Get excited.

You’ve just landed on the page that will change how you look at money for the rest of your life.

Trust me. That’s a good thing.

What is the Money Uprising Movement™ (MUM)?

Let me briefly explain…. MuM is the core principles of what this blog is about and what we are committed to. Most people have a HUGE disconnect with their finances and basically I’m fed up with it and not going to take it anymore. Boo-yah! MuM was initially erected from the Roth IRA Movement where I inspired over 140 bloggers all to write about how freaking awesome the Roth IRA is all on the same day. I followed that with the Life Insurance Movement making sure that you weren’t skimping out and making sure your family is protected. (If you still don’t have affordable term life insurance, go HERE immediately). In 2013, I (with ReadyForZero.com) launched The Debt Movement where we are currently motivating people to pay off $10 million dollars of debt. In January 2014 I launched what is now a lifetime goal: Operation: #investNOW. This movement is a bit different in that I want to encourage over 1 million people to invest in themselves.

Although these movements were all independent of each other, they all had one similar underlying theme:

—> It’s time to step up and take control of YOUR money. <—

Below are the core beliefs of what those movements were about and what The Money Uprising Movement (and this blog) stand for.

Rule #1: We never believe its too late to get started

Never say never. Period. We don’t like quitters, but we also understand that quitting something might lead you to a better opportunity. But just because you procrastinated for the last decade and haven’t saved a dime, doesn’t mean it’s too late. It’s time to “soldier up” and figure out what the minimum is that you need to do to get started.

Sign up for your company’s 401k? Do it.

Open a Roth IRA? No more excuses.

Start your new business?

Doesn’t happen on it’s own.

It’s time to start.

Rule #2: We never become complacent

When I was deployed to Iraq, we were always instructed to not become complacent.

For us, that meant not getting too comfortable with our surroundings or letting the enemy get us while our guard was down. Are you financially complacent? If you’re not sure, answer these quick questions:

- What is your 401k currently invested into?

- When’s the last time you checked your credit report?

- How much are you saving each month for retirement?

The subtitle of my book is Take Charge of Your Money and Invest in Your Future. The first part, “Take Charge of Your Money,” is most crucial. Stop being complacent with your money and learn how to make fast cash!

Rule #3: We know there’s more than one right way to do things

You should ONLY buy index funds. Why? Actively managed funds are the BEST thing ever! Perhaps…. You should NEVER use credit cards. Ummm….but I like getting cash back. My motto has always been “different strokes for different folks.” While I hate target date funds (and think you should, too), that doesn’t mean that you are WRONG for using them. Be careful of those that look to cram their ideals down your throat. Just because it worked for them, does NOT mean it will work for you.

Rule #4: We always trust but verify

A good friend of yours suggests investing in some stock that he has officially labeled “the next BIG thing.” Do you dump all your money into it and hope for the best? If so, slap the back of your hand and throw cold water in your face. If you are joining The MuM, you never invest in anything that you haven’t done a little bit of research for yourself or at least obtained a second opinion.

Before you act on any investment tip, follow these guidelines:

Consider the source. Tell me you didn’t get excited about a stock tip from your co-worker who day trades their 401k. If you were my kid, I would put you in timeout. Ask yourself, “Why is this so good?” I love when people watch Jim Cramer and then come to me ready to buy some stock so they can make millions. Warning: I may head butt you for this stupidity. Is it really a game changer? If you invested every single penny you had into it and the stock doubled, would that drastically change your life? Reversing roles: what if you lost every single penny you invested into it? If that would affect you more than making a little bit of profit, it’s not worth it. Verifying also applies before hiring a trusted advisor. Surprisingly, more than 70% of other people don’t do a background check before hiring a financial advisor. I say “other” because that’s not you.

Rule #5: We keep our debt in check

Mr. T says, “I pity the fool that has too much debt!” Okay, I really don’t know if he said that, but he should have! I’m cool with people using credit cards for rewards that pay them off each month. What I’m not cool with is people abusing their credit privileges and constantly wondering how to get a loan from the bank to buy crap they don’t need. Just because you can afford your monthly payment, doesn’t mean you’re in good financial shape. That’s what one guy tried to make me believe and I filmed a financial rant video about him. Don’t be the topic of my next video. You have been warned. $50,000 of debt is not a “little bit of debt”! To get out of debt you have to know what you’re working with. Drop the denial and attack it with a vengeance.

Know the Truth

Debt can crush you. I’ve seen it firsthand with clients, friends, and my own family. Getting out of debt should be your priority.

If you’re in denial, don’t be. You need to know exactly how much debt you have. Some clients tried to convince me that they only had a “little bit of debt”. Turns out they had over $50,000 of debt!

Rule #6: We keep getting educated, never complacent

After taking my last final of my senior year of college, I remember saying to myself, “I just took the last exam of my life. I couldn’t have been any more wrong. Since then, I’ve taken tests for my Series 7, Series 66, Series 24, AAMS designation, insurance licenses and, the CFP® exam. Above that, I’m constantly devouring new books (especially love books for entrepreneurs), reading blog posts and trade publications, purchasing online courses and on and on and on. I expect the same out of you. The world is ever evolving and you HAVE to stay ahead of the curve. For you, this could be getting your Masters or Doctorate degree, or it could be getting a new certification for your current job.

Whatever it is, you have to stay hungry and keep advancing yourself.

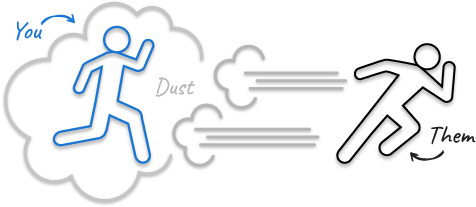

Why? Because I guarantee there’s someone out there who’s just as hungry (or hungrier), and they’ll pass you up and leave you in the dust.

Rule #7: We invest in ourselves (because if we don’t, who will?)

Most people think of investing as buying stocks or mutual funds. One of the best things I’ve ever done personally and professionally is invest in myself. I mentioned above how I obtained my Certified Financial Planner designation. Did I mention that I had to pay for it out of pocket? Did I also mention that I did not get a pay raise for it? I put myself through the misery of an 11 month fast track study program because I craved the knowledge I would have from going through it. I also knew that while I wouldn’t see an immediate boost in income that eventually would more than pay for itself, which it has 100x over!

Since then here’s how I’ve continued to invest in myself:

- Traditional investing into my 401k through my business (stocks, mutual funds)

- Peer to Peer lending (accounts with Prosper and Lending Club)

- Enrolled in my 1st coaching program (The Strategic Coach)

- Invest time into a weekly mastermind group where we share business ideas

- Invest into my online business. I detail all of that here.

- Purchased several online training programs

- And on and on and on……

I’ll never stop investing in myself and you shouldn’t either.

Rule #8: We never blame other people for our money struggles

“The government took all my money!” “My parents won’t help me out anymore!” “My job sucks!” “I just can’t catch any breaks!” Whah, whah, whah……

“Say and do something positive that will help the situation; it doesn’t take any brains to complain.”

Robert A. Cook

If you chose to join the MuM, it’s time to start doing. You are the only one who changes your situation. Sure, people are going to screw you over along the way, but it’s not your job to worry about them. Don’t worry. They’ll get theirs eventually.

Focus on what you can control. And for peep’s sake, stop blaming other people!

Rule #9: We take care of our battle buddies

When I joined the military I got introduced to the concept of a “battle buddy”. A battle buddy is someone who has your back no matter what. They know your darkest secrets and will go to bat for you even if it means they take the heat for it. Most importantly, they are not afraid to “keep it real” with you when they know you’re screwing up. If you’ve seen Good Will Hunting, then you know that Ben Affleck’s character is the epitome of a battle buddy.

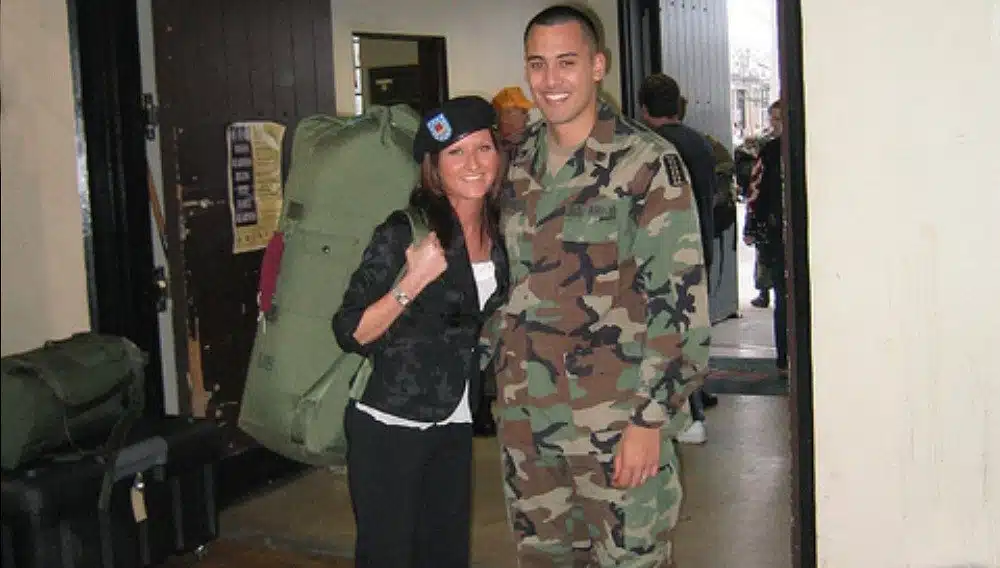

My Battle Buddy

In college I already had credit card and student loan debt but had somehow convinced myself that I needed/deserved a new flat screen TV. I had done my research and found that I could get a 42″ flat screen TV at Best Buy with 0% interest. Come to papa! I told my girlfriend (now wife) my master plan, and instead of supporting me, she offered me the following response:

“Do you really think you can afford that right now?” How dare her! I was miffed that she could ever question my logic. “Of course I can afford it,” I lied to myself. After I sat on it for a few days, I undoubtedly realized she was right. She knew the struggles my father had with debt and that I was following a similar path. Buying this TV on the income I had at the time would have been opening Pandora’s box for future financial blunders.

My wife knew that and she stepped up as my battle buddy and gave me the biff slap that I needed. Note: She technically didn’t biff slap me but if I would have bought the TV….well, you never know.

Rule #10: We call out our blue falcons

We just learned what a battle buddy is. Well a blue falcon is the complete opposite. The more common name used in the military is “buddy fudger”. <<Keepin’ it PG-13 In basic training, a Blue Falcon (Buddy Fu#$er) was the soldier who didn’t care about what happened to everyone else. Actions could include talking in formation, falling asleep during guard duty, not properly securing your weapon. Their carelessness often meant we would get the crap smoked out of us, i.e.; pushups and A LOT of them.

Who are the blue falcons in your financial life? Here’s a few examples:

- Broke parents that try to mooch off their successful kids.

- Lazy adult children that continue to mooch off their parents.

- Friends that guilt you into going shopping when they know you’re already in a ton of debt.

- Co-workers that continue to badger you about not eating lunch with them even know they are full aware of your financial situation.

In basic training we would kick the soldier’s butt who would continue to screw us over intentionally. Ever seen Full Metal Jacket? Ahem..

Rule #11: We aren’t afraid to fail

When I first started my career as a financial advisor I had cold calls all day and most weeknights trying to find new clients. Yes, I was the annoying guy that would call and interrupt your dinner. My apologies. Most days I would make 400-500 dials a day hoping to find someone interested to talk to me. Desperate I know. You know how many times I was rejected? A bunch! At first it bothered me. But the more I did it I realized that every “no” got me that much closer to a “yes”. Essentially, the faster I failed, the quicker I would succeed. And before you think that’s the only way I’ve failed in my life, here’s a few to come to mind that might make you feel better:

- Dropped out of college to work a dead end job doing data entry 8 hours a day.

- Attempted two MLM businesses wasting both time and money.

- Tried to become a real investor making a bid on a duplex only to later realize I had no idea what I was doing.

- Lost $5,000 investing in a penny stock that a client gave me a tip on even though they really knew nothing about it.

- Failed the Series 24 exam twice only to find out that I didn’t even need it.

- Invested $8,000 into a business that I did nothing with.

As you can see, “failure” is my middle name, but I’ve never let it get to me. You shouldn’t either.

When I first started my career as a financial advisor I had cold calls all day and most weeknights trying to find new clients. Yes, I was the annoying guy that would call and interrupt your dinner. My apologies. Most days I would make 400-500 dials a day hoping to find someone interested to talk to me. Desperate I know. You know how many times I was rejected? A bunch! At first it bothered me. But the more I did it I realized that every “no” got me that much closer to a “yes”. Essentially, the faster I failed, the quicker I would succeed. And before you think that’s the only way I’ve failed in my life, here’s a few to come to mind that might make you feel better:

- Dropped out of college to work a dead end job doing data entry 8 hours a day.

- Attempted two MLM businesses wasting both time and money.

- Tried to become a real investor making a bid on a duplex only to later realize I had no idea what I was doing.

- Lost $5,000 investing in a penny stock that a client gave me a tip on even though they really knew nothing about it.

- Failed the Series 24 exam twice only to find out that I didn’t even need it.

- Invested $8,000 into a business that I did nothing with.

As you can see, “failure” is my middle name, but I’ve never let it get to me. You shouldn’t either.

You’re never a failure.

A mentor of mine helped me realize that every time that I thought I had failed in the past wasn’t a failure at all. It was a valuable learning experience. I learned what didn’t work. Most importantly I learned a way to do it better. I have a secret. You’re going to fail. It’s inevitable. The key is how you respond. Will you let it bring you down? Or will you say “screw it” and attack it with a vengeance? If you’re in the MuM camp, then you better be ready to attack.

Rule #12: We always give back

I was raised a Southern Baptist (hey y’all!) and my grandma always taught me to give back. That wasn’t just tithing but also giving your time to other people. We all have unique experiences that is a wealth of information for the person just beginning that journey. Educate them. Mentor them. Prevent them from making the same mistakes. Did you get yourself into a money jam? Make sure your kids, friends, co-workers don’t do the same boneheaded thing you did. Make a lousy investment? What did you learn from it that others might benefit. We all have something to give.

Let’s Kick Butt Together!

Above is what MuM and I are all about. If any of that resonates with you, join us. If you’re still unsure, join us. When I signed up for the Army National Guard there was part of me that still had doubts: Is this right for me? Am I really tough enough? If I would have let those doubts control me I wouldn’t be here today. Be bold and take action. Besides, it’s free!