Heart disease is the leading cause of death in the United States. Life insurance companies will closely examine your risk of heart disease before making an insurance decision.

One of the factors they look at is your lipid levels because these are a kind indicator of future problems like arteriosclerosis. To get an idea of how this impacts your insurance rating, review our general underwriting guidelines for lipid levels.

To help you find life insurance, we are going to show you some of the ways you can get affordable insurance coverage. Your lipid levels are going to make life insurance more difficult, but not impossible.

Table of Contents

Life Insurance Underwriting for Lipid Levels

All life insurance applications will ask several questions about your heart health. Expect to answer:

- What are your current lipid levels (total cholesterol, HDL, LDL, and triglycerides)?

- Have you had any issues like chest pains, TIA or stroke, peripheral artery disease, or diabetes that could indicate future heart problems?

- Have you ever had any heart issues like a heart attack, or coronary artery disease, or needed a heart bypass?

- Have you ever had a stress electrocardiogram test for your heart? What were the results?

- General heart health questions like what is your cholesterol level, blood pressure, family history of heart disease, and do you smoke?

- What is your height and weight?

- Are you taking any medications for your heart or cholesterol?

Common medications for your heart include: Thrombolytics, Beta blockers, Nitrates, and cholesterol medication like statins. Most insurance companies won’t decline your application because of these prescriptions.

As you complete your application, give them as much health information as you can and make it as clear as possible. The insurance company will end up reconfirming the answers by a blood and urine test and by checking your medical records.

If your application appears to be inaccurate or missing information, your application could be denied or receive a poor rating.

Life Insurance Quotes Depending on Lipid Levels

Insurance companies look at your lipid levels because they are a good predictor of heart disease. If your cholesterol levels are high, especially your LDL levels, these lipids start to build up deposits in your arteries. Over time, this can lead to a blockage that causes a heart attack from arteriosclerosis. High HDL levels are a good thing though because this lipid clears bad deposits from your arteries.

Life insurance companies base their rating guidelines on ranges of lipid levels. They’ll also consider your other risks for heart disease and basic health factors. Every company is going to view your application through different standards, but here are some general guidelines:

- Preferred Plus: The best lipid readings for insurance purposes are total cholesterol below 200 mg/dl, LDL below 100 mg/dl, HDL over 40, triglycerides below 150 mg/dl, and total cholesterol to HDL ratio of less than 3.5. If your lipid levels meet these standards and you are in otherwise perfect health, you could receive a preferred plus rating, the best possible rating.

- Preferred: If one or more of your lipid levels are a bit off, say total cholesterol slightly over 200 mg/dl but you are in very good health otherwise, you would likely get a preferred rating which is still a discounted policy.

- Standard: If your lipid levels are a bit off optimal and/or you have other risk factors for heart disease like smoking, or a family history of heart disease, or have slightly high blood pressure, you could receive a standard rating. Despite these issues, you would still need to be in fairly good health.

- Table Rating (substandard): If your HDL level is below 25, your triglycerides are over 1000, your total cholesterol is over 300, and/or your cholesterol to HDL ratio is above 8.0, you’ll receive a rated policy. Your rating will depend on your lipid levels as well as if you have other heart risk factors. Insurance companies will also give you a worse rating the younger you are; lipid levels matter less when you are 65 or older.

- Declines: Insurance companies generally reject applicants that have a cholesterol to HDL ratio higher than 11 as this creates a high risk of future heart trouble. Also, if you’ve had a heart attack or coronary artery disease and also have poor lipid levels, your application will likely be rejected.

Lipid Level Life Insurance Case Studies

While you can’t change your lipid levels, the way you present your health information with your application can actually make a difference. Here are a couple of real-life examples that prove this point:

Case Study: Female, 60 y/o, non-smoker, slightly elevated cholesterol, otherwise in very good health

She was in pretty good shape when she applied for coverage. After submitting her blood and urine for the health exam, she was surprised to find out her cholesterol levels were a bit high. Because of her good health, she still received a policy offer, but it was a substandard rating.

We knew she could get better rates. We recommended this client request a stress electrocardiogram exam to prove her heart was in good shape. This confirmed she was in good health and she received a Preferred policy despite her slightly high cholesterol levels.

Case Study #2: Male, 57 y/o, former smoker, had high blood pressure and cholesterol, went to the hospital with chest pains but did not have a heart attack at 55, recently improved health and weight, taking statins and ACE inhibitors

He was not making the best health choice. One day at 55, he went to the hospital with chest pains. This scared the client into improving his lifestyle.

After this, he changed his life around. He finally quit smoking, lost some weight, and became more active.

He applied and got awful rates. The insurance was focusing on his past health, which they saw as a serious risk. To combat this, we told him to get a letter from his physician which showed his improved health. After he did this, he got a Substandard level 1 plan.

Your lipid levels are incredibly important for your life insurance rating and figuring out the underwriting isn’t always easy. As an experienced insurance broker, we can help. If you are healthy, we will make sure you get the discount you deserve. If your lipid levels are less than ideal, we can still help you find coverage.

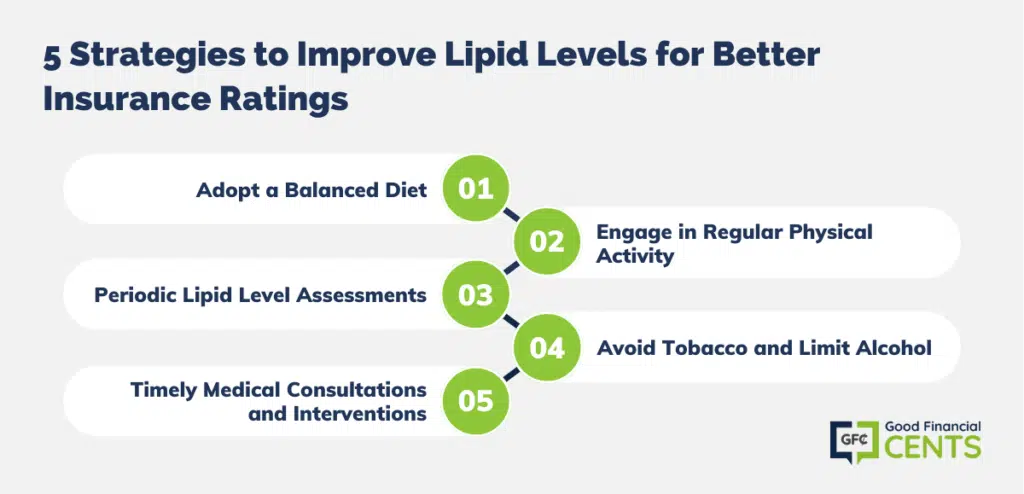

Strategies to Improve Lipid Levels for Better Insurance Ratings

Enhancing one’s insurance rating encompasses various strategies, to unlock better life insurance ratings adopt to the following strategic health practices:

1. Adopt a Balanced Diet

- Integrate a variety of fruits, vegetables, and whole grains into daily meals.

- Limit the consumption of saturated fats and cholesterol-heavy foods to manage cholesterol levels effectively.

2. Engage in Regular Physical Activity

- Incorporate exercises such as brisk walking, cycling, or swimming into your routine.

- Aim for at least 150 minutes of moderate aerobic activity every week to improve HDL (good cholesterol) and reduce LDL (bad cholesterol) levels.

3. Periodic Lipid Level Assessments

- Regularly monitor and assess lipid levels for proactive management.

- Make necessary lifestyle or medication adjustments based on assessment results.

4. Avoid Tobacco and Limit Alcohol

- Abstain from tobacco products to enhance cardiovascular health.

- Exercise moderation in alcohol consumption to maintain optimal lipid levels.

5. Timely Medical Consultations and Interventions

- Seek professional medical advice for personalized strategies and interventions.

- Ensure that health strategies are aligned with individual health needs and conditions.

Bottom Line: Lipid Levels, Arteriosclerosis & Life Insurance

When you’re shopping for coverage, the insurance company is going to see your health problems, but it doesn’t mean you can’t get life insurance. Every individual’s health profile is unique, and while certain medical conditions or lipid readings might raise concerns, they don’t automatically equate to a policy denial. Many insurers recognize the value of overall health improvements, lifestyle changes, and the potential for conditions to be well-managed.

Moreover, with the right guidance, preparation, and presentation of your health data, you can position yourself more favorably. Engaging with experienced insurance brokers can be invaluable in navigating this process. They can guide you in securing the best possible policy tailored to your health and financial needs. Always remember, life insurance is about protecting your loved ones, and there’s almost always a way to get the coverage you need.