individual’s situation.

The Bottom Line – Life Insurance With Anemia

Securing life insurance when dealing with anemia can initially seem like a daunting task. However, with the right knowledge, proactive management of your condition, and informed choices, it becomes achievable.

It’s vital to remember that each insurance company has its criteria and ratings, but showing commitment to your health through regular check-ups and treatment adherence can significantly sway the outcome in your favor. Likewise, embracing positive lifestyle habits further underscores your dedication to managing your health risks.

As you embark on your journey to find the ideal policy, consider all available options, from term life to no-exam policies, ensuring you select one that aligns with your specific needs and financial capabilities.

Your health challenges shouldn’t deter you from securing the future well-being of your loved ones. With preparation, clarity, and persistence, you can find an insurance policy that offers both protection and peace of mind.