If you’ve had endometrial cancer in the past, you’re going to face some unique challenges when shopping for life insurance.

If you’ve fully recovered from your cancer treatments, you may be able to buy a policy at a decent rating.

To help you determine whether you would qualify and at what rating, we’ve put together a complete guide to insurance underwriting for applicants who have had endometrial cancer.

Having the proper life insurance plan can help make losing a loved one a little easier without the added financial stress.

Table of Contents

- Life Insurance Underwriting for Endometrial Cancer

- Life Insurance Quotes After Endometrial Cancer

- Key Factors Influencing Insurance Premiums After Recovery

- Life Insurance Case Studies After Endometrial Cancer

- Strategies to Improve Your Insurance Approval Odds

- The Bottom Line: Endometrial Cancer Life Insurance

Life Insurance Underwriting for Endometrial Cancer

During the application process, they are going to ask you a lot of questions. They are going to review several categories:

- When were you diagnosed with endometrial cancer?

- What stage was your cancer in (in situ through stage 4)?

- How long did your cancer treatment last?

- What treatments did you receive for your cancer?

- How long has it been since you’ve recovered from your treatments?

- Do you have a family history of cancer and have any close family members died of cancer?

These are only some of the basic questions they are going to ask about your cancer. Each insurance company has a different questionnaire. The more information the carrier gets about you, the better your chances of being approved.

Life Insurance Quotes After Endometrial Cancer

After you’ve had endometrial cancer, your life insurance rating will depend on a few factors. First, insurance companies will want to know how far the cancer spread, rated by the cancer stage. If the cancer didn’t spread beyond the uterus, you have a better chance of getting insured than if the cancer spread further.

In addition, the longer you’ve been cancer-free, the better. This shows insurance companies that you haven’t had any new problems or complications. Insurance companies will also review your overall health to make a decision. While each company treats uterine cancer a little differently, here are some general guidelines that you can use to predict your life insurance rating.

- Preferred Plus: Impossible for someone who has had uterine cancer. The chances of a recurrence or other health problems are just too high for an applicant to receive a discounted policy.

- Preferred: Also impossible. Insurance companies generally don’t give discounted policies to people who have had cancer.

- Standard: Should not be expected for applicants that have had uterine cancer. In very rare cases, someone who has fully recovered and only had stage 0 or 1 uterine cancer may receive a standard rating Applicants would need to be in otherwise exceptionally good health and have waited at least four years since treatment.

- Table Rating (substandard): Most likely rating for applicants that have recovered from stage 0 and stage 1 endometrial cancer. An applicant should wait at least two years after treatment and would likely get a better rating for waiting four or more years. Applicants with stage 2 endometrial cancer (only in the uterus and cervix) may also get a rated policy several years after recovering from treatment.

- Declines: Applicants that have had stage 3 or 4 uterine cancer. There is just too high a risk to qualify for a regular insurance policy. Applicants that had stage 2 uterine cancer and applied within 5 years of treatment are also likely to be denied.

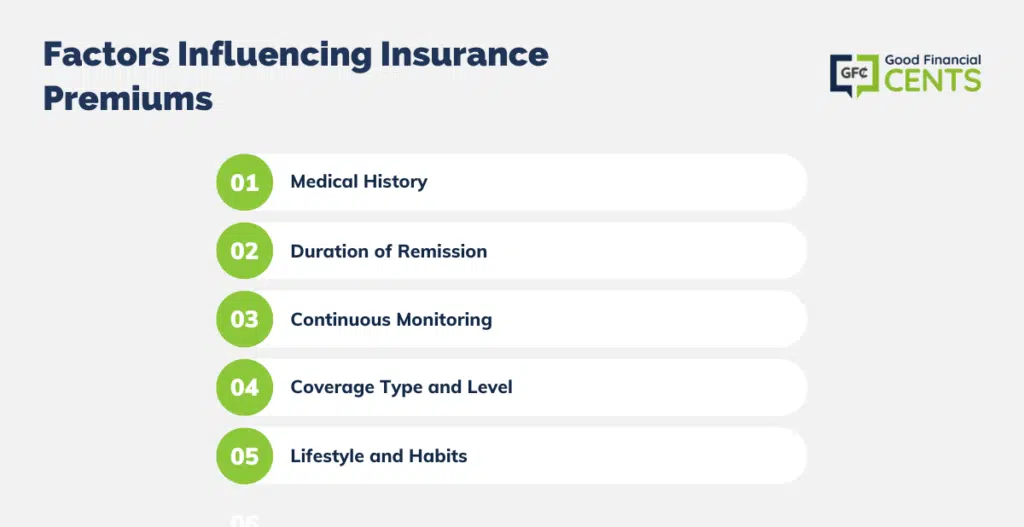

Key Factors Influencing Insurance Premiums After Recovery

Understanding the intricacies of insurance after recovery is crucial, as several components can influence your premium rates. Here’s a breakdown of the pivotal factors:

- Medical History Detailing: Insurers meticulously evaluate your medical records post-recovery. The extent, stage, and type of treatment received, and the duration of recovery, are crucial in premium determinations.

- Duration of Remission: A longer remission period post-treatment usually augurs well, often facilitating more favorable premium rates, as it indicates a lesser risk of recurrence.

- Continuous Health Monitoring: Regular health check-ups and a well-documented recovery journey emphasize ongoing health maintenance, playing a role in influencing premiums.

- Type and Level of Coverage: The chosen policy type, coverage amount, and any additional riders or benefits directly impact premium calculations. Tailoring these aspects according to necessity and budget is essential.

- Lifestyle and Habits: Your lifestyle choices, including exercise, diet, and the avoidance of high-risk behaviors such as smoking, also wield influence over premium determinations.

Life Insurance Case Studies After Endometrial Cancer

Qualifying for life insurance after endometrial cancer is difficult, but you can increase your chances. To help explain this, here are a few cases of previous clients we have worked with.

Case Study #1: Female, 58 y/o, non-smoker, had Stage 0 endometrial Cancer at 53, recovered fully after surgery and radiation therapy, tried applying for insurance right away, and was denied.

We helped her complete her application because her first attempt didn’t include enough information on her treatment. By reapplying with our help, she received a substandard level 1 policy, only one level below standard, and typically the best rating for someone who had uterine cancer.

Case Study #2: Female, 64 y/o, had Stage 2 endometrial cancer at 57, ended cancer treatment at 58

This applicant had Stage 2 endometrial cancer when she was 57. Luckily, she fully recovered after treatment. She tried applying for insurance at 64, but she couldn’t qualify. Insurance companies are generally wary of taking on applicants who have had Stage 2 uterine cancer. We suggested she go see her doctor for a complete check-up. The doctor verified that she was in great health and that there were no signs of cancer. After she did this, she qualified for a rated policy.

Strategies to Improve Your Insurance Approval Odds

Navigating the complexities of securing life insurance with a history of endometrial cancer can be intricate, but certain strategies can enhance your approval odds:

- Timely, Comprehensive Medical Records: Ensure your medical records are up-to-date, accurate, and meticulously detailed, showcasing the full recovery journey and present health status.

- Consult with Specialized Agents: Collaborate with insurance agents who specialize in high-risk cases. Their nuanced understanding and network can navigate the intricacies of your application more effectively.

- Continuous Health Monitoring: Regular check-ups to document your health progress post-recovery can instill confidence in insurers, highlighting your commitment to maintaining good health.

- Exploration of Various Insurance Companies: Different insurers have varied criteria and risk assessments. Explore multiple companies to find one that aligns best with your medical history.

- Customized Coverage Consideration: Be open to customizing your policy. Consider adjustments in terms, benefits, or riders to strike a balance that appeases both parties, making approval more likely.

- Be Transparent and Detailed in Applications: Provide comprehensive answers in your application, leaving no room for ambiguity. Transparency helps in building trust and facilitating a smoother approval process.

The Bottom Line: Endometrial Cancer Life Insurance

Qualifying for life insurance after endometrial cancer isn’t easy, but it is possible. It helps to work with a professional that understands this condition. Has plenty of experience working to get life insurance for people who have had uterine cancer.

We can help you fill out your application and give you the best chance of qualifying for a fair rating. If you can’t qualify for regular life insurance, we can also guide you through your other options, like guaranteed issue life insurance.

Even if you’ve had a hard time getting life insurance with cancer in the past, we can show you several different options for life insurance coverage.

One option is a guaranteed issue policy. These plans allow anyone to buy life insurance, regardless of past health complications. All you have to do is give some basic info. These plans don’t provide nearly as much insurance, but some coverage is better than no coverage.